Inheriting an IRA can be a significant financial event. While it might be tempting to use the funds for immediate needs, reinvesting them strategically can create a lasting financial legacy. At XOA TAX, we encourage you to consider these smart ways to reinvest your inherited IRA distributions to maximize growth and secure your financial future.

Key Takeaways

- Reinvesting inherited IRA distributions can help you achieve long-term financial goals.

- Various reinvestment options cater to different needs and risk tolerances.

- Understanding the tax implications of each strategy is crucial.

- Consulting a financial advisor can provide personalized guidance.

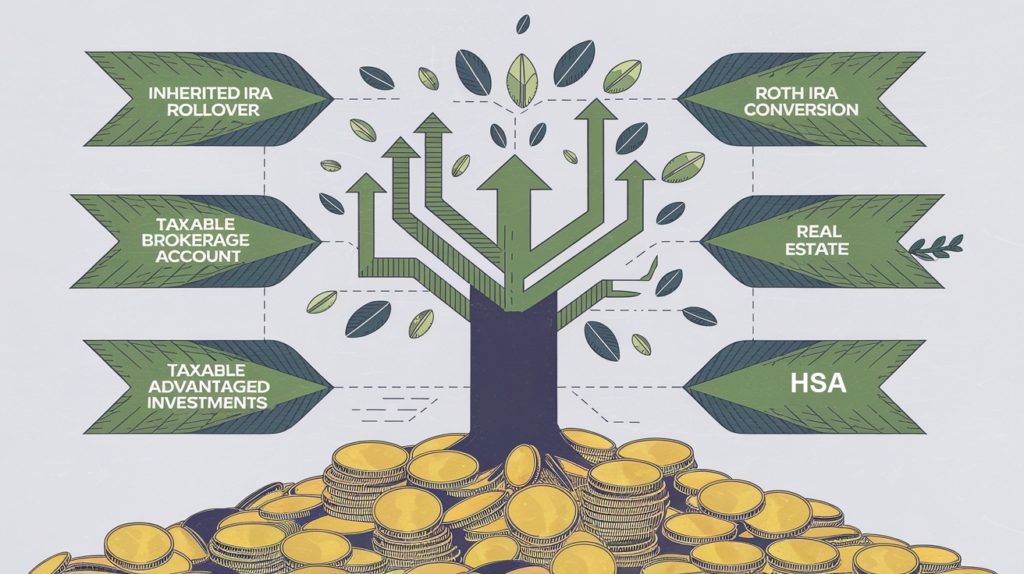

5 Smart Reinvestment Strategies

1. Roll Over to an Inherited IRA

- The simplest approach is to transfer the inherited IRA funds directly into an inherited IRA in your name.: This allows you to maintain the tax-deferred status of the assets and take distributions over your lifetime (or a shorter period, depending on the rules). This option provides flexibility and control over your withdrawals while continuing to benefit from tax-deferred growth.

Important Note: The SECURE Act 2.0 has introduced new regulations for inherited IRAs, including changes to the RMD rules.: It’s crucial to understand how these changes might affect your individual situation. For example, most non-spouse beneficiaries must now withdraw all funds within 10 years of the original owner’s death.

Key Deadlines for Inherited IRAs

Understanding the critical deadlines for inherited IRAs is essential for proper planning and avoiding penalties. Below is a timeline of key dates you need to know:

- Day of Death (Day 0): Starting point for all deadlines

- September 30 (Year After Death): Beneficiary determination date – final date to determine which beneficiaries will share in the IRA

- December 31 (Year After Death): Deadline for taking the first Required Minimum Distribution (RMD)

- 10-Year Deadline: Most non-spouse beneficiaries must empty the inherited IRA by December 31 of the tenth year following the original owner’s death

This timeline applies to most beneficiaries under the SECURE Act 2.0. However, eligible designated beneficiaries (such as surviving spouses, disabled individuals, chronically ill individuals, minor children of the deceased, or individuals not more than 10 years younger than the deceased) have different rules and should consult with a tax professional for their specific situation.

2. Contribute to a Roth IRA (If Eligible)

- Converting your inherited IRA distributions to a Roth IRA can be a savvy move, especially if you anticipate being in a higher tax bracket in the future.: While you’ll pay taxes on the conversion, qualified withdrawals in retirement will be tax-free. Remember that income limitations and contribution limits apply to Roth IRAs. For 2024, you can contribute up to $7,000 if you’re under 50, and $8,000 if you’re 50 or older.

5-Year Rule: Keep in mind that to make tax-free and penalty-free withdrawals from a Roth IRA, you generally need to wait five years from the date of your first contribution.

3. Invest in a Taxable Brokerage Account

- A taxable brokerage account provides access to a wide range of investments, including stocks, bonds, and mutual funds.: This option offers greater investment flexibility and allows you to tailor your strategy to your risk tolerance and financial goals. While you’ll pay taxes on dividends and capital gains, current long-term capital gains rates are relatively low.

Risk Consideration: Investing in the stock market always carries some level of risk.: It’s essential to diversify your portfolio and consider your investment timeline when making decisions.

4. Explore Tax-Advantaged Investments

- Consider reinvesting your distributions in tax-advantaged accounts like a Health Savings Account (HSA) if you have a high-deductible health plan.: HSAs offer triple tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. For 2024, the contribution limits are $4,150 for individuals and $8,300 for families.

Step-Up in Basis: If you inherit appreciated assets within the IRA, such as stocks, be aware of the step-up in basis rules.: This means the asset’s cost basis is adjusted to its market value at the time of the original owner’s death, potentially reducing your capital gains tax liability if you sell the asset later.

| Investment Option | Contribution Limit (2024) | Tax Benefits |

|---|---|---|

| Traditional IRA | $7,000 (under 50); $8,000 (50 and over) | Tax-deductible contributions; Tax-deferred growth; Taxes paid upon withdrawal in retirement. |

| Roth IRA | $7,000 (under 50); $8,000 (50 and over) | After-tax contributions; Tax-free growth; Tax-free qualified withdrawals in retirement. |

| Health Savings Account (HSA) | $4,150 (individual); $8,300 (family) | Triple tax benefit: Tax-deductible contributions; Tax-free growth; Tax-free withdrawals for qualified medical expenses. |

| 529 Plan | Varies by state; No federal limit | Tax-advantaged savings for qualified education expenses; Earnings grow tax-free; Withdrawals are tax-free when used for qualified expenses. |

5. Diversify with Real Estate

- Investing in real estate can be an excellent way to diversify your portfolio and potentially generate rental income and appreciation.: Real estate can also act as a hedge against inflation. However, it’s essential to carefully research potential investments and consider working with a real estate professional.

- Active Management: Real estate investments often require active management and can be illiquid.: Factor in the time commitment and potential risks before investing.

FAQ Section

Q: What are the tax implications of inheriting an IRA?

A: The tax implications depend on the type of IRA you inherit and your relationship to the original owner. Generally, you’ll need to take Required Minimum Distributions (RMDs) each year, which are taxable as income.

Exception for Spouses: Spouses generally have more options for inherited IRAs, including the ability to roll the funds over into their own IRA.

Q: How long do I have to withdraw the funds from an inherited IRA?

A: The rules vary depending on your relationship to the deceased and the type of IRA. Generally, non-spouse beneficiaries must withdraw all funds within 10 years of the original owner’s death. However, there are exceptions for certain eligible designated beneficiaries, such as those who are chronically ill or disabled.

Q: What are the penalties for missing RMDs?

A: Failing to take your required minimum distributions can result in a hefty 50% penalty on the amount not withdrawn. It’s crucial to stay on top of your RMD schedule and consult with a tax professional if you have any questions.

Q: Can I disclaim an inherited IRA?

A: Yes, you can disclaim an inherited IRA, which means you refuse to accept it. This can be beneficial for tax planning purposes, especially if you are in a high tax bracket or have other retirement savings. However, it’s important to consult with a tax professional before making this decision.

Q: How can an inherited IRA be used within a trust?

A: Inherited IRAs can be held in a trust, which can offer greater control and protection of the assets, especially for beneficiaries who are minors or may need assistance managing their finances. It’s essential to work with an estate planning attorney to set up the trust properly.

State Tax Considerations

Keep in mind that state tax laws regarding inherited IRAs can vary. Some states may have different tax rates or rules for distributions. It’s essential to consult with a tax professional familiar with your state’s specific regulations.

Case Study

Initial Inheritance: $500,000 Traditional IRA

Option A: 10-Year Withdrawal Strategy

- Annual Distribution: $50,000 (assuming equal distributions)

- Tax Implications: $50,000 added to your taxable income each year for 10 years.: The exact tax liability will depend on your overall income and tax bracket.

- Growth Potential: Limited growth potential, as the funds are gradually withdrawn and taxed.

Option B: Immediate Roth Conversion

- Tax Implications: Pay taxes on the entire $500,000 in the year of conversion.: This can be a significant tax liability, but it may be beneficial if you anticipate being in a higher tax bracket in the future.

- Growth Potential: Potential for tax-free growth, as qualified withdrawals in retirement are tax-free.

Note: This is a simplified example. The best option for you will depend on your individual circumstances, such as your age, income, tax bracket, and risk tolerance.

Connecting with XOA TAX

Inheriting an IRA can be complex, and the best reinvestment strategy depends on your individual circumstances. At XOA TAX, our experienced CPAs can provide personalized guidance to help you make informed decisions and optimize your inherited IRA for long-term financial success. Contact us today for a consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime