As CPAs at XOA TAX, we’re committed to helping our clients reduce their tax liability while making smart investments. One of the best ways to do that is by going green! Installing solar panels not only benefits the environment, but it can also lead to significant tax savings thanks to the Residential Clean Energy Credit. Let’s explore how this credit works and what you need to know to claim it for the 2024 tax year.

Key Takeaways

- The Residential Clean Energy Credit allows homeowners to claim a credit for a percentage of the cost of installing solar energy systems.

- The credit amount is currently 30% for systems installed between 2022 and 2032.

- Starting in 2024, new documentation requirements are in effect, so keep thorough records of your solar installation expenses.

- The IRS verifies claims through documentation review, manufacturer certifications, and cross-referencing data.

What is the Residential Clean Energy Credit?

The Residential Clean Energy Credit, formerly known as the Solar Investment Tax Credit (ITC), is a valuable incentive for homeowners who invest in renewable energy. It allows you to deduct a percentage of the cost of installing a solar energy system from your federal taxes.

Currently, that percentage is 30% for systems installed between 2022 and 2032. This means if you install a $20,000 solar energy system, you could potentially claim a $6,000 credit on your tax return!

Keep in mind that the credit percentage is scheduled to decrease in the coming years:

- 2033: 26%

- 2034: 22%

Solar Tax Credit Timeline

Maximum Savings Now

Lock in 30% credit before reduction

Limited Time

Credit expires after 2034

Act Now

Best rates available until 2032

After 2034, the credit is set to expire unless Congress renews it. So, if you’ve been considering making the switch to solar, now is a great time to take advantage of this substantial tax break.

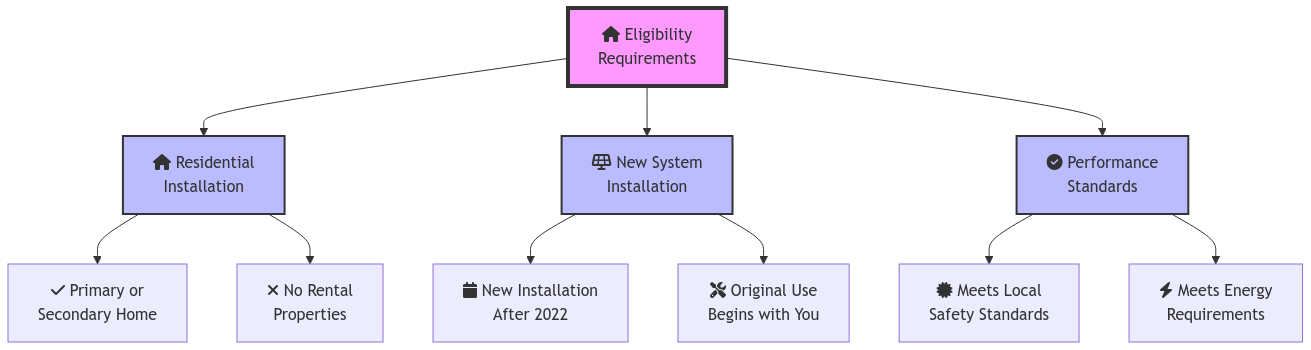

Are You Eligible?

Before you start planning your solar panel installation, let’s make sure you meet the eligibility requirements for the 2024 tax year. To qualify for the Residential Clean Energy Credit, your solar energy system must meet the following criteria:

- Residential Installation: The system must be installed on a primary or secondary residence in the United States that you own. This credit isn’t available for rental properties.

- New System: The system must be new and not previously used.

- Performance and Quality Standards: The system must meet specific performance and quality standards set by the IRS. This typically involves using equipment that has been certified by recognized organizations.

What Expenses Qualify?

The credit covers a wide range of expenses related to your solar installation. Here’s a breakdown of what typically qualifies:

- Solar Panels: This includes the cost of the solar panels themselves, which will vary depending on the size and efficiency of the panels.

- Inverters: Inverters are essential components that convert the direct current (DC) electricity generated by solar panels into alternating current (AC) electricity used in your home.

- Wiring and Mounting Hardware: This includes the cost of all wiring, conduit, and mounting hardware used to connect the solar panels to your home’s electrical system.

- Installation Labor: The cost of labor for installing the solar energy system is also eligible for the credit.

- Battery Storage Systems (New for 2024): Starting in 2024, the definition of qualifying equipment has been expanded to include battery storage systems with a capacity of at least 3 kilowatt-hours, even if they are installed without solar panels. This allows homeowners to store excess solar energy generated during the day for use at night or during peak demand periods. The credit applies to the total cost of installation, including labor and permitting fees.

It’s important to note that the credit only applies to the cost of the system itself, not to any expenses related to financing or maintenance. Also, keep in mind that any utility rebates you receive for your solar installation may reduce the cost basis used to calculate your tax credit.

Example Calculation (2024)

Let’s look at a complete example of how the credit works:

Solar System Installation:

- Solar panels and inverters: $15,000

- Installation labor: $5,000

- Battery storage system (10kWh): $8,000

- Permits and interconnection: $2,000

Total System Cost: $30,000

Local Utility Rebate: -$2,000

Net Cost Basis: $28,000

Federal Tax Credit Calculation:

- 30% of $28,000 = $8,400 potential tax credit

Try our interactive Solar Tax Credit Calculator to estimate your potential tax savings:

Solar Tax Credit Calculator

Total System Cost ? Total System Cost is the sum of all your initial expenses for the solar installation, including solar panels, inverters, wiring, labor, battery storage, and permits.

$0

After Rebate ? After Rebate is your Total System Cost minus any utility rebates you’ve received. This represents the net cost after rebates.

$0

State Incentives ? State Incentives are additional benefits or credits provided by your state to encourage solar installations. These can be fixed amounts or percentage-based credits depending on your state’s policies.

$0

Federal Tax Credit (30%) ? Federal Tax Credit (30%) allows you to deduct 30% of your After Rebate amount from your federal taxes. This credit reduces your overall tax liability.

$0

Eligible Credit ? Eligible Credit is the actual amount of tax credit you can apply this year. It is the smaller of (Federal Tax Credit + State Incentives) or your total Tax Liability.

$0

Carryforward Credit ? Carryforward Credit is any remaining tax credit that you cannot use this year because it exceeds your Tax Liability. This excess can be carried forward to future tax years.

$0

Calculator provided by XOA TAX – Your Tax Experts

Note: If your tax liability is less than $8,400, you can carry forward the unused portion to future tax years.

It’s important to distinguish between the types of utility incentives available. Direct rebates, like the one in this example, reduce your cost basis for the tax credit calculation. However, performance-based incentives, which are payments based on the amount of energy your system produces, do not affect your cost basis.

How to Claim the Credit

Claiming the credit is a straightforward process, but it’s crucial to maintain meticulous records. Here’s a step-by-step guide for the 2024 tax year:

- Gather Your Documentation: Keep detailed records of all expenses related to your solar installation. This includes:

- Purchase receiptsContractsManufacturer certificationsManufacturer certification statements (new for 2024)Energy performance fact sheets (new for 2024)Energy efficiency ratings (new for 2024)Utility interconnection agreement documentationLocal building permits and inspection certificatesEnergy production estimates from the installer

These documents are essential for substantiating your claim, especially if you’re ever audited.

- Complete Form 5695: When it’s time to file your taxes, you’ll need to complete IRS Form 5695, “Residential Energy Credits.” You can find the instructions for this form on the IRS website: https://www.irs.gov/forms-pubs/about-form-5695

- File Your Tax Return: Once you’ve calculated your credit on Form 5695, transfer the amount to the appropriate line on Form 1040. You can then file your tax return as usual, either electronically or by mail.

Required Documents

Technical Documentation

Installation Records

How the IRS Verifies Your Claim

While the IRS doesn’t typically conduct on-site inspections for solar tax credit claims, they do have a verification process in place to ensure compliance. This process may involve:

- Documentation Review: The IRS may review your Form 5695 and request supporting documentation to verify your eligible expenses.

- Manufacturer Certifications: They may also check manufacturer certifications to confirm that your installed equipment meets the required standards.

- Cross-Referencing: The IRS may cross-reference your claim with data from solar installers, utility companies, or local government permits to ensure consistency.

By maintaining accurate records and following the IRS guidelines, you can confidently claim your solar tax credit and be prepared for any verification process.

2024 Updates: What’s New This Year?

- Documentation Requirements: As mentioned earlier, new documentation requirements are in place for 2024. Be sure to gather all necessary paperwork to support your claim.

- State-Level Incentives: Many states have introduced or expanded their own solar incentives for 2024. These incentives can often be claimed in addition to the federal credit, potentially increasing your overall savings. Check with your state’s energy agency or consult a tax professional for details on available incentives in your area.

- Qualifying Equipment: The definition of qualifying equipment has been broadened to include standalone battery storage systems.

- No Income Limits: There are no income restrictions for claiming the Residential Clean Energy Credit in 2024.

Special Cases

- Rental Properties: The Residential Clean Energy Credit is not available for rental properties. However, landlords may be eligible for other tax benefits related to energy-efficient improvements.

- Vacation Homes: If you install a solar energy system on a vacation home, you can claim the credit based on the percentage of time you personally use the property.

- Commercial Properties: Businesses can claim a different tax credit for solar energy systems, known as the Business Energy Investment Tax Credit (ITC). This credit has different rules and requirements than the residential credit.

FAQs

Can I claim the credit if I lease my solar panels?

Typically, no. The credit is generally available to homeowners who own their solar energy systems. However, there may be exceptions for certain lease agreements, so it’s best to consult with a tax professional.

What if I don’t have enough tax liability to claim the full credit in one year?

The Residential Clean Energy Credit is nonrefundable, meaning you can’t receive any excess credit back as a refund. However, any unused credit can be carried forward to future tax years.

Are there any other energy-efficient home improvements that qualify for a tax credit?

Yes! The Energy Efficient Home Improvement Credit offers tax breaks for various upgrades, such as installing energy-efficient windows, doors, and heating/cooling systems. You can find more information about this credit on the Energy Efficient Home Improvement Credit page on the Energy Star website.

Where can I find more information about the Residential Clean Energy Credit?

The IRS website (IRS.gov) is a great resource for detailed information about the credit. You can find the latest guidance for the 2024 tax year in Publication 5695, Residential Energy Credits.

Need Help Navigating the Solar Tax Credit?

We understand that tax laws can be complex, and claiming credits can sometimes feel overwhelming. If you have any questions or need assistance with claiming the Residential Clean Energy Credit, don’t hesitate to contact us. Our team of experienced CPAs at XOA TAX can provide personalized guidance and ensure you maximize your tax savings.

We’re here to help you make the most of your solar investment and achieve your financial goals.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime