Owning rental property can be a rewarding investment, but it also comes with its share of complexities. One of the key decisions you’ll face as a landlord, particularly in California, is whether to form an LLC for your rental property. At XOA TAX, we understand the intricacies of real estate taxation and can help you navigate this important choice.

Key Takeaways

- An LLC can protect your personal assets from liabilities arising from your rental activities.

- Forming an LLC may offer tax advantages, but it’s essential to understand the specific implications.

- Setting up and maintaining an LLC involves costs and administrative requirements.

- Depending on your circumstances, operating as a sole proprietor might be suitable.

Understanding LLCs and Their Benefits for Landlords

An LLC is a legal structure that blends the liability protection of a corporation with the tax flexibility of a sole proprietorship or partnership. In essence, it creates a separate legal entity for your rental business, shielding your personal assets (like your home, car, and personal bank accounts) from potential lawsuits related to your rental property.

For instance, if a tenant were to sue you due to an injury sustained on your property, your personal assets would typically be protected. Only the assets held by the LLC would be at risk.

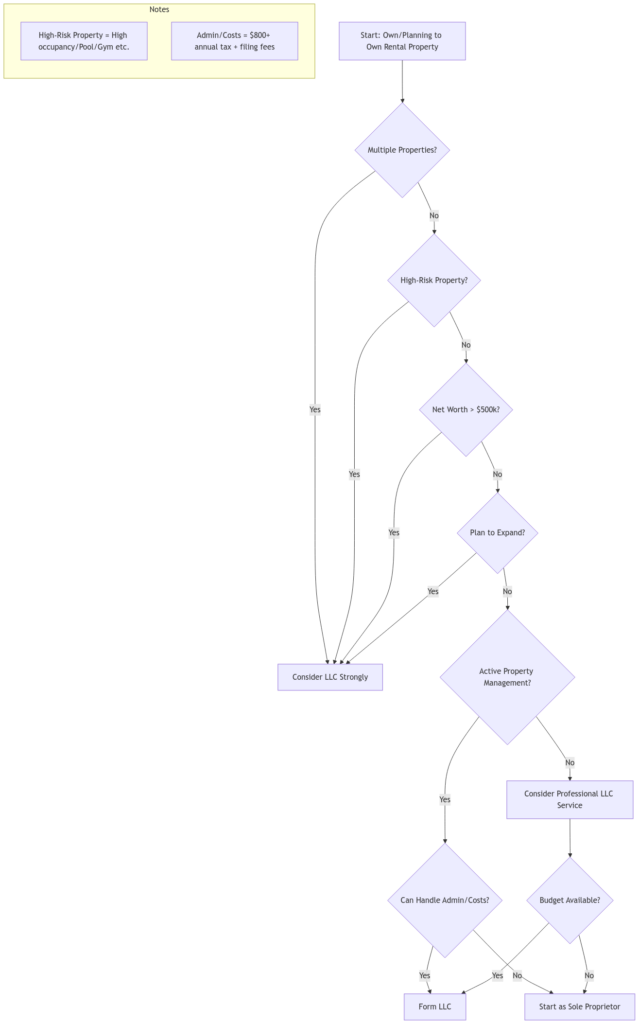

LLC Decision Guide

Tax Implications of an LLC for Rental Property

LLCs offer flexibility in terms of taxation. By default, a single-member LLC is treated as a “disregarded entity” by the IRS. This means that the rental income and expenses are reported on your personal income tax return (Schedule E). However, you can choose to have your LLC taxed as an S corporation or a C corporation.

Taxed as an S Corporation:

This option can be advantageous if you actively participate in managing your rental property. It might allow you to take some of your income as a salary, potentially reducing your overall tax burden.

Taxed as a C Corporation:

This structure is generally less common for small landlords, as it can lead to double taxation (at the corporate level and again on dividend distributions).

Important Note: Tax laws are complex and can vary significantly. It’s crucial to consult with a qualified tax professional, like the experts at XOA TAX, to determine the most advantageous tax structure for your specific situation. We offer comprehensive tax planning services tailored to real estate investors.

Advantages of Forming an LLC

- Liability Protection: This is the primary benefit, separating your personal assets from your rental business activities.

- Credibility: An LLC can lend a professional image to your rental business, enhancing your credibility with tenants, lenders, and vendors.

- Tax Flexibility: As discussed, you have options for how your LLC is taxed.

- Easier Management: Operating your rental property under an LLC can aid in organization and record-keeping.

Disadvantages of Forming an LLC

- Cost: Forming and maintaining an LLC involves fees, including filing fees, annual reports, and registered agent services.

- Administrative Requirements: LLCs have ongoing compliance requirements, such as maintaining separate bank accounts and adhering to record-keeping formalities.

When an LLC Might Not Be Necessary

If you own a single, small rental property and are actively involved in its management, operating as a sole proprietor might suffice. This simplifies administrative tasks and reduces costs. However, it’s crucial to weigh the potential risks associated with not having the liability protection an LLC provides.

Consider these factors when making your decision:

- Number of Properties: If you plan to expand your portfolio, an LLC becomes increasingly important.

- Risk Tolerance: If you’re risk-averse, the liability protection of an LLC offers peace of mind.

- Complexity of Your Rental Business: If your rental operations are complex, an LLC can provide a more structured framework.

Mortgage and Insurance Considerations

Mortgage Implications:

Transferring an existing property to an LLC can impact your mortgage. Some lenders may require you to refinance under the LLC’s name, potentially with different terms and interest rates. It’s essential to discuss this with your lender before transferring ownership.

Insurance Considerations:

Your insurance needs may change when you form an LLC. You might need to update your policies to reflect the LLC’s ownership and ensure adequate coverage for your rental business.

The Qualified Business Income (QBI) Deduction

The QBI deduction allows eligible taxpayers to deduct up to 20% of their qualified business income from rental real estate activities. The rules for claiming this deduction can be complex, and forming an LLC may affect your eligibility. It’s crucial to consult with a tax professional to understand the implications.

California-Specific LLC Requirements

California has specific regulations for LLCs, including:

- Statement of Information: You must file an initial Statement of Information with the California Secretary of State within 90 days of forming your LLC and biennially thereafter.

- Franchise Tax Board Requirements: LLCs are subject to an annual franchise tax, starting at $800.

California LLC fee

If your LLC will make more than $250,000, you will have to pay a fee. LLCs must estimate and pay the fee by the 15th day of the 6th month, of the current tax year.

| If the total California income rounded to the nearest whole dollar is: | The fee amount is: |

|---|---|

| $250,000 – $499,999 | $900 |

| $500,000 – $999,999 | $2,500 |

| $1,000,000 – $4,999,999 | $6,000 |

| $5,000,000 or more | $11,790 |

Frequently Asked Questions (FAQ)

1. How much does it cost to form an LLC in California?

The filing fee for an LLC in California is $70. There may be additional fees for expedited processing, certified copies, and other services.

2. Can I form an LLC myself?

Yes, you can file the necessary paperwork yourself. However, we recommend consulting with an attorney, CPA or formation service to ensure accuracy and compliance.

3. Do I need a separate bank account for my LLC?

Yes, maintaining separate bank accounts for your personal and LLC finances is crucial to preserve the liability protection the LLC offers.

4. Can I transfer an existing rental property to an LLC?

Yes, you can typically transfer ownership. However, there may be tax implications and recording fees involved, so it’s advisable to consult with a professional.

Need Expert Advice? Connect with XOA TAX!

Deciding whether to form an LLC for your rental property is a significant decision with both legal and tax ramifications. At XOA TAX, our experienced CPAs can provide personalized guidance and support every step of the way.

We can assist you with:

- LLC Formation: We can guide you through the process of setting up your LLC.

- Tax Planning: We can help you determine the optimal tax structure for your rental business.

- Compliance: We can ensure you meet all necessary legal and tax requirements.

Contact us today for a consultation:

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and should not be considered legal, tax, or financial advice. Laws, regulations, and tax rates are subject to change and can vary significantly by state and locality. This communication is not intended as a solicitation, and XOA TAX does not provide legal advice. It is essential to consult with a qualified professional for advice specific to your situation.

anywhere

anywhere  anytime

anytime