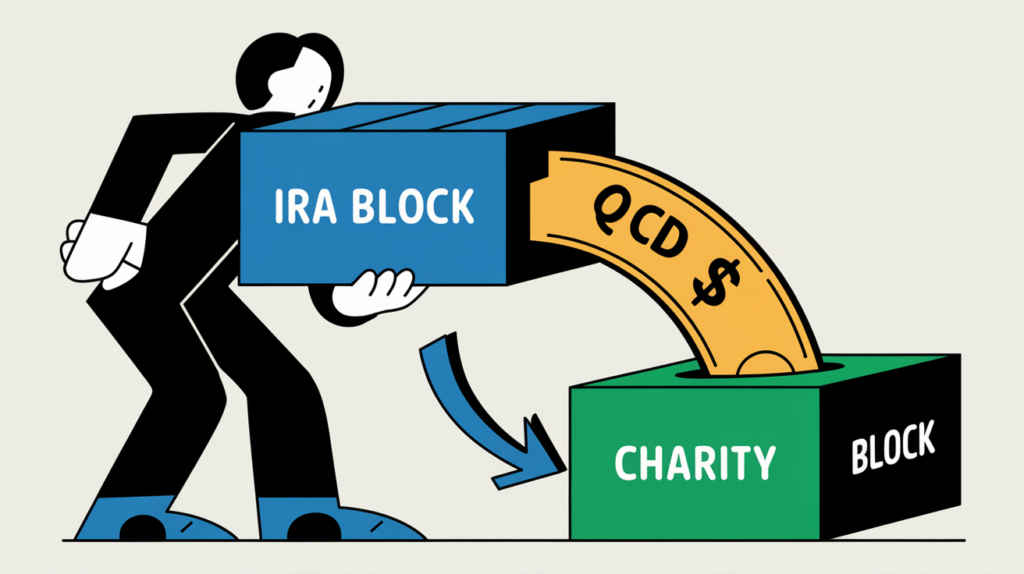

Want to support your favorite charity while minimizing your tax burden? If you’re 70½ or older and have a traditional IRA, Qualified Charitable Distributions (QCDs) offer a powerful way to do both. This tax-savvy strategy allows you to donate directly from your IRA, reducing your taxable income and maximizing your charitable impact.

Key Takeaways

- QCDs offer a tax-efficient way for individuals 70½ or older to donate to charity directly from their IRA.

- By reducing your taxable income, QCDs can lower your overall tax liability and potentially reduce Medicare premiums and taxes on Social Security benefits.

- QCDs can satisfy RMDs for those 73 or older without increasing AGI.

- Strategic use of QCDs can help manage future tax liabilities, align with estate planning goals, and maximize your charitable impact.

- Proper execution, including direct transfers and timely action, is crucial to reap the full benefits of QCDs.

What Exactly is a QCD?

A Qualified Charitable Distribution (QCD) is a direct transfer of funds from your IRA custodian to a qualified charity. By sending the distribution straight to the charity, you exclude it from your taxable income, offering significant tax advantages over traditional charitable donations.

Why QCDs Matter Under Current Tax Laws

With the increased standard deduction from the Tax Cuts and Jobs Act of 2017, fewer taxpayers benefit from itemizing deductions. QCDs allow you to receive a tax benefit for your charitable contributions even if you take the standard deduction.

Key Benefits of QCDs

- Reduce Your Taxable Income: Excluding the QCD amount lowers your Adjusted Gross Income (AGI), which can reduce your overall tax liability and potentially place you in a lower tax bracket.

- Qualify for More Tax Breaks: A lower AGI may make you eligible for deductions and credits that have income limitations, such as:

- Medical Expense Deductions

- Education Credits and Deductions

- Deductible IRA Contributions

- Lower Medicare Premiums: Since Medicare Part B and Part D premiums are based on your income, reducing your AGI can help you avoid the Income Related Monthly Adjustment Amount (IRMAA) surcharges.

- Minimize Taxes on Social Security Benefits: A reduced AGI can decrease the portion of your Social Security benefits that are taxable, increasing your net income.

- Satisfy Your Required Minimum Distribution (RMD): If you’re 73 or older (following the SECURE Act 2.0), QCDs can count toward your RMD, fulfilling the requirement without increasing taxable income.

Important Considerations

Direct Transfer is Crucial

- The funds must be transferred directly from your IRA custodian to the charity.

- If you withdraw the funds yourself, the distribution becomes taxable, and you lose the QCD benefit.

Eligible Accounts

- Only Traditional IRAs are eligible for QCDs.

- Other retirement accounts like 401(k)s or 403(b)s do not qualify, but you can roll over funds from these accounts into a traditional IRA first.

Age Requirement

- You must be at least 70½ years old at the time of the distribution.

Annual Limit

- There’s an annual QCD cap of $100,000 per person (indexed for inflation starting in 2024).

Charity Eligibility

- Donations must be made to an eligible 501(c)(3) public charity.

- Donor-Advised Funds, Private Foundations, and certain other organizations are ineligible.

No Double Dipping

- You cannot claim an itemized charitable deduction for QCD amounts since they’re already excluded from taxable income.

Proper Reporting

- Ensure your tax return reflects the QCD correctly to prevent it from being counted as taxable income.

- The QCD amount should be included on line 4a of Form 1040, with “QCD” written next to line 4b.

How to Make a QCD

- Contact Your IRA Custodian

- Choose a Qualified Charity

- Provide Detailed Instructions

- Mind the Timing

- Verify the Transfer

Strategic Planning with QCDs

Integrating QCDs into your financial plan can significantly enhance your tax efficiency and charitable impact. Here are specific strategies to consider:

Coordinate with Your RMDs

Satisfy RMDs with QCDs: If you’re required to take Required Minimum Distributions, using QCDs to fulfill this obligation can prevent an increase in your taxable income.

Example: Suppose your RMD for the year is $50,000. By making a $50,000 QCD to your favorite charity, you satisfy your RMD without adding $50,000 to your taxable income.

Plan for Future Tax Liabilities

Start QCDs Early: If you anticipate higher RMDs in future years due to account growth, beginning QCDs at age 70½ can help manage and reduce your taxable income over time.

Example: Starting QCDs before you’re subject to RMDs (age 73) allows you to lower your IRA balance, which can result in smaller future RMDs and potentially lower future tax liabilities.

Mitigate the Impact of Increased Income

Avoid Medicare Surcharges and Social Security Taxes: By reducing your AGI through QCDs, you may stay below income thresholds that trigger higher Medicare premiums or increased taxation of Social Security benefits.

Example: If your AGI is close to the IRMAA threshold, making a QCD can keep you below the limit, saving you from higher Medicare Part B and D premiums.

Maximize Charitable Impact Without Affecting Cash Flow

Use IRA Funds Instead of Cash: By donating through a QCD, you can support charities without impacting your cash reserves, effectively using pre-tax dollars for charitable giving.

Align with Estate Planning Goals

Reduce Taxable Estate: Regularly making QCDs reduces the balance of your IRA, potentially decreasing future estate taxes for your heirs.

Example: If you have a sizable IRA and are concerned about estate taxes, QCDs can be a strategic way to reduce the account balance over time.

Combine QCDs with Other Tax Strategies

Charitable Bunching: If you make significant charitable contributions, consider combining QCDs with strategies like donor-advised funds for non-IRA assets to maximize tax benefits.

Tax-Efficient Legacy Planning: Coordinate QCDs with beneficiary designations to optimize the transfer of wealth to your heirs and charitable organizations.

Recent Legislative Updates

SECURE Act 2.0 Enhancements

- Inflation Indexing: Starting in 2024, the $100,000 QCD limit will adjust for inflation, allowing for larger QCDs over time.

- One-Time Gifts to Split-Interest Entities: You can make a one-time QCD of up to $50,000 to certain split-interest entities like charitable remainder trusts or charitable gift annuities. This option enables you to receive income while supporting a charity, but it comes with specific rules and complexities. Consulting a tax professional is essential.

Contact Us Today

Ready to maximize your charitable impact and minimize your tax liability?

At XOA TAX, our experienced CPAs are here to guide you through the nuances of QCDs. We’ll help you integrate this strategy into your financial plan, ensuring you reap the full benefits.

Call us at: +1 (714) 594-6986

Email: [email protected]

Visit us at: https://www.xoatax.com/contact-us/

Schedule a consultation today and let us help you harness the power of QCDs for your financial and philanthropic goals.

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, or financial advice. Consult with a qualified professional before making any decisions regarding QCDs or other financial matters.

anywhere

anywhere  anytime

anytime