Starting a new business is an exciting journey! Whether you’re opening a bakery, launching a tech startup, or offering professional services, you’re likely focused on bringing your vision to life. But amidst the excitement, it’s essential to understand the licensing requirements for your Limited Liability Company (LLC).

One common misconception is that there’s a single “LLC License” you need to obtain. In reality, it’s a bit more nuanced. While there’s no specific license to form an LLC, various other licenses and permits may be required to operate your business legally. These requirements vary by industry, state, and locality.

This guide will clarify the ins and outs of LLC licensing and provide a clear path to ensure your business is compliant.

Understanding LLC Formation

Before we dive into licenses and permits, let’s briefly review how LLCs are formed. The foundation of an LLC is a legal document called the Articles of Organization. This document outlines key information about your business, such as:

- Your LLC’s name

- Business address

- Registered agent

- Management structure

It’s important not to confuse the Articles of Organization with the Articles of Incorporation, which are used to form corporations.

You’ll file your Articles of Organization with your state’s Secretary of State, along with any required fees. Once approved, your LLC is officially formed. You can then obtain a Certificate of Good Standing from the state, which verifies that your LLC is in compliance with state regulations.

Why Your LLC Needs Licenses and Permits

While forming an LLC is a significant step, it’s only the beginning. Various licenses and permits may be required to operate your business legally. These requirements ensure that businesses operate safely, ethically, and in compliance with industry standards.

Here are some examples of businesses that typically require licenses:

- Restaurants: Food service businesses need licenses to ensure they meet health and safety standards.

- Construction Companies: Contractors often need licenses to demonstrate their qualifications and comply with building codes.

- Healthcare Providers: Doctors, nurses, and other healthcare professionals require licenses to practice.

- Retail Stores: Businesses selling goods may need a seller’s permit to collect sales tax.

You can find detailed information about licensing requirements for specific industries on federal and state government websites. For example, the Small Business Administration (SBA) provides resources and guidance for small businesses, including licensing information.

Types of Licenses and Permits

LLCs may need licenses and permits at the federal, state, and local levels.

Federal Licenses

- Firearms: Businesses that manufacture, import, or sell firearms need a license from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). (Reference: ATF website)

- Alcohol: Breweries, wineries, and distilleries need licenses from the Alcohol and Tobacco Tax and Trade Bureau (TTB). (Reference: TTB website)

- Broadcasting: Radio and television stations require licenses from the Federal Communications Commission (FCC). (Reference: FCC website)

State Licenses

- Seller’s Permit: Allows businesses to collect sales tax on the goods they sell. (e.g., California Seller’s Permit)

- Professional Licenses: Required for occupations such as accountants, real estate agents, and cosmetologists. (e.g., California Board of Accountancy, California Department of Real Estate)

- Contractor’s License: Needed for businesses engaged in construction activities. (e.g., California Contractors State License Board)

Local Licenses

- General Business License: A basic license to operate a business within the city or county. (e.g., City of Los Angeles Business Tax Registration [invalid URL removed])

- Zoning Permit: Ensures that your business operates in an appropriate location according to zoning regulations.

- Fire Department Permit: May be required for businesses that handle flammable materials or have a high occupancy.

Steps to Obtain Necessary Licenses and Permits

Obtaining the necessary licenses and permits can seem daunting, but breaking it down into steps can make the process more manageable.

- Form Your LLC:

- Prepare and file your Articles of Organization with your state’s Secretary of State.

- Pay the required filing fees.

- Obtain a Certificate of Good Standing.

- Determine Licensing Requirements:

- Research federal, state, and local licensing requirements for your specific industry and location.

- Use online resources like the SBA website and your state’s government website.

- Register Your Business:

- Obtain a general business license from your state and/or local government.

- Apply for any industry-specific licenses required.

- Obtain an EIN:

- If you plan to hire employees or operate as a corporation or partnership, you’ll need an Employer Identification Number (EIN) from the IRS.

- You can apply for an EIN online for free on the IRS website.

- Complete Applications:

- Gather all required documentation and information.

- Complete license applications accurately and thoroughly.

- Pay any associated fees.

- Maintain Compliance:

- Renew licenses and permits as required.

- Stay informed about any changes in regulations.

To help you track your progress through the LLC licensing process, we’ve created this interactive checklist. You can use it to monitor your journey from LLC formation through obtaining all necessary permits and licenses. Simply expand each section and check off items as you complete them. The progress bar will help you visualize how far you’ve come in the process. Keep this checklist handy as you work through each requirement:

LLC Licensing Checklist

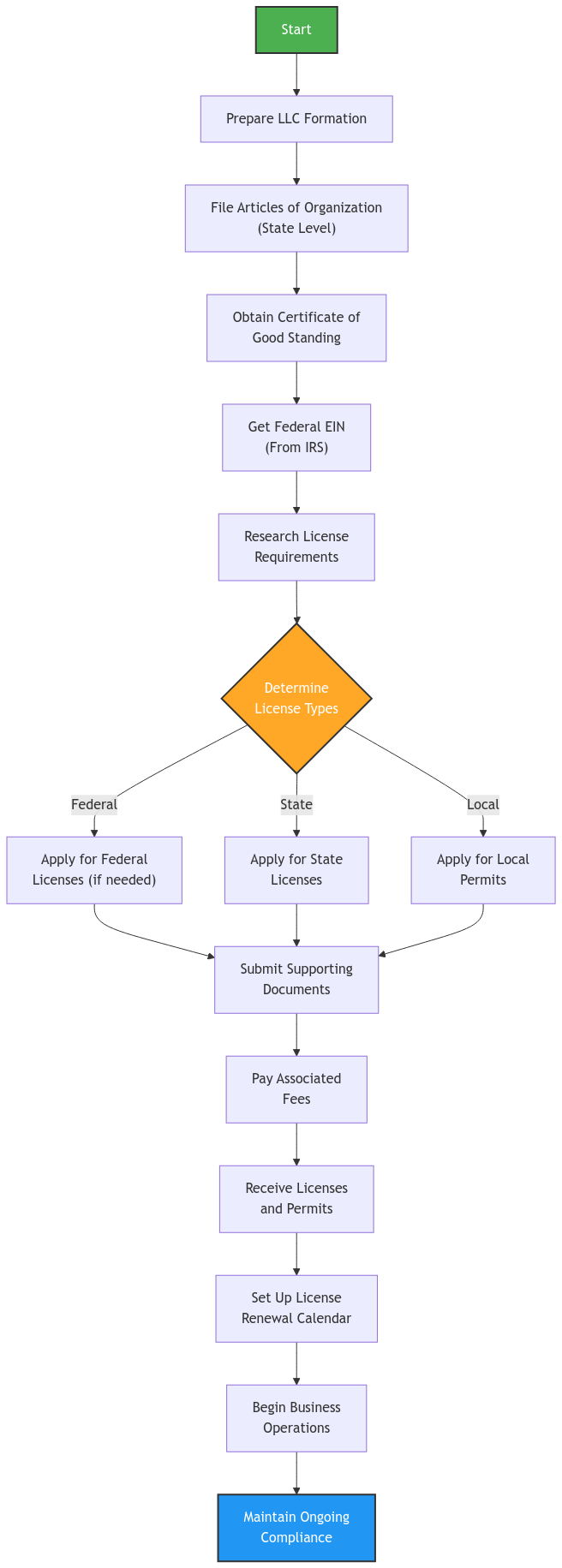

Now that you have a checklist to track your progress, let’s visualize how these steps flow together in the overall LLC licensing process. This flowchart provides a bird’s-eye view of your journey from initial LLC formation through ongoing compliance:

FAQ Section

What happens if I operate my LLC without the required licenses?

Operating without the necessary licenses can result in various penalties, including fines, legal action, and even the suspension or revocation of your business license.

How do I know which licenses my LLC needs?

The specific licenses required will depend on your industry, location, and business activities. You can research licensing requirements on federal, state, and local government websites. The SBA website also offers helpful resources.

How often do I need to renew my licenses?

Renewal requirements vary by license and jurisdiction. For example, in California, most state-issued business licenses must be renewed annually. You can usually find renewal information on the website of the issuing agency.

Do I need a separate license for each state where I do business?

If you operate in multiple states, you’ll typically need to register as a foreign LLC and obtain the necessary licenses in each state.

Connecting with XOA TAX

Understanding and navigating the complexities of LLC licensing can be challenging. At XOA TAX, we can help! Our team of experienced CPAs can:

- Identify the specific licenses and permits your business needs.

- Guide you through the application process.

- Ensure you meet all compliance requirements.

We’ve helped numerous businesses successfully navigate the licensing process. For example, we recently assisted a new restaurant owner in obtaining all the necessary permits and licenses to open their doors, including a food handler’s license, a seller’s permit, and a health permit.

Contact us today to schedule a consultation and let us help you navigate the path to business success.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime