As a small business owner or independent contractor, the world of tax forms can seem daunting. One crucial aspect that often trips people up is understanding Form 1099. At XOA TAX, we’re dedicated to simplifying the complexities of tax season. We’re here to guide you through the ins and outs of 1099s for the 2024 tax year.

Key Takeaways

- Form 1099 reports various types of income earned outside of traditional employment.

- Different 1099 forms exist for specific income categories.

- Accurate and timely filing is crucial to avoid penalties.

- XOA TAX can provide expert assistance with your 1099 needs.

What is Form 1099?

Think of Form 1099 as a record keeper for income earned outside of your regular paycheck. Whether you’re a freelancer, independent contractor, or landlord, these forms track those earnings and ensure they’re reported to the IRS. This helps maintain transparency and keeps everyone on the right side of tax regulations.

Types of 1099 Forms: A Quick Overview

Just like there are different types of income, there are different types of 1099 forms. Here are some of the most common ones you might encounter:

Form 1099-NEC (Nonemployee Compensation): This is the go-to form for reporting payments made to independent contractors, freelancers, and other non-employees for services rendered. If you paid someone $600 or more in 2024, this form is your friend. For example, if you hired a freelance graphic designer to create a logo for your business, you’d likely need to file a 1099-NEC.

Form 1099-MISC (Miscellaneous Information): This form is a bit of a catch-all for various types of income. It’s used to report things like rents, royalties, prizes, and awards. For instance, if you paid a musician royalties for using their song in an advertisement, you’d use a 1099-MISC.

Form 1099-INT (Interest Income): Did you earn $10 or more in interest from your bank account or investments? This form is where you’ll report it. This could include interest earned on a savings account, certificate of deposit, or even some types of bonds.

Form 1099-DIV (Dividends and Distributions): Similar to interest income, this form reports dividends and distributions from investments. If you own stock in a company and receive dividend payments, you’ll need to report those on a 1099-DIV.

Form 1099-B (Proceeds from Broker and Barter Exchange Transactions): If you’ve sold stocks or engaged in barter exchanges, this form comes into play. For example, if you sold shares of Apple stock through a brokerage, you would receive a 1099-B.

Form 1099-R (Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.): This one covers distributions from retirement accounts and similar sources. When you take a withdrawal from your 401(k) or traditional IRA, you’ll receive a 1099-R.

Form 1099-K (Payment Card and Third Party Network Transactions): This form tracks payments received through platforms like PayPal or credit card processors. However, there have been some recent changes to the reporting thresholds for 1099-K, which we’ll discuss later.

Who Needs to File a 1099?

Generally, if you’re a business owner and you made payments of $600 or more to an independent contractor during 2024, you’ll need to file a 1099-NEC. The same applies to other types of income reported on different 1099 forms.

Here’s a quick checklist:

- Did you hire freelancers or independent contractors?

- Did you pay rent to a landlord?

- Did you receive significant interest or dividends from investments?

If you answered “yes” to any of these, it’s likely you’ll need to file a 1099.

Filing Deadlines: Don’t Miss the Mark!

Meeting deadlines is crucial in the tax world. Here’s a rundown of the important dates for 1099s in 2025:

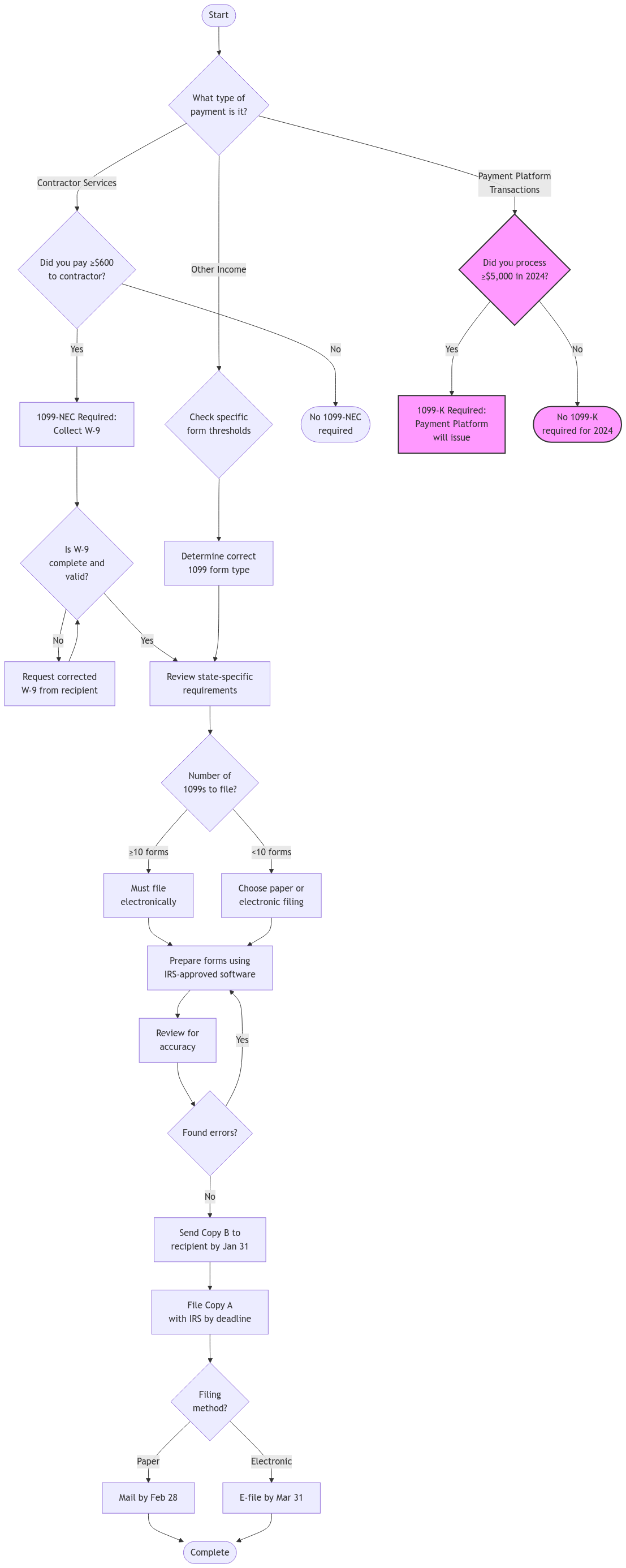

- Recipient Copies: Get those 1099s to the recipients by January 31, 2025.

- IRS Filing:

- Form 1099-NEC: Due to the IRS by January 31, 2025.

- Other Forms: February 28, 2025 for paper filing, and March 31, 2025, for electronic filing.

How to File Your 1099s

- Choose the Right Form: Make sure you’re using the correct 1099 form for the type of income you’re reporting.

- Gather Your Information: You’ll need the recipient’s name, address, and taxpayer identification number (TIN). Having them fill out a W-9 form upfront can make this process smoother. This form helps you collect the necessary information and avoid errors.

- Complete the Form: Fill in all the required information accurately, including the amount paid. The IRS provides detailed instructions for each 1099 form on their website.

- Distribute Copies: Send Copy B to the recipient and Copy A to the IRS. You can download and print these forms from the IRS website or purchase them from office supply stores.

- File with the IRS: You can file online or by mail. Remember that electronic filing is mandatory if you’re submitting 10 or more forms. The IRS FIRE system is a common method for e-filing.

Penalties: A Costly Oversight

Late filing can lead to penalties, so it’s best to stay on top of those deadlines. The penalty amounts vary based on how late the filing is:

- Within 30 days: $60 per form

- More than 30 days, but before August 1: $120 per form

- After August 1, or not filed at all: $310 per form

- Intentional disregard: $630 per form

Recent Changes: Keeping Up with the IRS

Electronic Filing Threshold

The IRS has recently lowered the threshold for mandatory electronic filing from 250 to 10 forms. So, if you’re filing 10 or more 1099s, you’ll need to do it electronically.

1099-K Reporting Changes

Electronic Filing Threshold

The IRS has recently lowered the threshold for mandatory electronic filing from 250 to 10 forms. So, if you’re filing 10 or more 1099s, you’ll need to do it electronically.

1099-K Reporting Changes: Important Update!

There have been some important changes to the reporting requirements for Form 1099-K. Previously, third-party payment networks (like PayPal and Venmo) were only required to issue a 1099-K if you had over 200 transactions and over $20,000 in payments.

While the American Rescue Plan Act of 2021 initially aimed to lower this threshold to $600, the IRS has delayed the implementation of this change.

Here’s what you need to know for the 2024 tax year:

-

$5,000 Threshold: For 2024, third-party payment networks are required to issue a Form 1099-K if you receive over $5,000 in payments, regardless of the number of transactions.

-

Phased Approach: The IRS is taking a phased approach to eventually implement the $600 threshold. Stay tuned for future updates and changes to these reporting requirements.

-

State Variations: It’s important to note that while the federal threshold is set to change, some states may have different reporting requirements. Taxpayers should stay informed about both federal and state regulations to ensure compliance.

This change is important to be aware of, as it may affect many more taxpayers who use these platforms for business transactions. We recommend checking with your state’s tax agency for their specific 1099-K reporting rules.

State-Specific Requirements: Don’t Forget Your Local Obligations

While this blog post focuses primarily on federal tax requirements, it’s important to remember that states may have their own 1099 filing rules. Some states have similar requirements to the federal government, while others may have different thresholds or forms. It’s essential to consult with a tax professional or your state’s tax agency to ensure you’re meeting all your obligations.

Backup Withholding: When Taxes Aren’t Withheld Upfront

In some cases, you may be subject to backup withholding on your 1099 income. This typically happens if you haven’t provided your taxpayer identification number (TIN) to the payer or if the IRS has notified the payer that your TIN is incorrect. Backup withholding means that a certain percentage of your payments will be withheld and sent directly to the IRS. This can be avoided by ensuring your TIN is accurate and provided to all payers.

Common 1099 Mistakes and How to Avoid Them

Even with the best intentions, mistakes can happen when filing 1099s. Here are a few common errors to watch out for:

- Using the wrong form: Make sure you’re using the correct 1099 form for the type of income you’re reporting.

- Incorrect recipient information: Double-check that you have the recipient’s correct name, address, and TIN.

- Missing or inaccurate payment amounts: Ensure the payment amounts are correct and match your records.

- Filing late: Be aware of the deadlines and file on time to avoid penalties.

By taking the time to review your forms and ensure accuracy, you can minimize the risk of errors and potential penalties.

Correcting 1099 Errors: Don’t Panic!

We understand that mistakes happen. If you discover an error on a 1099 form that you’ve already filed, don’t worry! The IRS provides a way to correct these errors. You’ll need to file a corrected 1099 form with the IRS and provide an updated copy to the recipient. It’s important to correct these errors as soon as possible to avoid any potential penalties or issues with the recipient’s tax return.

Record Retention: How Long Should You Keep Those 1099s?

Keeping good records is essential for any business, and 1099 forms are no exception. The IRS generally recommends keeping 1099 forms for at least three years from the date you filed your tax return. However, it’s often a good idea to keep them for longer, just in case. Proper record keeping can help you stay organized and prepared in case of an audit or any questions from the IRS.

FAQs

What is a 1099-NEC form?

Form 1099-NEC is used to report non-employee compensation. This includes payments made to independent contractors, freelancers, and self-employed individuals for their services. This form is crucial for informing the IRS about any payments of $600 or more made throughout the year. It’s important to remember that independent contractors must report all income on Schedule C, even if it falls below the $600 threshold and doesn’t appear on a 1099-NEC.

Why did the worker receive a 1099 form and not an employee W-2?

Receiving a 1099 form instead of a W-2 typically means that the payer classified you as an independent contractor or freelancer. This means they did not withhold taxes from your pay. This distinction affects your tax responsibilities and benefits, so it’s essential to understand the difference. If you believe you’ve been misclassified, you should contact the payer and discuss the issue.

From a U.S. tax perspective, which is better: being an independent contractor reporting income on Form 1099, or a Form W-2 employee?

The choice between being an independent contractor (reporting income on Form 1099) or a W-2 employee depends on various factors. These include tax implications, job security, and benefits. It’s advisable to consult with a tax professional to make an informed decision based on your specific circumstances. At XOA TAX, we can help you weigh the pros and cons and make the best choice for your situation.

How do I give my independent contractor a 1099 form?

If you’re an employer or client, you are responsible for providing a 1099 form to your independent contractors or freelancers. Ensure that you accurately report their non-employee compensation to comply with tax regulations. You can send Form 1099-NEC to your independent contractors by January 31st each year.

What’s the difference between a 1099-NEC and a 1099-MISC?

While both forms report miscellaneous income, they serve different purposes. The 1099-NEC is specifically for reporting nonemployee compensation, such as payments to independent contractors. The 1099-MISC is used for other types of miscellaneous income, like rents, royalties, prizes, and awards.

What if I made a mistake on a 1099 form that I already filed?

Don’t worry, mistakes happen! You can file a corrected 1099 with the IRS and provide an updated copy to the recipient. It’s important to correct these errors promptly to avoid any potential penalties.

Where can I get help with my 1099s?

XOA TAX is here to help! Our team of experienced CPAs can assist you with all your 1099 needs, from determining which forms to file to ensuring accurate and timely filing. Contact us today for a consultation.

XOA TAX is Here to Help

We understand that navigating the world of 1099s can be confusing. At XOA TAX, we’re here to provide expert guidance and ensure your tax reporting is accurate and stress-free. Contact us today for personalized assistance.

Need Help with Your 1099s?

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime