IRAs can be powerful tools for retirement planning, but it’s essential to understand the rules and regulations to make the most of them. At XOA TAX, we often find that people have questions about recharacterizations – that is, changing the type of IRA a contribution is designated for. This in-depth article will clarify the tax consequences of IRA recharacterizations and conversions, empowering you to make informed decisions for your financial future.

Key Takeaways

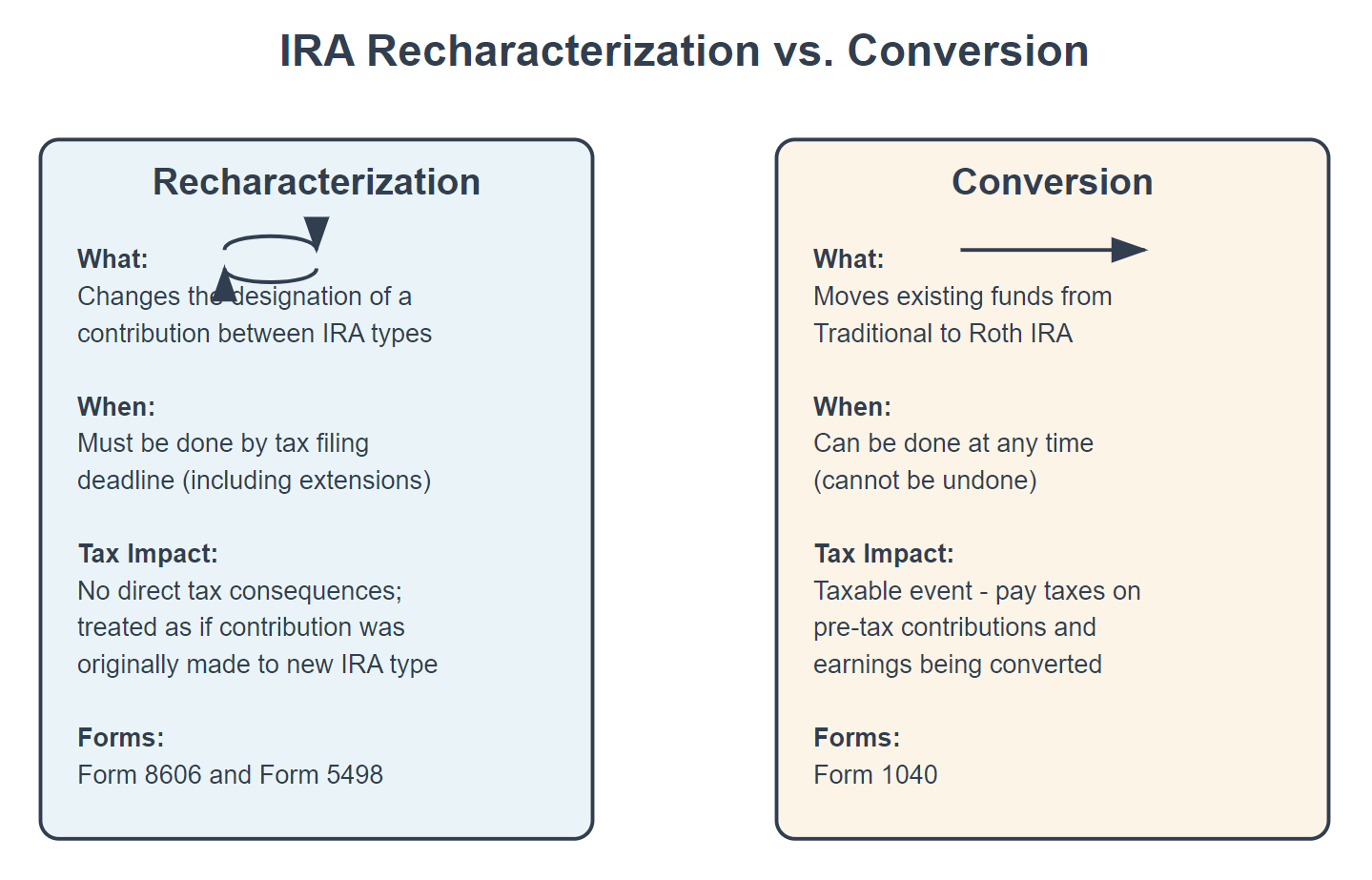

- You can recharacterize contributions between Traditional and Roth IRAs, changing their tax treatment.

- Recharacterizations must be completed by the tax filing deadline, including extensions.

- Converting a Traditional IRA to a Roth IRA is a taxable event, but it may offer long-term benefits.

- XOA TAX can provide expert guidance to help you navigate these complex transactions.

Understanding IRA Recharacterizations

An IRA recharacterization allows you to move a contribution from one type of IRA to another. For example, if you contributed to a Traditional IRA but later decide a Roth IRA is a better fit, you can recharacterize the contribution. This process effectively treats the contribution as if it were originally made to the new IRA.

Tax Implications of Recharacterizations

It’s important to note that recharacterizing a contribution doesn’t directly result in taxable income. Instead, it changes how the contribution is treated for tax purposes. For instance, if you recharacterize a Traditional IRA contribution to a Roth IRA, the contribution will be considered a Roth IRA contribution from the outset. This means it will be subject to the Roth IRA’s rules, including those regarding withdrawals and taxes.

Example: Let’s say you contributed $6,000 to a Traditional IRA in 2024, but your income unexpectedly increased, making you ineligible for the tax deduction. You could recharacterize this to a Roth IRA.

- Original Contribution: $6,000 to Traditional IRA (which would now not be tax-deductible)

- After Recharacterization: $6,000 to Roth IRA (after-tax contribution)

- Any earnings accrued while the funds were in the Traditional IRA would also transfer to the Roth IRA.

When recharacterizing a contribution, any earnings or losses attributable to that contribution must also be transferred proportionally to the new IRA. Your IRA custodian will typically calculate the amount of earnings or losses to be transferred during a recharacterization.

Converting a Traditional IRA to a Roth IRA

While recharacterization involves changing the designation of a contribution, converting a Traditional IRA to a Roth IRA is a different process. It involves transferring funds from a Traditional IRA to a Roth IRA and paying taxes on the amount converted. This strategy can be advantageous if you anticipate being in a higher tax bracket in retirement, as qualified withdrawals from a Roth IRA are tax-free.

Keep in mind that Roth IRAs have a 5-year rule for qualified withdrawals. This means that you generally must wait five years after your first Roth IRA contribution before you can take tax-free and penalty-free withdrawals of earnings.

Converting a Traditional IRA to a Roth IRA can also affect your Required Minimum Distributions (RMDs) in retirement. While Traditional IRAs require you to start taking RMDs at age 73, Roth IRAs do not have RMDs during the owner’s lifetime.

Conversions are reported differently than recharacterizations on your tax return. Form 8606 is used for recharacterizations, while Form 1040 is used to report Roth conversions.

IRA Contribution Limits and Income Phase-Outs

Before contributing to an IRA, it’s important to be aware of the contribution limits and any income restrictions that may apply. Here’s a summary for 2024:

| IRA Type | 2024 Contribution Limit | 2024 Income Phase-Out Ranges (Modified Adjusted Gross Income) |

|---|---|---|

| Traditional IRA (If covered by workplace plan) | $7,000 | * Single: $83,000 – $93,000 * Married Filing Jointly: $136,000 – $146,000 * Married Filing Separately: $0 – $10,000 |

| Roth IRA | $7,000 | * Single: $153,000 – $163,000 * Married Filing Jointly: $228,000 – $238,000 * Married Filing Separately: $0 – $10,000 |

Important Note: If you’re age 50 or older, you can make an additional “catch-up” contribution of $1,000, bringing the total possible contribution to $8,000.

The income phase-out ranges for Traditional IRAs only affect the deductibility of your contributions, not your ability to contribute. You can still contribute to a Traditional IRA even if your income exceeds the phase-out range, but your contributions may not be tax-deductible.

You can always make non-deductible contributions to a Traditional IRA, regardless of your income. These contributions won’t reduce your taxable income now, but qualified withdrawals in retirement will be tax-free.

If you’re converting a Traditional IRA to a Roth IRA and have both pre-tax and after-tax money in your Traditional IRA, the “pro-rata rule” applies. This rule means that the taxable portion of your conversion is calculated based on the ratio of pre-tax to after-tax funds in your Traditional IRA.

Why Recharacterize an IRA Contribution?

There are several reasons why you might choose to recharacterize an IRA contribution:

- Market Performance: If the investments in your Traditional IRA significantly decline after your contribution, you might recharacterize it to a Roth IRA to avoid paying taxes on those losses when you eventually withdraw the funds.

Example of Market Timing Impact:

- You contribute $6,000 to a Traditional IRA.

- The market declines, and your IRA balance drops to $5,000.

- By recharacterizing to a Roth IRA and then converting, you would only pay taxes on the $5,000 value, not the original $6,000.

Note: While market timing can affect your tax liability, it shouldn’t be the sole factor in your decision to recharacterize or convert. Consider your overall financial situation and long-term retirement goals.

- Income Changes: If your income changes unexpectedly, you might need to recharacterize a contribution to comply with the income limits for either a Traditional or Roth IRA.

- Tax Situation Changes: If your tax situation changes, such as getting a new job with a different retirement plan, you might recharacterize a contribution to optimize your tax strategy.

Deadlines and Considerations

To recharacterize an IRA contribution, you must do so by the tax filing deadline for the year of the contribution, including extensions. For most taxpayers, this means you have until October 15 of the following year if you filed for an extension.

Be aware that some custodians may charge fees for recharacterizations and conversions.

FAQs

What is the main difference between recharacterizing an IRA contribution and converting a Traditional IRA to a Roth IRA?

Recharacterizing an IRA contribution changes the designation of the contribution from one type of IRA to another, while converting a Traditional IRA to a Roth IRA involves transferring funds and paying taxes on the converted amount.

Is there a limit on the number of times I can recharacterize an IRA contribution?

No, there is no limit on the number of times you can recharacterize an IRA contribution, as long as you meet the deadline.

Can I recharacterize a Roth IRA conversion?

No, the Tax Cuts and Jobs Act of 2017 eliminated the ability to recharacterize Roth IRA conversions.

What tax forms are needed for reporting IRA recharacterizations?

You’ll typically need to report the recharacterization on Form 8606 (Nondeductible IRAs) and Form 5498 (IRA Contribution Information). Your IRA custodian will usually provide you with Form 5498.

Where can I find more information about IRA recharacterizations and conversions?

The IRS website (IRS.gov) provides comprehensive information and publications on IRAs and retirement planning. You can also consult with a qualified tax professional for personalized guidance.

Connecting with XOA TAX

Recharacterizations and conversions can be valuable tools for managing your retirement savings, but understanding the rules and tax implications is crucial. At XOA TAX, our team of experienced CPAs can provide personalized advice and support to help you make informed decisions. We can analyze your situation, explain the options available to you, and guide you through the process, ensuring you meet all the necessary requirements and optimize your retirement plan.

Contact us today to schedule a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime