Hey there, food entrepreneurs! At XOA TAX, we know you’re busy whipping up delicious creations and building your culinary empire. But amidst all the excitement, it’s easy to overlook some tasty tax breaks, like the Research and Development (R&D) Tax Credit. You might be surprised to learn that it’s not just for tech companies or scientists in lab coats. If you’re innovating in the kitchen, you could be eligible too!

Key Takeaways

- The R&D tax credit isn’t just for high-tech companies; food businesses often qualify.

- Activities like developing new recipes, improving food processing techniques, and experimenting with ingredients could be eligible for the credit.

- Qualifying activities must involve a systematic process of experimentation to overcome technical challenges.

- Proper documentation is key to claiming the R&D tax credit successfully.

What is the R&D Tax Credit?

Think of the R&D tax credit as a reward from the government for businesses like yours that are pushing boundaries and creating new things. It’s designed to encourage innovation and help companies invest in the future. The credit can help offset your tax liability, putting money back in your pocket to reinvest in your business.

How Can Food Businesses Qualify?

Now, you might be thinking, “But I’m not exactly inventing a flying car in my kitchen. How does this apply to me?” Well, the IRS has a pretty broad definition of what qualifies as research and development. In the food world, it can include things like:

- Developing new recipes: This could involve creating healthier versions of popular foods, experimenting with unique flavor combinations, or finding ways to cater to dietary restrictions, but it must go beyond routine recipe adjustments. For example, simply substituting one type of sugar for another wouldn’t qualify, but developing a new sugar-free recipe that maintains the desired texture and flavor could.

- Improving existing recipes: Maybe you’re tweaking a classic recipe to reduce sugar content, extend shelf life, or make it easier to mass-produce. Again, the key is that the improvements must be substantial and involve overcoming a technical challenge.

- Developing new food products: Think of creating innovative snacks, meal kits, or beverages that meet specific consumer needs.

- Improving food processing techniques: This could involve finding ways to make production more efficient, reduce waste, or enhance food safety.

- Experimenting with new ingredients: Perhaps you’re exploring alternative protein sources, developing gluten-free options, or finding sustainable substitutes for traditional ingredients. However, it’s important to note that the research must focus on the functional aspects of the ingredients, not just taste preferences.

Example: Imagine you own a bakery and spend months systematically experimenting with different gluten-free flour blends, analyzing their properties, and conducting baking tests to perfect a gluten-free bread recipe that has the same texture and taste as traditional bread. This process of overcoming the technical challenges of gluten-free baking could qualify for the R&D tax credit!

Is Your Food R&D Eligible?

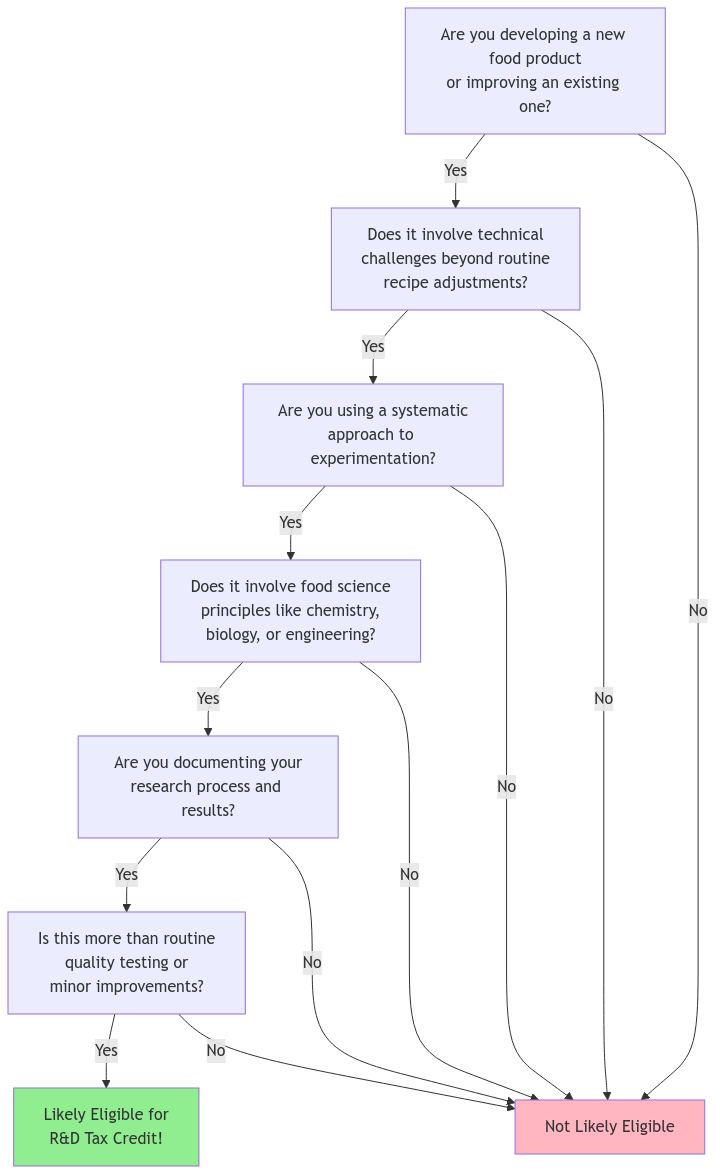

Not sure if your food innovation qualifies? Use this flowchart to do a quick assessment of your R&D activities:

What Doesn’t Qualify?

It’s important to remember that not all activities in the food industry qualify for the R&D tax credit. Here are some examples of activities that generally wouldn’t qualify:

- Routine quality control testing

- Minor recipe adjustments that don’t address a technical challenge

- Market research or consumer taste testing

- Changes to product packaging or labeling

- Routine production or manufacturing processes

What are Qualified Research Activities (QRAs)?

To claim the R&D tax credit, your activities need to meet what the IRS calls a “four-part test.” It sounds a bit technical, but let’s break it down:

- Permitted Purpose: The research must aim to create a new or improved product or process.

- Technological in Nature: The process must rely on principles of hard sciences like engineering, physics, chemistry, or biology. For example, in food science, this could involve analyzing the chemical reactions involved in baking or the physical properties of different ingredients.

- Elimination of Uncertainty: You must be experimenting to overcome some technical challenge or uncertainty. This could involve finding a solution to a production problem, improving the nutritional profile of a product, or extending shelf life.

- Process of Experimentation: You need to test different approaches, evaluate results, and refine your process. This means having a systematic approach to your research, not just trial and error.

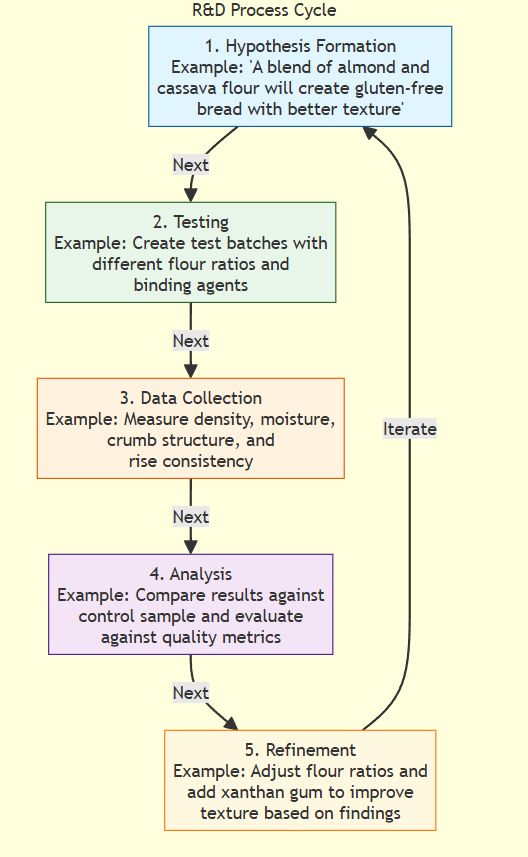

The R&D Process in Action

Here’s how a typical food R&D process works, using gluten-free bread development as an example:

Each stage of this process must be well-documented and demonstrate a systematic approach to problem-solving. Notice how each step builds on the previous one and may require multiple iterations to achieve the desired result.

Documentation is Key

Just like keeping your recipes organized, good record-keeping is essential for claiming the R&D tax credit. The IRS requires contemporaneous documentation, which means you need to be recording your research activities as they happen. You’ll need to document:

- Project goals and objectives: What were you trying to achieve with this research?

- Experiments conducted: What specific experiments did you conduct, and what were the variables?

- Results and conclusions: What were the outcomes of your experiments? Did you achieve your goals?

- Associated expenses (wages, supplies, etc.): Keep detailed records of all expenses related to your research activities.

Think of your documentation as the recipe book for your R&D activities. The IRS wants to see a clear record of what you did, why you did it, and what the results were. This could include lab notebooks detailing experiments, testing logs with data and observations, and even photographs of prototypes or experimental setups. If you’re keeping digital records, ensure they’re organized, secure, and easily accessible for review. Don’t forget to track the time your team spends on research activities, as this is a significant component of your QREs.

Calculating the Credit

Calculating the R&D tax credit can be a bit complex, as there are two main methods: the Regular Research Credit (RRC) and the Alternative Simplified Credit (ASC). The method you choose will depend on your specific circumstances and research expenses.

To determine the actual credit amount, you’ll need to consider your qualified research expenses (QREs). These typically include wages for researchers, supplies used in experiments, and costs associated with contract research. You’ll also need to calculate a “base amount” based on your historical research expenses. The credit percentage can vary, but it often falls within the range of 6-14% of your QREs.

Common QREs include:

- Direct wages for R&D staff

- Supplies used in research

- Contract research expenses (65% eligible)

- Cloud computing costs related to R&D

The Payroll Tax Credit Option for Startups

If your food business is a startup and you haven’t generated taxable income yet, you may be eligible to apply the R&D tax credit against your payroll tax liability. This can be a valuable option for new businesses looking to reinvest those savings back into their research efforts.

A Word About Funded Research

If you’re conducting research funded by a client or another third party, the eligibility for the R&D tax credit can get a bit more complicated. It often depends on who retains the rights to the research findings and the nature of the contractual agreements. It’s best to consult with a tax professional to determine how funded research impacts your specific situation.

R&D and Food Safety

Did you know that research aimed at meeting FDA requirements or developing new food safety protocols could also qualify for the R&D tax credit? For example, if you’re developing a new Hazard Analysis and Critical Control Points (HACCP) plan or researching innovative ways to prevent foodborne illnesses, those activities might be eligible. It’s all about pushing the boundaries of food safety and improving public health.

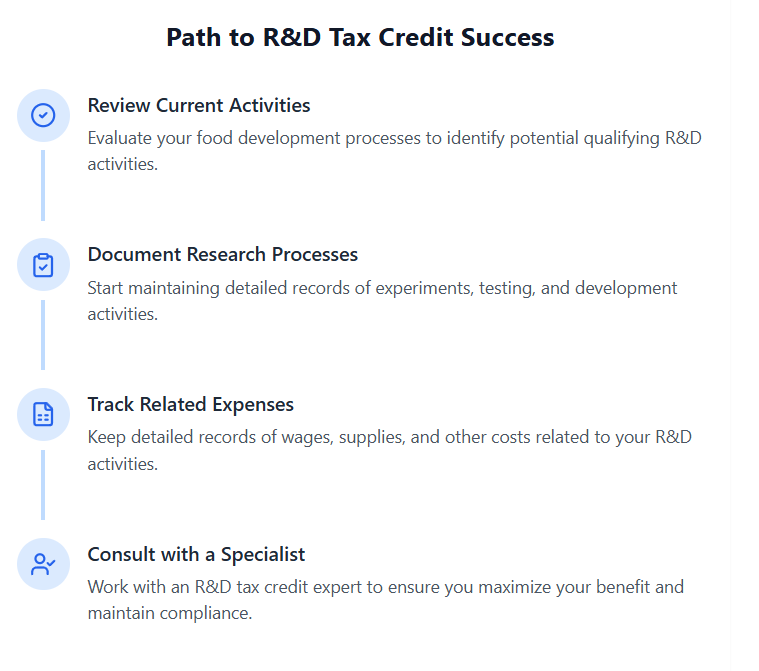

Next Steps

- Review your current food development activities

- Start documenting your research processes

- Track related expenses

- Consult with an R&D tax specialist

FAQs

Can I claim the R&D tax credit for past years?

Yes, you can often amend your tax returns to claim the credit for up to three prior years.

How much is the R&D tax credit worth?

The credit amount varies depending on your qualified research expenses and the calculation method used.

Is the R&D tax credit available at the state level?

Many states also offer their own R&D tax credits, so be sure to check the rules in your state.

Connecting with XOA TAX

Navigating the R&D tax credit can be tricky, but XOA TAX is here to help! We can guide you through the process, ensure you meet all the requirements, and maximize your credit. Contact us today for a free consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime