Hey there, fellow landlords! Dealing with rental losses on your taxes can feel like wandering through a maze, right? But don’t worry, XOA TAX is here to be your guide. Today, we’re shining a light on Form 8582, your key to understanding and managing those sometimes-tricky rental property losses.

Think of Form 8582 as your map for allocating losses from rental real estate activities. It helps you figure out how much of your rental loss you can actually deduct on your taxes each year. Now, let’s break down this form step by step, so you can confidently tackle your taxes and keep more of your hard-earned money.

Key Takeaways

- Form 8582 helps you allocate losses from rental properties.

- Understanding passive activity loss limitations is crucial for maximizing deductions.

- This guide provides a clear breakdown of Form 8582 and its purpose.

What is Form 8582?

Form 8582, officially titled “Passive Activity Loss Limitations,” is a must-use for taxpayers who own rental properties and have losses from those properties. It helps you navigate the rules around passive activity losses, which can be a bit confusing.

Why is it important?

The IRS has rules about how much of your rental losses you can deduct each year. These rules prevent taxpayers from using losses to offset all their other income. Form 8582 helps you follow these rules correctly.

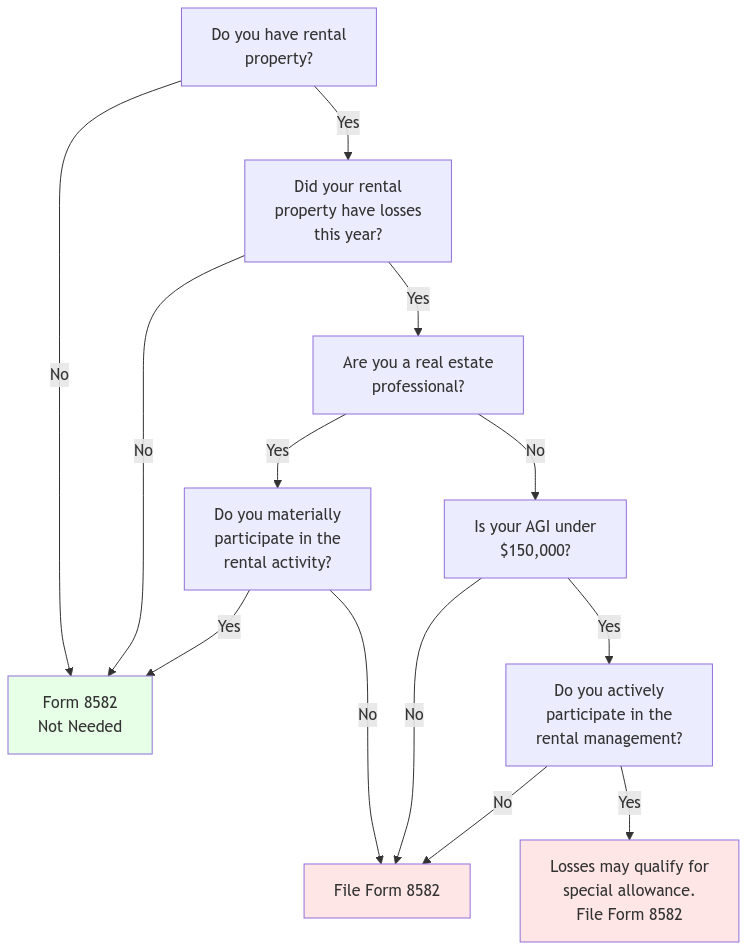

Who Needs to File Form 8582?

You’ll generally need to file Form 8582 if:

- You have a loss from your rental property.

- This loss is considered a “passive activity loss.”

What’s a passive activity loss?

Imagine you own a rental property, but you’re not actively involved in its day-to-day management. Perhaps you’ve hired a property manager to handle everything. In this case, any loss from that property is generally considered a passive activity loss.

How to Complete Form 8582: A Step-by-Step Guide

Form 8582 may seem daunting at first, but it’s actually quite manageable when broken down. Here’s a simplified look at the key sections:

Part I: 2023 Passive Activity Loss

This is where you’ll list each of your rental properties separately and calculate the income or loss from each property.

Part II: Special Allowance for Rental Real Estate Activities

If you actively participate in managing your rental property, you might qualify for a special allowance of up to $25,000 in deductible losses, even if you don’t have other passive income. This section helps you determine if you meet the criteria for active participation.

Important Note: This special allowance is phased out for taxpayers with higher incomes. For 2023, the phase-out begins at $100,000 and is completely phased out at $150,000 of adjusted gross income (AGI).

Part III: Total Losses Allowed

This section helps you calculate the total amount of passive activity losses you can deduct this year, taking into account any special allowances and limitations.

Worksheets 1-3

Form 8582 includes three worksheets to help you navigate the calculations:

- Worksheet 1: Used to figure out your passive activity loss from all activities.

- Worksheet 2: Helps you determine your rental real estate loss allowance.

- Worksheet 3: Used to calculate the amount of your passive activity loss allowed for the year.

Example:

Let’s say Jane owns a rental property and actively participates in its management. Her rental property generated a loss of $15,000 for the year. She also has a salary of $80,000 and no other passive income.

Using Form 8582, Jane would:

- Report the $15,000 loss in Part I.

- In Part II, she would claim the special allowance for rental real estate activities. Since her AGI is below $100,000, she can deduct up to $25,000 in losses.

- Because her rental loss is less than the special allowance, she can deduct the entire $15,000 loss this year.

Active vs. Material Participation

Requirements

Active Participation

- • Making management decisions

- • Arranging for repairs

- • Collecting rent

- • No specific hour requirement

Material Participation

- • 500+ hours of participation annually

- • Substantial involvement in operations

- • Regular, continuous, and significant involvement

- • Must maintain detailed time logs

Key Differences

Active Participation

- • Less stringent participation requirements

- • Focus on management decisions

- • Can qualify with minimal time investment

- • Easier to document

Material Participation

- • Strict hour requirements

- • Focus on day-to-day operations

- • Requires significant time commitment

- • Needs detailed documentation

Benefits & Limitations

Active Participation

- • Up to $25,000 in loss deductions

- • Subject to income limitations

- • Phase-out starts at $100,000 AGI

- • Complete phase-out at $150,000 AGI

Material Participation

- • Unlimited loss deductions

- • No income limitations

- • Losses fully deductible

- • Can offset other income types

Qualifying Activities

Active Participation

- • Reviewing & approving tenants

- • Setting rental terms

- • Approving major repairs

- • Annual property inspections

Material Participation

- • Daily property management

- • Performing maintenance work

- • Showing units to prospects

- • Handling tenant issues directly

Important Considerations

- Types of Passive Activities: Passive activities aren’t limited to just rental real estate. They can also include interests in businesses where you don’t materially participate, such as limited partnerships.

- Material Participation: To qualify for the active participation exception, you must meet certain criteria. The IRS has specific tests to determine material participation, such as spending a significant amount of time managing the property or making key management decisions.

- Recordkeeping: It’s crucial to keep thorough and accurate records of your rental income and expenses. This includes things like rent receipts, mortgage interest statements, insurance policies, and receipts for repairs and maintenance.

- Disposition of Passive Activity: When you sell your rental property, you can generally deduct any remaining passive losses that you haven’t been able to use in previous years.

- Real Estate Professionals: If you qualify as a real estate professional, you might be able to deduct your rental losses without limitation. This generally requires that you spend more than half of your working hours and more than 750 hours per year in real estate activities.

FAQs about Form 8582

Where can I find the latest version of Form 8582 and its instructions?

You can find the most up-to-date forms and instructions on the IRS website: [invalid URL removed]

What if my rental property is part of a larger business activity?

The rules can get more complex if your rental property is part of a larger trade or business. It’s best to consult with a tax professional to determine the best way to report your income and losses in this situation.

Are there any special rules for rental losses related to vacation homes?

Yes, there are specific rules for deducting rental losses from vacation homes that you also use personally. These rules depend on how many days you rent out the property versus how many days you use it for personal purposes.

Common Mistakes to Avoid

- Not understanding the active participation rules: Many taxpayers mistakenly believe they can deduct rental losses simply because they own the property. Make sure you meet the criteria for active participation to qualify for the special allowance.

- Incorrectly calculating the special allowance: The special allowance is subject to income limitations and phase-out rules. Calculate your AGI carefully to determine the correct amount you can deduct.

- Poor recordkeeping: Failing to keep accurate records of your rental income and expenses can lead to missed deductions and potential problems with the IRS.

Need Help with Your Rental Losses?

We understand that Form 8582 and the rules around passive activity losses can be complex. If you have any questions or need assistance, the team at XOA TAX is here to help! We can guide you through the process, ensure you’re maximizing your deductions, and take the stress out of tax season.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime