Health Savings Accounts (HSAs) are a savvy way to save for medical expenses while enjoying tax advantages. But for married couples, the rules around HSA contributions can seem a bit complex. This blog post clarifies how contributions work for married couples in various scenarios so you can maximize your HSA benefits.

Key Takeaways

- Married couples have a family contribution limit, even with separate HSAs.

- Contribution limits depend on whether you have individual or family health insurance coverage.

- You can split the family contribution limit between spouses, but the total can’t exceed the limit.

- Coordinate contributions to avoid penalties.

- Special rules apply for those 55 and older and individuals becoming eligible mid-year.

Understanding HSA Contribution Limits for Married Couples

2024 HSA Contribution Limits

| Coverage Type | Basic Limit | With Catch-up (55+) |

|---|---|---|

| Individual Coverage | $4,150 | $5,150 |

| Family Coverage | $8,300 | $9,300 |

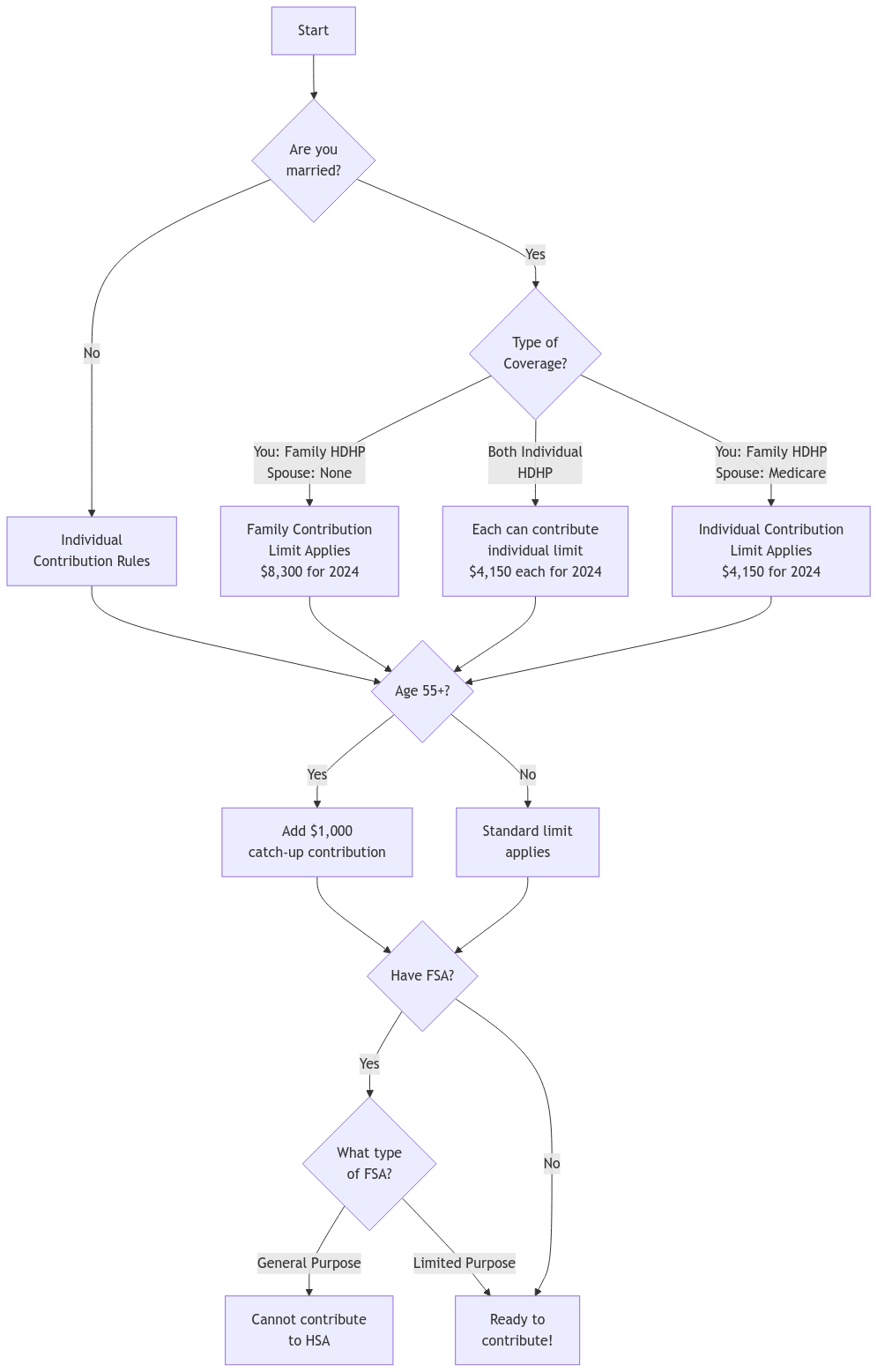

The IRS views married couples as a single unit for HSA contributions. This means even if both spouses are eligible to contribute, there’s a maximum family contribution limit. For 2024, this limit is $8,300 for family HDHP coverage. If both spouses have individual HDHP coverage, each can contribute up to $4,150.

Scenario 1: One Spouse Has Family HDHP Coverage

In this case, only one HSA is needed. The spouse with the family HDHP can contribute up to the family maximum ($8,300 for 2024). The funds in this HSA can then be used to pay for qualified medical expenses for both spouses.

Scenario 2: Each Spouse Has an Individual HDHP

If each spouse has their own individual HDHP, they must each have their own HSA. Each spouse can contribute up to the individual maximum ($4,150 for 2024) to their respective accounts.

Dividing Contributions

Maximum Family HSA Contribution Scenarios (2024)

Different ways couples can split their $8,300 family contribution limit

50/50 Split

70/30 Split

80/20 Split

One Spouse Only

You have flexibility in how you divide the family contribution limit. You can split it evenly or allocate it differently based on your needs. Just ensure the combined contributions don’t exceed the family limit.

Employer Contributions

If your employer contributes to your HSA, those contributions count toward your annual limit. Make sure to coordinate your personal contributions with your employer’s contributions to avoid exceeding the limit.

Age 55 and Older: Catch-Up Contributions

If you’re 55 or older, you can make an extra “catch-up” contribution of $1,000 per year, in addition to the regular limit. If both spouses are 55 or older, each spouse can make a $1,000 catch-up contribution to their own HSA.

Becoming HSA-Eligible Mid-Year: Understanding the Rules

If you become HSA-eligible mid-year, a few rules determine how much you can contribute:

- Testing Period: This refers to the 12 months *after* the last month of the tax year. Essentially, you need to be eligible for the entire testing period to contribute the full amount. For example, if you become eligible in July of 2024, your testing period runs from July 2024 to June 2025.

- Last-Month Rule: This rule can help you qualify for the full contribution amount even if you don’t meet the testing period requirements. If you’re eligible on the first day of the last month of your tax year (December 1st for most people) and remain eligible through the following year, you’re considered eligible for the entire year.

- Full-Contribution Rule: This rule allows you to contribute the full amount for the year if you meet the testing period, even if you switch health plans or employers mid-year, as long as you maintain HDHP coverage.

Still confused? We get it! These rules can be complex. Check out IRS Publication 969 or reach out to us at XOA TAX for personalized guidance.

What is an HDHP?

To be eligible to contribute to an HSA, your health insurance plan must be a High Deductible Health Plan (HDHP). For 2024, an HDHP must have a minimum deductible of:

- $1,600: for individual coverage

- $3,200: for family coverage.

It also has a maximum out-of-pocket limit of:

- $8,050: for individual coverage

- $16,100: for family coverage.

This means that although you pay more upfront for healthcare expenses until you meet your deductible, there’s a limit on how much you’ll have to spend out-of-pocket each year.

Coordinating with Flexible Spending Accounts (FSAs)

Having a general-purpose FSA may make you ineligible to contribute to an HSA.

- Types of FSAs: There are three types of FSAs: for medical care reimbursements, adoption assistance, and dependent care assistance.

- Limited Purpose FSAs: These are a type of FSA that can be used with an HSA, but they can only be used to pay for dental and vision expenses.

It’s essential to understand FSA rules to ensure you remain eligible to contribute to your HSA.

Important Considerations

- Excess contributions: Overcontributing to an HSA can result in penalties. Monitor your contributions carefully and stay within the limits.

- Coordination: If both spouses are contributing, coordinate your efforts to avoid exceeding the family limit.

- Distributions: HSA distributions are tax-free when used for qualified medical expenses. However, if you withdraw funds for non-qualified expenses, you’ll generally incur a 20% penalty, in addition to paying income tax on the distribution.

State-Specific HSA Rules

It’s essential to note that HSA tax treatment can vary by state. For example, California does not offer the same tax advantages as the federal government. Be sure to check the rules in your state.

Mid-Year Marriage and HSAs

Getting married mid-year can create unique HSA contribution situations. For example, if each spouse had individual HDHP coverage and separate HSAs before marriage, they’ll need to adjust their contributions after marriage to comply with the family contribution limit for the rest of the year.

Divorce and HSAs

- Dividing Assets: In a divorce, HSA assets are typically treated as marital property and subject to division, and may be subject to taxation.

- State Laws: The specific rules for dividing HSA assets can vary depending on state law and the terms of the divorce decree.

HSA Beneficiaries

- Spouse as Beneficiary: Upon your death, the HSA will pass to your named beneficiary. If your spouse is your beneficiary, they will become the owner of the account.

- Non-Spouse Beneficiary: If you name someone other than your spouse, the account will no longer be an HSA, and the beneficiary will be responsible for paying income tax on the distributions.

FAQs

Can we have a joint HSA?

No, there’s no such thing as a joint HSA. Each spouse must maintain their own individual account.

Can I transfer money between my spouse’s HSA and mine?

No, direct transfers between HSAs belonging to spouses are not permitted.

What if one spouse has a family HDHP and the other has an individual HDHP?

This can be tricky. The spouse with the family HDHP can contribute up to the family limit. However, the other spouse may also contribute up to the individual limit. Review IRS Publication 969 carefully or consult with a tax professional.

Can I contribute to my HSA if my spouse is covered by Medicare?

If you have family HDHP coverage and your spouse is enrolled in Medicare, you can still contribute to your HSA. However, your contribution limit will be the individual limit ($4,150 for 2024) since your spouse is not eligible for an HSA.

Connecting with XOA TAX

Navigating HSA contributions can be complex, especially for married couples. At XOA TAX, we can help you understand the rules, optimize your contributions, and ensure you’re maximizing the benefits of your HSA. Contact us today for personalized guidance:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.