Incentive stock options (ISOs) are a popular way for companies to attract and retain top talent. They offer employees the opportunity to purchase company stock at a discounted price, which can lead to significant financial gains. However, ISOs can also be complex from a tax perspective, especially when it comes to the alternative minimum tax (AMT). In this blog post, we’ll break down the basics of ISOs and the AMT, providing clear explanations and real-world examples to help you understand how these concepts work. We’ll also offer expert tips for managing your taxes and timing your ISO transactions effectively.

Key Takeaways

- ISOs can be a valuable employee benefit, but it’s important to understand the tax implications.

- The AMT can significantly impact your tax liability if you exercise ISOs.

- Careful planning and timing can help you minimize your AMT liability and maximize your gains.

What are Incentive Stock Options (ISOs)?

ISOs are a type of stock option that allows employees to purchase company stock at a predetermined price (the “strike price”) for a set period. Unlike non-qualified stock options (NSOs), which are taxed upon exercise, ISOs offer potential tax advantages if certain conditions are met. The difference between the strike price and the fair market value (FMV) of the stock at the time of exercise is known as the “bargain element.” This bargain element is not taxed as ordinary income when you exercise ISOs. Instead, it’s a tax preference item for AMT purposes, which we’ll discuss in more detail below.

Understanding the Alternative Minimum Tax (AMT)

The AMT is a separate tax system that runs parallel to the regular income tax system. It was designed to ensure that high-income taxpayers pay a minimum amount of tax, regardless of deductions and credits. The AMT has its own set of rules and calculations, and it can be triggered by certain types of income, including the bargain element from exercising ISOs. This can result in a higher tax liability than you would have under the regular tax system.

Example: Let’s say you exercise 1,000 ISOs with a strike price of $10 when the FMV is $50. The bargain element is $40 per share ($50 FMV – $10 strike price), resulting in a total of $40,000 in AMT income. This $40,000 will be added to your other income for AMT purposes, potentially increasing your tax liability.

Timing Your ISO Sales: A Critical Factor

The timing of your ISO sales can significantly impact your tax liability. Here are a few key considerations:

- Holding Period: To qualify for long-term capital gains treatment (which is generally lower than the ordinary income tax rate), you must hold your ISO stock for at least two years from the grant date and one year from the exercise date. If you sell before meeting these holding periods, your gains will be taxed as ordinary income.

- AMT Credit: If you pay AMT in one year due to exercising ISOs, you may be able to claim an AMT credit in future years to offset your regular tax liability. This credit is limited to the amount by which your AMT liability exceeded your regular tax liability in the year you paid AMT.

- Market Volatility: Stock prices can fluctuate significantly. Consider the current market conditions and your own financial goals when deciding when to sell.

Wash Sale Rules and ISOs: What You Need to Know

The wash sale rule generally prevents you from claiming a loss on the sale of a security if you repurchase a substantially identical security within 30 days before or after the sale. While this rule typically doesn’t apply when selling ISOs at a gain, it’s important to note that it can apply to ISO transactions that result in a loss.

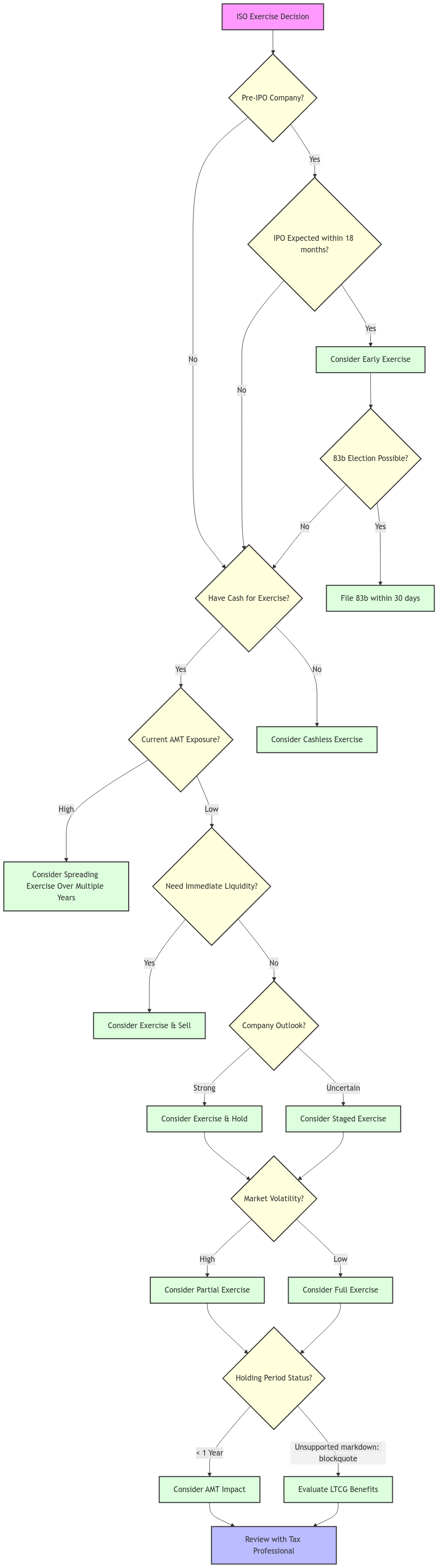

Strategies to Minimize AMT Impact

Spread out exercises and sales: Instead of exercising all your ISOs at once, consider spreading them out over several years to reduce the impact on your AMT liability in any single year.

Hold for the long term: If possible, hold your ISO stock for the required periods to qualify for long-term capital gains treatment.

Sell a portion of your shares: If you need cash, consider selling only a portion of your ISO stock to manage your tax liability.

State Tax Implications: Don’t Forget Your State!

It’s crucial to remember that states may have different rules for taxing ISOs. Some states may conform to federal tax treatment, while others may have their own specific regulations. Be sure to research your state’s tax laws or consult with a tax professional to understand the potential implications.

Understanding the $100,000 Limit

There’s a limit on how much ISO bargain element can qualify for favorable tax treatment each year. The total fair market value of the shares you exercise in a calendar year cannot exceed $100,000. Any amount exceeding this limit may be treated as a non-qualified stock option and taxed differently.

Early Exercise: An Option to Consider

In some cases, you may be able to exercise your ISOs before they vest. This is known as early exercise. While it can offer potential benefits, it’s essential to understand the associated risks and tax implications. Consult with a tax professional to determine if early exercise is right for you.

Navigating ISOs in Pre-IPO Companies

If you have ISOs in a pre-IPO company, there are unique factors to consider. For example, there may be a lock-up period after the IPO, restricting when you can sell your shares. Also, the IPO itself can significantly impact the stock’s value, affecting your tax liability and investment strategy.

The 83(b) Election: A Potential Tax Advantage

The 83(b) election allows you to pay taxes on the bargain element of your ISOs at the time of grant rather than at the time of exercise. This can be advantageous if you expect the stock price to appreciate significantly. However, it’s a complex decision with potential drawbacks, so it’s crucial to consult with a tax professional before making this election.

Real-World ISO Scenarios and Examples

Scenario Comparison: Three Common ISO Situations

Scenario 1: The Conservative Approach

Situation:

• 1,000 ISOs granted

• Strike price: $10

• Current FMV: $15

• Annual income: $150,000

Strategy: Exercise small batches over time

• Year 1: Exercise 300 shares

• Year 2: Exercise 300 shares

• Year 3: Exercise 400 shares

Tax Impact:

• Smaller annual AMT exposure

• More manageable cash flow

• Lower risk if stock price declines

Scenario 2: The Pre-IPO Strategy

Situation:

• 2,000 ISOs granted

• Strike price: $5

• Current FMV: $20

• IPO expected within 18 months

Strategy: Early exercise with 83(b) election

• Exercise all shares immediately

• File 83(b) election within 30 days

• Hold through IPO and beyond

Considerations:

• Requires significant upfront cash

• Higher risk if IPO doesn’t occur

• Potential for maximum tax benefit

Scenario 3: The Balanced Exit Strategy

Situation:

• 1,500 ISOs vested

• Strike price: $10

• Current FMV: $50

• Need to diversify holdings

Strategy: Staggered exercise and sell

• Exercise and hold 500 shares (qualifying disposition)

• Exercise and sell 500 shares (disqualifying disposition)

• Keep 500 shares unexercised as a hedge

Tax Impact:

• Mixed tax treatment

• Balanced risk profile

• Immediate liquidity for some shares

Decision Making Framework

- Personal Financial Assessment – Current cash available – Risk tolerance – Immediate financial needs – Investment diversification goals

- Company Outlook Analysis – Growth prospects – Exit opportunities – Market conditions – Competition landscape

- Tax Planning Considerations – Current tax bracket – AMT exposure – State tax implications – Long-term financial goals

Best Practices Checklist

[ ] Calculate exercise costs and tax implications before taking action

[ ] Document all grant dates, exercise dates, and FMV calculations

[ ] Keep records of all communications regarding your ISOs

[ ] Regular consultation with tax advisor

[ ] Monitor company valuation changes

[ ] Review and update strategy quarterly

ISO Quick Reference Guide

Key Terms and Definitions

| Term | Definition |

|---|---|

| Strike Price | The price at which you can exercise your ISOs |

| FMV | Fair Market Value – current market price of the stock |

| Bargain Element | Difference between FMV and strike price |

| AMT | Alternative Minimum Tax |

| Qualifying Disposition | Sale after meeting holding requirements |

| Disqualifying Disposition | Sale before meeting holding requirements |

Important Deadlines and Periods

- Exercise Period: Typically 10 years from grant

- Holding Period Requirements:

- 2 years from grant date

- 1 year from exercise date

- 83(b) Election: 30 days from exercise

- Post-termination Exercise: Usually 90 days

Tax Rate Quick Reference (2024)

- Long-term Capital Gains Rates: 0%, 15%, or 20%

- AMT Rates: 26% or 28%

- Regular Income Tax Brackets: 10% to 37%

Common Pitfalls to Avoid

- Exercising without understanding AMT impact

- Missing 83(b) election deadline

- Not considering state tax implications

- Overlooking company-specific restrictions

- Poor documentation of transactions

FAQ Section

Q: How can I estimate my potential AMT liability before exercising ISOs?

A: You can use online AMT calculators or tax preparation software to estimate your AMT liability. However, it’s best to consult with a tax professional for personalized advice, as they can consider your unique circumstances and provide a more accurate estimate.

Q: What are the main differences between ISOs and NSOs?

A: ISOs offer potential tax advantages if held for certain periods, while NSOs are taxed upon exercise. ISOs are generally only offered to employees, while NSOs can be offered to consultants and advisors as well.

Q: Where can I find reliable information about ISO and AMT regulations?

A: The IRS website (www.irs.gov) is an excellent resource for detailed information about ISOs and the AMT. You can also find helpful publications and guides on the websites of reputable financial institutions and tax advisory firms.

Q: What happens to my ISOs if I leave my job?

A: Typically, you have a limited time (often 90 days) to exercise your vested ISOs after leaving your job. If you don’t exercise them within that timeframe, you’ll likely lose them. It’s essential to check your company’s stock option plan document for specific details.

Q: Can I transfer my ISOs to someone else?

A: Generally, ISOs are not transferable. They are specific to the employee who received them.

Connecting with XOA TAX

Navigating the complexities of ISOs and the AMT can be challenging. At XOA TAX, our experienced CPAs can help you understand your options, develop a tax-efficient strategy, and ensure you comply with all applicable regulations.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

We’re here to help you make informed decisions and achieve your financial goals.

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

/

anywhere

anywhere  anytime

anytime