Stepping into the world of international tax can feel like navigating a complex maze, especially when it comes to foreign partnerships. But fear not, fellow adventurers! Today, we’re shining a light on Form 8865, the essential tax document for U.S. persons with interests in foreign partnerships. Whether you’re a seasoned entrepreneur with ventures abroad or just starting to explore international opportunities, understanding Form 8865 is crucial for staying compliant with IRS regulations and achieving your financial goals.

Ready to tackle Form 8865? We’ll break down the essentials, explain what you need to know, and help you navigate the ins and outs of this important tax form. Let’s make sure your international tax journey is a successful one!.

Key Takeaways

- Form 8865 is a critical tax document for U.S. persons with interests in foreign partnerships.

- Filing requirements vary based on your ownership percentage and the type of partnership.

- Understanding Form 8865 can help you avoid penalties and maintain accurate financial reporting.

Form 8865 Quick Reference Guide

Key Thresholds to Remember

- Category 1: > 50% ownership

- Category 2: ≥ 10% ownership + $100,000+ contribution

- Category 3: ≥ 10% ownership with significant changes

- Category 4: Any acquisition/disposition of interest

Common Schedules Required

| Category | Required Schedules |

|---|---|

| 1 | A, A-1, A-2, B, K, K-1, M, N, O |

| 2 | A, A-1, A-2, B, K, K-1, P |

| 3 | O |

| 4 | P |

Important Deadlines

- Individuals: April 15

- Partnerships/Corps: March 15

- Extensions available: 6 months

Red Flags to Watch

- Missing currency conversion documentation

- Incomplete constructive ownership analysis

- Failure to report changes in ownership

- Inconsistent reporting across forms

What is Form 8865?

Form 8865, officially titled “Return of U.S. Persons With Respect to Certain Foreign Partnerships,” is an informational tax form. It’s used to report your activities related to foreign partnerships, especially those not formed under U.S. laws. This ensures the IRS has oversight of these international activities.

Who Needs to File?

You need to file Form 8865 if you’re a U.S. person with an interest in a foreign partnership. This includes:

- U.S. citizens or resident aliens

- Domestic corporations

- Domestic partnerships

- Estates or trusts (that are not foreign)

Why is Form 8865 Important?

The IRS requires U.S. partners in foreign partnerships to disclose specific information. This helps prevent tax evasion and ensures everyone pays their fair share. Failing to file correctly can lead to penalties.

Types of Foreign Partnerships

It’s important to distinguish between different types of foreign partnerships. A foreign partnership is any partnership not organized under U.S. law. A controlled foreign partnership (CFP) is a specific type of foreign partnership where U.S. persons own more than 50% of the partnership’s interests. CFPs have additional reporting requirements.

Ownership in a Foreign Partnership: U.S. Tax Implications

Owning a part of a foreign partnership can have significant tax implications:

- Increased Reporting: Form 8865 and potentially other forms are required.

- Worldwide Income: As a U.S. taxpayer, your worldwide income is taxed, including income from foreign partnerships.

- Foreign Tax Credits: You may be able to claim a credit for taxes paid to a foreign government on partnership income to avoid double taxation.

- Currency Exchange: Income or losses need to be reported in U.S. dollars, which might require complex calculations.

Important Tax Considerations: GILTI and Subpart F Income

When dealing with foreign partnerships, U.S. partners need to understand these key concepts:

Global Intangible Low-Taxed Income (GILTI):

- GILTI may apply if the foreign partnership owns CFCs (Controlled Foreign Corporations).

- U.S. partners might need to include their share of GILTI in their current year income.

- Special considerations apply for partnerships making § 962 elections.

Subpart F Income:

- Foreign partnerships may generate Subpart F income that requires special attention.

- U.S. partners may need to recognize this income currently, even without distributions.

- Complex calculations may be required to determine each partner’s share.

- Interaction with tax treaties needs careful consideration.

Navigating the Maze: Form 8865 and Other International Reporting Requirements

Form 8865 is just one piece of the puzzle when it comes to international tax reporting. Depending on your situation, you might also need to file other forms. Here are two important ones to be aware of:

- Form 8938 (Statement of Specified Foreign Financial Assets): This form is used to report your interests in specific foreign financial assets, such as foreign bank accounts, stocks, and financial instruments. If the total value of your specified foreign financial assets exceeds certain thresholds, you’ll need to file Form 8938.

- FBAR (Foreign Bank Account Report): If you have a financial interest in, or signature authority over, foreign financial accounts that exceed $10,000 in aggregate at any time during the year, you’ll need to file an FBAR electronically with the Financial Crimes Enforcement Network (FinCEN).

It’s important to understand how these different forms interact with each other and with Form 8865. For example, certain information reported on Form 8865 might also need to be reported on Form 8938.

(Insert a helpful diagram here illustrating the relationship between Form 8865, Form 8938, and FBAR)

The rules and thresholds for these forms can be complex, so it’s crucial to consult with a tax professional to determine your specific filing obligations.

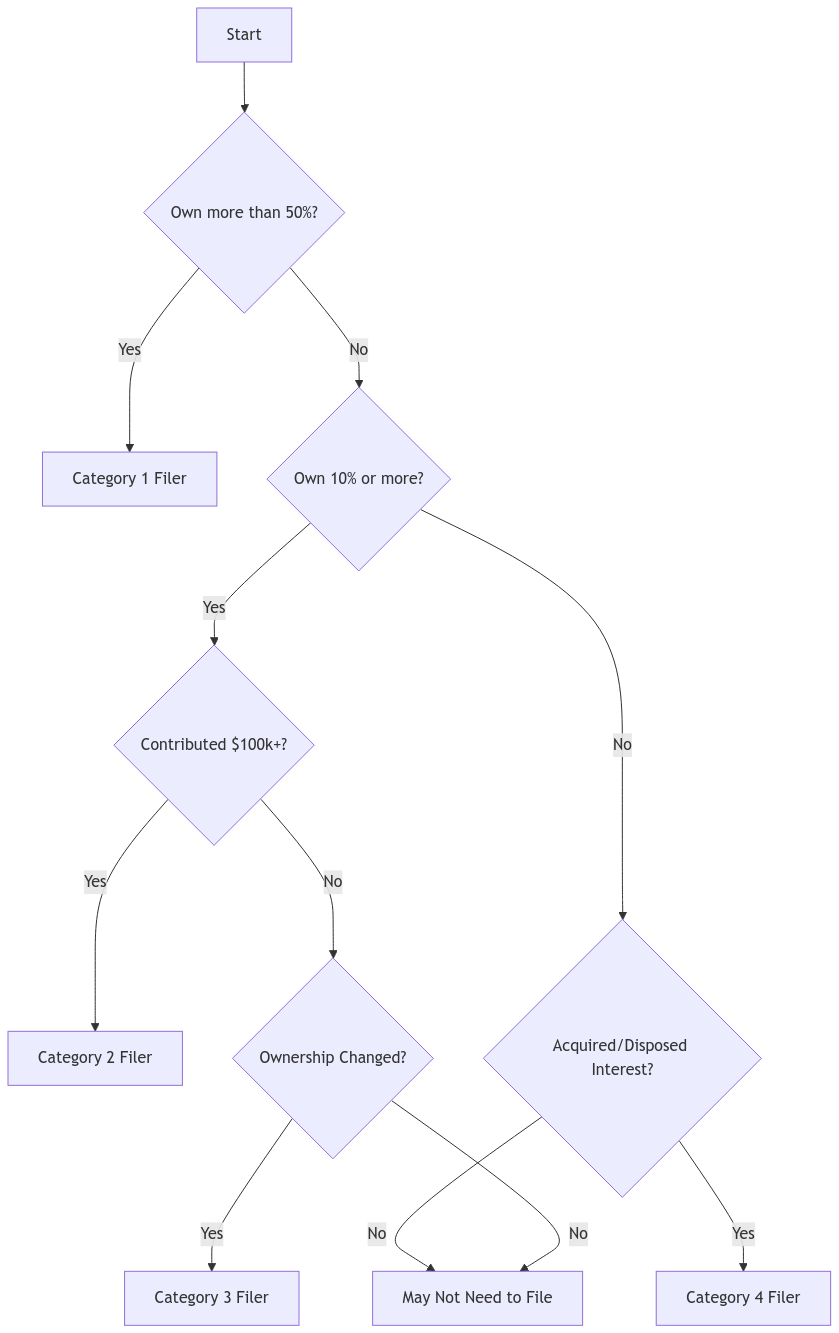

Categories of Filers

Before diving into the specifics, use this flowchart to determine which category applies to your situation:

Form 8865 has four main filer categories, let’s explore each category in detail:

Category 1: You’re the Boss!

- This category applies if you own more than 50% of the foreign partnership.

- Example: Imagine you’re an entrepreneur who started a tech company in Estonia. You own 60% of the company, making you a majority owner and a Category 1 filer for Form 8865.

Category 2: Significant Contributor

- If you own at least 10% of the partnership and contribute property worth more than $100,000, you’ll fall into this category.

- Example: Let’s say you’re a partner in a German engineering firm. You own 15% of the partnership and recently contributed specialized equipment valued at $200,000. This makes you a Category 2 filer.

Category 3: Ownership Shake-Up

- This category captures significant changes in your ownership interest.

- Example: You hold a 25% stake in a French wine importing business. This year, you sold a portion of your shares, reducing your ownership to 8%. This change triggers Category 3 filing requirements.

Category 4: Entering or Exiting the Partnership

- If you acquire or dispose of a direct interest in the foreign partnership, you’ll need to file under this category.

- Example: You purchased a 5% interest in a Canadian real estate venture. This acquisition makes you a Category 4 filer for Form 8865.

Filing Requirements

Form 8865 Filing Requirements

Click on each category to see required schedules and details.

Additional Filing Tips

- File with your income tax return or information return

- Electronic filing available for most filers

- Maintain copies of all filed schedules

- Keep supporting documentation for at least 6 years

Constructive Ownership

Constructive ownership is when you’re treated as an owner due to your relationship with the actual owner (e.g., your spouse). This impacts your filing obligations.

Example: If your spouse owns a majority interest in a foreign partnership, you may need to file Form 8865, even if you don’t directly own any part of the partnership.

Deadlines and Penalties

Deadlines:

- April 15th for individuals.

- March 15th for partnerships and corporations.

Extensions:

- Form 4868 for individuals.

- Form 7004 for partnerships and corporations.

Penalties:

Initial Penalties:

- Base penalty: $10,000 for failure to file.

- Additional $10,000 for each 30-day period the failure continues after IRS notification, up to a maximum of $50,000 per return.

Category-Specific Penalties:

Category 1 and 2 Filers:

- Base penalty: $10,000 per year per partnership.

- Reduction in foreign tax credits.

- Possible criminal penalties for willful violations.

Category 3 Filers:

- 10% of the value of transferred property.

- Maximum penalty: $100,000 per reportable event.

- Additional penalties for continued non-compliance.

Category 4 Filers:

- Standard $10,000 penalty applies.

- Additional penalties for failure to report changes in ownership.

Reasonable Cause Exception: The IRS may waive penalties if you can demonstrate reasonable cause and lack of willful neglect, supported by proper documentation.

Criminal Penalties: Willful failure to file or providing false information may result in criminal prosecution, fines up to $50,000, possible imprisonment, and damage to your tax compliance record.

Exceptions to Filing

There are some exceptions, such as when a joint return is filed with another Category 1 filer, or the foreign partnership provides all necessary information to the IRS.

Special Situations

- Partnerships in U.S. Territories: Different rules apply for partnerships in Puerto Rico, Guam, and other U.S. territories.

- Tax Treaty Considerations: Special provisions may apply if the partnership operates in a country with a U.S. tax treaty.

- Hybrid Entity Rules: Special attention is needed if the partnership is treated differently in foreign jurisdictions.

Record-Keeping Requirements

Maintaining accurate records is crucial for complying with Form 8865 requirements.

- Keep thorough records for at least 6 years.

- Essential documents to retain include:

- Partnership formation documents

- Capital contributions and distributions

- Annual financial statements

- Foreign tax payments and credits

- Currency exchange calculations

Frequently Asked Questions

What’s the main purpose of Form 8865?

Form 8865 serves as a monitoring tool for the IRS to track U.S. persons involved with foreign partnerships. It helps ensure tax compliance and prevents tax evasion through offshore partnerships. The form provides detailed information about international business activities and their financial implications.

Who exactly qualifies as a “U.S. person” for Form 8865?

A U.S. person includes U.S. citizens and resident aliens, as well as domestic corporations, partnerships, estates, and trusts. Any entity treated as a U.S. person under IRS regulations must comply with Form 8865 requirements if they meet the filing thresholds.

How is Form 8865 different from forms for U.S. partnerships?

While Form 8865 shares similarities with Form 1065 (used for U.S. partnerships), it specifically addresses foreign partnerships. The key differences lie in its additional schedules for international operations, currency translations, and foreign tax credits. It also requires more detailed reporting of cross-border transactions and ownership changes.

How do I know which schedules to attach?

The required schedules depend on your filing category. Category 1 filers need the most comprehensive reporting, including Schedules A through O. Category 2 filers submit most of these same schedules but may omit certain ones. Category 3 filers typically only need Schedule O, while Category 4 filers focus on Schedule P. Your specific situation may require additional schedules based on your partnership activities.

What’s the filing deadline for Form 8865?

The deadline aligns with your regular tax return. Individual filers must submit by April 15, while partnerships and corporations have until March 15. You can request a six-month extension if needed, but remember that this doesn’t extend the time to pay any taxes due.

What are the penalties for not filing?

The penalties for non-compliance are significant. The IRS typically starts with a $10,000 initial penalty. If the violation continues after notification, additional $10,000 penalties may apply every 30 days, up to $50,000. For Category 3 violations involving property transfers, penalties can reach 10% of the transferred value. In cases of willful non-compliance, criminal penalties might apply.

Is there a statute of limitations for Form 8865?

The standard IRS statute of limitations is three years from the filing date. However, this extends to six years for substantial omissions of income. In cases of fraud or failure to file, there’s no statute of limitations, meaning the IRS can assess penalties indefinitely.

What if I inherited an interest in a foreign partnership?

Inherited interests in foreign partnerships may trigger Form 8865 filing requirements. Your filing obligations depend on the size of your inherited interest and any subsequent changes or transactions. Even passive inherited interests require proper reporting to maintain compliance.

Do I need to file if the foreign partnership is inactive?

Yes, filing requirements persist even for inactive partnerships if you meet the ownership thresholds. You should indicate the partnership’s dormant status on the form, but don’t assume inactivity eliminates your filing obligation.

How do I handle currency conversion for Form 8865?

Currency conversion requires careful documentation. Use the yearly average exchange rate for income and expense items, while balance sheet items should use the exchange rate from the last day of the tax year. Maintain detailed records of your conversion methodology to support your calculations.

What if I can’t get all the required information from the foreign partnership?

Document all your attempts to obtain the necessary information. You may need to estimate based on available data, but attach a detailed statement explaining your situation and methodology. For persistent issues, consider seeking guidance from the IRS or a qualified tax professional.

How long should I keep Form 8865 records?

Maintain comprehensive records for at least six years from the filing date. This includes partnership agreements, financial statements, tax returns, contribution and distribution documentation, and currency conversion calculations. Good record-keeping is crucial for defending your positions in case of an IRS inquiry.

What documentation do I need for reasonable cause relief?

To support a reasonable cause claim, maintain records showing your attempts to comply with requirements, any professional advice received, circumstances that prevented timely filing, and steps taken to remedy non-compliance. Thorough documentation is essential for penalty relief consideration.

Need Help?

Navigating the complexities of Form 8865 can be challenging. XOA TAX is here to help! Our experienced CPAs can guide you through the process, ensuring you meet your obligations and avoid penalties. Contact us today for a consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime