Planning for retirement is a significant step, and understanding the intricacies of Individual Retirement Accounts (IRAs) is crucial for a smooth transition. One area that often causes confusion is tax withholding on distributions, particularly when it comes to Required Minimum Distributions (RMDs). While your IRA custodian should be a source of clear guidance, sometimes the information they provide can be unclear or incomplete. This lack of clarity can lead to costly mistakes and potential penalties.

At XOA TAX, we believe in empowering you with the knowledge to navigate these complexities. In this blog post, we’ll clarify what to do when your IRA custodian isn’t clear about tax withholding, equipping you with the steps to manage your RMD distributions effectively and meet IRS requirements.

Key Takeaways

- Understanding tax withholding on IRA distributions is essential to avoid penalties.

- You have the right to specify your withholding preferences to your IRA custodian.

- Clear communication with your custodian is key to ensuring accurate tax withholding.

- XOA TAX can provide expert guidance to help you navigate these complexities.

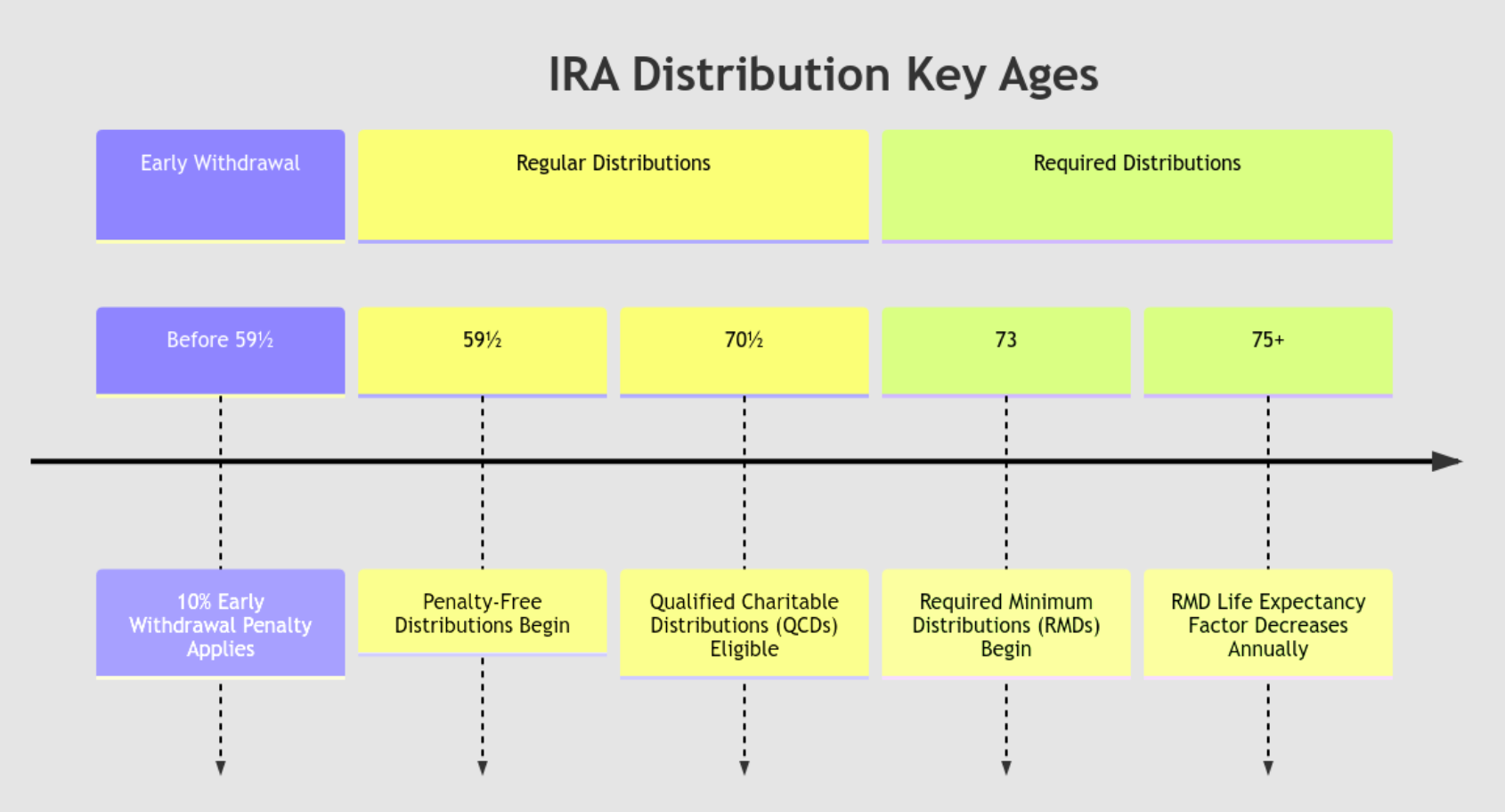

Important IRA Age Milestones

Before diving into the details, let’s understand the key age-related requirements for IRA distributions:

Understanding Tax Withholding on IRA Distributions

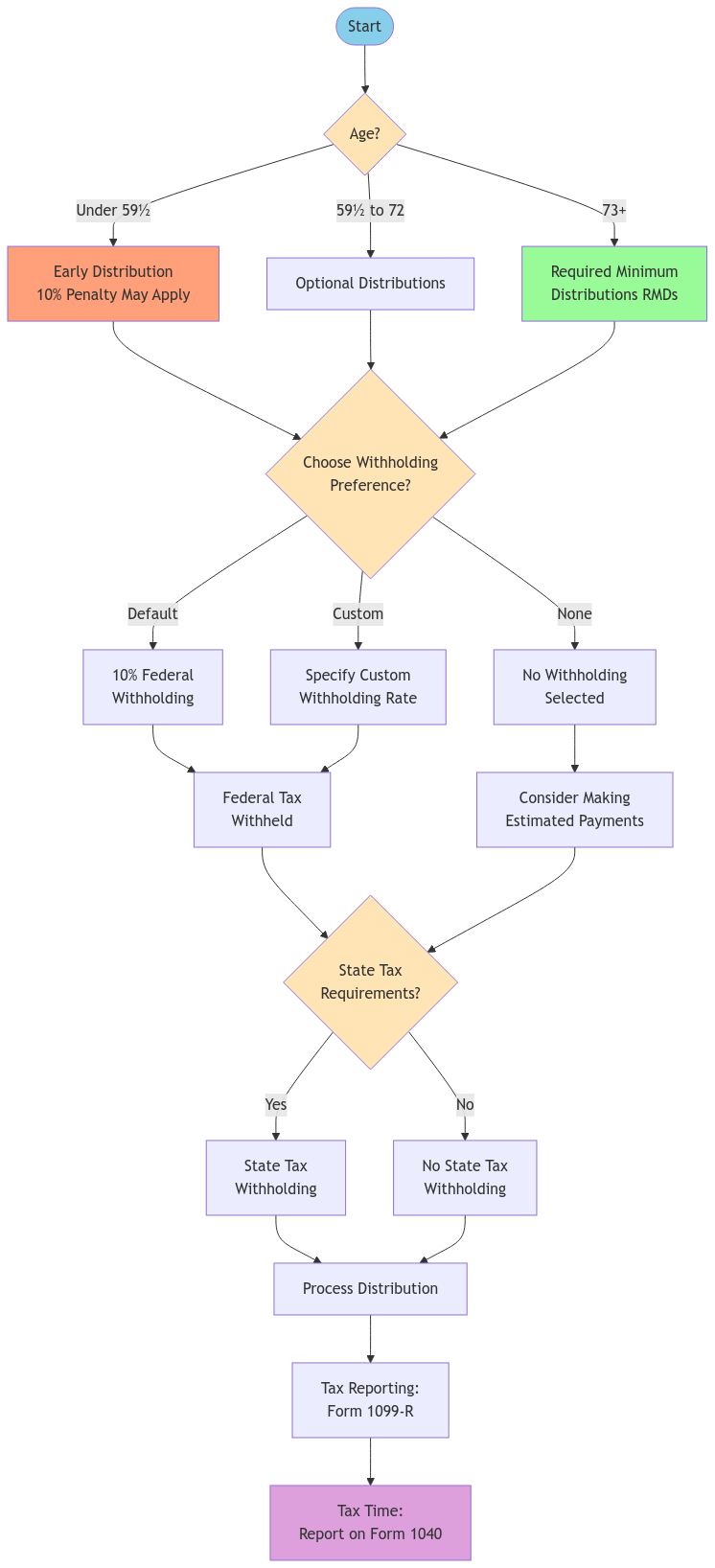

When you take a distribution from your traditional IRA, it’s generally subject to federal income tax. To ensure you pay your taxes throughout the year, the IRS mandates that your IRA custodian withhold a certain percentage of your distributions. The default withholding rate is 10%, but you have the flexibility to adjust this. You can choose to have more or less withheld, or even opt for no withholding at all. However, it’s crucial to remember that if you don’t withhold enough, you may face penalties at tax time.

Required Minimum Distributions (RMDs)

Currently, once you reach age 73, you must start taking RMDs from your traditional IRA. These are minimum amounts you must withdraw each year, and they’re also subject to tax withholding. It’s important to note that this age requirement has been adjusted over the years by legislation like the SECURE 2.0 Act. It was previously 72, and before that, 70½.

What to Do When Your Custodian Isn’t Clear

Review Your Custodian’s Materials:

Start by carefully reviewing any documents or information provided by your custodian.: Look for details on their withholding policies, forms for specifying your preferences (like Form W-4R), and instructions on how to change your withholding.

Contact Your Custodian Directly:

If you can’t find the information you need or have specific questions, don’t hesitate to contact your custodian directly.: Be prepared to explain your situation and ask clear questions about their withholding procedures.

Document Your Interactions:

Keep records of all communications with your custodian, including dates, times, and the names of individuals you speak with.: This documentation can be helpful if any issues arise later on.

Consult a Tax Professional:

If you’re still unsure about your tax withholding or need help understanding your options, it’s always wise to consult a qualified tax professional.: They can provide personalized guidance and ensure you’re meeting all IRS requirements.

Tips for Managing Your RMDs and Tax Withholding

Calculate Your RMD: Use the IRS worksheets or online calculators to determine your exact RMD amount for the year. You can find the current year’s life expectancy tables in IRS Publication 590-B.

Specify Your Withholding: Don’t rely on the default 10% withholding. Calculate your estimated tax liability and adjust your withholding accordingly using Form W-4R to avoid underpayment penalties.

Make Estimated Tax Payments: If you opt for lower withholding or no withholding, consider making estimated tax payments throughout the year to avoid a large tax bill at filing time.

Review Your Withholding Regularly: Your tax situation may change from year to year, so it’s important to review your withholding choices periodically and make adjustments as needed.

Don’t Miss the Deadline: Generally, you must take your full RMD by December 31st each year. Failure to do so can result in a hefty 50% penalty on the undistributed amount.

One-Rollover-Per-Year Rule: Keep in mind that you’re generally limited to one rollover from one IRA to another IRA within a 12-month period. This rule doesn’t apply to rollovers from 401(k)s to IRAs.

Sample RMD Calculation

Let’s look at a practical example:

Jane is 75 years old and has a traditional IRA worth $500,000 at the end of the previous year. Using the 2024 Uniform Lifetime Table:

- At age 75, her life expectancy factor is 24.6

- Her RMD calculation: $500,000 ÷ 24.6 = $20,325.20

If Jane chooses the default 10% withholding:

- Withholding amount: $20,325.20 × 10% = $2,032.52

- Net distribution: $20,325.20 – $2,032.52 = $18,292.68

However, if Jane is in the 22% tax bracket:

- Actual tax due: $20,325.20 × 22% = $4,471.54

- Additional tax needed: $4,471.54 – $2,032.52 = $2,439.02

This example highlights how the default withholding might not be sufficient for everyone. It’s important to estimate your tax liability and adjust your withholding accordingly to avoid potential underpayment penalties.

Special Considerations

Inherited IRAs

If you’ve inherited an IRA, different RMD rules apply. These rules vary depending on your relationship to the original owner and the type of beneficiary you are.

Roth IRAs

Roth IRAs don’t have RMDs for the original owner. However, beneficiaries of Roth IRAs will generally have RMDs.

State Taxes

In addition to federal taxes, you may also need to consider state tax withholding on your IRA distributions. Requirements vary from state to state.

Non-Resident Aliens

If you’re a non-resident alien, the default withholding rate on your IRA distributions is 30%, but this can be reduced with a properly filed tax treaty.

Qualified Charitable Distributions (QCDs)

If you’re age 70½ or older, you can make direct transfers from your IRA to a qualified charity. These QCDs can count towards your RMD and are excluded from your taxable income, potentially offering tax advantages.

Note: The CARES Act, passed in 2020, included a waiver for RMDs that applied to 2020 distributions. This waiver is no longer in effect.

FAQs

Can I change my tax withholding at any time?

Yes, you can generally change your withholding preferences by contacting your IRA custodian and completing the necessary forms.

What happens if I don’t withhold enough taxes from my IRA distributions?

If you underpay your taxes, you may be subject to penalties from the IRS.

Are there any exceptions to the RMD rules?

While generally everyone age 73 and older must take RMDs, there are a few exceptions, such as for certain workplace retirement plans if you’re still employed.

Where can I find more information about IRA distributions and tax withholding?

The IRS website (IRS.gov) is an excellent resource for detailed information on IRA rules and regulations. You can also find helpful publications like IRS Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs).

Connecting with XOA TAX

Managing your IRA distributions and understanding the nuances of tax withholding can be complex. At XOA TAX, our experienced CPAs can provide personalized guidance and support to ensure you meet all your tax obligations and avoid potential penalties. We can help you understand your RMDs, calculate your optimal withholding, and answer any questions you may have.

Contact us today to schedule a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986 (Pacific Time)

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime