It happens to the best of us. Life gets busy, deadlines sneak up, and suddenly you realize you’ve missed a crucial tax deadline. Whether it’s filing your income tax return, paying estimated taxes, or submitting a form, missing a deadline can be stressful. But don’t panic! The IRS has procedures in place to help you get back on track.

Here at XOA TAX, we understand that dealing with the IRS can be intimidating. That’s why we’re here to guide you through the process, explain your options, and help you minimize any potential penalties.

Understanding the Consequences

First, it’s important to understand the potential consequences of missing a tax deadline. These can vary depending on the type of deadline missed and your specific circumstances. Common penalties include:

- Late Filing Penalty: This is typically 5% of the unpaid taxes owed for each month or part of a month that your return is late, up to a maximum penalty of 25%.

- Late Payment Penalty: If you didn’t pay your taxes by the deadline, you may be subject to a late payment penalty, which is usually 0.5% of the unpaid amount per month, up to a maximum of 25%.

- Interest: Interest can accrue on any unpaid taxes, and it can also be charged on penalties.

Example Scenario

Let’s say you owe $10,000 in taxes and filed your return 2 months late:

- Late Filing Penalty: 10% (5% × 2 months) = $1,000

- Late Payment Penalty: 1% (0.5% × 2 months) = $100

- Total Penalties: $1,100 (plus interest)

Late Filing Penalty (5% per month)

For $10,000 in unpaid taxes:

Late Payment Penalty (0.5% per month)

For $10,000 in unpaid taxes:

Important Notes:

- Both penalties may apply simultaneously

- Interest charges are separate and continue to accrue on unpaid taxes and penalties

- Filing your return on time even if you can’t pay will save you substantial penalties

The good news is that the IRS often offers penalty relief in certain situations, such as:

- First-time abatement: If you have a history of filing and paying on time, you may qualify for penalty relief.

- Reasonable cause: If you had a valid reason for missing the deadline (e.g., serious illness, natural disaster), you may be able to avoid penalties.

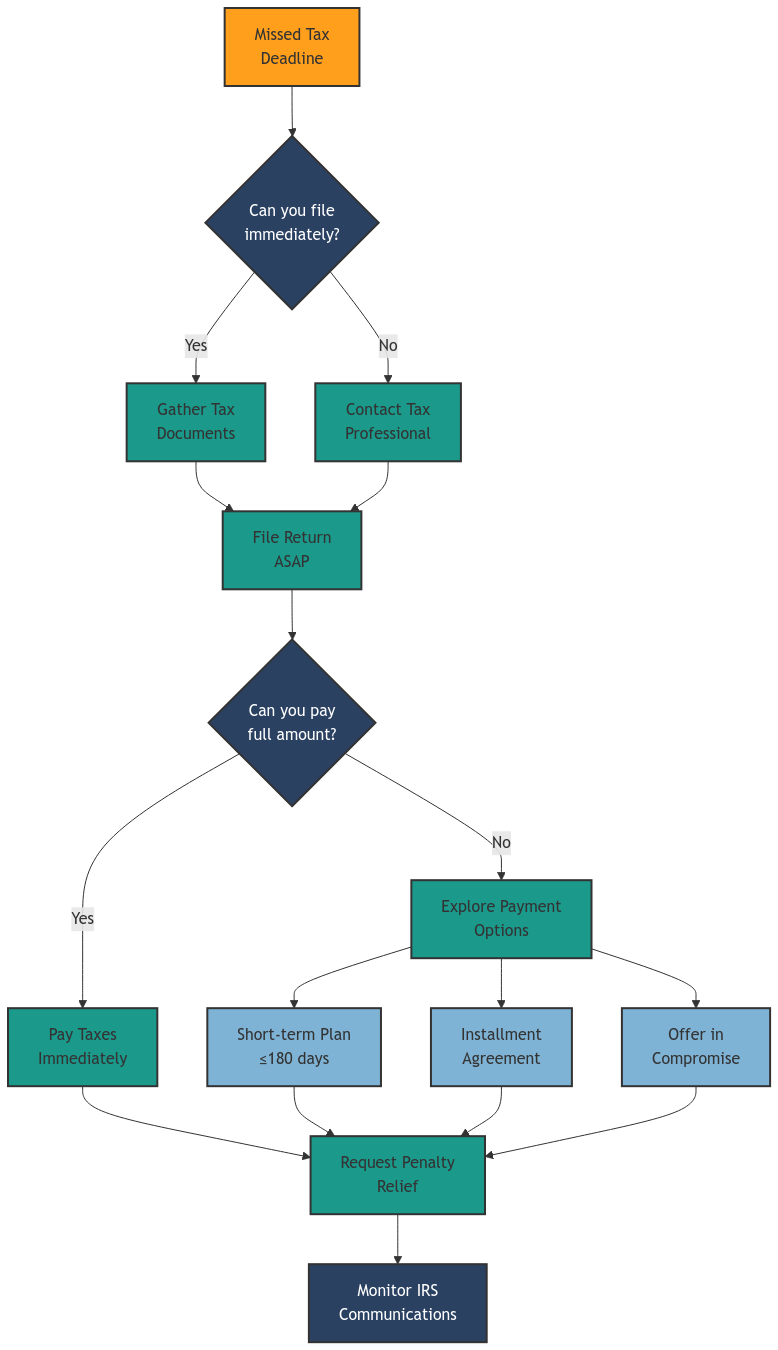

Steps to Take After Missing a Deadline

Follow this process guide to get back on track with your taxes:

Let’s break down each step in detail:

- Gather Your Tax Information: This includes your Social Security number, income statements (W-2s, 1099s), and any other relevant documents.

- File Your Return or Form as Soon as Possible: Even if you can’t pay the full amount owed, file your return or form to avoid further penalties. You can often file online, by mail, or with the help of a tax professional.

- Explore Payment Options: If you can’t pay your taxes in full, the IRS offers several payment options, including:

- Short-term payment plan: You may be able to get up to 180 days to pay your balance in full, but this option is generally limited to tax debts under $100,000.

- Offer in Compromise (OIC): In certain circumstances, you may be able to settle your tax debt for less than the full amount owed. However, OICs have strict eligibility requirements and are not available to everyone.

- Installment agreement: This allows you to make monthly payments over an extended period.

- Consider Seeking Professional Help: If you’re facing a complex tax situation or need help navigating the IRS procedures, consider contacting a qualified tax professional. They can provide guidance, represent you before the IRS, and help you find the best solution for your situation.

Important Deadlines to Know:

- Individual Tax Returns: Generally due in mid-April (the exact date varies by year).

- Estimated Tax Payments: Due quarterly (April 15, June 15, September 15, January 15).

- Extension Deadlines: October 15 for individual returns.

Specific Situations:

- Missed Estimated Tax Payments: If you’re self-employed, an independent contractor, or have other income not subject to withholding, you may need to make estimated tax payments throughout the year. If you missed a payment, catch up as soon as possible to minimize penalties.

- Missed the April 15th Deadline: This is the general deadline for filing your federal income tax return, but the actual date can vary. If you missed it, file your return electronically or by mail as soon as possible.

- Missed State Tax Deadlines: State tax deadlines can vary. Check with your state’s tax agency for information on late filing and payment procedures.

Digital Filing Options

The IRS encourages taxpayers to file electronically. Here are some things to keep in mind:

- E-filing options: You can e-file through authorized providers like tax preparation software or tax professionals.

- Documentation requirements: Ensure you have all necessary documents in a digital format before e-filing.

- Record retention: Even when filing electronically, keep your tax records for at least 3-7 years.

FAQs

What happens if I miss the tax deadline by just one day?

Even missing the deadline by one day can result in penalties. It’s crucial to file as soon as possible to minimize these penalties.

I can’t afford to pay what I owe. What should I do?

The IRS offers several payment options, including payment plans, offers in compromise, and installment agreements. Contact the IRS or a tax professional to discuss your options.

I missed a deadline because I was hospitalized. Can I get the penalties waived?

Yes, you may qualify for penalty relief due to reasonable cause. You’ll need to provide documentation to support your claim.

XOA TAX Can Help

Missing a tax deadline can be a stressful experience, but it’s important to remember that you have options. By taking prompt action and understanding the available resources, you can resolve the issue and get back on track with your taxes.

If you’re feeling overwhelmed or unsure about what to do, don’t hesitate to reach out to XOA TAX. Our team of experienced CPAs can provide personalized guidance, help you understand your options, and ensure you meet your tax obligations.

Remember, proactive communication with the IRS is key. Don’t ignore the problem – address it head-on and seek professional help if needed.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.