The world of international tax can feel complex. When it comes to transferring property to a foreign corporation, understanding IRS Form 926 is key to staying compliant and avoiding penalties. This guide will break down this important form and help you navigate the ins and outs of international property transfers.

What is Form 926?

Form 926, officially titled “Return by a U.S. Transferor of Property to a Foreign Corporation,” is required when a U.S. person transfers property to a foreign corporation. But what exactly is a “U.S. person”? For the purposes of Form 926, this broadly includes U.S. citizens, resident aliens, domestic partnerships, domestic corporations, estates, and trusts. Essentially, it covers a wide range of individuals and entities based in the U.S. that transfer property to a foreign corporation1.

This form helps the IRS maintain transparency and fairness in the tax system by keeping track of these international transactions, even if the transfer is non-taxable. Understanding these requirements ensures compliance and helps avoid inadvertent penalties.

What Property is Reportable?

“Property” has a broad definition in this context. It includes more than you might think:

- Tangible property: Machinery, equipment, vehicles, real estate, and other physical assets.

- Intangible property: Copyrights, patents, trademarks, and other intellectual property.

- Securities: Stocks and bonds.

- Cash: Transfers exceeding $100,000 in a 12-month period may require you to file. This applies to the aggregate of all cash transferred during the 12 months, not just individual transactions.

- Other: Partnership interests and certain other rights can also be considered reportable property.

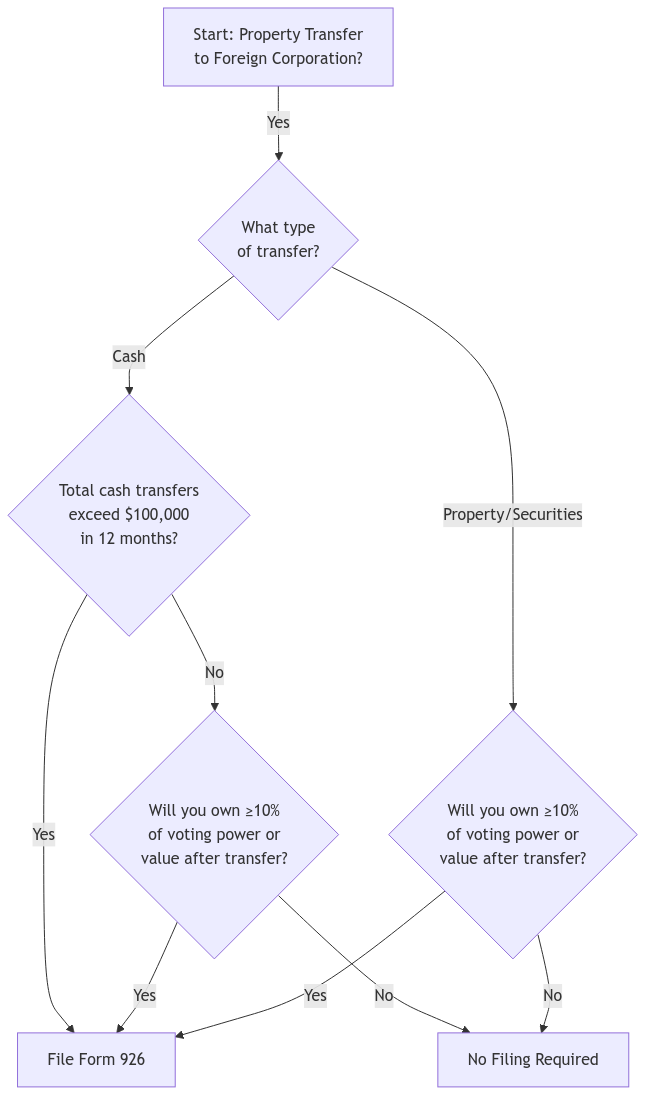

Who Needs to File?

You generally need to file Form 926 if you meet any of the following criteria:

- Transfer for Stock: You transfer property to a foreign corporation in exchange for stock, and after the transfer, you own at least 10% of the total voting power or the total value of the foreign corporation’s stock – whichever is greater.

- Example: If you contribute a patent to a foreign corporation and receive stock in return that gives you 12% of the voting power but only 8% of the overall stock value, you would likely need to file.

- Cash with Ownership: You transfer cash to a foreign corporation, and after the transfer, you own at least 10% of the total voting power or the total value of the foreign corporation’s stock (whichever is greater).

- Large Cash Transfers: You transfer cash exceeding $100,000 to a foreign corporation within a 12-month period. This applies to all cash transfers to that corporation within that timeframe, even if each individual transfer is less than $100,000.

- Gain Recognition Agreements: You transfer securities or stock to a foreign corporation under a gain recognition agreement.

- Liquidating Distributions: You are a domestic liquidating corporation distributing property to a foreign corporation.

- Indirect Transfers: Transfers made indirectly through intermediaries or other entities may also trigger Form 926 filing requirements.

Exceptions to Filing

While the rules for filing Form 926 are broad, there are some exceptions. These exceptions can be complicated and depend on various factors, such as the type of property transferred, your ownership in the foreign corporation, and the specifics of the transaction. Some common exceptions include:

- Transfers between Certain Affiliated Entities: Transfers between related U.S. entities and their foreign affiliates may be exempt under specific conditions.

- Transfers of Certain Types of Property: Transfers of specific types of property, like certain types of debt obligations or portfolio interest, may be exempt from reporting.

- Business Restructurings: Certain business reorganizations and restructurings may qualify for exceptions.

- Example: Transferring property as part of a corporate restructuring where the foreign corporation is a subsidiary may qualify for an exception, depending on the specifics.

To determine if your situation qualifies for an exception, it’s crucial to consult the latest IRS instructions for Form 926 or get professional advice.

Consequences of Non-Compliance

Failing to file Form 926 when required can result in significant penalties. These penalties can be as high as 5% of the fair market value (FMV) of the transferred property for each month the form is late, up to a maximum penalty of 25% of the FMV. Interest can also be charged on any unpaid penalties, increasing the overall cost of non-compliance. While the IRS may consider reasonable cause to reduce penalties, it’s always best to ensure you’re compliant from the beginning.

Form 926 Penalty Calculator

Calculate potential penalties for late Form 926 filing

Special Considerations

Section 367 Implications

Transfers of property to a foreign corporation may also be subject to Section 367 of the Internal Revenue Code, which deals with the taxation of transfers of property to foreign corporations. Depending on the nature of the transfer, certain gains may be recognized, and specific tax treatments may apply. It’s essential to evaluate Section 367 implications when planning property transfers to ensure comprehensive compliance.

Interaction with Other Reporting Requirements

Form 926 interacts with other international information reporting requirements, such as:

- Form 5471: Information return for U.S. persons with respect to certain foreign corporations.

- Form 8865: Information return for U.S. persons with respect to certain foreign partnerships.

- FBAR (FinCEN Form 114): Reporting of foreign financial accounts.

Form 926 & Related Forms Network

Interactive diagram showing relationships between Form 926 and related international tax forms

Form 926

Return by a U.S. Transferor of Property to a Foreign Corporation

Form 5471

Information Return of U.S. Persons With Respect to Certain Foreign Corporations

More infoForm 8865

Return of U.S. Persons With Respect to Certain Foreign Partnerships

More infoFBAR (FinCEN 114)

Report of Foreign Bank and Financial Accounts

More infoForm Relationships

Click on any form to see its relationship with Form 926

Ensuring that all relevant forms are filed in conjunction can help maintain full compliance with U.S. international tax laws.

Key Updates for 2024

IRS Form 926, titled Return of a U.S. Transferor of Property to a Foreign Corporation, is a crucial document for U.S. persons making certain transfers to foreign corporations. Recent updates for the 2024 tax year have clarified filing requirements, penalties for non-compliance, and key deadlines.

Filing Requirement: A U.S. person must file Form 926 if they transfer property to a foreign corporation and either:

- They hold at least 10% of the voting power or value of the foreign corporation immediately after the transfer.

- The total cash transferred exceeds $100,000 during the tax year.

Penalties for Non-Compliance:

- A penalty of 10% of the fair market value (FMV) of the transferred property applies, capped at $100,000 unless the failure was due to intentional disregard.

- If not filed, the IRS can extend the statute of limitations on tax assessments until the form is filed.

Filing Deadline: Form 926 must be attached to the annual tax return and filed by the same deadline as that return. For most taxpayers, this means it is due by April 15, 2024, unless an extension is filed.

Summary of Key Deadlines and Thresholds

| Item | Details |

|---|---|

| Filing Requirement | Transfer property to a foreign corporation if: – Own ≥10% post-transfer – Cash transfer > $100,000 in a year |

| Deadline for Filing | Same as annual tax return (April 15, 2024) |

| Penalty for Non-Filing | 10% of FMV (max $100,000); higher if intentional disregard |

| Threshold for Cash Transfers | > $100,000 in a tax year |

Supporting Documentation

Form 926 requires detailed information about both the transferor and transferee, including:

- Name and address of the U.S. transferor.

- Details about the foreign corporation (name, address, country of incorporation).

- Description and FMV of the transferred property.

- Date of transfer and ownership percentage post-transfer.

Common supporting documents include:

- Appraisals: For determining the fair market value of property.

- Balance Sheets: To provide financial context for the transfer.

- Gain Recognition Agreements: If applicable to the transaction.

- Transfer Agreements: Detailed agreements outlining the terms of the property transfer.

Refer to the IRS Form 926 Instructions for a detailed list of required supporting documents based on the nature of your transfer

Form 926 Supporting Documentation Checklist

Track required supporting documents for your Form 926 filing

Professional valuations for determining fair market value of transferred property

- Required for non-cash property transfers

- Must be from qualified appraiser

- Should be dated near transfer date

Financial statements showing the value and composition of transferred assets

- Pre and post-transfer balance sheets

- Must be properly dated

- Should show clear asset values

Legal documents detailing the terms and conditions of the property transfer

- Must be signed by all parties

- Should specify transfer date

- Include all transfer terms

Agreements related to future recognition of gain on transferred property

- Required for certain transfers

- Must follow IRS guidelines

- Include gain computation

0 of 4 items completed (0%)

State Tax Implications

In addition to federal requirements, transferring property to a foreign corporation may have state tax implications. While federal tax laws primarily govern Form 926, states may have their own reporting requirements or tax treatments for such transfers. It’s essential to:

- Consult State Tax Laws: Each state may have different rules regarding the transfer of assets to foreign entities.

- Consider Nexus and Filing Obligations: Determine if the transfer affects your state tax nexus and if additional filings are necessary.

- Seek Professional Advice: Given the variability among states, consulting a tax professional familiar with both federal and state tax laws is advisable to ensure full compliance.

FAQs

What if I am a U.S. person living abroad? Do I still need to file Form 926?

Yes, if you meet the criteria mentioned earlier, your U.S. citizenship or residency still obligates you to file Form 926, even if you live abroad.

How do I determine the fair market value of the property I transferred?

Determining fair market value can be tricky. It’s generally the price a willing buyer would pay a willing seller in an arm’s-length transaction. For some types of property, like real estate or business interests, you may need appraisals or valuations from qualified professionals.

Can I file Form 926 electronically?

Currently, Form 926 must be filed on paper and mailed to the IRS. However, it’s always a good idea to check for updates, as the IRS occasionally introduces electronic filing options for its forms.

Where can I get help with completing Form 926?

The IRS instructions provide detailed information. However, due to the complexity of international tax laws, it’s often wise to seek help from a qualified tax professional.

When is the deadline to file Form 926?

Generally, Form 926 is due with your income tax return, which is typically April 15th for individuals and corporations. However, there can be exceptions, so it’s best to confirm the exact deadline based on your specific circumstances.

What supporting documents do I need to file with Form 926?

The required supporting documents can vary depending on the type of property transferred. Common documents include appraisals, balance sheets, and gain recognition agreements. The IRS instructions provide a detailed list of required documents.

What if I need to correct information on a previously filed Form 926?

If you need to make corrections, you’ll need to file an amended Form 926. Be sure to clearly mark it as “Amended Return” and include explanations for the changes made.

Need Help?

Navigating Form 926 and international tax laws can be challenging. If you have questions or need help with your situation, don’t hesitate to contact us at XOA TAX. We offer a range of services to help you with international tax compliance, including:

- Form 926 preparation and filing

- International tax planning

- Fair market value determination

- Assistance with IRS inquiries

Our team of experienced professionals can provide expert guidance and ensure accurate and timely filing.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime