Thinking about jumping into the world of house flipping? It’s exhilarating. Yet, before you take the plunge, grasping the tax implications can be a game-changer. This knowledge doesn’t just protect your profit; it can elevate your entire flipping strategy. Let’s dig into how taxes impact house flipping in 2024.

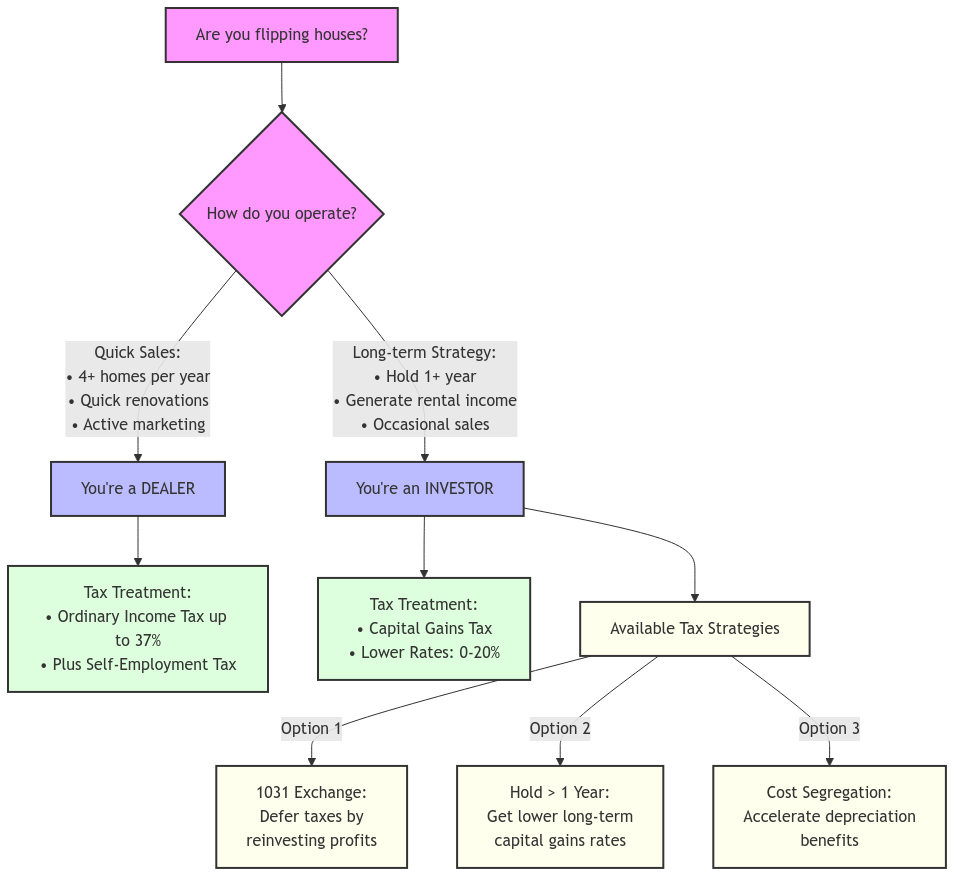

Trader or Investor: Know Your Tax Identity

The IRS has stark distinctions on how they view flippers. Your approach will affect how your profits are taxed. Understanding your classification is pivotal.

Who qualifies as a Dealer?

If your strategy revolves around quick turnarounds in property sales, the IRS might label you a dealer. Here are clues that could seal your dealer status:

- Frequency: Selling more than four homes each year.

- Renovation Efforts: Undertaking significant renovations, not just painting or minor fixes.

- Business-Like Behavior: Actively marketing your homes and managing your ventures like a business.

The Tax Consequences for Dealers

As a dealer, your profits bite the bullet of ordinary income tax rates—up to 37%! You might also pay self-employment taxes, reducing your overall earnings. It’s essential to be prepared for this reality.

Who is an Investor?

If your properties generate cash flow—either through renting or long-term holds—you’re likely viewed as an investor. Traits for an investor include:

- Holding Time: Possessing properties for longer durations—typically a year.

- Transaction Count: Occasional property sales, few and far between.

- Intent Documentation: Keeping notes on your strategy and market changes provides clarity on your goals.

Investor Tax Advantages

As an investor, you’re often taxed on profits as capital gains. This usually results in lower rates compared to ordinary income.

Dissecting Passive and Active Income

Understanding income types can simplify tax perspectives:

- Passive Income comes from rentals where you’re hands-off. Profits are usually taxed at capital gains rates when you sell.

- Active Income arises from the hustle of flipping houses, where direct involvement prevails. This income generally faces ordinary tax rates.

Capital Gains Taxes: What You Must Know

For investors, capital gains taxes are crucial. Here’s the scoop:

- Short-Term Gains: Properties held for a year or less hit you with ordinary rates.

- Long-Term Gains: Homes owned for over one year benefit from more favorable capital gains tax rates.

Capital Gains Tax Rates for 2024

The capital gains tax rates for 2024 have been adjusted to account for inflation. The updated thresholds are as follows:

For Single Filers:

- 0% Rate: Up to $47,025

- 15% Rate: $47,026 to $518,900

- 20% Rate: Over $518,900

For Married Couples Filing Jointly:

- 0% Rate: Up to $94,050

- 15% Rate: $94,051 to $583,750

- 20% Rate: Over $583,750

These figures represent an approximate 5% increase from the 2023 thresholds, reflecting adjustments for inflation. Remember that these rates apply to long-term capital gains—profits from the sale of assets held for more than one year. Short-term capital gains are taxed at ordinary income tax rates.

It’s always a good idea to check the latest IRS guidelines or connect with a tax professional for the most accurate and personalized information.

Keep Your Eye on the Tax Ball

Moving into 2024, no major federal tax law alterations for house flipping are on the horizon. However, tax laws are always subject to change, so staying updated requires regularly checking the IRS website and consulting a tax professional.

Strategies to Keep More in Your Pocket

Here’s how to limit the tax bite on your profits:

Hold Properties Over One Year

Maintain ownership past 12 months to unlock the lower long-term capital gains rates.

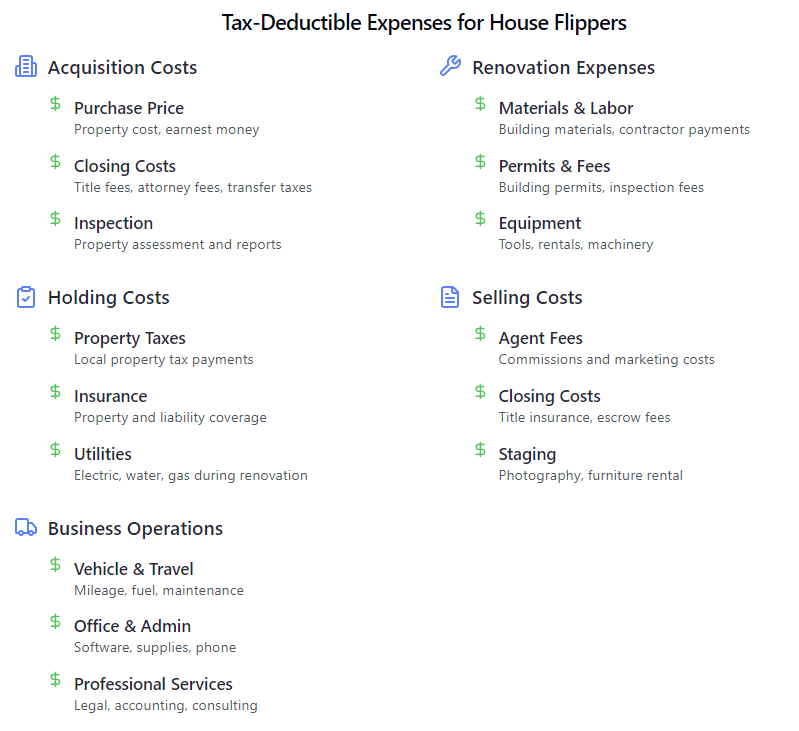

Keep Detailed Records

When it comes to tracking costs related to your property, here’s what to include:

- Purchase Costs: Listing price, closing fees, legal expenses.

- Renovation Costs: Materials, labor, permits, adjustments.

- Ongoing Costs: Property taxes, insurance, upkeep.

- Selling Costs: Agent commissions and advertising fees.

These records lower your taxable gain—make them thorough!

1031 Exchange

Planning to roll your profits into another investment? Consider a 1031 exchange to defer capital gains taxes. Here’s the gist:

- Like-Kind Property: You need to invest in a similar type of property.

- Timelines: Identify a replacement within 45 days, close in 180.

This allows your investment to expand without immediate tax repercussions.

Cost Segregation Study

A cost segregation study can help you break costs down, accelerating depreciation. This could cut your taxable income in the nascent years of property ownership.

Dive into Opportunity Zones

Investing in Qualified Opportunity Zones can enhance your appreciation. When you reinvest capital gains in these zones, taxes can defer or diminish down the line.

Structuring through LLCs

Using an LLC to hold properties may deliver liability protection alongside potential tax perks. Yet, consider:

- Extra Work: An LLC demands more paperwork and deeper financial commitment.

- Tax Hit: Check for any lingering self-employment tax implications.

Evaluate the pros and cons before committing, and confer with a tax specialist.

Rent Before You Flip

Considering holding a property as a rental? This creates added tax benefits like:

- Depreciation Deductions: Deductions from property value over time can reduce overall taxable income.

- Long-Term Advantage: It may stretch your holding period over a year for superior tax treatment.

Seek Expert Guidance

Empower yourself by consulting a tax advisor skilled in real estate matters. Tailored support makes all the difference.

Recognizing Common Flipping Expenses

Typical deductions to lower your taxable income include:

- Closing Costs: Title, insurance, legal fees when buying or selling.

- Regular Expenses: Property taxes, utilities, maintenance costs while owning.

- Renovation DocuClave: Any costs incurred boosting the property’s value.

- Marketing Costs: Dollars spent to present your property in the best light.

Precise records of these expenses matter—a well-maintained ledger can enhance profitability. Track these expenses throughout your project to maximize your deductions come tax time.

Keep Your Eyes Open for Additional Concerns

State & Local Taxes

State tax obligations can vary. Some jurisdictions impose their own capital gains taxes or provide specialized incentives. Do your due diligence by checking your state’s regulations.

Net Investment Income Tax

Heads up—if you’re a high earner, a 3.8% tax kicks in on certain net investment income, which profits from property sales fall under.

Home Office Deduction

If you carve out a space solely for your flipping business at home, you may qualify for a home office deduction—further diminishing taxable income.

Useful Resources

Extra info can help with your tax strategies:

- IRS Publication 544 – Sales and Other Dispositions of Assets: Offers detailed information on how to report sales and other dispositions of property.

- IRS Publication 523 – Selling Your Home: Provides guidance if you’re selling your primary residence, including potential exclusions from income.

- IRS Publication 537 – Installment Sales: Explains how to report income from a sale when you receive payments over time.

- State Tax Agencies: Links to state tax agency websites for specific rules and regulations that may affect your investments.

Navigating house flipping is more than it appears; strategic maneuvering through taxes is key. Set yourself up right by being savvy, and remember—investing in sound tax advice yields rewarding dividends. By diligently keeping records and planning strategically, you can transform real estate ventures into profitable, sustainable businesses.

Frequently Asked Questions

What taxes should I be aware of when flipping houses in 2024?

Flippers should consider capital gains tax, which applies to the profit made from the sale of the property, as well as potential self-employment taxes if flipping is considered a business activity.

How is capital gains tax calculated on a house flip?

Capital gains tax is calculated based on the difference between the purchase price and the selling price, minus any allowable expenses for improvements, closing costs, and selling expenses.

Are there any tax deductions available for house flippers in 2024?

Yes, house flippers may be eligible for various tax deductions such as the costs of repairs, renovations, and certain business expenses if flipping is treated as a business enterprise.

Do I need to keep track of my expenses while flipping houses?

Absolutely. Keeping detailed records of all expenses related to the property is crucial for accurately calculating your profit and ensuring you can claim all possible deductions on your taxes.

Need Help with Your Real Estate Taxes?

Feeling overwhelmed by the tax complexities of house flipping? At XOA TAX, we understand the unique challenges you face. Our team of experienced CPAs can provide personalized guidance and support, helping you navigate the intricacies of real estate taxation and maximize your returns.

Whether you’re a seasoned investor or just starting out, we’re here to help you make informed decisions and achieve your financial goals.

Ready to discuss your house flipping project?

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime