The insurance landscape is constantly evolving, demanding agencies to be financially agile and strategic. At XOA TAX, we understand that successful insurance agencies are built on a solid financial foundation. This post provides in-depth insights and actionable strategies to help your agency achieve sustainable growth, optimize tax efficiency, and navigate the financial complexities of the insurance industry.

Key Takeaways

- Develop a comprehensive budget tailored to the unique needs of insurance agencies: Tailored to the unique needs of insurance agencies.

- Forecast future needs considering industry trends, economic conditions, and regulatory changes: Considering industry trends, economic conditions, and regulatory changes.

- Explore financial planning strategies specific to insurance agency growth, stability, and producer management: Specific to insurance agency growth, stability, and producer management.

- Understand the critical role of cash flow management in the insurance industry: The critical role of cash flow management in the insurance industry.

- Integrate tax planning to enhance financial decisions and ensure compliance: To enhance financial decisions and ensure compliance.

- Seek professional advice to optimize your financial and tax strategies: To optimize your financial and tax strategies.

Understanding Your Financial Position

Before diving into strategies, it’s crucial to assess your agency’s financial health:

- Analyze your income statement: Evaluate revenue streams, including premiums, commissions, fees, and investment income. Carefully analyze expenses like salaries, marketing, technology, and regulatory compliance costs. Incorporate tax-related expenses and potential deductions to understand net profitability accurately.

- Review your balance sheet: Assess assets, including premium receivables, agency management systems, and office equipment. Examine liabilities such as unearned premiums, loans, and accounts payable. Understand your equity position and how it reflects your agency’s financial strength. Consider the tax implications of your assets and liabilities, such as depreciation methods and interest deductions.

- Monitor your cash flow statement: Track the movement of cash, paying close attention to premium collections, commission payouts, operating expenses, and loan repayments. Ensure you have sufficient liquidity to meet your financial obligations. Implement tax-efficient cash flow strategies to optimize liquidity and minimize tax liabilities.

Budgeting for Success

A well-defined budget is your agency’s financial roadmap. It helps you:

- Allocate resources effectively: Strategically allocate funds across critical areas like producer compensation, marketing and advertising, technology upgrades, staff training, regulatory compliance, and tax obligations. Incorporate tax planning into your budgeting process to maximize deductions and credits.

- Track performance: Monitor your actual results against your budget to identify areas for improvement, such as cost reductions, revenue increases, or adjustments to your commission structure. Use tax performance metrics to assess the effectiveness of your tax strategies.

- Control costs: Pinpoint unnecessary expenses and find opportunities for savings, such as negotiating better rates with vendors, optimizing staffing levels, implementing energy-efficient practices, and leveraging tax incentives for cost-saving measures.

Forecasting Future Needs

Accurate forecasting helps you anticipate challenges and opportunities. Consider:

- Industry trends: Stay informed about market dynamics, such as shifts in customer demand, emerging risks (e.g., cyber liability, climate change), and new distribution channels (e.g., online platforms, mobile apps). Analyze how these trends might affect your tax obligations and opportunities for tax credits.

- Sales projections: Estimate future premium volume based on historical data, market analysis, producer performance, retention rates, and projected new business growth. Incorporate tax projections to understand how increased sales will impact your tax liabilities.

- Economic conditions: Factor in macroeconomic factors like interest rates, inflation, and unemployment rates that may affect operating costs, customer behavior, insurance affordability, and tax planning strategies.

- Regulatory changes: Anticipate the financial and tax impact of new regulations or compliance requirements issued by state insurance departments. Stay updated on tax law changes that could affect your agency.

Financial Planning Strategies for Insurance Agencies

Growth Strategies

- Invest in technology: Implement agency management systems that streamline operations, improve customer service, and facilitate data analysis. Explore insurtech solutions for client onboarding, policy management, and claims processing to enhance efficiency and customer experience. Leverage tax incentives for technology investments to reduce costs.

- Expand your product offerings: Diversify your portfolio by partnering with new carriers to offer a wider range of insurance products, catering to evolving customer needs and market demands. Consider the tax implications of new product lines and structure them to optimize tax benefits.

- Focus on client retention: Implement strategies to improve client relationships and increase retention rates, such as personalized communication, proactive policy reviews, and loyalty programs. Utilize tax-efficient loyalty programs that offer value to clients while maximizing tax benefits.

- Develop a strong online presence: Invest in digital marketing, search engine optimization (SEO), and social media strategies to attract new clients, build brand awareness, and expand your market reach. Take advantage of tax credits for digital transformation initiatives.

Stability Strategies

- Build a strong reserve fund: Set aside funds to cover unexpected expenses, economic downturns, or large claims payouts. This financial cushion provides resilience and peace of mind. Optimize your reserve fund strategy with tax-advantaged accounts where possible.

- Manage risk effectively: Secure adequate Errors & Omissions (E&O) insurance, cyber liability coverage, and business interruption insurance to protect your agency from potential liabilities and ensure business continuity. Understand the tax deductibility of insurance premiums to reduce taxable income.

- Optimize your capital structure: Maintain a healthy balance between debt and equity financing to ensure long-term financial stability and flexibility. Use tax-efficient financing methods to minimize interest expenses and maximize tax benefits.

- Implement robust data security measures: Protect sensitive client information and comply with data privacy regulations to maintain trust and avoid costly penalties. Invest in data security solutions that may qualify for tax credits or deductions.

Producer Management Strategies

- Optimize commission structures: Design competitive and motivating commission structures that incentivize producers to achieve sales targets and prioritize client retention. Structure commissions in a tax-efficient manner to benefit both the agency and the producers.

- Invest in producer development: Provide ongoing training and development opportunities to enhance producers’ skills, knowledge, and performance. Allocate budget for tax-deductible training expenses to maximize financial efficiency.

- Track key performance indicators (KPIs): Monitor metrics like new business production, policy renewal rates, and client satisfaction to assess producer performance and identify areas for improvement. Incorporate tax performance metrics to evaluate the effectiveness of compensation and incentive programs.

Regulatory Compliance Strategies

- Stay informed: Keep abreast of the latest regulations and compliance requirements issued by your state insurance department. Stay updated on tax law changes that impact your agency.

- Factor in licensing renewals: Include the costs of license renewals and continuing education in your budget and financial forecasts. Utilize tax deductions for professional development and licensing fees.

- Consult with legal and tax experts: Seek professional advice to ensure your agency’s operations and financial practices are fully compliant with all applicable laws and regulations. Integrate tax compliance into your overall regulatory compliance efforts to avoid penalties and optimize tax positions.

Tax Planning Strategies

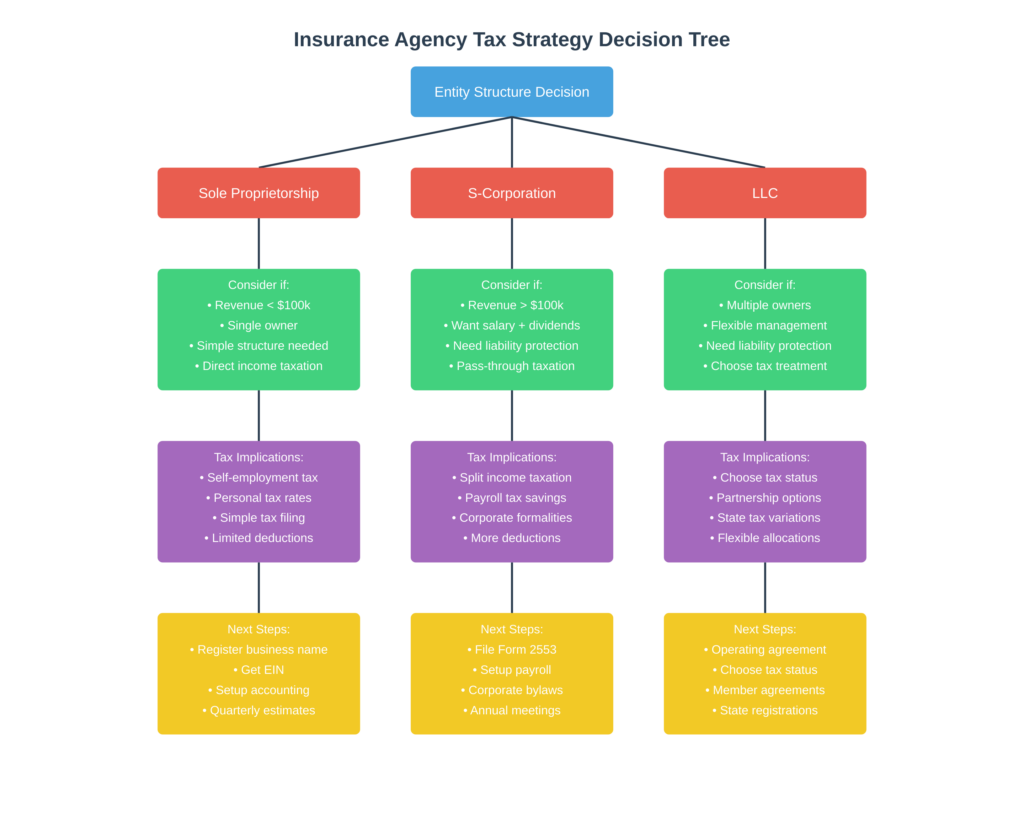

- Entity Structuring: Choose the right business structure (LLC, S-Corp, etc.) for tax efficiency. Each structure has different tax implications that can affect your agency’s profitability.

- Depreciation Methods: Optimize depreciation of assets like office equipment and technology investments to maximize tax deductions and reduce taxable income.

- Tax Credits: Identify and utilize available tax credits for technology upgrades, employee training programs, and other qualifying expenses to lower your tax liability.

- Tax Forecasting: Anticipate future tax obligations and incorporate them into your financial planning. Stay informed about potential tax law changes that could impact your agency.

FAQ Section

What are some common financial challenges faced by growing insurance agencies?

Growing insurance agencies often face challenges like managing cash flow fluctuations due to irregular commission payments, securing adequate financing for expansion, keeping up with evolving technology and regulatory requirements, optimizing tax strategies, and attracting and retaining top-performing producers.

How can I improve my agency’s cash flow management?

Improving cash flow involves strategies like optimizing your billing and collection processes, negotiating favorable commission payment terms with carriers, diversifying your product offerings to ensure a more consistent income stream, closely monitoring your expenses, and implementing tax-efficient cash flow strategies to enhance liquidity.

What key performance indicators (KPIs) should I track to assess my agency’s financial health?

Essential KPIs for insurance agencies include revenue growth, profitability margins, customer acquisition cost, client retention rate, loss ratio, policy renewal rates, producer performance metrics, and tax efficiency indicators such as effective tax rate and tax liability trends.

How often should I review my agency’s financial plan?

It’s recommended to review your financial plan at least quarterly, or more frequently if your agency is undergoing significant changes or experiencing market fluctuations. This allows you to adapt to new challenges and opportunities, including changes in tax laws and economic conditions.

What software integrations are recommended for insurance agencies?

Integrating your agency management system with accounting software, customer relationship management (CRM) tools, marketing automation platforms, and tax planning software can significantly improve efficiency, data analysis, and tax compliance.

How can I effectively negotiate contracts with insurance carriers?

Building strong relationships with carriers, demonstrating your agency’s value and growth potential, having a clear understanding of your agency’s financial and tax data, and presenting well-structured proposals can lead to successful carrier negotiations.

How can tax planning benefit my growing insurance agency?

Effective tax planning can help minimize liabilities, maximize deductions, ensure compliance with tax laws, and enhance your agency’s profitability and financial stability. It allows you to strategically allocate resources and invest in growth opportunities while optimizing your tax position.

Connecting with XOA TAX

Successfully navigating the financial complexities of the insurance industry requires expertise and foresight. At XOA TAX, our experienced CPAs understand the unique challenges and opportunities your agency faces. We provide personalized guidance and support to help you achieve your business goals. Whether you need assistance with budgeting, forecasting, tax planning, tax compliance, or any other financial matter, we’re here to help.

Our Specialized Services Include:

- Tax Strategy Development: Crafting tailored tax strategies that align with your agency’s growth and financial goals.

- Tax Compliance Audits: Ensuring your agency adheres to all relevant tax laws and regulations, minimizing the risk of penalties.

- Personalized Tax Advisory Services: Offering expert advice on tax-efficient business structures, deductions, credits, and more.

- Financial and Tax Integration: Combining financial planning with tax optimization to provide a holistic approach to your agency’s financial health.

Contact us today to schedule a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime