At XOA TAX, we understand that dealing with taxes can sometimes feel overwhelming. That’s why we’re here to simplify things for you. In this guide, we’ll break down everything you need to know about IRS Form 1040-V, a handy tool for taxpayers who choose to pay their taxes by mail.

Important Note: Tax laws and forms are always subject to change. While this information is based on current IRS guidelines, it’s always a good idea to check the official IRS website (www.irs.gov) for the latest updates.

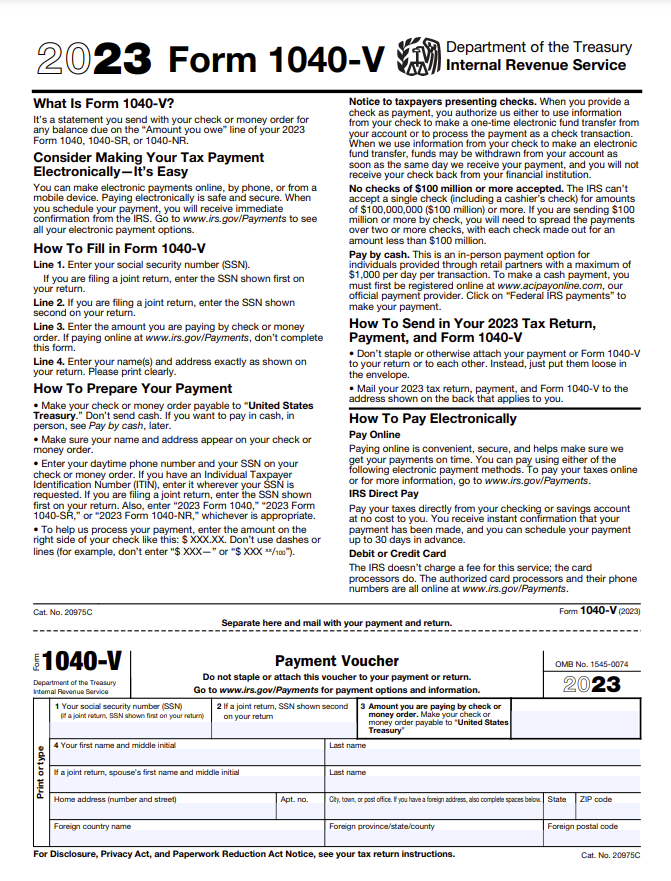

What is Form 1040-V?

Think of Form 1040-V as a payment voucher. It’s a simple form you include when you’re sending a check or money order to the IRS to cover your tax liability. You’ll need this form if you’re making a payment with any of the following tax returns:

- Form 1040: U.S. Individual Income Tax Return

- Form 1040-SR: U.S. Tax Return for Seniors

- Form 1040-NR: U.S. Nonresident Alien Income Tax Return

Form 1040-V can also be used for:

- Estimated Taxes: Payments made throughout the year by self-employed individuals and those with income not subject to sufficient withholding.

- Underpayment Penalties: If you didn’t pay enough taxes during the year.

- Additional Self-Employment Tax: Covers Social Security and Medicare taxes for self-employed individuals.

Who Needs to Use Form 1040-V?

Form 1040-V is only necessary if you’re mailing a check or money order with a paper tax return. If you e-file and pay electronically, you can skip this form altogether.

Key Takeaways:

- Form 1040-V is not required for electronic payments.

- Never staple or attach the voucher to your check or money order.

- Double-check all information for accuracy.

- Always verify current IRS guidelines at www.irs.gov.

How to Fill Out Form 1040-V:

Personal Information:

- Line 1: Your Social Security Number (SSN). If filing jointly, enter the first SSN shown on your tax return.

- Line 2: If filing jointly, enter the second SSN.

- Line 3: The exact amount you’re paying.

- Line 4: Your name and address, exactly as they appear on your tax return.

Check or Money Order Instructions:

- Make payable to “U.S. Treasury”.

- Include your full name and address on the check.

- Add your daytime phone number and SSN (or ITIN).

- In the memo line, write the tax year and the form you’re filing (e.g., “2024 Form 1040”).

- Write the amount as “$XXX.XX” (e.g., $1,234.56).

Mailing Instructions:

- Do not staple or attach the voucher to your payment.

- Find the correct IRS mailing address on the second page of Form 1040-V or on the IRS website. The address varies by state and form type.

- Mail the voucher and payment in the same envelope.

Avoid These Common Mistakes:

At XOA TAX, we’ve seen these common errors trip up many taxpayers:

- Missing Signatures: Don’t forget to sign and date the form!

- Incomplete Information: Make sure you’ve completed all required sections.

- Incorrect Address: Double-check that your address matches your tax return.

- Stapling or Attaching: Remember to keep the voucher and payment separate in the envelope.

Payment Options:

The IRS encourages electronic payment methods for faster and more secure processing. Here are your options:

When E-filing:

- IRS Direct Pay: Pay directly from your bank account via the IRS website or IRS2Go mobile app.

- Debit Card, Credit Card, or Digital Wallet: Pay online or by phone through a third-party provider (fees may apply).

- Electronic Funds Withdrawal: Debit your bank account when e-filing.

When Mailing a Paper Return:

- Check or Money Order with Form 1040-V: Follow the instructions above.

- Cash: See the next section for details.

Paying with Cash:

You can pay your taxes in cash at participating retail locations.

- Set up your payment: Visit the PayUSAtax website to start the process.

- Receive confirmation: You’ll get an email confirming your payment details.

- Obtain a payment code: A second email will provide a payment code and instructions.

- Make your payment: Take the code to a participating retail location (find locations using the PayUSAtax locator tool) within seven days. Pay the cashier and get a receipt.

Important Notes:

- Verify the current cash payment limit on the IRS website.

- Processing fees apply to cash payments.

- You can also schedule an appointment to pay in cash at an IRS Taxpayer Assistance Center.

Payment Processing Times:

- Electronic payments: Typically process within 1-2 business days.

- Mailed payments: Can take several weeks to process, especially during peak tax season.

To avoid delays, file and pay your taxes early.

What If My Payment is Lost or Delayed?

- If you mailed a check: Contact your bank to see if it has been cashed. If not, you may need to stop payment and reissue a new check with a new Form 1040-V.

- If you paid with a money order: Contact the issuer to trace the money order. You may need to obtain a replacement.

- For any payment issues: Contact the IRS directly for assistance.

Important Dates and Deadlines:

- Tax Day: Generally April 15th, but can vary. Check the IRS website for the exact deadline.

- Estimated Tax Deadlines: Vary throughout the year. Refer to IRS Publication 505 for details.

Payment Plans and Installment Agreements:

If you can’t pay your taxes in full, you may be eligible for a payment plan or installment agreement. Visit IRS.gov or contact the IRS to learn more.

Documentation and Security:

- Keep copies: Make copies of your Form 1040-V, check, money order, and any payment confirmation emails.

- Take photos: Consider taking photos or scans of your check before mailing it.

- Mail securely: Use a secure mailbox or post office. Never send cash through the mail.

- Consider certified mail: For added security and proof of delivery, use certified mail or delivery confirmation.

Digital Resources:

- IRS Online Account: Create an account on IRS.gov to view payment history, access tax records, and track your payments online.

- IRS2Go Mobile App: Download the app for convenient access to tax tools and information.

FAQs

Can I track my payment if I mail a check with Form 1040-V?

While the IRS doesn’t offer a tracking system specifically for mailed checks, you can monitor your bank account to see if the check has been cashed. For extra peace of mind, consider using certified mail with return receipt requested. This will provide confirmation that the IRS received your payment.

What happens if I make a mistake on Form 1040-V?

We all make mistakes! If you realize you’ve made an error after mailing the form, contact the IRS as soon as possible. They can guide you on the best way to correct the issue.

Need More Help?

We know that taxes can be complex. If you have any questions or need assistance with Form 1040-V or any other tax-related matter, don’t hesitate to reach out to us.

- IRS Website: www.irs.gov

- IRS2Go Mobile App: Download for tax tools and information.

- Taxpayer Assistance Centers: Find a center near you for in-person help.

Need personalized guidance? XOA TAX is here to assist. Our experienced CPAs can ensure your tax return is accurate and filed on time. Contact us today:

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

By understanding Form 1040-V and the various payment options available, you can confidently navigate tax season and fulfill your tax obligations. We’re here to support you every step of the way!

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime