Retirement is a time to enjoy the fruits of your labor, not worry about Uncle Sam taking a big bite out of your pension. If you’re thinking about taking a lump sum payout from your pension plan, it’s important to understand the tax implications and how to keep more of your hard-earned money. Let’s break it down in plain English, no jargon required.

Key Takeaways

- Roll it over! 💲 Moving your pension money directly into an IRA can help you avoid immediate taxes.

- Direct is best. ➡️ Direct rollovers prevent that 20% federal tax withholding.

- XOA TAX is here to help. 🤝 We can help you optimize your retirement income and tax strategy.

- Know the rules. 📝 Understanding IRS rules and eligibility is key to minimizing your tax bill.

What Exactly is a Lump Sum Pension Payout?

Imagine your pension as a pie. 🥧 Instead of receiving slices (monthly payments) over time, a lump sum payout gives you the whole pie at once. This gives you greater control over your money, but it also comes with tax considerations.

Why Might You Choose a Lump Sum?

- You’re the boss. You can manage and invest your retirement savings according to your own goals.

- Leaving a legacy. You can leave any remaining funds to your loved ones.

- Need cash now? You have access to funds for big expenses or investment opportunities.

- Worried about your pension plan? A lump sum protects you against potential pension fund issues.

Are You Eligible for a Lump Sum?

This depends on your employer’s specific plan and federal regulations. Generally, you might be eligible if:

- You’ve earned the right to your pension benefits (you’re vested).

- You’ve reached your plan’s retirement age.

- Your plan allows for lump sum distributions.

Pro Tip: Always check your pension plan documents or talk to your plan administrator to be sure.

Taxes, Taxes, Taxes

The IRS sees your lump sum pension payout as ordinary income. This means it’s taxed at your regular income tax rate, which could potentially bump you into a higher tax bracket. Ouch!

Mandatory Withholding

If you take the lump sum directly, your employer has to withhold 20% for federal taxes. Think of this as a down payment on your tax bill. Don’t forget, you’ll also need to factor in state taxes, which vary depending on where you live.

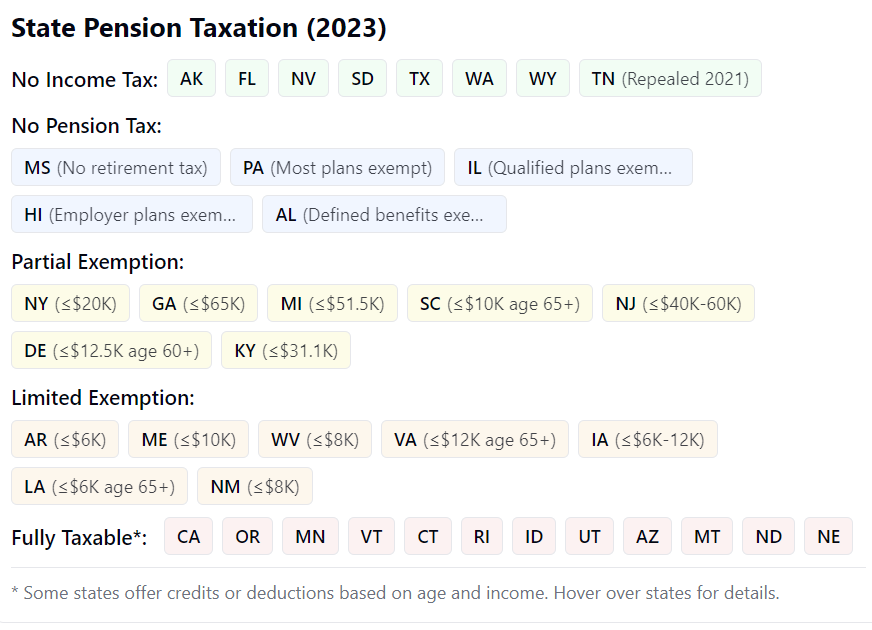

State Tax Considerations

While federal taxes are consistent across the country, state taxes on your pension can differ significantly. Some states don’t tax pension income at all, while others tax it as regular income.

Example:

- California: Pension income is generally taxed as regular income, with rates ranging from 1% to 13.3%.

- New York: Pension income is also taxed as regular income, with rates ranging from 4% to 8.82%.

Pro Tip: Check your state’s tax authority website for specific details on how pension income is taxed in your area.

How to Keep More of Your Money

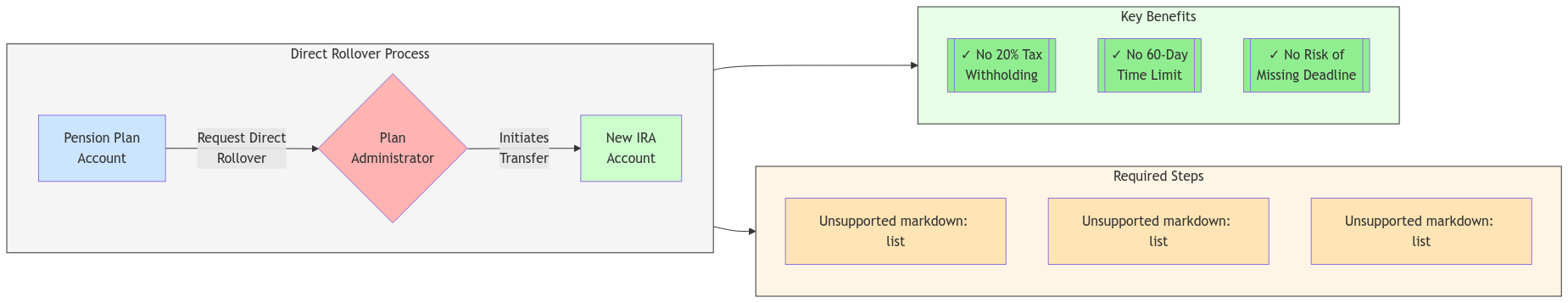

1. Direct Rollover to an IRA or Qualified Plan

The easiest way to avoid immediate taxes is to move your pension money directly into an Individual Retirement Account (IRA) or another qualified retirement plan. This is called a direct rollover. Here’s why it’s great:

- The money goes straight from your pension to the IRA, no detours.

- You avoid that pesky 20% withholding.

- You won’t owe taxes until you start taking money out of the IRA.

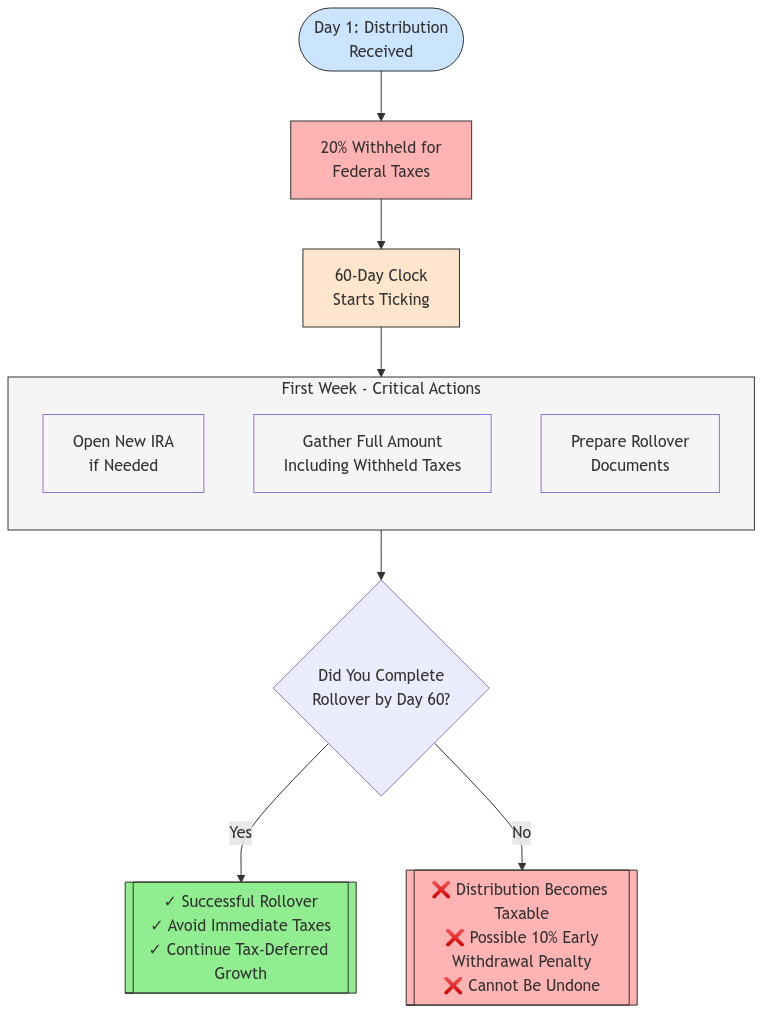

2. Indirect Rollover (60-Day Rule)

If you already received the lump sum, you still have a chance to avoid taxes! You can roll the entire amount into an IRA within 60 days.

Just remember:

- You have to deposit the entire amount, including the 20% that was withheld.

- If you miss the 60-day deadline, the withheld amount becomes taxable.

- You might also face a 10% penalty if you’re under 59 ½, unless you qualify for an exception (like disability, certain medical expenses, or death). [Link to the IRS page with details on early withdrawal penalty exceptions].

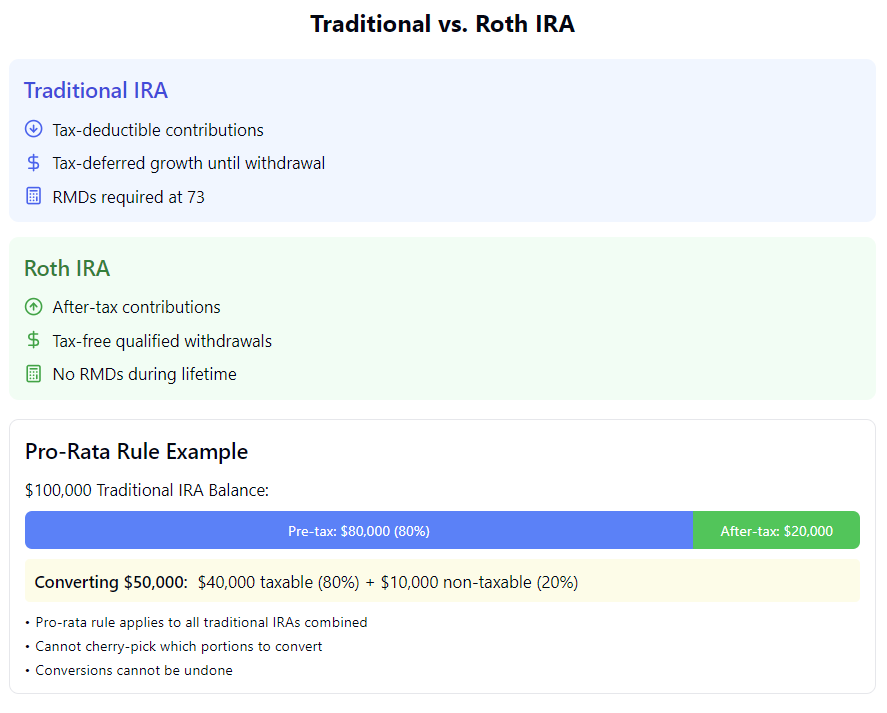

3. Roth IRA Conversion – Pay Now, Enjoy Later

Converting your traditional IRA to a Roth IRA can be a smart move for long-term tax planning. Here’s how it works:

- You pay taxes on the converted amount now.

- All future earnings and qualified withdrawals are tax-free!

- This is especially helpful if you think you’ll be in a higher tax bracket in retirement.

However, it’s important to understand the pro-rata rule. If you have both pre-tax and after-tax money in your IRA, converting to a Roth IRA means you’ll pay taxes on a portion of the pre-tax amount.

Example:

Let’s say your traditional IRA has $100,000, with $80,000 from pre-tax contributions and $20,000 from after-tax contributions. This means 80% of your IRA balance is pre-tax. If you convert the entire $100,000 to a Roth IRA, you’ll only pay taxes on 80% of the converted amount ($80,000).

Also, keep in mind that you can’t undo a Roth conversion (recharacterizations are no longer allowed).

4. Unlocking Value from Company Stock: The NUA Strategy

If your pension plan includes company stock, you might be able to take advantage of Net Unrealized Appreciation (NUA). This allows you to pay a lower tax rate on the stock’s increase in value since you acquired it. Talk to us to see if NUA makes sense for your situation!

5. Partner with a Financial Advisor

Retirement planning can be complex. A financial advisor can help you:

- Navigate IRS rules and avoid penalties.

- Build a tax-efficient investment portfolio.

- Create a comprehensive retirement income plan.

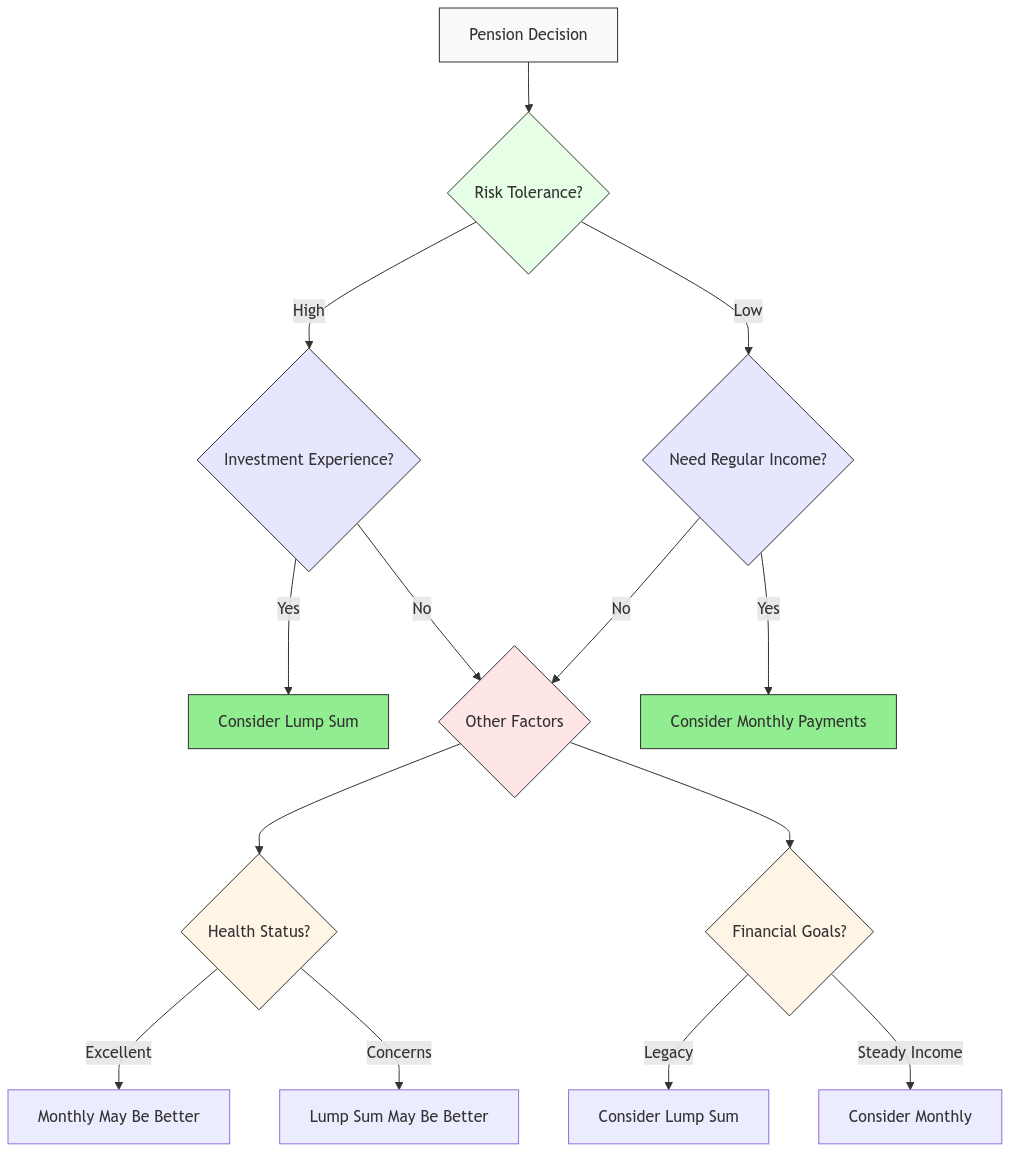

Lump Sum vs. Monthly Payments: Which is Right for You?

Choosing between a lump sum payout and monthly pension payments is a big decision. Here’s a table summarizing the key differences to help you decide what’s best for your situation:

| Feature | Lump Sum Payout | Monthly Payments |

|---|---|---|

| Control | • Full control over investment decisions | • Less control, funds managed by the pension plan |

| Flexibility | • Access to a large sum of money for immediate needs | • Predictable income stream |

| Taxes | • Potentially higher upfront taxes | • Taxes spread out over time |

| Risk | • Investment risk and potential for loss | • Risk of pension plan insolvency |

| Legacy Planning | • Can leave remaining funds to beneficiaries | • May have limited or no survivor benefits |

Don’t Forget These Important Details

- IRS Rules: ⚠️ Stay updated on the latest IRS guidelines to avoid penalties. You can find helpful information on [link to IRS Topic No. 412 – Lump-Sum Distributions]

- Social Security and Medicare: Large distributions can affect your Medicare premiums and how your Social Security benefits are taxed. Careful planning can minimize the impact.

- Required Minimum Distributions (RMDs): 🗓️ The SECURE Act 2.0 gradually increases the age for RMDs. Currently, it’s 73 (as of 2023), but this will change in the coming years. You’ll need to start taking RMDs from your traditional IRA and any inherited retirement accounts once you reach the applicable age.

- Survivor Benefits: Opting for a lump sum might mean giving up certain survivor benefits offered by your pension plan. It’s essential to consider your beneficiaries and long-term needs.

- Pension Insurance: The Pension Benefit Guaranty Corporation (PBGC) provides some protection for your pension benefits in case your employer’s plan runs into financial trouble.

Quick Reference Guide

- 20%: Federal tax withholding on lump sum pension payouts.

- 60 Days: The deadline for rolling over a lump sum distribution to an IRA to avoid taxes.

- 73: The age (as of 2023) when Required Minimum Distributions (RMDs) begin for traditional IRAs and inherited retirement accounts. This age will gradually increase in future years due to the SECURE Act 2.0.

- $6,500 (2023): The maximum contribution limit for Traditional and Roth IRAs for individuals under 50.

- $7,000 (2024): The maximum contribution limit for Traditional and Roth IRAs for individuals under 50.

- $8,000 (2024): The maximum contribution limit for Traditional and Roth IRAs for individuals 50 and over. This includes a $1,000 “catch-up” contribution for those aged 50 and above.

- April 15th: The deadline to contribute to an IRA for the tax year. (For example, April 15, 2025, is the deadline for the 2024 tax year.)

Common Mistakes to Avoid

- Missing the 60-day rollover deadline.

- Failing to consider state taxes.

- Overlooking survivor benefits offered by your pension plan.

- Not understanding the pro-rata rule when converting to a Roth IRA.

- Forgetting about Required Minimum Distributions (RMDs).

Tax Planning Timeline

- 5 years before retirement: Start estimating your retirement income needs and exploring pension payout options.

- 3 years before retirement: Begin developing a tax-efficient withdrawal strategy.

- 1 year before retirement: Meet with a financial advisor to finalize your retirement plan and discuss tax implications.

- Upon retirement: If taking a lump sum, initiate the direct rollover process to avoid immediate taxes.

- Throughout retirement: Stay informed about tax law changes and adjust your withdrawal strategy as needed.

Frequently Asked Questions (FAQs)

How does the IRS tax pension distributions?

Pension distributions are considered ordinary income. The IRS requires a 20% withholding on lump sum distributions for federal taxes. You might owe more when you file your tax return, depending on your total income and your state’s tax rules.

Any tips for creating a steady retirement income?

Absolutely! Here are a few ideas:

• Diversify your investments. 💡 Mix stocks, bonds, and other assets to balance risk and growth.

• Consider annuities. These can provide a guaranteed income stream.

• Maximize Social Security. Delaying benefits can increase your monthly payments.

• Talk to the pros. 🗣️ Financial advisors can help you tailor strategies to your specific needs.

How can XOA TAX help me optimize my investments and reduce taxes in retirement?

We can help you with:

• Direct rollovers to avoid immediate taxation.

• Tax-efficient investment strategies.

• Guidance on Roth conversions and NUA.

• Planning withdrawals to minimize taxes.

Give us a call at +1 (714) 594-6986 or email us at [email protected] for personalized assistance.

What’s the 60-day rollover rule all about?

This rule gives you 60 days to deposit your lump sum distribution into an IRA to avoid taxes. Miss the deadline, and the distribution becomes taxable and possibly subject to penalties.

Can I avoid taxes by leaving my money in the pension plan?

Keeping your money in the pension plan defers taxes, but you’ll still owe income tax on the distributions when you receive them. Rolling over to an IRA often provides more control and potential tax advantages.

Making the Most of Your Retirement

Understanding how to avoid taxes on your lump sum pension payout is crucial for a comfortable retirement. By using strategies like direct rollovers and working with experienced professionals like the team at XOA TAX, you can secure your financial future and minimize your tax burden.

Ready to take control of your retirement? Contact XOA TAX today. We’re here to help you navigate the complexities of retirement planning and make informed decisions.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime