Filing taxes can feel overwhelming, especially when you encounter complex forms like Form 1040 Schedule 3. Misunderstanding instructions or missing out on eligible credits can make the process even more stressful. But don’t worry—with the right guidance, completing Schedule 3 can be easy and stress-free.

Ready to make your tax filing smoother and get the most out of your eligible credits? This guide will walk you through everything you need to know about Form 1040 Schedule 3 for the 2024 tax year, helping you file accurately and efficiently.

Key Points

- Purpose: Form 1040 Schedule 3 is used to report additional credits and payments not directly listed on Form 1040.

- Credits: Line 6 includes various nonrefundable credits like the Foreign Tax Credit and Adoption Tax Credit.

- Who Needs It: Only those claiming specific credits or payments need to file Schedule 3.

- Benefits: Correctly filling out Schedule 3 can lower your tax bill and possibly increase your refund.

- Tools: Use available tools and calculators to make tax preparation easier.

What is Form 1040 Schedule 3?

Form 1040 is the main form U.S. taxpayers use to file their annual income tax returns. It lets you report your income, claim deductions, and calculate your tax owed. Schedule 3, titled “Additional Credits and Payments,” is a supplementary form where you report various tax credits and payments that don’t fit directly on the main Form 1040.

Schedule 3 is split into two parts:

- Part I: Nonrefundable Credits: Includes credits like the Foreign Tax Credit, Child and Dependent Care Credit, Education Credits, and Retirement Savings Contributions Credit.

- Part II: Refundable Credits and Other Payments: Covers refundable credits such as the Net Premium Tax Credit and Qualified Sick and Family Leave Credits, along with other payments.

Who Needs to File Schedule 3?

Not every taxpayer needs to file Schedule 3. You should file it if you:

- Claim Nonrefundable Credits: Such as the Foreign Tax Credit or Education Credits.

- Eligible for Refundable Credits: Like the Net Premium Tax Credit or Qualified Sick and Family Leave Credits.

- Report Specific Payments: Including excess Social Security tax withheld or payments made with an extension request.

Understanding whether you need Schedule 3 ensures your tax return is complete and optimized.

Schedule 3 Eligibility Flowchart

Benefits of Filing Schedule 3

- Maximize Your Credits: By reporting all eligible credits, you can lower your tax bill significantly.

- Increase Refunds: Refundable credits can provide a direct refund, even if you don’t owe any taxes.

- Stay Compliant: Properly filing Schedule 3 meets IRS requirements, reducing the risk of penalties.

- Better Financial Planning: Knowing which credits you qualify for helps in planning your finances for future tax years.

How to Complete Schedule 3

Filling out Schedule 3 involves a few straightforward steps to ensure you report your credits and payments correctly:

Step 1: Gather Necessary Documents

Before you start, collect all relevant documents related to your income, deductions, and credits. This includes:

- Income Forms: W-2s, 1099s

- Credit Documentation: Forms like 1116 for Foreign Tax Credit, 8863 for Education Credits

- Tax Payment Records: Proof of taxes paid or withheld

Step 2: Fill Out Personal Information

At the top of Schedule 3, enter your name, Social Security number, and other required personal details.

Step 3: Report Nonrefundable Credits (Part I)

- List Each Credit: Enter the amount for each nonrefundable credit you’re claiming.

- Attach Supplemental Forms: If you’re claiming credits like the Adoption Credit, ensure you include the necessary forms.

Step 4: Report Refundable Credits and Other Payments (Part II)

- Enter Refundable Credits: Include credits such as the Net Premium Tax Credit.

- Other Payments: Report any other payments, like excess Social Security tax withheld.

Step 5: Calculate Totals

Add up the amounts from both parts of Schedule 3.

Step 6: Transfer Totals to Form 1040

- Nonrefundable Credits: Move the total from Part I to Line 20 on Form 1040.

- Refundable Credits: Move the total from Part II to Line 31 on Form 1040.

Step 7: Review and File

- Double-Check Entries: Ensure all information is correct.

- Attach Schedule 3: If filing by paper, attach it to your Form 1040. If filing electronically, make sure it’s included in your submission.

Following these steps carefully will help you maximize your credits and comply with IRS requirements.

Important Considerations

- Keep Records: Save all documents related to your credits and payments in case the IRS asks for them later.

- Meet Deadlines: File your taxes by the deadline to avoid penalties. If you need more time, use Form 4868 to request an extension.

- Ensure Accuracy: Double-check all information to prevent delays or adjustments to your tax return.

- Seek Help if Needed: If you’re unsure about any part of Schedule 3, consider consulting a tax professional.

- State Tax Credits: Be aware that state tax credits may interact with federal credits. Check your state’s tax guidelines or consult a tax professional for specific information.

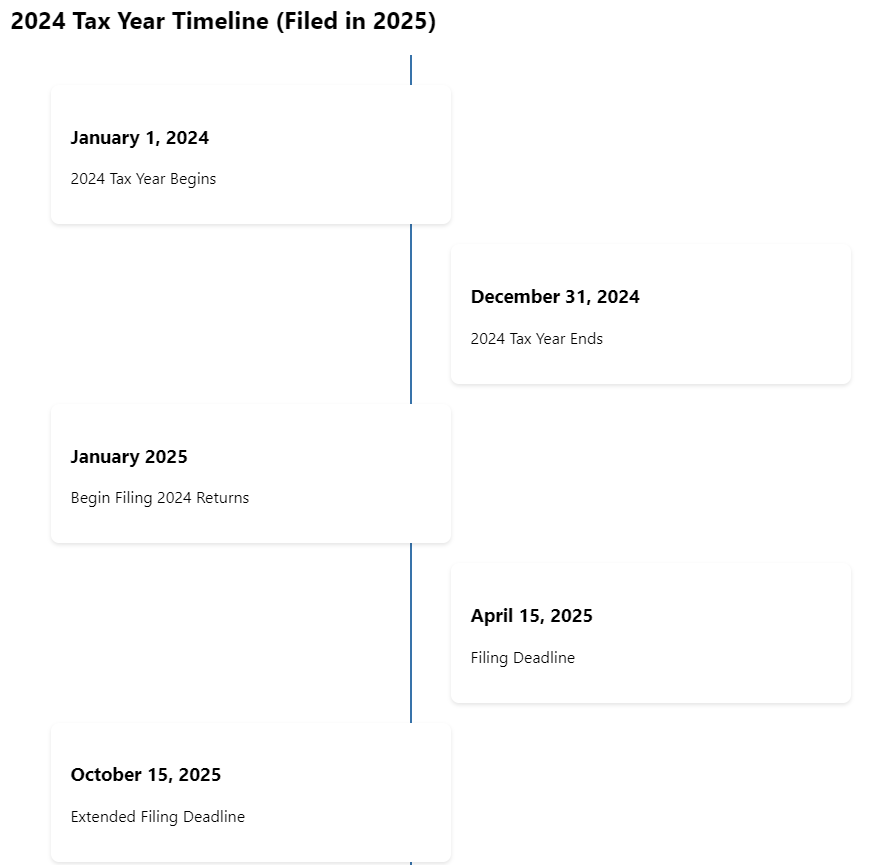

Updates for 2024

To ensure your tax filing is up-to-date, consider the following changes and updates for the 2024 tax year:

Credit Amounts and Thresholds

Tax credits like the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) are adjusted annually for inflation. For 2024, these credits have been updated accordingly:

Child Tax Credit (CTC): Remains at up to $2,000 per qualifying child. The refundable portion, known as the Additional Child Tax Credit (ACTC), has increased to up to $1,700 per qualifying child. The income phase-out begins at $200,000 for single filers and $400,000 for married couples filing jointly.

Earned Income Tax Credit (EITC): Maximum credit amounts for 2024 are:

- $7,830 for taxpayers with three or more qualifying children.

- $6,960 for those with two qualifying children.

- $4,213 for those with one qualifying child.

- $632 for those with no qualifying children.

Income Thresholds: The income thresholds and phase-out ranges have been adjusted for inflation. For detailed information, refer to the IRS EITC guidelines

Recent Tax Law Changes

The Tax Relief for American Families and Workers Act of 2024 introduced modifications to the Child Tax Credit and other provisions:

- Child Tax Credit Adjustments: Expanded eligibility for higher-income earners and maintained the credit amounts as mentioned above.

- Education Credits: Enhanced benefits for education-related expenses, including higher maximum credits for tuition and fees.

- Digital Filing Requirements: There are no new mandates requiring digital filing for specific credits in the 2024 tax year. Taxpayers can continue to file electronically or via paper based on their preference.

Post-COVID Tax Credits: As of November 2024, most COVID-19-related tax credits, such as the Recovery Rebate Credit, have expired and are not applicable for the 2024 tax year. Always verify the current status of any pandemic-related credits to determine your eligibility.

Specific Credits on Schedule 3

Here are some of the most common credits that are reported on Schedule 3:

- Foreign Tax Credit: If you paid income taxes to a foreign country, you might be able to claim this credit to avoid double taxation.

- Retirement Savings Contributions Credit: This credit, also known as the Saver’s Credit, is for eligible contributions to retirement accounts like IRAs and 401(k)s.

- Child and Dependent Care Credit: If you paid expenses for the care of a qualifying individual to enable you to work or look for work, you might be able to claim this credit.

- Education Credits: There are two main education credits: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit. These credits are for qualified education expenses paid for yourself, your spouse, or a dependent.

- Adoption Tax Credit: This credit is for qualified expenses paid to adopt an eligible child.

Recent Changes to the Child Tax Credit and Earned Income Tax Credit

The Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) have undergone some significant changes in recent years. Here’s a summary of the key updates:

- Child Tax Credit: The American Rescue Plan Act of 2021 temporarily expanded the CTC, making it fully refundable and increasing the credit amount. However, these changes expired at the end of 2021. The Tax Relief for American Families and Workers Act of 2024 made further adjustments, expanding eligibility for higher-income earners.

- Earned Income Tax Credit: The EITC is a refundable credit for low- and moderate-income working individuals and families. The maximum credit amount and income limits are adjusted annually for inflation.

It’s important to stay updated on these changes to ensure you’re claiming the correct credit amounts.

FAQs

Is Schedule 3 the same as Form 1040?

No, Schedule 3 is a supplementary form used to report additional credits and payments that aren’t included directly on Form 1040.

What happens if I forget to file Schedule 3?

If you’re required to file Schedule 3 and don’t, the IRS may charge extra taxes or penalties. It’s important to include all necessary forms to avoid issues.

What is Schedule 3 on an income tax return?

Schedule 3 is used to report additional credits and payments, such as nonrefundable credits like the Foreign Tax Credit and refundable credits like the Net Premium Tax Credit.

What is Line 6 of Schedule 3 used for?

Line 6 is for various nonrefundable credits that don’t fit into other categories, including the Alternative Minimum Tax Credit, Credit for the Elderly or Disabled, and Adoption Tax Credit.

What situations require more than a simple Form 1040 return?

Situations like itemized deductions, additional income sources (unemployment benefits, self-employment income), investments, and specialized credits or deductions require more than a basic Form 1040.

What situations are included in a simple Form 1040 return?

A simple Form 1040 typically includes employment income from W-2 forms, interest and dividends, standard deductions, Earned Income Tax Credit (EITC), Child Tax Credit (CTC), student loan interest deductions, and retirement plan distributions.

How was Form 1040 redesigned in 2018, and what schedules were introduced?

In 2018, the IRS simplified Form 1040 by consolidating previous forms into one. They introduced three schedules:

Schedule 1: Additional income and deductions

Schedule 2: Additional taxes

Schedule 3: Additional credits and payments

What tools and calculators can help with tax preparation?

There are various tools available, including:

- General tax calculators

- Tax bracket calculators

- E-file status trackers

- W-4 withholding calculators

- Donation trackers

- Self-employment calculators

- Cryptocurrency calculators

- Capital gains calculators

- Bonus calculators

- Tax document checklists

What options are available for tax filing using online software?

Online tax software offers:

- Free editions for simple returns

- Deluxe editions for maximizing deductions and credits

- Tools for self-employed individuals

- Military discounts

- Live tax expert assistance

- Premium support services

- Business tax solutions

- Verified professional services

Conclusion

Filing Form 1040 Schedule 3 doesn’t have to be a headache. By understanding its structure, knowing when to use it, and following the steps to complete it accurately, you can navigate your tax filing with ease. Properly filling out Schedule 3 can help you take full advantage of available tax credits, lower your tax bill, and potentially increase your refund.

Connecting with XOA TAX

Navigating tax forms and credits can be tricky. If you need personalized help to ensure your tax return is accurate and optimized, reach out to the experts at XOA TAX. We’re here to guide you through the process and answer any questions you may have.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.