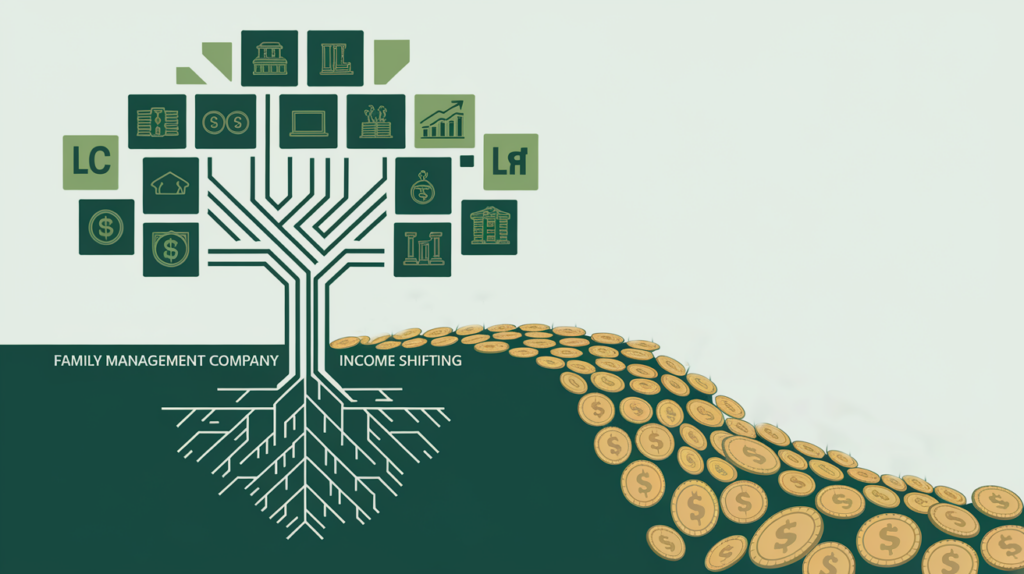

Running a business and supporting your family? You might be looking for ways to optimize your tax situation. Family Management Companies (FMCs) can be a valuable tool, but it’s crucial to understand the nuances before you get started.

What is a Family Management Company?

An FMC is a separate business entity that provides legitimate services to your primary business. This structure allows you to strategically employ your family members, potentially reducing your overall tax burden and offering other benefits. Common FMC structures include:

- LLC (Limited Liability Company): Offers flexibility and potential liability protection.

- Sole Proprietorship: Simple to set up, but the owner is personally liable for business debts.

- Partnership: Suitable for collaborations, but partners share liability.

- S-Corporation: Offers potential tax benefits and liability protection, but has stricter compliance requirements.

The best structure for your FMC depends on factors like the nature of your business, desired liability protection, and the number of family members involved.

How FMCs Work

- Choose the Right Structure: Consider the pros and cons of each structure to determine the best fit for your needs.

- Provide Real Services: The FMC must offer genuine and necessary services to your main business. This could include:

- Administrative Support: Bookkeeping, scheduling, email management, travel arrangements.

- Marketing and Sales: Social media management, content creation, customer service, market research.

- Technical Services: Website development, IT support, graphic design.

- Consulting: Providing specialized advice based on a family member’s expertise.

- Employ and Pay Family Members: The FMC hires and pays your family members to perform these services. This is where the income shifting and tax advantages come into play.

Potential Tax Benefits

- Standard Deduction: By paying family members, you can utilize their standard deduction, potentially making some of their income tax-free. Remember that the standard deduction applies to any earned income, not just income from an FMC.

- Payroll Tax Savings: In certain cases, you can avoid paying Social Security and Medicare taxes on wages paid to children under 18 (or under 21 for agricultural work) employed by a sole proprietorship or parent-owned partnership. This exemption generally doesn’t apply to LLCs or S-corps.

- Income Shifting: Shifting income from your higher tax bracket to your family members’ lower tax brackets can significantly reduce your overall tax liability.

Important Considerations

- Reasonable Compensation: Pay family members fair market value for their services. For example, bookkeeping services might range from $20 to $50 per hour, while a marketing consultant might earn a monthly retainer of $500 to $5,000, depending on the scope of work.

- Legitimate Business Purpose: All activities and services must have a genuine business purpose and be meticulously documented with contracts, invoices, timesheets, and expense records. A typical service agreement will outline the scope of services, payment terms, and responsibilities of both parties.

- State Tax Laws: State tax laws regarding FMCs vary. Some states have specific rules or offer tax advantages, while others may be less favorable. Research your state’s regulations or consult a tax professional.

- “Kiddie Tax”: Be aware of the “kiddie tax” rules, which can affect the taxation of a child’s unearned income.

- Workplace Compliance: Comply with all relevant workplace regulations, such as workers’ compensation, labor laws, and minimum age requirements.

Potential Drawbacks and Risks

- Complexity: Setting up and managing an FMC requires careful planning, legal agreements, and detailed record-keeping.

- IRS Scrutiny: Transactions between related parties are often subject to increased IRS scrutiny. Maintain accurate records and ensure all transactions have a clear business purpose to avoid audits.

- Personal Liability: Depending on the chosen structure, you may face personal liability for business debts or legal issues.

- Non-Compliance: Failing to comply with tax laws and regulations can result in back taxes, penalties, and even legal consequences.

Seek Professional Advice

Given the complexities of FMCs, consult with a qualified tax professional to:

- Determine if an FMC is the right strategy for you.

- Choose the appropriate structure and ensure proper setup and compliance.

- Explore all available tax planning options.

- Navigate the required tax filings, which typically include annual tax returns (Form 1065, 1120S, or Schedule C) and potentially other state-specific filings.

- Understand how your FMC interacts with your other business entities.

Frequently Asked Questions (FAQ)

1. Can I hire any family member in my FMC?

You can generally hire any family member, including your spouse, children, parents, and siblings. However, there might be age restrictions and specific rules depending on your state and the type of work involved.

2. What kind of services can my FMC provide?

Your FMC can provide a wide range of services, as long as they are legitimate and necessary for your primary business. This could include administrative support, marketing, technical services, consulting, and more.

3. How much should I pay my family members?

You need to pay reasonable compensation, which means the amount should be comparable to what you would pay an unrelated third party for similar services.

4. What are the record-keeping requirements for an FMC?

You need to maintain detailed records of all FMC activities, including contracts, invoices, timesheets, expense reports, and any other relevant documentation.

5. Is an FMC subject to audits?

Yes, like any business, an FMC can be audited by the IRS. It’s crucial to comply with all tax laws and regulations and keep accurate records to avoid potential issues.

Conclusion

Family Management Companies can be a powerful strategy for business owners to optimize their tax situation, plan for the future, and involve their family in their business. However, they require careful planning, meticulous execution, and ongoing compliance. By seeking professional guidance and understanding the intricacies involved, you can leverage the benefits of an FMC while minimizing potential risks.

Take the Next Step

Want to explore if an FMC is right for you? Contact XOA TAX today for a consultation. Our experienced professionals can help you navigate the complexities and ensure you’re making informed decisions.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime