Navigating business taxes can feel overwhelming, but Form 3800—the General Business Credit form—offers a simpler way to claim valuable tax credits. This guide will walk you through everything you need to know to confidently claim the credits your business qualifies for.

1. What is Form 3800?

Form 3800 lets you claim a variety of business tax credits, directly reducing your tax bill. Instead of filing separate forms for each credit, you can combine them on Form 3800, making your tax filing process smoother.

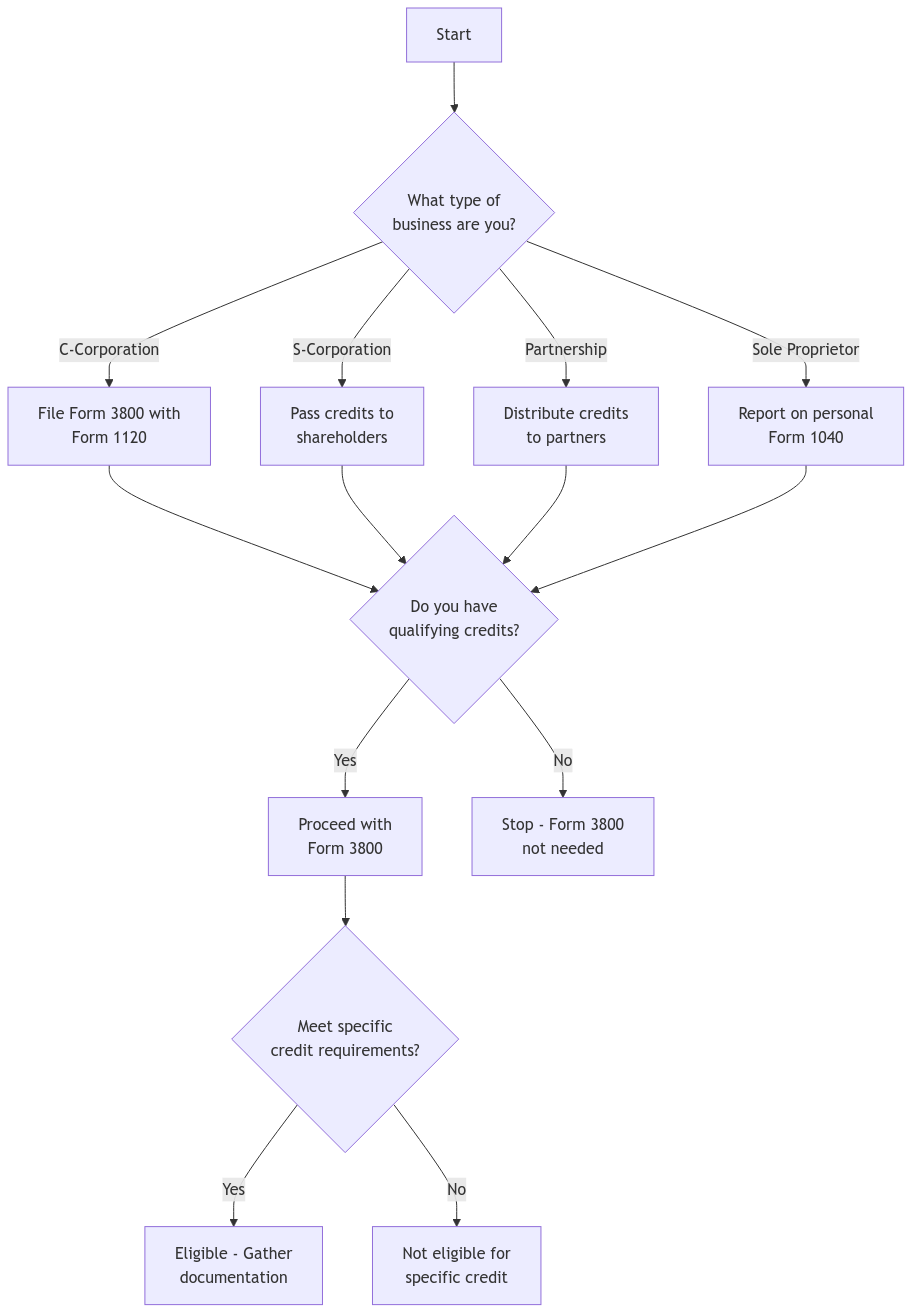

2. Who Needs to Use Form 3800?

You should use Form 3800 if:

- Your business is claiming multiple tax credits.

- You’re part of an S-corporation or partnership.

- You’re an individual business owner claiming business credits.

- You’re a corporation claiming business credits.

3. Are You Eligible?

Before diving in, make sure you meet the eligibility criteria:

Business Structure:

- C-Corporations: File Form 3800 with your corporate tax return (Form 1120).

- S-Corporations: Pass the credits to your shareholders to report on their personal tax returns (Form 1040).

- Partnerships: Distribute the credits to your partners to report on their personal tax returns (Form 1040).

- Sole Proprietors: Report the credits on your personal tax return (Form 1040).

Credit Specifics:

Each credit has its own set of rules, requirements, and limitations. Be sure to read the IRS instructions for each specific credit form. You can find these on the IRS website.

4. Filling Out Form 3800: A Step-by-Step Guide

Part I: Current Year Credits

- List All Credits: Start by listing all the credits you’re claiming for the current tax year.

- Complete Individual Credit Forms First: Before filling out Form 3800, complete the specific forms for each credit. For example, if you’re claiming the Research Credit, fill out Form 6765 first.

Part II: Allowable Credit

- Calculate Your Limit: Determine how much of the credit you can use this year. This may be limited based on your income, tax liability, or other factors.

Important Considerations

- Regular Tax Liability: Generally, credits can only offset your regular tax liability.

- Alternative Minimum Tax (AMT): The AMT might affect how much credit you can use. Some credits can’t reduce your AMT liability. Refer to the Instructions for Form 6251 for more details.

- Passive Activity Limitations: If you have passive income or losses, certain credits might be limited. Check out IRS Publication 925 for guidance.

- Credit Ordering Rules: The IRS has specific rules about the order in which to apply credits. Following these can help you maximize your benefits. Details are available in the Instructions for Form 3800. Generally, you use carryforward credits from previous years before current year credits.

5. Common Mistakes to Avoid

- Incorrect Carryforward Calculations: If you have unused credits from previous years, calculating the correct carryforward amount can be tricky. Keep precise records.

- Missing Documentation: Always maintain thorough records like invoices, contracts, and receipts to support your credit claims.

- Ignoring Credit Ordering Rules: Applying credits in the wrong order can lead to missed opportunities for savings.

- Overlooking Phase-Out Rules: Some credits reduce as your income increases. Be aware of these thresholds to avoid surprises.

6. What’s New for 2024?

The IRS has updated Form 3800 for the 2024 tax year:

- New Credits Added:

- Clean Electricity Production Credit (Section 45Y): For businesses producing electricity from renewable sources. Reported on Form 3800, Part III, line 1gg. Requires Form 7211.

- Clean Fuel Production Credit (Section 45Z): Encourages production of clean transportation fuels. Reported on Form 3800, Part III, line 1q. Requires Form 7218.

- Clean Electricity Investment Credit (Section 48E): For investments in clean electricity facilities. Reported on Form 3800, Part III, line 1v. Details found in Part V of Form 3468.

- Enhanced Reporting: The form now includes sections for elective payment and transfer elections under sections 6417 and 6418.

- Updated Parts V and VI: These sections have been revised for more detailed reporting, especially for businesses with multiple facilities or pass-through entities.

- Pre-Filing Registration Required: If you plan to make an elective payment or transfer election, you must complete a pre-filing registration with the IRS.

Always refer to the official IRS website for the most current information.

7. Filing Deadlines

- Individuals: For the 2024 tax year, the deadline is April 15, 2025. State deadlines might differ.

- C-Corporations: Generally due by the 15th day of the fourth month after your fiscal year ends. If you operate on a non-calendar fiscal year, adjust accordingly.

8. Real-World Examples

Example 1: Small Business Research Credit

“InnovateTech,” a tech startup, spends $200,000 on qualified research expenses. The simplified credit rate is 14%.

Calculation:

- Research Credit: $200,000 × 14% = $28,000

Note: This is a simplified calculation using the Alternative Simplified Credit method. The actual process may involve more steps.

Example 2: Work Opportunity Credit

“GreenGear,” a manufacturing company, hires a veteran from a targeted group and pays them $25,000 in the first year.

Calculation:

- Maximum Wages Considered: $6,000 (standard limit for most target groups)

- Credit Rate: 40%

- Work Opportunity Credit: $6,000 × 40% = $2,400

Note: The wage limit and credit rate can vary depending on the employee’s target group.

Example 3: Credit Limitations with the AMT

“Solar Solutions Inc.” has $50,000 in Renewable Electricity Production Credits but is subject to the AMT.

- Issue: Some credits can’t offset AMT liability.

- Action: They consult the Instructions for Form 6251 to determine how much credit can be used this year and consider carrying forward the remainder.

Example 4: Carryforward Calculation

“Eco Products LLC” has $30,000 in unused credits from last year. This year, they earn $20,000 in new credits.

- Application Order:

- First: Apply the $30,000 carryforward.

- Second: Apply the $20,000 current year credit.

- Result: They can use up to $50,000 in credits this year, depending on their tax liability.

9. Documentation Checklist

Before you file, make sure you have:

- Completed Credit Forms: All specific forms for the credits you’re claiming.

- Detailed Calculations: Records showing how you arrived at each credit amount.

- Supporting Documents: Invoices, receipts, contracts, and other proof of your credit claims.

- Carryforward Schedules: Documentation of any credits carried forward from previous years.

- Entity Information: If applicable, details on how credits are allocated in partnerships or S-corporations.

Record Retention: Keep all documents for at least three years from your filing date in case of an audit.

Electronic Filing: If you’re filing electronically, ensure all forms, including Form 3800, are submitted properly. Double-check with your tax software or preparer.

10. State Tax Implications

State-Specific Credits: Many states offer their own business credits, which may differ from federal credits.

- California: Offers a Research and Development Tax Credit.

- New York: Provides an Investment Tax Credit.

Different Rules: State credits often have unique qualifications and limitations.

Tip: Check with your state’s tax authority to understand the credits available to you and how to claim them.

11. Penalties for Incorrect Filing

Making mistakes can cost you:

- Penalties: The IRS may charge penalties for inaccuracies, negligence, or fraud.

- Interest: You’ll owe interest on any underpaid taxes due to incorrect credits.

- Audits: Incorrect or unsupported claims may trigger an audit.

Best Practice: Keep accurate records, follow IRS guidelines closely, and consult a tax professional if you’re unsure.

12. Need Help with Form 3800?

Tax credits can be complicated, but you don’t have to navigate them alone. XOA TAX is here to assist with:

- Complex Credit Calculations

- Strategic Tax Planning

- Audit Support

- Industry-Specific Advice

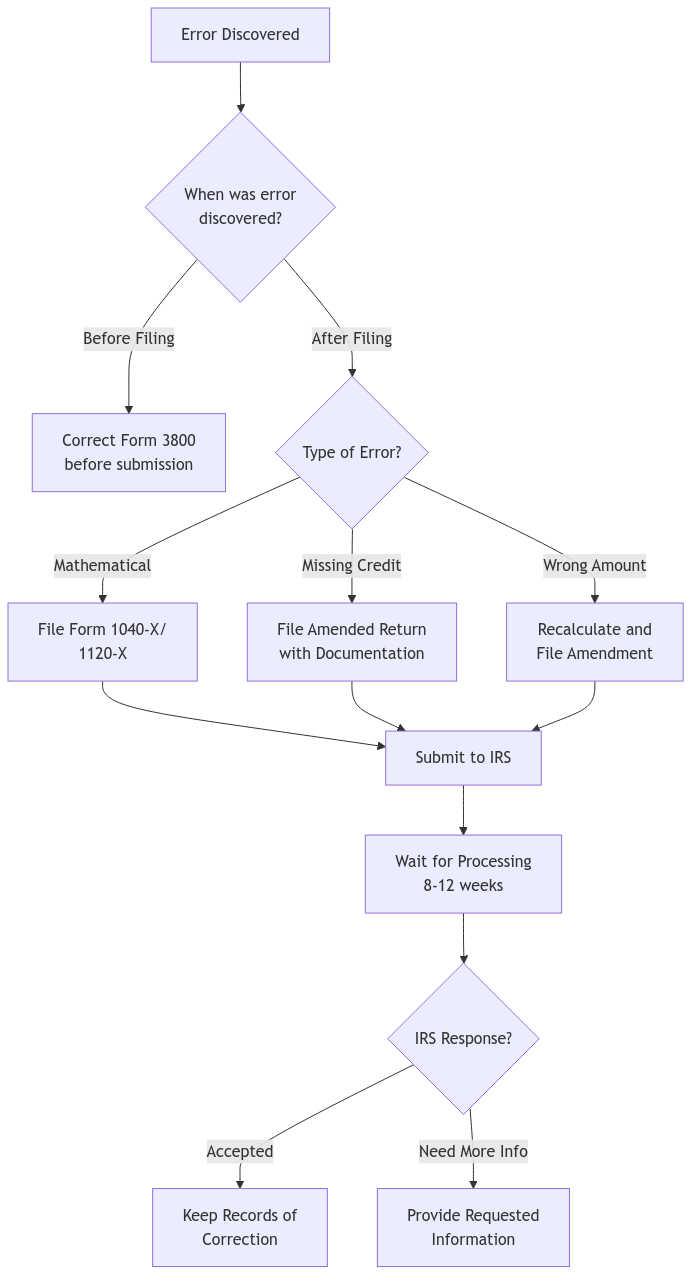

We can also guide you on processing times and how to amend returns if needed.

IRS Resources:

- Website: IRS.gov

- Phone: 1-800-829-1040

Processing Times: The IRS usually processes Form 3800 within 10-12 weeks, but this can vary.

Correcting Errors: If you find a mistake after filing, you can amend your return using Form 1040-X for federal taxes. State amendment procedures will vary.

Want to see how XOA TAX can help your business succeed?

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime