Planning for a comfortable retirement is a priority for many, but it can seem challenging when you’re working with a limited income. The good news is that with careful planning and an understanding of contribution limits, you can still build a solid nest egg. At XOA TAX, we often help clients navigate these complexities. Let’s break down how you can maximize your retirement contributions, even when your earned income isn’t as high as you’d like.

Key Takeaways

- Even with limited income, contributing to retirement accounts is crucial.

- 401(k)s and IRAs have different contribution limits, both impacted by your earned income.

- Understanding how earned income is calculated is vital for maximizing contributions.

- Various retirement plan options are available depending on your employment situation.

- XOA TAX can provide personalized guidance to optimize your retirement savings strategy.

Understanding Contribution Limits

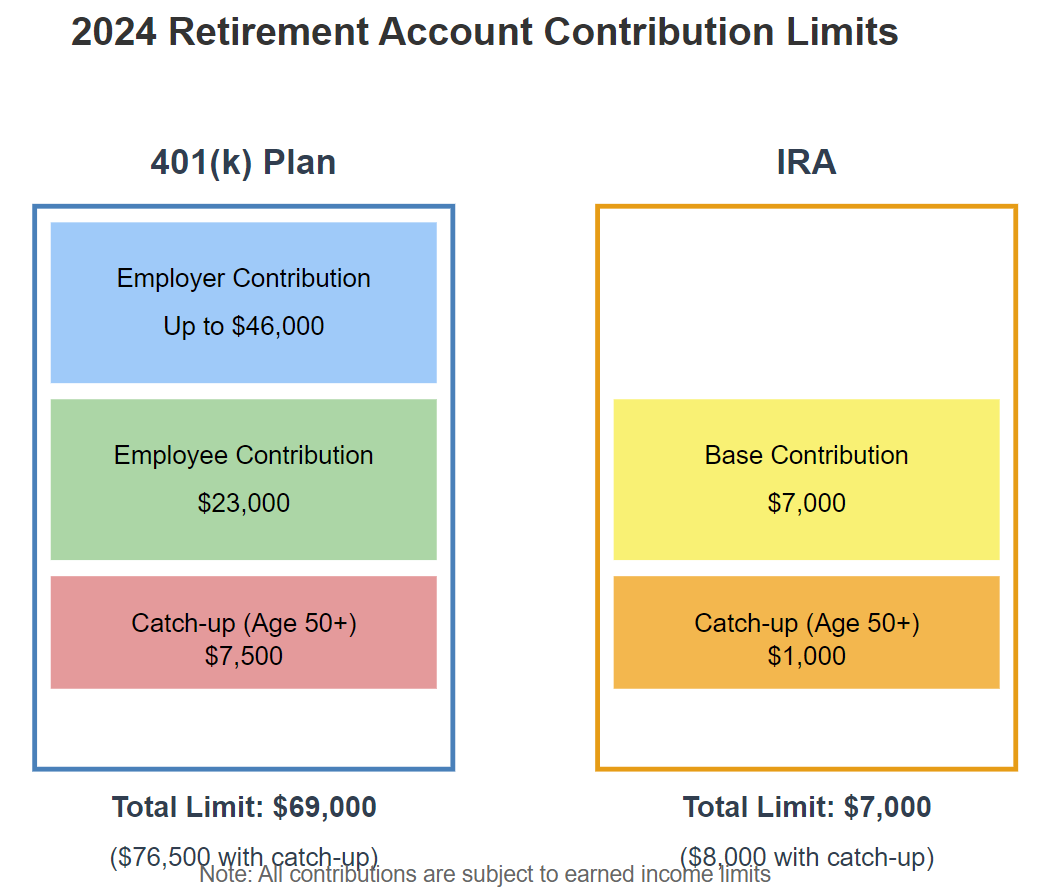

It’s important to know the rules when it comes to contributing to your retirement accounts. Here’s a closer look at the limits for 2024:

401(k) Plans

- Employee Contribution: You can contribute up to $23,000 to your 401(k). If you’re 50 or older, an additional “catch-up” contribution of $7,500 is allowed, bringing the potential total to $30,500.

- Employer Contribution: Your employer might also contribute to your 401(k). Keep in mind that the combined total of your contributions and your employer’s contributions can’t exceed certain limits. For 2024, this limit is the lesser of 100% of your compensation or $69,000 (or $76,500 if you’re 50 or older).

- Employer Matching: Many employers offer matching contributions to their employees’ 401(k) plans. This means that for every dollar you contribute, your employer will contribute a certain amount, up to a specified limit. Common matching formulas include a dollar-for-dollar match up to a certain percentage of your salary or a 50% match on your contributions. Be sure to understand your employer’s matching formula to maximize your retirement savings.

Individual Retirement Accounts (IRAs)

- Contribution Limit: The maximum you can contribute to either a traditional or Roth IRA in 2024 is $7,000, or $8,000 if you’re 50 or older.

- Earned Income: A key factor with IRAs is that your contributions can’t exceed your earned income for the year. Earned income typically includes wages, salaries, tips, and net earnings from self-employment.

- Roth IRA Income Limits: There are income limits for contributing to a Roth IRA. For 2024, if your modified adjusted gross income is $153,000 or greater as someone filing as single, married filing separately, or head of household, you can’t contribute to a Roth IRA. The limit is $228,000 for those who are married filing jointly or who are qualifying widow(er)s.

- Traditional IRA Deductibility: If you or your spouse are covered by a retirement plan at work, your deduction for traditional IRA contributions may be limited or phased out depending on your income.

Retirement Plans for Small Business Owners and Self-Employed Individuals

- SEP IRA: A Simplified Employee Pension (SEP) IRA allows self-employed individuals and small business owners to contribute directly to traditional IRAs set up for themselves and their employees. For 2024, the maximum contribution is the lesser of 25% of your net adjusted self-employed income or $66,000.

- SIMPLE IRA: Savings Incentive Match Plans for Employees (SIMPLE) IRAs are another option for small businesses. They allow both employee and employer contributions, with limits of $15,500 in 2024 ($19,000 for those 50 and over).

Important Considerations

Separate Limits

The contribution limits for 401(k) plans and IRAs are independent of each other. If you have enough earned income, you can contribute the maximum to both types of accounts. This allows for greater flexibility in your retirement savings strategy.

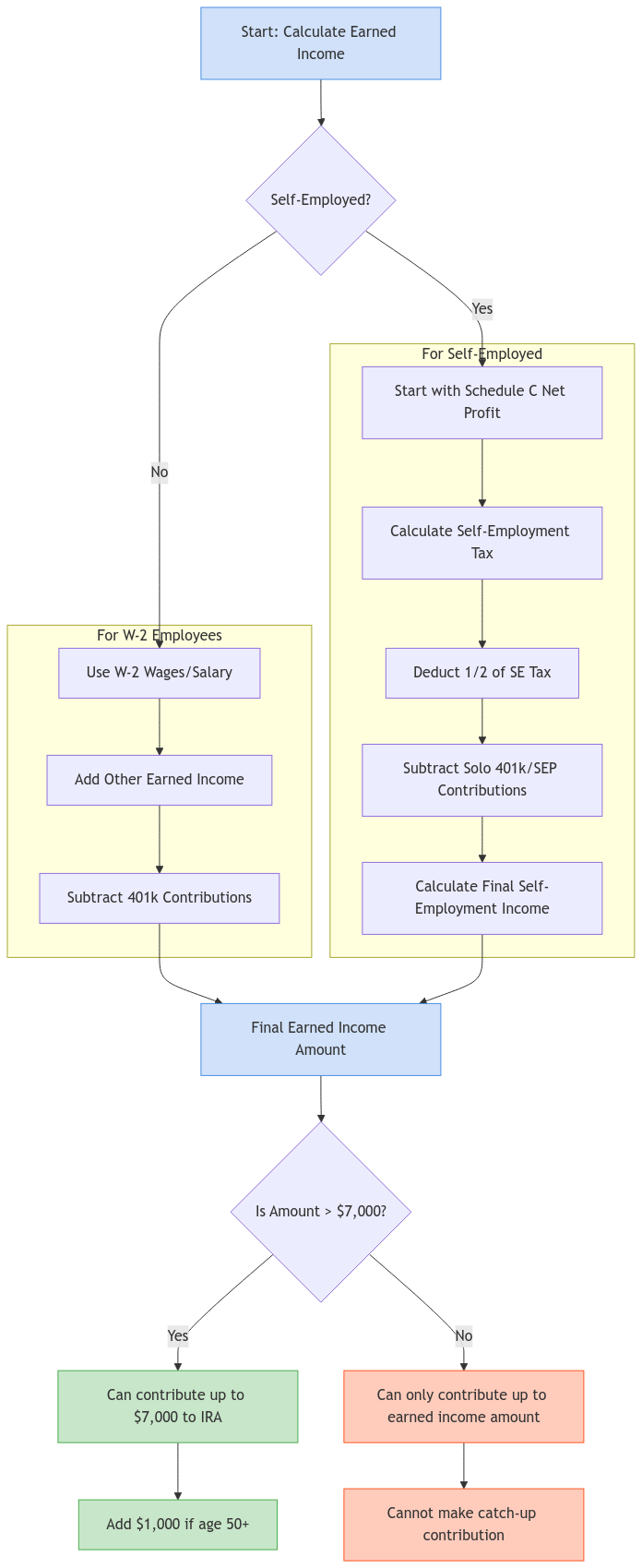

Earned Income: The Deciding Factor

Your total contributions to all your retirement accounts cannot be more than your total earned income for the year. This is a critical rule to remember, especially if you’re trying to maximize your contributions.

Calculating Earned Income for Self-Employed Individuals

Determining your earned income when you’re self-employed requires careful consideration of various factors. Here’s a simplified breakdown:

- Net Profit: Start with your net profit from your business (as reported on Schedule C of your Form 1040).

- Deductible Self-Employment Tax: Subtract one-half of your self-employment tax. This is because half of your self-employment tax is deductible as an adjustment to income.

- Contributions to Other Retirement Plans: Subtract any contributions made to other retirement plans, such as a solo 401(k).

The resulting amount represents your earned income for IRA contribution purposes.

Solo 401(k) vs. SEP IRA

- Solo 401(k): This plan allows you to contribute both as an “employee” and an “employer.” It offers higher contribution limits and more flexibility in investment choices compared to a SEP IRA.

- SEP IRA: This plan is simpler to administer and has lower administrative costs. However, it offers lower contribution limits and less flexibility compared to a solo 401(k).

Choosing between a solo 401(k) and a SEP IRA depends on your individual circumstances and preferences. It’s advisable to consult with a tax professional to determine the best option for your business.

Real-World Examples

- Example 1: Sarah earns $60,000 per year. She maxes out her 401(k) contributions at $23,000. She can also contribute up to $7,000 to an IRA, as this combined amount is still less than her earned income.

- Example 2: David is self-employed and has a net profit of $40,000 from his business. He contributes $10,000 to a solo 401(k). He calculates his self-employment tax to be $5,652. After deducting half of the self-employment tax ($2,826) and his solo 401(k) contribution, his earned income for IRA purposes is $27,174 ($40,000 – $2,826 – $10,000). He can contribute up to $7,000 to a traditional IRA.

Roth vs. Traditional: Tax Considerations

When deciding between Roth and traditional contributions, consider your current and future tax brackets.

- Roth: Contributions aren’t tax-deductible, but qualified withdrawals in retirement are tax-free. This can be advantageous if you anticipate being in a higher tax bracket in retirement.

- Traditional: Contributions may be tax-deductible, leading to tax savings in the present. However, withdrawals in retirement are taxed as ordinary income.

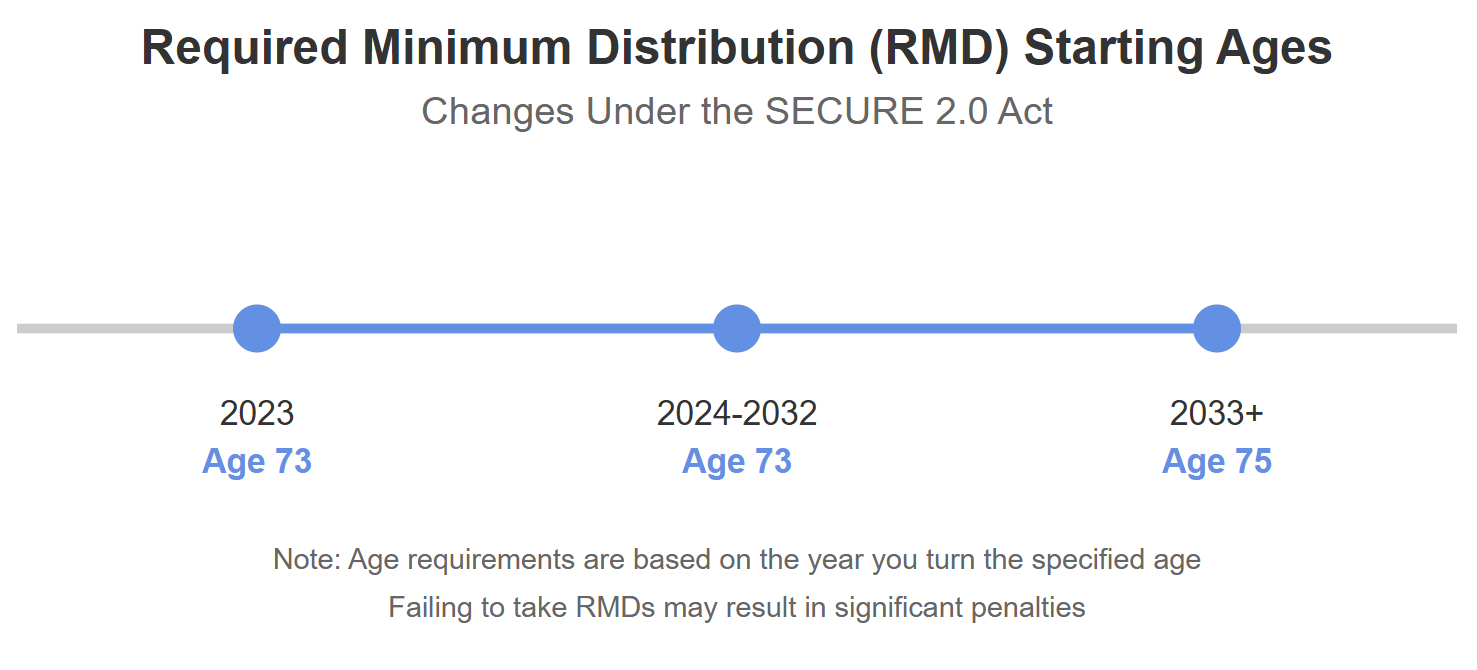

Required Minimum Distributions (RMDs)

Traditional IRAs, 401(k)s, and similar retirement accounts require you to start taking Required Minimum Distributions (RMDs) once you reach a certain age.

- Starting Age: Currently, the age for starting RMDs is 73. However, the SECURE 2.0 Act gradually increases this age to 75 by 2033.

- Calculation: RMDs are calculated based on your account balance at the end of the previous year and your life expectancy according to IRS tables.

- Penalties: Failing to take your RMDs can result in a hefty penalty tax.

Understanding RMD rules is essential for tax-efficient retirement planning.

Spousal IRA Contributions

If you’re married and your spouse doesn’t have earned income, you can still contribute to a traditional or Roth IRA on their behalf through a spousal IRA. This allows you to save for your spouse’s retirement, even if they aren’t currently working.

- Eligibility: To contribute to a spousal IRA, you must be married and file a joint tax return. Your spouse must also be under the age of 73 (as of the end of 2024).

- Contribution Limits: The contribution limit for a spousal IRA is the same as for a regular IRA—$7,000 in 2024, or $8,000 if your spouse is 50 or older.

- Income Limits: For Roth IRAs, the same income limits apply as for regular Roth IRAs.

Spousal IRAs can be a valuable tool for couples to increase their retirement savings and ensure both spouses have a secure financial future.

State Tax Implications

While the information provided in this blog post primarily focuses on federal tax rules, it’s important to be aware that state tax laws regarding retirement contributions and withdrawals can vary significantly. Some states offer tax deductions for contributions to traditional IRAs or 401(k)s, while others may tax retirement income differently.

It’s crucial to research your state’s specific tax laws or consult with a tax professional to understand how they may impact your retirement savings strategy.

Comparison of Retirement Account Types

To help you choose the best retirement savings options for your needs, here’s a table summarizing the key features of various account types:

| Account Type | Contribution Limit (2024) | Eligibility | Tax Benefits | Special Considerations |

|---|---|---|---|---|

| 401(k) | $23,000 ($30,500 with catch-up) | Offered by employer | Traditional: Tax-deductible contributions, taxable withdrawals. Roth: After-tax contributions, tax-free withdrawals. | Employer may offer matching contributions. Subject to RMDs. |

| Traditional IRA | $7,000 ($8,000 with catch-up) | Earned income | Tax-deductible contributions (may be limited), taxable withdrawals. | Deductibility may be phased out if covered by a workplace retirement plan. Subject to RMDs. |

| Roth IRA | $7,000 ($8,000 with catch-up) | Earned income, income limits apply | After-tax contributions, tax-free withdrawals. | Income limits apply. No RMDs during the account owner’s lifetime. |

| SEP IRA | Lesser of 25% of net adjusted self-employed income or $66,000 | Self-employed individuals and small businesses | Tax-deductible contributions, taxable withdrawals. | Simple to administer. Lower contribution limits than solo 401(k). Subject to RMDs. |

| SIMPLE IRA | $15,500 ($19,000 with catch-up) | Employees of small businesses | Traditional: Tax-deductible contributions, taxable withdrawals. | Both employee and employer can contribute. Lower contribution limits than 401(k). Subject to RMDs. |

| Solo 401(k) | Lesser of 25% of net adjusted self-employed income or $66,000 | Self-employed individuals and small businesses | Traditional: Tax-deductible contributions, taxable withdrawals. Roth: After-tax contributions, tax-free withdrawals. | Higher contribution limits than SEP IRA. More flexibility in investment choices. Subject to RMDs. |

| Spousal IRA | $7,000 ($8,000 with catch-up) | Spouse with no earned income, married filing jointly | Same as Traditional or Roth IRA, depending on the type chosen. | Allows for contributions on behalf of a non-working spouse. Subject to RMDs (for traditional IRAs). |

Frequently Asked Questions (FAQ)

Q: Can I contribute to both a Roth and a traditional IRA in the same year?

A: Yes, you can contribute to both, but your combined contributions cannot exceed the annual limit ($7,000, or $8,000 if you’re 50 or older).

Q: What if I don’t have enough earned income to contribute to both a 401(k) and an IRA?

A: Prioritize contributing to your 401(k), especially if your employer offers matching contributions. Then, contribute as much as you can to an IRA, up to your earned income limit.

Q: Where can I find the most up-to-date information on IRA contribution limits?

A: The IRS website (IRS.gov) is the best source for current information on contribution limits and other tax-related matters.

Connecting with XOA TAX

Planning for retirement can be complex, especially when you’re dealing with limited income. At XOA TAX, we can help you develop a personalized retirement savings strategy that aligns with your financial goals and ensures you’re maximizing your contributions within IRS guidelines. We can help you understand:

- The best retirement plan options for your circumstances

- Contribution limits and deadlines

- Tax implications of different contribution types

- Strategies for maximizing your retirement savings

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime