Inheriting assets like a house or stocks can be a mix of emotions. While it’s a time to remember loved ones, it also comes with tax questions. One important thing to know about is the “step-up basis.” It might sound complicated, but don’t worry, we’ll explain it in a way that’s easy to understand.

Key Takeaways

- The step-up basis can reduce capital gains taxes on inherited assets.

- It adjusts the asset’s value to its fair market value at the time of the original owner’s death.

- Different types of assets have specific rules and considerations.

- It’s essential to keep accurate records and consult with a tax professional for personalized advice.

What is a Step-Up Basis?

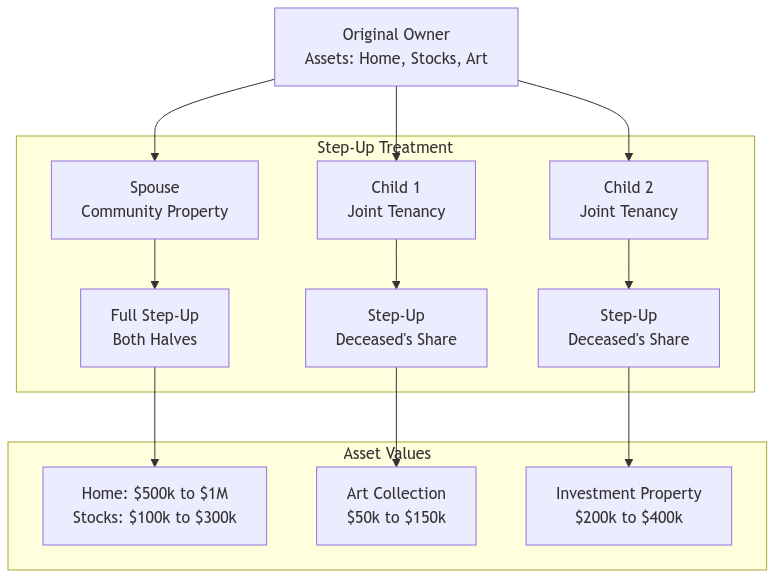

Think of the step-up basis as a helpful adjustment to the value of something you inherit. Let’s say your grandma bought stock for $10 a share back in 1990, and now those shares are worth $100 each when she passes away in 2023. The step-up basis changes the value from the original $10 to the current $100. This is great news because it lowers how much you might owe in taxes if you decide to sell the stock later on.

How Does it Work?

Imagine you sell that stock for $110 a share. Because of the step-up basis, you only have to pay taxes on the $10 profit per share, not the whole $100 difference from when your grandma first bought it.

Calculate Your Potential Savings

Want to get an idea of how much the step-up basis could save you? Try our simple calculator:

Step-Up Basis Tax Savings Calculator

Your Potential Tax Savings

Without Step-Up Basis: $90,000

With Step-Up Basis: $10,000

Total Tax Savings: $80,000

Example Calculator:

- Original Purchase Price: $100,000

- Value at Death: $500,000

- Current Sale Price: $550,000

- Step-Up Basis Tax Savings: $80,000 (assuming a 20% capital gains rate)

Note: This calculator is for illustrative purposes only. Actual tax savings may vary based on your individual circumstances and current tax rates.

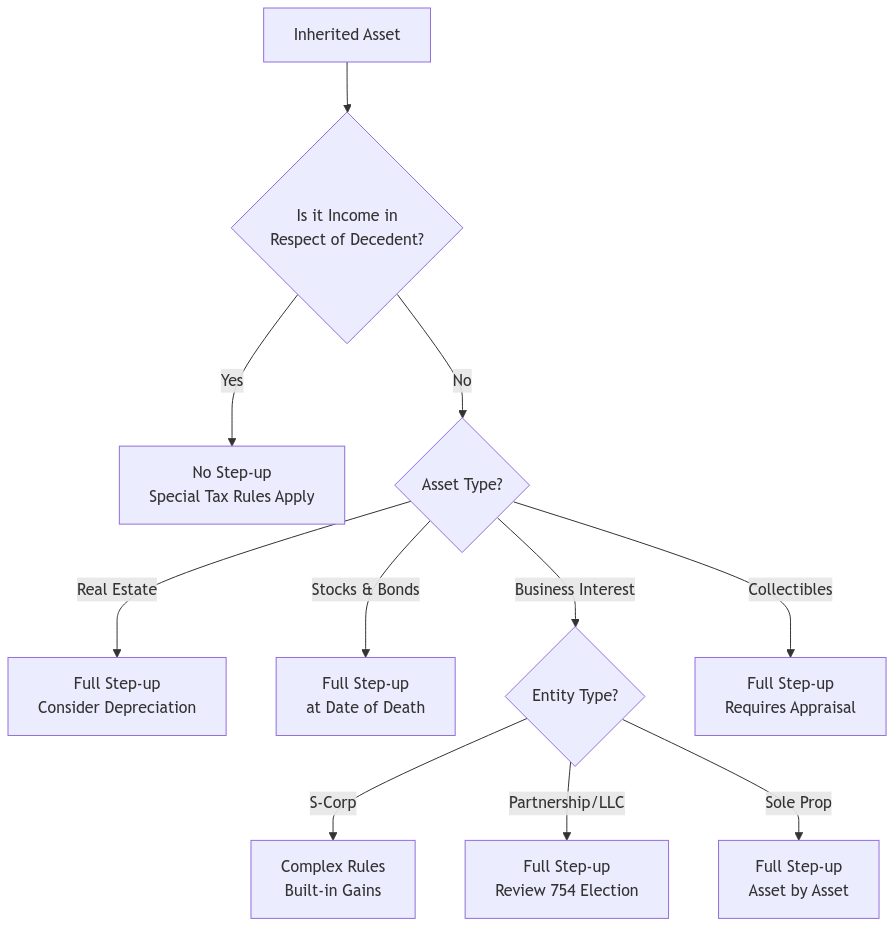

Step-Up Basis and Different Types of Assets

The step-up basis applies to many things, but here are a few examples:

- Real Estate: If you inherit a rental property, the step-up basis affects how you calculate depreciation, which can lower your taxes.

- Stocks and Bonds: Just like the example with your grandma’s stock, the value gets adjusted to the current market price.

- Collectibles: If you inherit valuable items like artwork or antiques, getting an appraisal is important to determine the correct value.

Step-Up Basis at a Glance

| Asset Type | Step-Up Rules | Special Considerations |

|---|---|---|

| Real Estate | Full step-up | Depreciation recapture rules apply |

| Stocks | Full step-up | Careful cost basis tracking is essential |

| IRAs | No step-up | Different distribution rules and tax implications |

| Collectibles | Full step-up | Professional appraisals are often needed |

Navigating the Tricky Parts

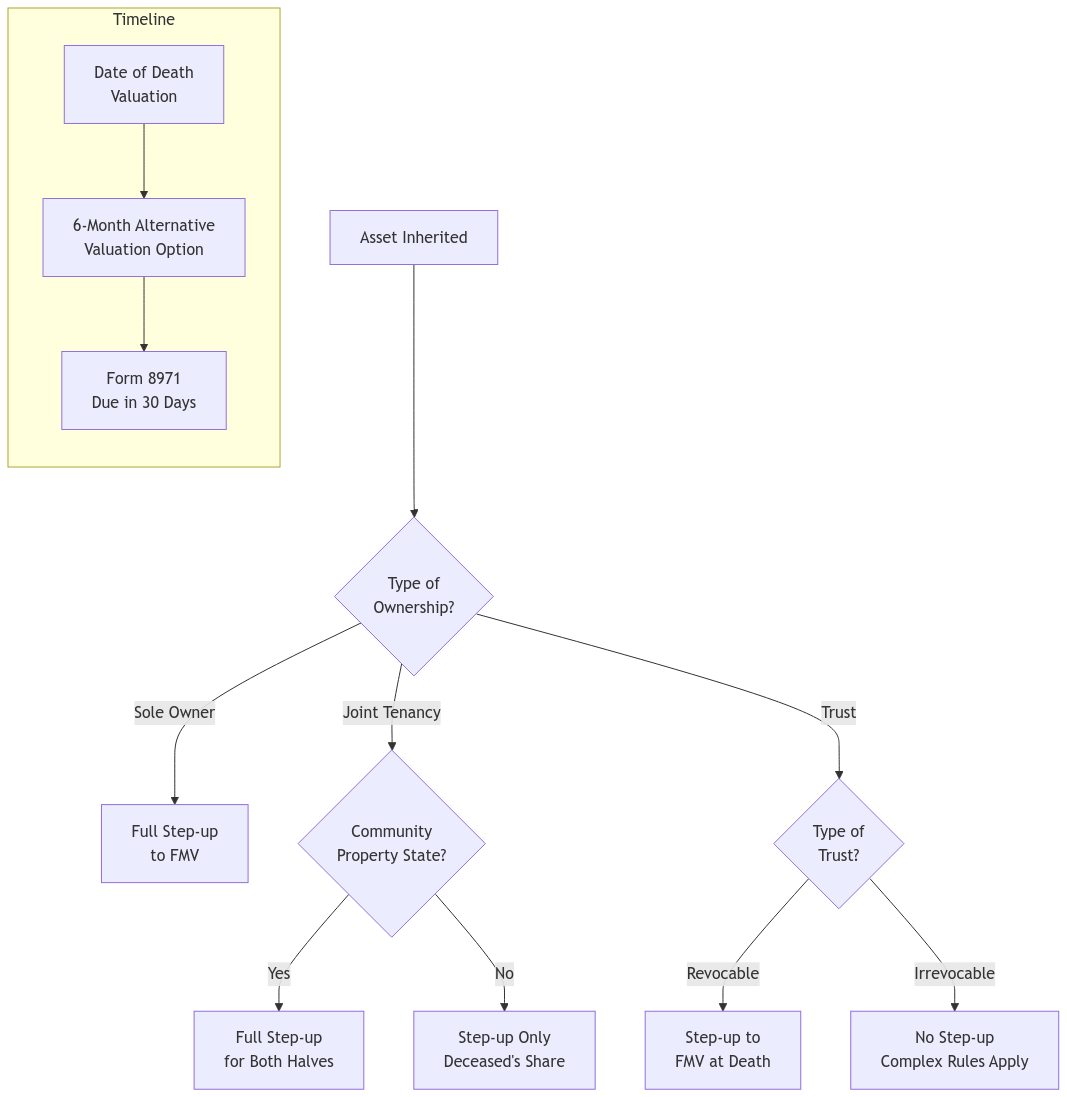

There are a few special situations to keep in mind:

- State Laws: Some states have their own rules about how the step-up basis works, especially with property owned together by spouses.

- Retirement Accounts: Retirement accounts like IRAs generally don’t get a step-up basis, but they have their own tax rules.

- Alternative Valuation: In some cases, the executor of the estate can choose to value the assets six months after the date of death.

Estate Tax Portability

For married couples, there’s something called “portability.” This means if one spouse passes away, the other can sometimes use their unused estate tax exemption. It can get a bit complicated, but it’s worth looking into if it applies to you.

Important Deadlines and Forms

- Form 706 (Estate Tax Return): This form is generally due nine months after death if the estate is large enough to require it.

- Form 8971 (Basis Information): This form is used to report the step-up basis to the IRS.

FAQs

Does the step-up basis eliminate all capital gains taxes?

Not necessarily. While it reduces the taxable gain, any appreciation that happens *after* you inherit the asset is still taxable. Also, keep in mind that state estate or inheritance taxes might apply, and there are limits on how much capital loss you can claim.

What if the asset’s value goes down after I inherit it, but before I sell it?

You’ll still use the stepped-up basis. Unfortunately, you can’t claim a loss based on the lower fair market value at the time of sale.

How does the step-up basis work if I inherit property with someone else?

The rules for jointly inherited property can be a bit tricky and vary depending on your state. It’s best to talk to a tax professional to understand how it works in your specific situation.

Is the holding period for inherited assets always considered long-term?

Yes, that’s a great benefit! Inherited assets are always considered long-term, regardless of how long the original owner held them. This can lead to lower tax rates on any gains.

XOA TAX Can Help!

We know this can be a lot to take in. If you’re feeling overwhelmed or have questions, don’t hesitate to reach out to us. We’re here to help you understand your options and make sure you’re taking advantage of every tax benefit available.

We’re here to answer your questions and help you navigate the complexities of inherited assets. Contact us today for personalized guidance.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime