Inheriting an IRA can be a significant financial event. While it offers opportunities for long-term growth, it also comes with tax implications that require careful consideration. This guide will walk you through the key aspects of managing inherited IRA distributions, particularly in light of recent legislation, to help you make informed decisions and potentially reduce your tax burden.

Key Takeaways

- The SECURE Act introduced a 10-year rule for most non-spouse beneficiaries of inherited IRAs.

- Strategic timing of distributions can significantly impact your tax liability.

- Various tax-advantaged accounts and strategies can help offset taxes on inherited IRA distributions.

- Consulting a tax professional is crucial for navigating the complexities of inherited IRAs.

Understanding the SECURE Act and Its Implications

The 10-Year Distribution Rule

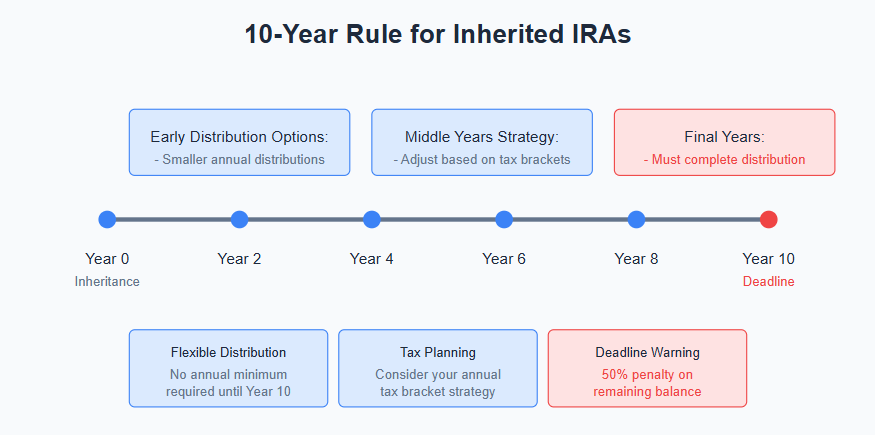

For most non-spouse beneficiaries, the SECURE Act mandates full distribution of the inherited IRA within 10 years of the original owner’s death. This rule applies to both Traditional and Roth inherited IRAs. The 10-year period begins on December 31st of the year the original IRA owner passed away. This rule effectively eliminated the “stretch IRA” strategy, which allowed beneficiaries to stretch distributions over their lifetime, potentially reducing their annual tax liability.

Important Note: The rules differ for those who inherited IRAs from owners who died before January 1, 2020. These beneficiaries may still be able to use the “stretch IRA” strategy, depending on their relationship to the deceased. It’s essential to consult a tax professional to understand the specific rules that apply to your situation.

Required Minimum Distributions (RMDs)

If the original IRA owner had already begun taking RMDs, beneficiaries might need to continue these distributions within the 10-year window. However, the IRS has provided some relief by waiving penalties for missed RMDs through 2024. This allows beneficiaries to defer distributions without immediate tax consequences, providing some flexibility in managing their tax liability.

SECURE 2.0 Act

The SECURE 2.0 Act of 2022 introduced further changes, including an exception to the 10-year rule for certain eligible designated beneficiaries, such as chronically ill individuals and those with disabilities. These beneficiaries may have more flexibility in taking distributions.

Strategies to Minimize Tax Impact

Assess Your Tax Bracket

- Evaluate Your Income: Take into account your current income and projected earnings over the next 10 years. Distributing inherited IRA funds during lower-income years can help minimize your overall tax liability.

- Avoid Bracket Creep: Be mindful that large distributions could push you into a higher tax bracket. This means a larger portion of your income, including those distributions, would be taxed at a higher rate.

Strategic Timing of Withdrawals

- Spread Out Distributions: Rather than taking a lump-sum distribution, consider spreading withdrawals over the 10-year period. This can help you manage your taxable income more effectively each year.

- Year-End Planning: Review your income towards the end of each year. This allows you to determine the optimal amount to withdraw from your inherited IRA before year-end, helping you balance your tax liability.

Utilize Tax-Efficient Accounts

- Contribute to Tax-Deferred Accounts: If you’re eligible, contributing to tax-deferred retirement accounts like traditional IRAs or 401(k)s can help offset the taxable income from your inherited IRA distributions.

- Health Savings Accounts (HSAs): For those with qualifying high-deductible health plans, HSAs offer triple tax advantages. Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This can be a valuable tool to reduce your overall taxable income.

Consider Roth Conversions

- Convert to a Roth IRA: Converting your inherited IRA to a Roth IRA involves paying taxes upfront. However, this allows the account to grow tax-free, and qualified withdrawals in retirement are also tax-free. This strategy can be particularly beneficial if you anticipate being in a lower tax bracket in the future.

Leverage Charitable Contributions

- Qualified Charitable Distributions (QCDs): If you’re over 70 ½, you can make qualified charitable distributions directly from your inherited IRA to a qualified charity. These distributions are excluded from your taxable income, up to $100,000 annually.

Stay Informed on Tax Law Changes

- Monitor Legislative Updates: Tax laws are subject to change, so staying informed is crucial. For example, the IRS recently announced inflation adjustments for the 2025 tax year, which could affect your planning. You can find updates and helpful resources on the official IRS website https://www.irs.gov.

State Tax Implications

It’s important to be aware that state tax laws regarding inherited IRAs can vary. Some states may have different rules or tax rates than federal law. Be sure to research the specific regulations in your state or consult with a tax professional to understand the implications.

FAQ Section

Q: What happens if I don’t take the required distributions within the 10-year period?

A: Failing to take the full distribution within the 10-year period can result in a hefty 50% penalty on the undistributed amount. It’s crucial to adhere to the rules to avoid this penalty.

Q: Are there any exceptions to the 10-year rule?

A: Yes, certain beneficiaries are exempt from the 10-year rule, including:

- Surviving spouses

- Minor children of the original account owner

- Disabled or chronically ill beneficiaries

- Individuals not more than 10 years younger than the deceased account owner

Connecting with XOA TAX

Managing inherited IRAs and optimizing your tax strategy can be complex. At XOA TAX, our experienced CPAs can provide personalized guidance tailored to your unique financial situation. We can help you navigate the intricacies of inherited IRA distributions, ensure compliance with current regulations, and develop a plan to minimize your tax liability.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime