Imagine this: you’re a rapidly growing e-commerce business, and you’re considering securing a significant loan to invest in new inventory and expand your marketing efforts. You pore over your monthly financial statements, confident in the picture they paint of your company’s financial health. But what if those reports are misleading? What if a seemingly minor error in revenue recognition or expense categorization is distorting the true picture of your profitability?

At XOA TAX, we’ve witnessed firsthand how inaccurate financial statements can lead businesses down a path of misguided decisions, wasted resources, and even legal complications. In one instance, a client in the manufacturing sector nearly missed out on a lucrative acquisition opportunity due to an understated cash flow position in their reports. In another case, a retail business faced a costly audit triggered by inconsistencies in their sales tax reporting.

This blog post delves into the common pitfalls of financial reporting and provides practical, actionable solutions to ensure your statements are accurate, insightful, and empower you to make informed decisions that drive sustainable growth.

Key Takeaways

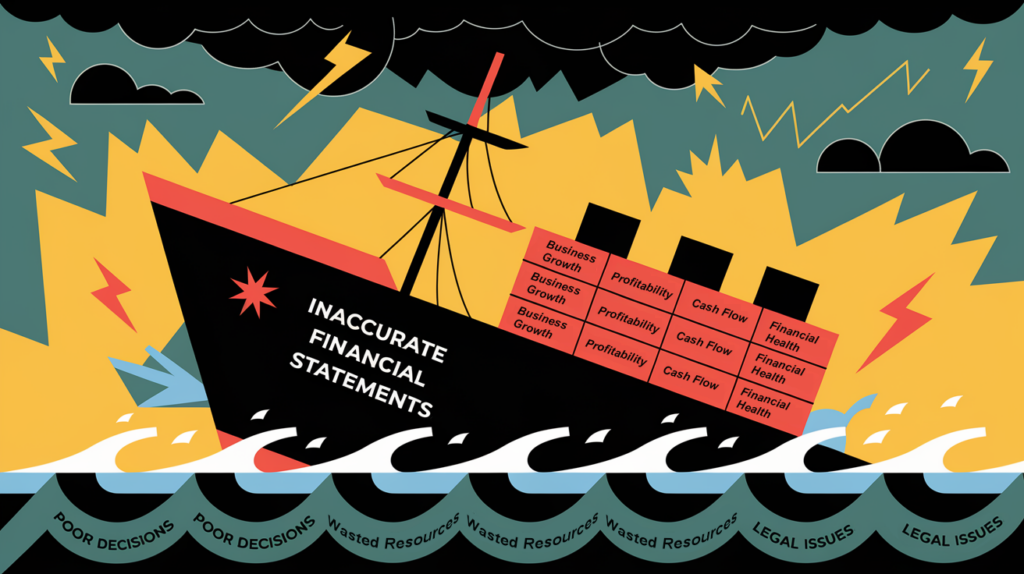

- Inaccurate financial statements can lead to poor decision-making, wasted resources, and potential legal issues.

- Common causes of inaccurate reporting include manual processes, lack of communication, and insufficient review procedures.

- Automating processes, standardizing accounting methods, and investing in staff training can significantly improve accuracy.

- Partnering with a trusted CPA firm like XOA TAX can provide expert guidance and support for reliable financial reporting.

The Hidden Dangers of Inaccurate Financial Statements

Ideally, your monthly financial statements should serve as a clear and reliable compass, guiding your business decisions and providing a comprehensive understanding of your financial performance. They should offer valuable insights into your profitability, cash flow, and overall financial health. But in the real world, many businesses grapple with inaccuracies in their reports, often without even realizing the extent of the problem.

These inaccuracies can range from minor discrepancies to significant misrepresentations, and the consequences can be severe:

- Misguided Decisions: Just as a faulty map can lead you astray, inaccurate financial data can result in poor business decisions. For instance, a construction company might overestimate its project profitability due to an error in cost allocation, leading to underbidding on future projects and ultimately jeopardizing its financial stability.

- Wasted Time and Resources: Imagine a restaurant owner spending hours analyzing reports that are riddled with errors. This not only wastes valuable time but also erodes trust in the data, making it difficult to make informed decisions about pricing, inventory, and staffing.

- Cash Flow Problems: Inaccurate reporting can distort your understanding of your cash position. A tech startup, for example, might believe it has ample funds available to invest in product development when, in reality, an error in accounts receivable reporting masks an impending cash crunch.

- Legal and Regulatory Risks: Inaccurate financial reporting can attract unwanted scrutiny from the IRS or other regulatory bodies. This can lead to audits, penalties, and even legal action in severe cases. A recent case involved a healthcare provider facing hefty fines due to inconsistencies in their revenue recognition practices.

Why Financial Statements Go Wrong

At XOA TAX, we’ve identified several recurring factors that contribute to inaccuracies in financial reporting. Some of the most common culprits include:

- Manual Processes: Relying on manual data entry and calculations increases the risk of human error. Even a simple typo can have significant consequences. For example, a misplaced decimal in a manufacturing company’s inventory valuation can lead to a substantial misstatement of assets.

- Communication Breakdowns: Miscommunication between departments or a lack of clear accounting policies can lead to inconsistencies and errors in reporting. Imagine a marketing agency where the sales team and the accounting department have different interpretations of when to recognize revenue, resulting in discrepancies in the income statement.

- Poor Data Integration: If your business uses multiple software systems that don’t communicate effectively, data can become fragmented and difficult to reconcile, increasing the risk of errors. This is a common challenge for businesses in the logistics industry, where data from various sources, such as transportation management systems and warehouse management systems, needs to be integrated for accurate financial reporting.

- Inadequate Review Processes: Without a robust review process, errors can easily slip through the cracks. This is particularly concerning if your team is understaffed or lacks the necessary expertise. For instance, a small business owner without a dedicated accounting team might overlook critical errors in their financial statements due to a lack of time or knowledge.

Strategies for Accurate Financial Reporting

The good news is that you can take proactive steps to improve the accuracy of your financial statements. Here are some strategies we recommend at XOA TAX:

- Embrace Automation: Transitioning from manual processes to automated accounting software can significantly reduce the risk of human error. Software like Xero, with its user-friendly interface and robust features, is ideal for small businesses, while QuickBooks Online offers scalability and advanced reporting capabilities for larger enterprises. However, it’s essential to choose software that aligns with your specific needs and budget. Our team at XOA TAX can help you evaluate different options and select the best fit for your business.

- Standardize Accounting Methods: Ensure consistency across departments by implementing standardized accounting procedures and policies. This reduces discrepancies and makes it easier to consolidate financial data. For example, clearly define how to categorize expenses, when to recognize revenue, and how to handle accounts payable. Document these procedures in a company-wide accounting manual to ensure everyone is on the same page.

- Prioritize Communication: Foster clear communication channels between departments and management to ensure everyone is on the same page regarding accounting practices and reporting requirements. Regular meetings, shared online workspaces, and clear documentation can facilitate effective communication and minimize the risk of misunderstandings.

- Invest in Training: Equip your team with the knowledge and skills they need to maintain accurate financial records. This might involve training on new software, accounting standards updates, or best practices for financial reporting. Consider investing in continuing education courses or certifications to enhance your team’s expertise and ensure they stay abreast of the latest developments in accounting.

- Engage a CPA Firm: If your internal team is struggling to maintain accurate financial records or needs additional expertise, consider partnering with a CPA firm like XOA TAX. We can provide comprehensive bookkeeping, accounting, and tax services tailored to your business needs. Our team of experienced professionals can help you implement best practices, identify and rectify errors, and ensure your financial reporting is accurate, reliable, and compliant with all applicable regulations.

Industry-Specific Considerations

Different industries face unique challenges and considerations when it comes to financial reporting. Here are a few examples:

- Retail: Retail businesses must accurately track inventory, manage sales tax complexities, and account for returns and discounts.

- Manufacturing: Manufacturing companies need to track costs associated with raw materials, labor, and overhead, and accurately allocate those costs to finished goods.

- Technology: Technology companies often deal with complex revenue recognition models, especially for subscription-based services, and must comply with evolving accounting standards for software development.

- Construction: Construction companies face challenges in tracking project costs, estimating completion percentages, and recognizing revenue over long-term projects.

At XOA TAX, we have extensive experience working with businesses across various industries. We understand the unique nuances of each sector and can provide tailored solutions to address your specific financial reporting needs.

Preparing for Tax Season

Accurate financial reporting is not only crucial for day-to-day operations but also essential for a smooth and stress-free tax season. By maintaining organized and accurate records throughout the year, you can simplify the tax preparation process, minimize the risk of errors, and potentially reduce your tax liability.

Here are some tips to prepare for tax season:

- Reconcile Accounts Regularly: Reconcile your bank accounts and credit card statements monthly to ensure all transactions are accurately recorded.

- Categorize Expenses: Properly categorize your expenses to ensure you’re claiming all eligible deductions and credits.

- Track Fixed Assets: Maintain detailed records of your fixed assets, including purchase dates, costs, and depreciation schedules.

- Stay Informed: Keep up-to-date with the latest tax laws and regulations. Subscribe to our XOA TAX newsletter for timely updates and valuable insights.

By taking these steps, you can approach tax season with confidence and avoid last-minute scrambling.

Frequently Asked Questions

How often should I review my financial statements?

At XOA TAX, we recommend reviewing your financial statements at least monthly. However, the ideal frequency depends on the nature of your business and the specific reports. For example, businesses with high transaction volumes or fluctuating cash flows might benefit from weekly or even daily reviews of their cash flow statement. We can help you determine the appropriate review schedule for your needs.

What are some red flags that might indicate errors in my financial statements?

Some common red flags include significant fluctuations in account balances without clear explanations, unexplained discrepancies between different reports, or difficulty reconciling bank statements. If you notice unusual trends or inconsistencies, it’s crucial to investigate further to identify the root cause and ensure the accuracy of your data.

How can I ensure my accounting software is properly integrated with other business systems?

Many accounting software solutions offer integrations with other business tools, such as CRM or inventory management systems. It’s essential to choose software that seamlessly integrates with your existing technology stack and to ensure data is properly mapped between systems. This often involves working with your software vendors or IT professionals to configure the integration and ensure data flows smoothly between different platforms.

What are the benefits of outsourcing my bookkeeping and accounting to XOA TAX?

Outsourcing to XOA TAX can free up your time and resources, allowing you to focus on your core business activities. Our team of experts can ensure your financial records are accurate, organized, and compliant with all applicable regulations. We can also provide valuable insights and advice to help you make informed financial decisions and optimize your business performance.

Protect Your Financial Data

In today’s digital age, protecting your financial data is more critical than ever. Implementing robust security measures can safeguard your business from cyber threats and data breaches.

Here are some essential steps to consider:

- Strong Passwords: Use strong, unique passwords for all your financial accounts and software.

- Data Encryption: Encrypt sensitive financial data both in transit and at rest.

- Regular Backups: Regularly back up your financial data to a secure offsite location.

- Employee Training: Train your employees on cybersecurity best practices to prevent phishing scams and other social engineering attacks.

By prioritizing data security, you can minimize the risk of financial loss and protect your business’s reputation.

Need Help with Your Financial Reporting?

Accurate financial statements are the bedrock of sound business decisions and sustainable growth. If you’re feeling overwhelmed by the complexities of financial reporting or simply want to ensure your records are in order, don’t hesitate to contact XOA TAX.

Contact XOA TAX Today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime