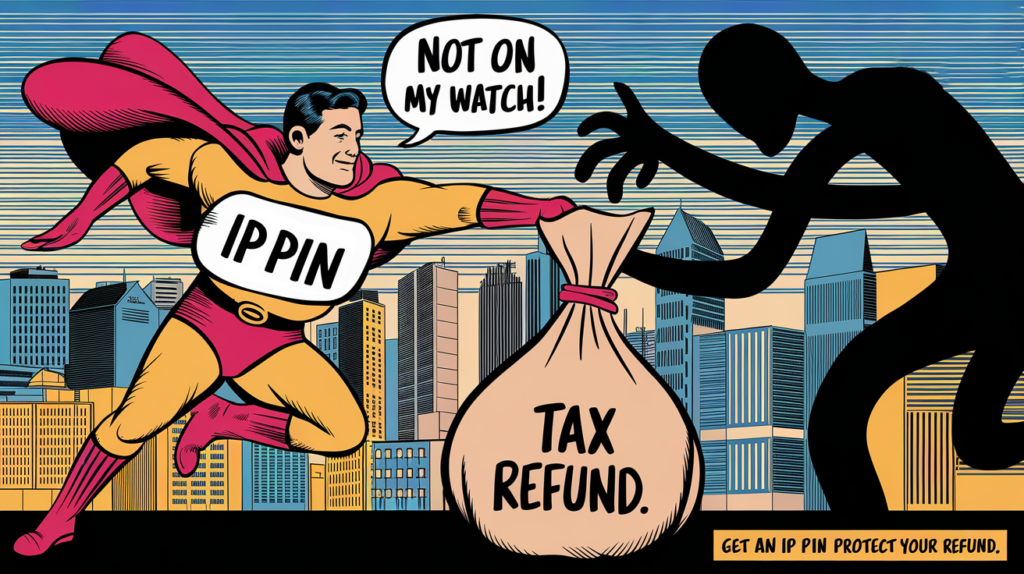

Tax season can be stressful enough without worrying about identity theft. Did you know the IRS offers a free tool to help protect yourself from tax-related fraud? It’s called the Identity Protection PIN (IP PIN), and it adds an extra layer of security to your Social Security number (SSN).

What is an IP PIN?

Think of it as a secret code for your tax return. This six-digit number is known only to you and the IRS. When you file your taxes, you’ll need to enter this PIN. If someone tries to file a fraudulent return using your SSN but doesn’t have your IP PIN, the IRS will know it’s not legitimate.

Why should I get one?

Identity theft is a serious problem, and tax-related fraud is one of the most common types. By getting an IP PIN, you can help prevent someone from:

- Filing a fraudulent tax return in your name

- Claiming your refund

- Using your SSN to get a job

Who is eligible?

Anyone with a Social Security number or Individual Taxpayer Identification Number can apply for an IP PIN.

How do I get an IP PIN?

It’s easy! Just visit the IRS website and use the “Get an IP PIN” tool. You’ll need to verify your identity, but once you’re approved, you’ll receive your PIN. It’s valid for one year and is automatically renewed each year.

FAQs

What if I forget my IP PIN?

No worries! You can retrieve your IP PIN online through the IRS website. Just be prepared to verify your identity again.

Don’t wait until it’s too late! Take control of your tax security and get an IP PIN today. It’s a simple and effective way to protect yourself from identity theft and ensure that your tax return is safe and secure.

To learn more and apply for your IP PIN, visit the IRS website: https://www.irs.gov/identity-theft-fraud-scams/frequently-asked-questions-about-the-identity-protection-personal-identification-number-ip-pin

Need help with your taxes?

Contact XOA TAX today!

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

anywhere

anywhere  anytime

anytime