Starting a business often means keeping things straightforward. But as your company grows, you might start wondering if there’s a better way to organize it. At XOA TAX, we’re here to help you explore how using multiple business entities can offer significant advantages. By carefully selecting the right structure, you can protect your assets, save on taxes, and set yourself up for future growth—all without unnecessary complications.

Key Takeaways

- Asset Protection, Tax Savings, and Flexibility: Using multiple business entities can help safeguard your assets, reduce taxes, and provide more options for expansion.

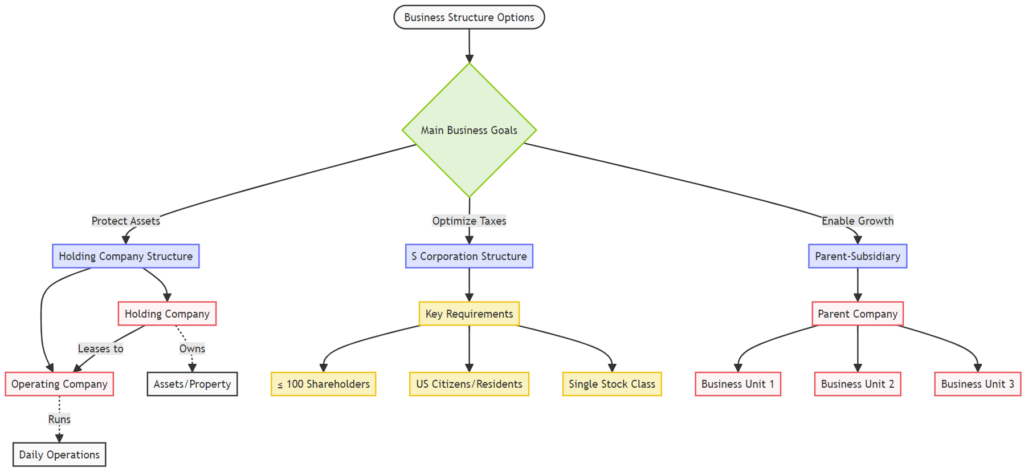

- Common Structures: These include holding company with operating company setups, parent-subsidiary arrangements, and fee-for-service models.

- S Corporations Considerations: While they offer tax benefits, S Corporations have specific rules about ownership and profit distribution.

- Tailored to Your Needs: The best structure depends on your business activities, ownership goals, and state tax laws.

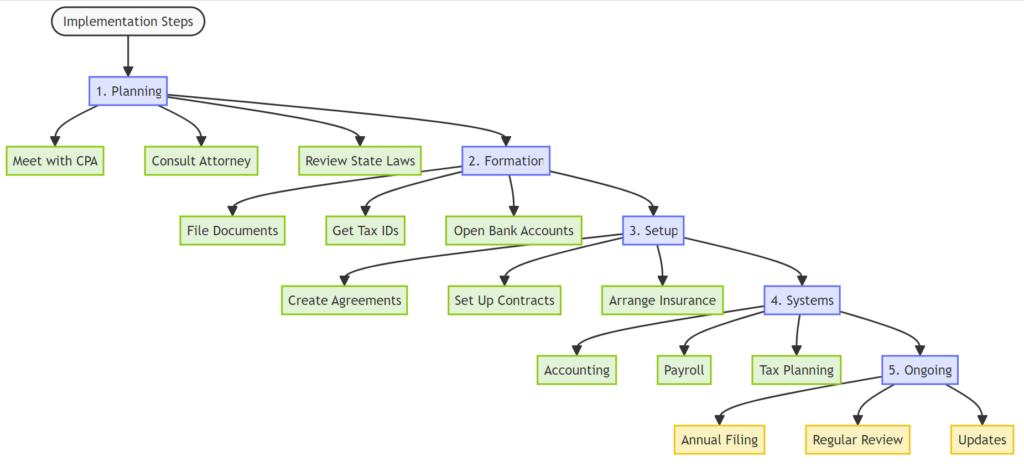

- Expert Guidance is Crucial: Careful planning with professional advice is key to navigating the complexities of multi-entity structures.

As your business evolves, adjusting its structure can open up new opportunities. Let’s delve into some common multi-entity structures and how they might benefit you.

Holding Company and Operating Company

This setup separates your valuable assets from your daily business activities.

- Holding Company: Owns assets like real estate, equipment, or intellectual property.

- Operating Company: Runs the core business and leases assets from the holding company.

Benefits:

- Protecting Your Assets: By separating assets from operations, you shield them from potential liabilities. If the operating company faces legal issues, the holding company’s assets are generally protected.

*Example*: If you own a fleet of trucks, placing them in a holding company and leasing them to your operating company can protect those assets from lawsuits against your business operations. - Tax Savings: Shifting income from the operating company to the holding company as rent can reduce self-employment taxes.

- Flexibility for Growth: Easier to bring in new partners or expand the business without affecting asset ownership.

Parent-Subsidiary Structures

In this arrangement, a parent company owns one or more subsidiary companies, which can be LLCs or corporations.

Benefits:

- Separating Business Lines: Keep different business ventures distinct while managing them under one umbrella.

*Example*: A parent company owns separate subsidiaries for a restaurant and a catering service, allowing for focused management and liability protection. - Facilitating Partnerships: Allows for joint ventures where the parent company and other investors share ownership of a subsidiary.

- Custom Ownership and Profits: Tailor ownership percentages and profit-sharing arrangements in each subsidiary to meet specific goals.

Important Considerations for S Corporations

Eligibility Requirements:

- Limited to 100 shareholders.

- Shareholders must be U.S. citizens or residents.

- Only certain entities can be shareholders (e.g., individuals, certain trusts).

Distribution Rules:

- Profits and losses are typically distributed based on ownership percentages.

- Special allocations are generally not allowed without careful planning.

Fringe Benefits:

- S Corporation owners may access tax-advantaged benefits like health insurance and retirement plans.

- Specific rules apply, especially for shareholders owning more than 2% of the company.

Tip: If considering an S Corporation, consult with a tax professional to understand how these rules impact your situation.

Fee-for-Service Arrangements

This model involves multiple S Corporations owned by different individuals, all providing services to a central multi-member LLC (MMLLC).

Benefits:

- Flexible Profit Sharing: Share profits based on each owner’s contribution, overcoming the proportional distribution requirement of S Corporations.

- State Tax Advantages: In some states, this structure can minimize certain taxes, but it’s essential to analyze state-specific laws.

Important Notes:

- Arm’s Length Pricing: Services between entities must be priced as if dealing with unrelated parties.

- Detailed Documentation: Keep thorough records of all inter-company transactions for compliance purposes.

Example: Three consultants each own an S Corporation. They form an LLC to handle joint projects, billing the LLC for their services. Profits are then distributed based on each consultant’s input.

Holding Company vs. Management Company

- Holding Company: Primarily owns and manages assets, such as real estate or equipment.

- Management Company: Provides services like administration, marketing, or consulting to other businesses for a fee.

Choosing the Right Structure:

- Consider the nature of your business activities.

- Align the structure with your ownership goals and operational needs.

- Consult with professionals to determine the best fit.

Essential Considerations for Multi-Entity Structures

Setting up multiple entities involves several key factors:

- Operating Agreements: Define ownership, responsibilities, and profit-sharing for each entity.

- Health Insurance: Plan how to provide benefits across different companies.

- Insurance Coverage: Ensure each entity has adequate liability and professional insurance.

- Licensing and Compliance: Meet all regulatory requirements for each business activity.

- Retirement Plans: Explore options for offering 401(k) or other retirement plans.

- Asset Depreciation: Understand how depreciation will be handled for tax purposes.

- Professional Fees: Account for costs related to tax preparation, payroll, and legal advice.

- Asset Appreciation: Consider how increases in asset value will be treated within different entities.

Practical Tips:

- Work with Professionals: Engage a CPA and legal counsel to navigate the complexities.

- Plan Ahead: Establish clear procedures and documentation from the outset.

Navigating the Complexities

While multi-entity structures offer benefits, they also introduce challenges:

- Payroll Management: Coordinating payroll across entities requires careful administration.

- Inter-company Transactions: Proper documentation is essential to satisfy tax regulations.

- Compliance Requirements: Each entity has its own filing and regulatory obligations.

- Banking Relationships: Managing multiple bank accounts can add complexity.

- Additional Costs: Be prepared for increased expenses in accounting, legal fees, and state filings.

- Implementation Timing: Strategically plan the formation and transition to new entities.

Advice:

- Weigh the Pros and Cons: Assess whether the benefits outweigh the additional complexity for your specific situation.

- Stay Organized: Implement robust accounting and record-keeping systems.

FAQ Section

Q: Is a multi-entity structure right for my small business?

A: It depends on your unique circumstances. Factors like the nature of your business, growth plans, and the need for asset protection play a significant role. Consulting with a professional can help determine if it’s the right move.

Q: What are the potential drawbacks of a multi-entity structure?

A: Potential downsides include increased complexity in accounting and compliance, higher administrative costs, and the need for detailed documentation and planning.

Q: How can I determine the best multi-entity structure for my business?

A: Working with experienced CPAs and legal advisors can help you analyze your goals and select a structure that aligns with your objectives.

Connecting with XOA TAX

Navigating multi-entity business structures can be complex, but you don’t have to do it alone. At XOA TAX, our seasoned professionals are here to help you explore your options, understand the tax implications, and design a structure that fits your business goals.

Schedule a Consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and doesn’t provide legal, tax, or financial advice. Laws and regulations can change and vary by location. This communication isn’t intended to be a solicitation, and XOA TAX doesn’t provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime