At XOA TAX, we’re passionate about helping businesses navigate the complexities of tax season. One common question we encounter revolves around Form 3800 – the General Business Credit. While it offers valuable opportunities to reduce tax liability, it often raises questions like: “What needs to be done *before* even considering Form 3800?”

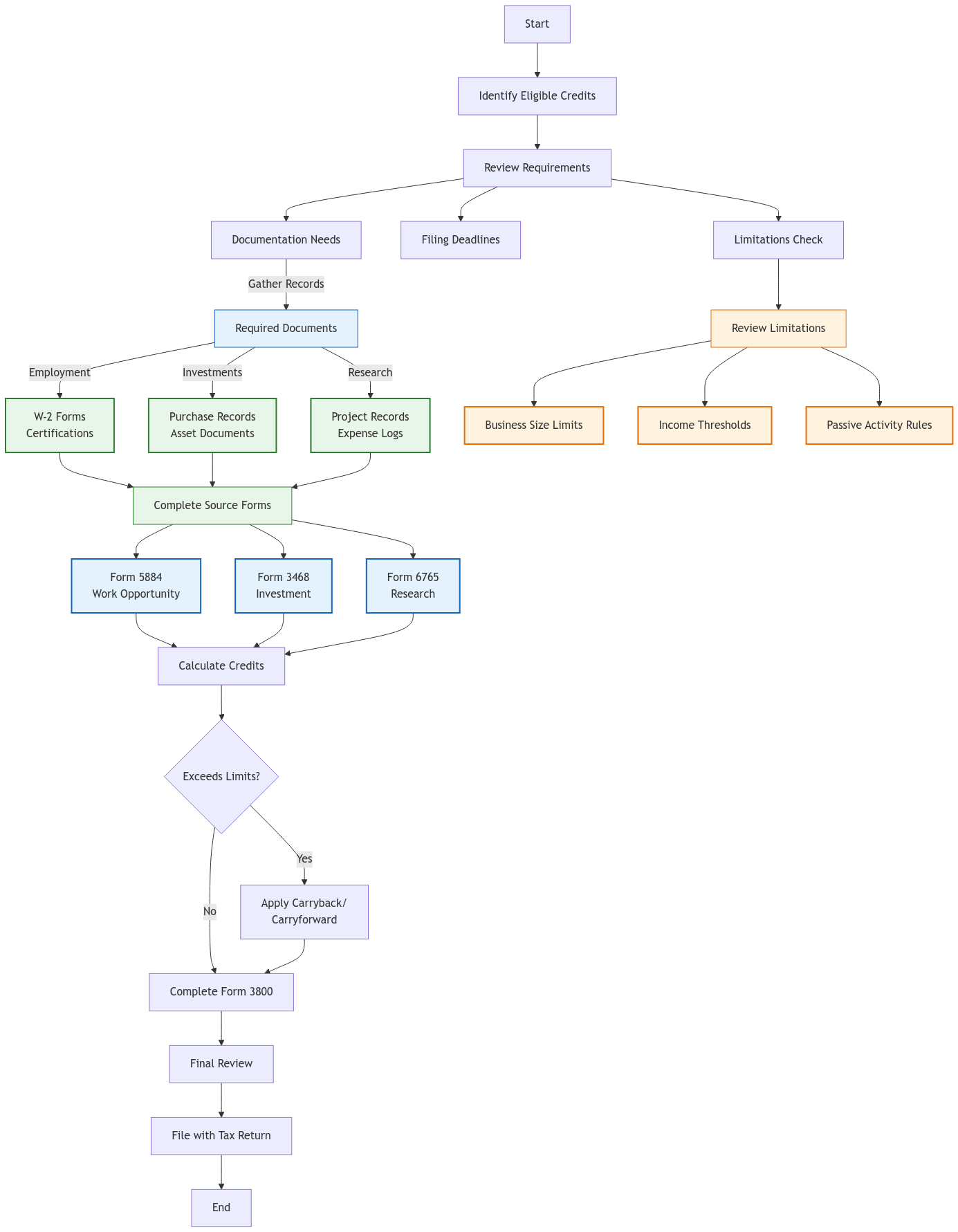

The key lies in recognizing that Form 3800 serves as a summary form. Before tackling it, you must first complete the specific IRS form(s) for each individual business credit you plan to claim. These are often called “source credit forms,” and they’re vital for calculating the amount of each credit.

Key Takeaways

- Don’t start with Form 3800.

- File the individual tax credit forms first.

- Use the calculated amounts from those forms to complete Form 3800.

- Keep detailed records to support your credit claims.

Understanding the “Source Credit Forms”

Let’s illustrate this with a scenario. Imagine you’re a small business owner aiming to claim both the Work Opportunity Credit and the Investment Credit.

- Work Opportunity Credit (Form 5884): This credit incentivizes hiring individuals from specific targeted groups, such as veterans or qualified ex-felons. To claim it, you’ll first need to complete Form 5884. This form helps calculate the credit amount based on your eligible employees. Importantly, you’ll need to maintain records verifying each employee’s eligibility, such as a certification from a designated local agency.

- Investment Credit (Form 3468): This credit encourages businesses to invest in qualified property, such as new equipment or machinery. You’ll use Form 3468 to calculate the credit based on your eligible investments. Keep detailed records of the qualified property, including purchase date, cost, and any applicable recapture provisions.

Once you’ve accurately completed these “source credit forms,” transfer the calculated credit amounts to the corresponding sections of Form 3800.

Important Considerations: Limitations, Carryovers, and More

Documentation is Key

Maintain meticulous records to support your credit claims. The IRS may require documentation to substantiate your eligibility for each credit. For example, if you’re claiming the Disabled Access Credit for making your business accessible to individuals with disabilities, you’ll need to keep records of the expenses incurred to make those modifications.

Credit Limitations

Be aware that certain limitations may apply to the amount of credit you can claim. These limitations can be based on factors like your business size, income level, or the type of business activity you engage in. For instance, there might be a cap on the amount of Investment Credit a business can claim in a given year.

Passive Activity Limitations

If your business has passive income, understand how the passive activity loss rules may affect your ability to claim certain credits. These rules can limit the amount of losses from passive activities that can be used to offset other income, including income from business credits.

Carryback and Carryforward Provisions

If your general business credit exceeds your current year’s tax liability, you may be able to carry the excess credit back or forward to other tax years, subject to specific rules and limitations. This allows you to utilize the credit in years where it can provide the greatest tax benefit.

Pre-certification or Pre-approval

Some credits, like the Research Credit, may require pre-certification or pre-approval from relevant agencies before you can claim them. This ensures that the activities or expenses qualify for the credit before you claim it on your tax return.

Statute of Limitations

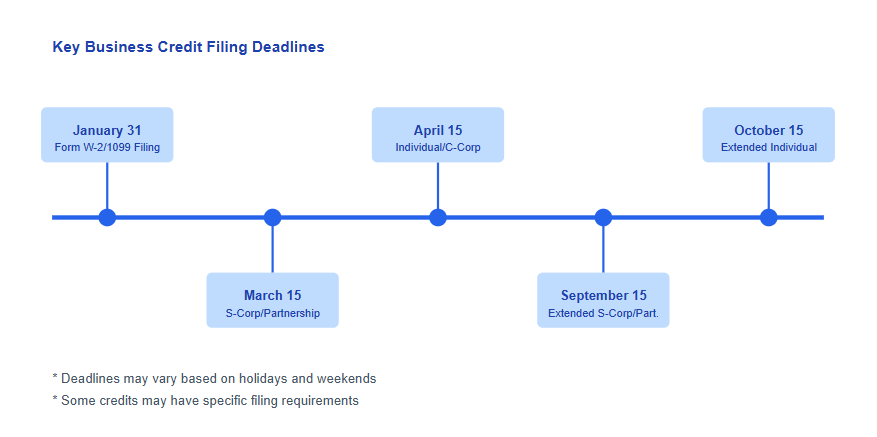

There’s a limited timeframe for claiming business credits. Generally, you must claim a credit in the tax year it is earned, but some have carryback or carryforward provisions. Refer to the instructions for each specific credit form to ensure timely filing and avoid losing out on potential tax benefits.

State Tax Credit Interactions

Be mindful of how state tax credits might interact with federal credits, as there can be key differences and considerations, especially for businesses operating in multiple states. For example, a state might offer a credit for renewable energy investments that can be claimed in addition to the federal Renewable Electricity Production Tax Credit.

Coordination with Other Federal Tax Benefits

Business credits may interact with other federal tax benefits, such as deductions or exclusions. Consider these interactions as part of a comprehensive tax planning strategy. For instance, you might need to choose between claiming a deduction for certain expenses or using those expenses to qualify for a business credit.

Planning Ahead: A Checklist for Success

- Identify Eligible Credits: Research and determine which credits your business qualifies for.

- Gather Documentation: Compile all necessary documentation to support your credit claims.

- Calculate Credit Amounts: Use the appropriate “source credit forms” to accurately calculate the amount of each credit.

- Understand Deadlines: Familiarize yourself with the deadlines for claiming each credit, including any carryback or carryforward provisions.

- Consult a Tax Professional: Seek guidance from a qualified tax advisor to ensure you’re maximizing your credit opportunities and complying with all regulations.

Navigating the Complexities

We understand that the world of business credits can be intricate. At XOA TAX, we’re dedicated to guiding you through the process. We can help you:

- Identify which credits your business qualifies for.

- Ensure you have the necessary documentation to support your claims.

- Accurately complete all required forms.

- Stay informed about any recent tax law changes affecting business credits.

FAQ

Where can I find the instructions for these individual credit forms?

The IRS website (IRS.gov) is your best resource. You can find detailed instructions for each form by searching for the form number.

What if I made a mistake on one of the source credit forms?

It’s important to correct any errors as soon as possible. You can file an amended return (usually Form 1040-X) if you’ve already filed your taxes.

Can I file Form 3800 electronically?

Yes, Form 3800 can be e-filed with your tax return.

Are there any specific deadlines for claiming these credits?

Yes, there are statutory deadlines for claiming business credits. Generally, you must claim a credit in the tax year it is earned, but some credits have carryback or carryforward provisions. It’s crucial to consult the instructions for each specific credit form and seek professional advice to ensure timely filing.

What are some common mistakes businesses make when claiming these credits?

Common mistakes include:

- Insufficient Documentation: Failing to maintain adequate records to support credit claims.

- Misinterpreting Eligibility Criteria: Incorrectly determining eligibility for a credit.

- Missing Deadlines: Not claiming credits within the allowed timeframes.

Connecting with XOA TAX

We know that tax season can be stressful. If you have questions about Form 3800, the General Business Credit, or any other tax matter, don’t hesitate to reach out to us. Our team of experienced CPAs is here to provide personalized guidance and support.

You can connect with us through our:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

We’re here to help you navigate the complexities of tax season and achieve your financial goals.

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime