Cash flow is the engine that drives growth and stability in manufacturing. Without it, production grinds to a halt. At XOA TAX, we understand the financial intricacies of the manufacturing world. This blog post equips you with actionable strategies to optimize your cash flow and enhance operational efficiency.

Key Takeaways

- Control production costs through strategic supplier negotiations and streamlined inventory management.

- Forecast expenses accurately to anticipate financial needs and make informed decisions.

- Improve cash flow by accelerating accounts receivable and optimizing payment terms.

- Seek expert advice from CPAs to develop tailored strategies for your business.

1. Managing Production Costs

Keeping production costs in check is paramount for profitability and healthy cash flow. Here’s how:

Negotiate with Suppliers: Cultivate strong supplier relationships to unlock discounts, favorable payment terms, and bulk purchase opportunities. Don’t hesitate to negotiate!

Optimize Inventory: Efficient inventory management minimizes storage costs, reduces waste from obsolete inventory, and prevents costly production delays.

Consider Just-in-Time (JIT) inventory management, where you receive materials only when needed for production. Aim for an inventory turnover ratio between 8 and 12 – a key metric indicating efficient inventory management. For example, if your cost of goods sold is $1 million and your average inventory value is $125,000, your inventory turnover ratio is 8 ($1,000,000 / $125,000 = 8).

Invest in Efficiency: Embrace automation, lean manufacturing principles, and process improvements to reduce waste, optimize resource allocation, and lower labor costs.

For example, a client of ours implemented a robotic welding system that reduced labor costs by 15% and increased production output by 20%, generating a significant return on investment within the first year.

Analyze Overhead: Regularly review overhead expenses, such as rent, utilities, and administrative costs, to identify areas for reduction or renegotiation. Benchmark your overhead percentage against industry averages to identify potential cost savings.

2. Forecasting Expenses

Accurate expense forecasting allows you to anticipate financial needs, avoid surprises, and make informed decisions.

Historical Data Analysis: Analyze past financial data to identify trends, seasonal fluctuations, and potential cost increases.

Sales Projections: Develop realistic sales forecasts to estimate future revenue and align production accordingly.

Contingency Planning: Factor in potential unexpected expenses, such as equipment repairs or economic downturns, to ensure financial stability.

For instance, allocate a percentage of your budget (say, 5-10%) for unforeseen expenses to create a financial buffer.

3. Improving Cash Flow

Beyond cost management and forecasting, these strategies can directly enhance your cash flow:

Accelerate Accounts Receivable: Offer incentives for early payments, implement efficient invoicing systems, and proactively follow up on outstanding invoices.

Consider offering a 2/10 net 30 discount: a 2% discount for payments made within 10 days, with the full invoice due in 30 days.

Optimize Payment Terms: Negotiate favorable payment terms with suppliers to extend your payment deadlines and improve cash flow flexibility. Aim for Net 45 or Net 60 terms whenever possible.

Explore Financing Options: Consider options like lines of credit, invoice factoring, or equipment financing to bridge cash flow gaps and support growth initiatives.

Lines of credit offer revolving access to funds, typically with interest rates ranging from 6% to 12% for manufacturers. Invoice factoring allows you to leverage outstanding invoices to obtain immediate cash, with factoring fees typically ranging from 1% to 6% of the invoice value.

Monitor Key Performance Indicators (KPIs): Track metrics like inventory turnover, days sales outstanding (DSO), and operating cycle to identify areas for improvement. Aim for a DSO of 45 days or less – this indicates how quickly you collect payments from customers. You can calculate your DSO by dividing your average accounts receivable balance by your average daily sales.

| Financing Type | Interest Rates/Fees | Terms | Qualification Requirements | Best For |

|---|---|---|---|---|

|

Business Line of Credit

|

6% – 12% APR

Varies by credit quality

|

Revolving credit 6 months – 5 years Draw as needed |

650+ credit score 2+ years in business $250K+ annual revenue |

Working capital needs and seasonal cash flow gaps

|

|

Equipment Financing

|

8% – 15% APR

Equipment serves as collateral

|

2-7 year terms Up to 100% financing Fixed payments |

600+ credit score 1+ year in business $100K+ annual revenue |

Purchasing new manufacturing equipment or upgrading existing machinery

|

|

Invoice Factoring

|

1% – 6% per month

Based on invoice amount and terms

|

30-90 day terms Up to 90% advance rate No long-term commitment |

No minimum credit score B2B invoices required Creditworthy customers |

Quick cash flow from outstanding invoices; businesses with long payment terms

|

|

SBA Loans

|

5% – 9.75% APR

Prime rate + 2.25% to 4.75%

|

Up to 25 years Up to $5 million Monthly payments |

680+ credit score 2+ years in business $100K+ annual revenue Detailed business plan |

Long-term expansion, equipment purchase, or refinancing existing debt

|

|

Purchase Order Financing

|

1.8% – 6% per month

Based on PO amount and terms

|

30-120 day terms Up to 100% of PO value Pay upon customer payment |

No minimum credit score Valid purchase orders Creditworthy customers |

Funding large orders when suppliers require upfront payment

|

Notes:

- Rates and terms are approximate and may vary based on market conditions, business profile, and lender policies

- Multiple financing options can be used together based on specific needs

- Consider consulting with a financial advisor to determine the best option for your situation

4. Navigating Industry-Specific Challenges

The manufacturing industry has unique financial considerations:

Working Capital Management: Manufacturers often require significant working capital to fund operations due to long production cycles. Monitor your working capital ratio (current assets divided by current liabilities) to ensure you have sufficient liquidity. A healthy ratio is typically between 1.2 and 2.

Seasonal Fluctuations: Many manufacturing businesses experience seasonal demand. Plan for these fluctuations by adjusting production levels, managing inventory accordingly, and securing financing in advance if needed.

Equipment Depreciation: Capital-intensive equipment depreciates over time, impacting your cash flow and tax liability. Understand different depreciation methods (straight-line, accelerated) and their implications. For example, accelerated depreciation methods, like double-declining balance, allow you to deduct a larger portion of the asset’s cost in the early years, which can reduce your tax burden and improve cash flow.

Compliance Costs: Factor in environmental regulations, safety standards, and other compliance costs that can impact your cash flow.

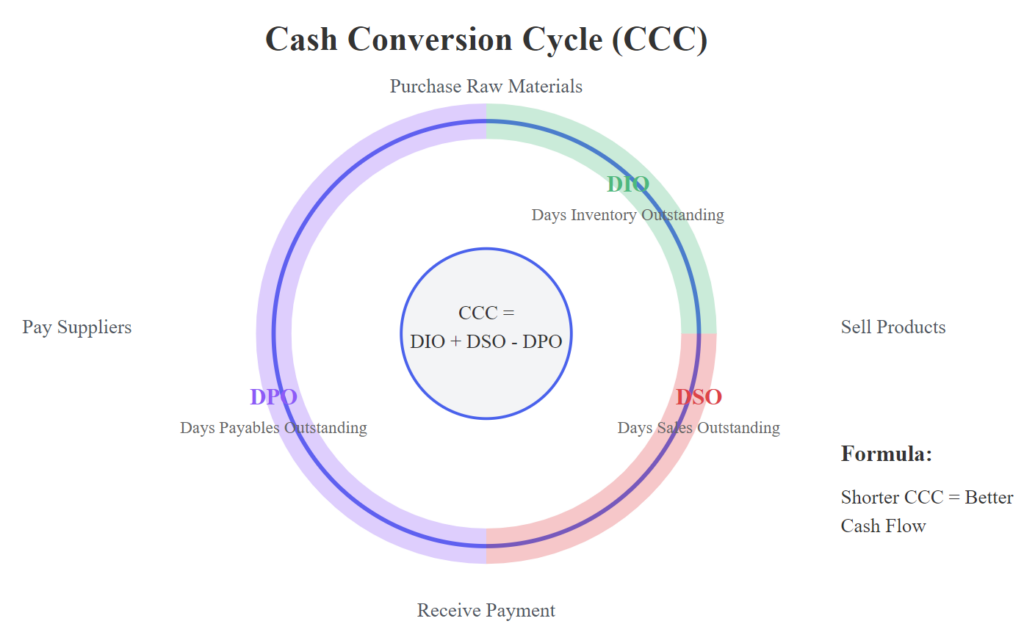

5. Understanding the Cash Conversion Cycle

The cash conversion cycle (CCC) measures the time it takes to convert investments in inventory and other resources into cash flow from sales. It’s a crucial metric for manufacturers to monitor. A shorter CCC means your cash is tied up for less time, improving liquidity.

CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

- Days Inventory Outstanding (DIO): The average number of days it takes to sell inventory.

- Days Sales Outstanding (DSO): The average number of days to collect payment after a sale.

- Days Payables Outstanding (DPO): The average number of days to pay suppliers.

FAQ Section

What are some common cash flow challenges faced by manufacturers?

Manufacturers often experience challenges such as long lead times, high inventory holding costs, fluctuating raw material prices, and economic volatility.

How can I improve my cash flow during a period of slow sales?

During slowdowns, focus on reducing expenses, actively managing inventory, negotiating extended payment terms with suppliers, and exploring alternative revenue streams.

What are the benefits of using accounting software for cash flow management?

Accounting software can automate tasks, provide real-time financial data, generate cash flow forecasts, and facilitate better decision-making.

Connecting with XOA TAX

Effectively managing cash flow in manufacturing requires a proactive and strategic approach. At XOA TAX, our experienced CPAs can provide personalized guidance tailored to your specific business needs. We can assist with:

- Developing comprehensive cash flow forecasts.

- Identifying cost reduction opportunities.

- Implementing efficient accounting systems.

- Optimizing your tax strategy to maximize cash flow. We can help you take advantage of tax deductions specific to manufacturers, such as Section 179 expensing, which allows you to deduct the full purchase price of qualifying equipment in the year it’s placed in service, and research and development tax credits.

Connect with us today to schedule a consultation and learn how we can help your manufacturing business thrive.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime