Ah, dependents! Those wonderful individuals who bring joy (and maybe a little chaos) to our lives. But did you know they can also bring joy to your tax return? That’s right, claiming dependents can unlock some serious tax benefits, potentially saving you a bundle. Think of it like this: each dependent is a potential key to a treasure chest of tax savings. But just like any treasure hunt, you need a map to guide you. Consider this blog post your guide to navigating the ins and outs of claiming dependents, from who qualifies to how it impacts your tax bill. We at XOA TAX are here to help you unlock those savings and keep more of your hard-earned money where it belongs – in your pocket!

Key Takeaways

- No Limit on Dependents: You can claim an unlimited number of dependents, provided each meets IRS criteria.

- Tax Benefits: Claiming dependents can significantly reduce your tax liability through credits and deductions.

- Identification Needed: Each dependent must have a valid taxpayer identification number (SSN, ITIN, or ATIN).

What Is a Dependent?

A dependent is someone other than yourself or your spouse who relies on you for financial support. This support includes essentials like shelter, food, clothing, education, and healthcare. Dependents are typically your children or relatives but can also include non-relatives who meet specific IRS criteria. By claiming a dependent, you’re informing the IRS that you provide significant financial support to that person, which may make you eligible for various tax credits and deductions.

How Claiming Dependents Affects Your Taxes

The Shift from Exemptions to Credits

Before 2018, each dependent you claimed reduced your taxable income through a personal exemption. However, the Tax Cuts and Jobs Act of 2017 eliminated personal exemptions and instead increased the standard deduction while enhancing tax credits related to dependents.

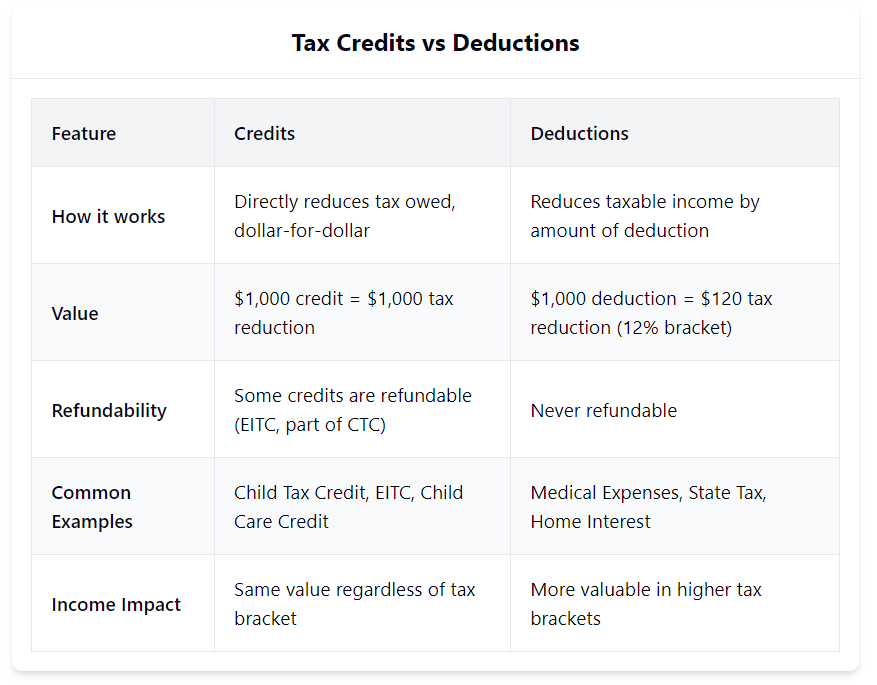

Tax Credits vs. Deductions

- Tax Credits: Directly reduce the amount of tax you owe. For example, a $1,000 tax credit lowers your tax bill by $1,000.

- Tax Deductions: Reduce your taxable income, which indirectly reduces your tax liability based on your tax bracket.

Key Tax Benefits for Claiming Dependents

It’s important to remember that each tax credit and deduction has specific eligibility requirements, and not all dependents will qualify for every benefit.

- Earned Income Tax Credit (EITC):

- A refundable credit for low-to-moderate-income individuals and families.

- For 2024, the maximum EITC is $7,430 for taxpayers with three or more qualifying children.

- Income limits apply and vary based on filing status and the number of children.

- Requires that the dependent has a valid Social Security Number (SSN).

- Child and Dependent Care Credit:

- Helps offset costs for childcare or dependent care necessary for you to work or look for work.

- Offers a credit of up to 35% of qualifying expenses, with limits based on your income.

- Applies to dependents under 13 or those physically or mentally incapable of self-care.

- Child Tax Credit:

- A credit for each qualifying child under age 17.

- Provides up to $2,000 per qualifying child, with up to $1,500 refundable as the Additional Child Tax Credit.

- Income phaseouts begin at $200,000 for single filers and $400,000 for joint filers.

- Credit for Other Dependents:

- A non-refundable credit for dependents who don’t qualify for the Child Tax Credit.

- Offers up to $500 per qualifying dependent.

- Includes dependents of any age, including elderly parents.

- Adoption Credit:

- A credit for qualified adoption expenses.

- Provides up to $15,950 for 2024.

- Income limits apply.

- Medical Expense Deduction:

- Allows you to deduct unreimbursed medical expenses exceeding 7.5% of your adjusted gross income (AGI).

- Can include medical expenses for your dependents.

- Requires you to itemize deductions to claim.

- Education Credits:

- American Opportunity Credit: Up to $2,500 per eligible student for qualified education expenses during the first four years of higher education.

- Lifetime Learning Credit: Up to $2,000 per tax return for qualified tuition and related expenses.

- Income phaseouts apply.

Maximum Tax Credits for Dependents (2024)

Who Qualifies as a Dependent?

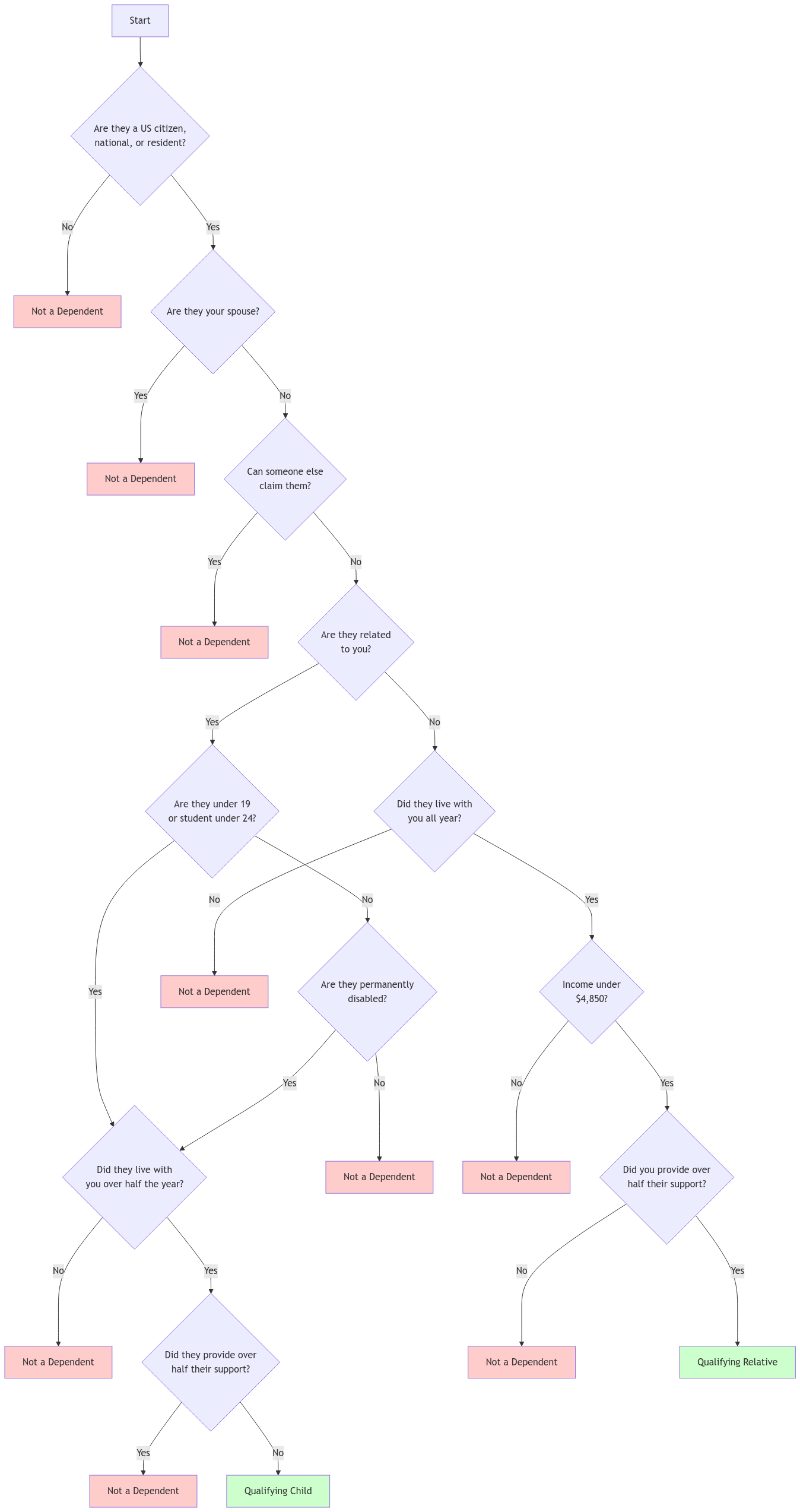

The IRS categorizes dependents into two types:

- Qualifying Child

- Qualifying Relative

General Requirements for All Dependents

- Citizenship: Must be a U.S. citizen, U.S. national, U.S. resident alien, or a resident of Canada or Mexico.

- Taxpayer Identification: Must have a valid SSN, ITIN, or ATIN.

- Filing Status: Cannot file a joint return with a spouse unless it’s solely to claim a refund.

- Dependent Status: Cannot be claimed as a dependent by another taxpayer.

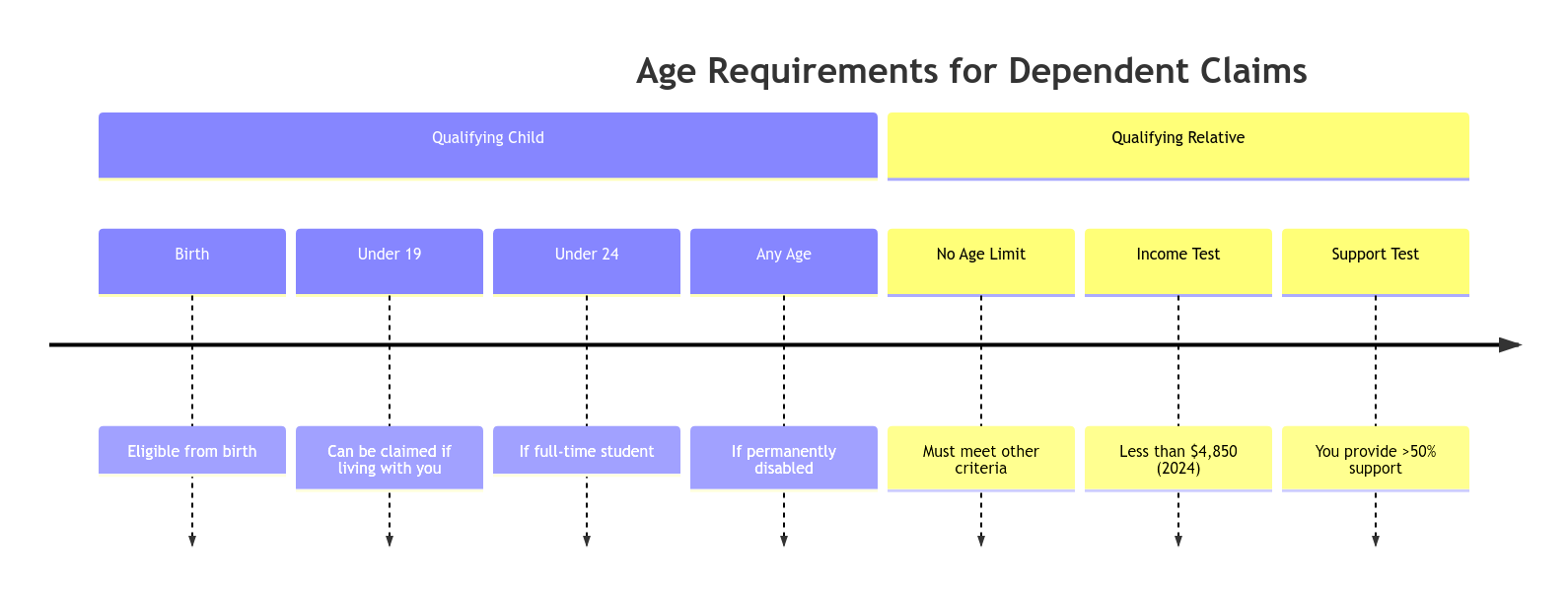

Qualifying Child Criteria

- Relationship: Your child (biological, step, foster, or adopted), sibling, or a descendant of any of these.

- Age: Under age 19 at the end of the year; under age 24 if a full-time student; any age if permanently and totally disabled.

- Residency: Must live with you for more than half the year. Temporary absences (school, vacation, military service) don’t count against this.

- Support: Child cannot provide more than half of their own support.

Qualifying Relative Criteria

- Not a Qualifying Child: Cannot be someone else’s qualifying child.

- Relationship or Residence: Lives with you all year as a member of your household, or is related to you (parent, grandparent, sibling, aunt, uncle, in-law, etc.).

- Gross Income: Must be less than $4,850 for 2024.

- Support: You must provide more than half of their total support for the year.

Identification Requirements for Dependents

To claim a dependent, you’ll need their taxpayer identification number:

- Social Security Number (SSN): For U.S. citizens and eligible residents.

- Individual Taxpayer Identification Number (ITIN): For non-resident and resident aliens not eligible for an SSN. You can apply for an ITIN by filing Form W-7 with the IRS. You’ll need original or certified copies of documents to prove your foreign status and identity. More information on ITINs can be found on the IRS website.

- Adoption Taxpayer Identification Number (ATIN): If you’re in the process of adopting a child and don’t have an SSN for them yet, you can apply for an ATIN by filing Form W-7A with the IRS. You’ll need to provide information about the adoption and the child.

How to Claim Dependents on Your Tax Return

- Gather Necessary Information: Full name, SSN/ITIN/ATIN, and relationship of each dependent.

- Complete the Dependents Section: On Form 1040, fill out the “Dependents” section with the required information.

- Attach Necessary Schedules: For certain credits (like the Child Tax Credit), you may need to attach additional forms or schedules.

- E-File for Accuracy: Consider electronic filing to reduce errors and speed up processing.

Special Situations and Considerations

- Divorced or Separated Parents: Special rules determine who can claim a child as a dependent in cases of divorce or separation. Generally, the custodial parent (the parent with whom the child lived for the greater part of the year) has the right to claim the child. However, the custodial parent can release this right to the non-custodial parent using Form 8332.

- Tie-Breaker Rules: If more than one person can claim the same dependent, tie-breaker rules come into play. These rules prioritize the taxpayer with the higher adjusted gross income (AGI), among other factors.

- Calculating Support: Determining whether you provide more than half of a dependent’s support involves considering various expenses, such as:

- Housing: Rent or mortgage payments, property taxes, utilities

- Food: Groceries, dining out

- Clothing: Purchases of clothing and shoes

- Education: Tuition, books, supplies

- Medical Care: Doctor’s visits, medications, insurance premiums

- Transportation: Car expenses, public transportation costs

- Other Necessities: Personal care items, entertainment

Example: If you spend $10,000 on your child’s support throughout the year, and they provide $4,000 of their own support through part-time work, you provide more than half of their support, and they meet the support test.

- International Dependents: Special rules and residency requirements apply to claiming dependents who live in another country. It’s important to consult the IRS guidelines or a tax professional if you have a dependent living abroad.

- Dependents with Disabilities: If you’re claiming a dependent with a disability, you may need to provide documentation to the IRS to support your claim. This documentation could include a doctor’s statement or other proof of the disability.

State Tax Implications

While this blog post focuses on federal tax rules, it’s important to remember that state tax laws may have different rules for claiming dependents. Some states may still offer dependency exemptions, while others may have different income thresholds or residency requirements. Be sure to check your state’s tax guidelines for specific information.

Tips for Maximizing Your Tax Benefits

- Keep Detailed Records: Maintain documentation of support provided, residency, and relationship for each dependent. This includes receipts, bank statements, and other relevant records.

- Stay Updated: Tax laws can change. Make sure you’re aware of the latest IRS guidelines by checking the IRS website or subscribing to their updates.

- Consult a Tax Professional: Complex situations, such as claiming a dependent with significant income or a dependent living abroad, may require expert advice to ensure compliance and maximize benefits.

- Use Tax Software: Reliable tax preparation software can help identify eligible credits and deductions and ensure you’re claiming everything you’re entitled to.

FAQs

How Much Can a Dependent Child Earn?

• Qualifying Child: Can earn any amount as long as they do not provide more than half of their own support.

• Qualifying Relative: Must have a gross income less than $4,850 for 2024.

When Does a Child Need to File a Tax Return?

• Earned Income: If they have earned income over the threshold for the year. You can find the current threshold in IRS Publication 501.

• Unearned Income: If they have unearned income (interest, dividends) over $1,250.

• Self-Employment: If net earnings from self-employment are $400 or more.

When Should I Stop Claiming My Child?

• Age Limit: When they exceed the age requirements and are not full-time students.

• Support Test: If they start providing more than half of their own support.

• Residency Test: If they no longer live with you for more than half the year.

Can I Claim Adult Dependents?

Yes, if they meet the qualifying relative criteria, including the income and support tests.

Is There a Limit to the Number of Dependents I Can Claim?

No, there’s no limit as long as each dependent meets the IRS requirements.

Conclusion

Understanding the IRS rules for claiming dependents can significantly impact your tax liability. By ensuring each dependent meets the necessary criteria and taking advantage of available tax credits and deductions, you can optimize your tax situation and potentially save thousands of dollars.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime