Acquiring or selling a business can be an exciting venture, but it also comes with important tax considerations. One crucial document that plays a significant role in this process is Form 8594, the Asset Acquisition Statement. This form, required by the IRS, helps both buyers and sellers accurately report the allocation of the purchase price among various asset classes.

At XOA TAX, we understand that navigating the complexities of Form 8594 can be challenging. That’s why we’ve created this comprehensive guide to help you understand its requirements and ensure a smooth transaction.

Key Takeaways

- Form 8594 is required for both the buyer and seller in an applicable asset acquisition.

- The purchase price must be allocated among seven specific asset classes using the residual method.

- Accurate allocation impacts tax basis, depreciation, and capital gains calculations.

- Failing to file Form 8594 or providing inaccurate information can result in IRS penalties.

What is Form 8594?

Form 8594 is used to report the sale of a group of assets that constitute a trade or business. It ensures that both the buyer and seller are on the same page regarding the purchase price allocation, which directly impacts their respective tax obligations.

Understanding the Seven Asset Classes

The IRS has defined seven distinct asset classes for the purpose of allocating the purchase price on Form 8594. These classes are:

- Class I: Cash and General Deposit Accounts: This includes cash, checking accounts, and savings accounts.

- Class II: Actively Traded Personal Property & Certificates of Deposit: This includes stocks, bonds, and other marketable securities.

- Class III: Accounts Receivable, Mortgages Held, and Credit Card Receivables: This class covers debt instruments.

- Class IV: Inventory: This includes any property held for sale to customers in the ordinary course of business.

- Class V: Furniture, Fixtures, Vehicles, Land, and Equipment: This encompasses tangible assets used in the business.

- Class VI: Section 197 Intangibles: This includes intangible assets like patents, copyrights, and trademarks, but excludes goodwill and going concern value.

- Class VII: Goodwill and Going Concern Value: This represents the residual value after allocating the purchase price to the other six classes.

The Residual Method

The IRS requires the use of the residual method to allocate the purchase price among these asset classes. This method involves:

- Determining the Fair Market Value (FMV): Establish the FMV of each asset acquired.

- Allocating to Class V Assets: Allocate the purchase price to Class V assets based on their FMV.

- Allocating to Other Classes: Allocate the remaining purchase price to the other asset classes (I, II, III, IV, and VI) in proportion to their FMV.

- Residual Allocation: Any remaining amount after allocating to the first six classes is allocated to Class VII (Goodwill and Going Concern Value).

How to Complete Form 8594

Form 8594 has three parts:

- Part I: Provides identifying information for both the buyer and seller, such as the tax year of the transfer and the date of sale.

- Part II: Used by both parties to report the original asset allocation.

- Part III: Used to report any subsequent adjustments to the allocation.

Original Statement: If you’re filing Form 8594 for the first time for a given transaction, you’ll complete Parts I and II.

Supplemental Statement: If you need to adjust the allocation after the original filing, you’ll complete Parts I and III.

Why Accurate Reporting Matters

Accurate reporting on Form 8594 is crucial for both buyers and sellers due to its significant tax implications:

- Depreciation: Buyers can depreciate certain assets over time, reducing their taxable income. The Tax Cuts and Jobs Act (TCJA) made significant changes to depreciation rules, including bonus depreciation and Section 179 expensing, which can significantly impact tax liabilities. The allocation of the purchase price on Form 8594 determines the depreciable basis for each asset class. For example, Class V assets (equipment, furniture, etc.) are typically depreciated over 5 or 7 years, while Class VI intangibles (patents, copyrights) are amortized over 15 years.

- Capital Gains: Sellers usually recognize capital gains on the sale of business assets. The allocation on Form 8594 impacts the amount and character of the gain.

- Section 1245 and 1250 Recapture: For sellers, the allocation can trigger depreciation recapture under Section 1245 (for personal property) or Section 1250 (for real property), which could result in some of the gain being taxed at ordinary income tax rates.

When to File Form 8594

Form 8594 must be filed with your tax return for the year in which the asset acquisition occurs. If you need to make adjustments to the allocation in a later year, you’ll file a supplemental Form 8594 with your tax return for that year.

Penalties for Non-Compliance

Failing to file Form 8594 or providing inaccurate information can have consequences. The IRS can impose penalties for various reasons, including:

- Failure to File: Penalties may apply if you don’t file Form 8594 when required.

- Inaccurate Information: Providing inaccurate information can also lead to penalties.

- Inconsistency with Tax Returns: Discrepancies between the information on Form 8594 and your tax return can trigger IRS scrutiny.

The specific penalty amount varies depending on the nature of the violation and other circumstances. It’s crucial to file Form 8594 accurately and on time to avoid potential penalties.

Special Considerations

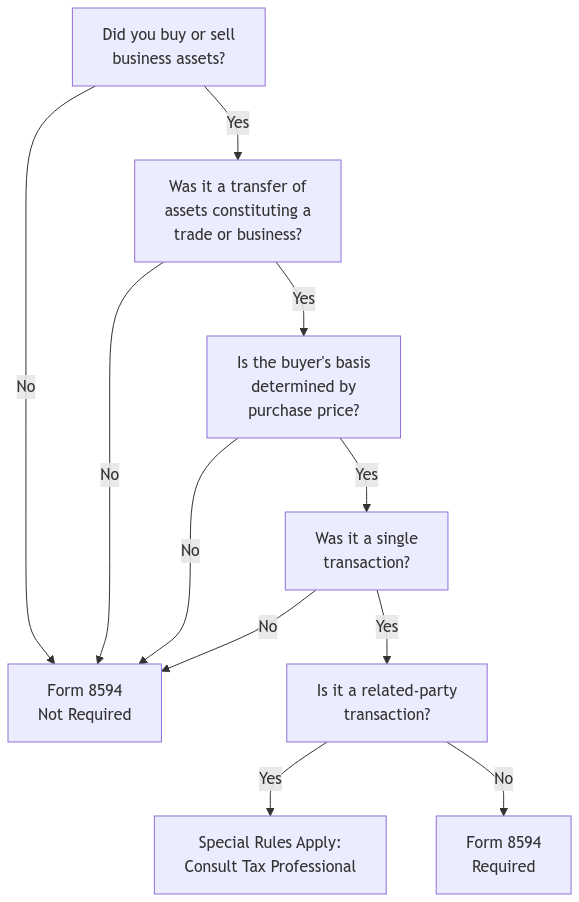

- Applicable Asset Acquisitions: It’s important to note that Form 8594 is specifically required for “applicable asset acquisitions” as defined under Section 1060 of the Internal Revenue Code. This generally includes transfers of assets that constitute a trade or business where the buyer’s basis is determined by the amount paid.

- Reporting Threshold for Individual Assets: In some cases, you may not need to report individual assets on Form 8594 if their value doesn’t exceed $10,000.

- Treatment of Covenant Not to Compete: A covenant not to compete is an agreement where the seller agrees not to compete with the buyer for a certain period in a certain geographical area. Payments for a covenant not to compete are generally amortized over 15 years.

- Related-Party Transactions: Special rules apply to asset acquisitions between related parties. These rules are designed to prevent tax avoidance and ensure that transactions occur at arm’s length. If you’re involved in a related-party transaction, it’s essential to consult with a tax professional to ensure compliance.

- International Acquisitions: Acquisitions involving foreign entities or assets can have complex tax implications. Factors like tax treaties and foreign tax credits come into play. It’s crucial to seek expert advice to navigate these complexities.

- State Tax Implications: In addition to federal taxes, you’ll need to consider state tax implications. States have their own rules regarding asset acquisitions, and the allocation on Form 8594 can impact your state tax liability.

XOA TAX Can Help

At XOA TAX, we have a team of experienced CPAs who can assist you with all aspects of Form 8594, including:

- Determining Fair Market Value

- Allocating the Purchase Price

- Filing and Compliance

Don’t let the complexities of Form 8594 overwhelm you. Contact XOA TAX today for expert guidance and support throughout your business acquisition.

FAQs

What is the purpose of Form 8594?

Form 8594 is used to report the sale of a group of assets that constitute a trade or business. It helps buyers and sellers consistently allocate the purchase price among different asset classes, which impacts their tax liabilities.

What are the seven asset classes on Form 8594?

The seven asset classes are:

1. Cash and General Deposit Accounts

2. Actively Traded Personal Property & Certificates of Deposit

3. Accounts Receivable, Mortgages Held, and Credit Card Receivables

4. Inventory

5. Furniture, Fixtures, Vehicles, Land, and Equipment

6. Section 197 Intangibles

7. Goodwill and Going Concern Value

What is the residual method?

The residual method is a specific allocation method required by the IRS for Form 8594. It involves allocating the purchase price to assets in a specific order, with any remaining amount allocated to goodwill and going concern value.

When is Form 8594 due?

Form 8594 is due with your tax return for the year in which the asset acquisition occurred.

What are the penalties for not filing Form 8594?

The IRS can impose penalties for not filing Form 8594, providing inaccurate information, or having inconsistencies between the form and your tax return.

Connecting with XOA TAX:

Navigating the complexities of business acquisitions can be challenging, especially when it comes to tax implications and compliance requirements like Form 8594. At XOA TAX, we’re here to help. Our team of experienced CPAs can provide expert guidance and support throughout the process, ensuring a smooth and successful transaction. Contact us today to schedule a consultation and let us help you navigate the complexities of your business acquisition.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime