Many people are taking on multiple jobs to increase their income, pursue their passions, or gain valuable experience. While there are many benefits to working multiple jobs, it’s important to understand the tax implications. This blog post will provide a comprehensive guide to navigating the tax complexities of being a multi-job employee.

Key Takeaways

- Having multiple jobs can affect your tax withholding and potentially lead to owing taxes at the end of the year.

- Accurate completion of Form W-4 for each employer is crucial to ensure proper withholding.

- Understanding potential pitfalls, such as excess Social Security tax withholding, can help you avoid surprises during tax season.

- XOA TAX can provide personalized guidance and support in optimizing your tax situation when working multiple jobs.

Understanding Tax Withholding with Multiple Jobs

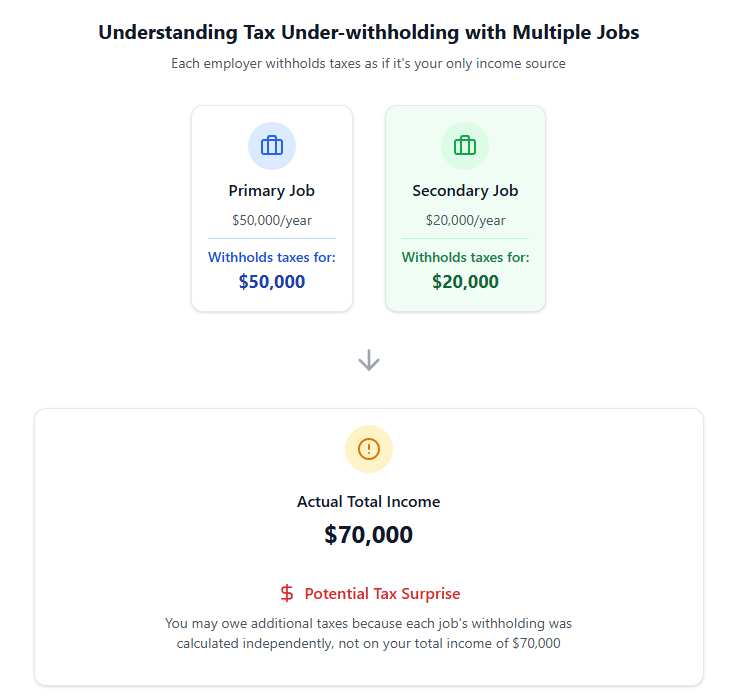

When you work multiple jobs, each employer will withhold taxes from your paycheck based on the information you provide on Form W-4, Employee’s Withholding Certificate. The challenge is that each employer typically withholds taxes as if it’s your only source of income. This can lead to under-withholding, meaning not enough taxes are taken out of your paychecks throughout the year.

Example of Under-withholding

For example, imagine you earn $50,000 per year from your primary job and $20,000 from a second job. Both employers will base your withholding on the assumption that you’re only making that single income. This can result in a significant tax bill come April.

Filing Requirements

Even if your total income from all jobs falls below the filing threshold, you may still need to file a tax return to claim a refund for any over-withheld taxes. If your combined income exceeds the filing threshold, you are required to file a tax return. You can find more information about filing requirements on the IRS website https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return.

Common Pitfalls

- Excess Social Security Tax: In 2024, the Social Security wage base is $168,600. If your combined wages from multiple jobs exceed this limit, you may have too much Social Security tax withheld. You can claim a credit for this excess on your tax return.

- Under-withholding: As mentioned earlier, under-withholding is a common issue for employees with multiple jobs. This can result in an unexpected tax bill or even penalties at the end of the year.

State Tax Considerations

It’s important to remember that state income tax laws can differ significantly from federal regulations. Some states have flat income tax rates, while others have graduated rates. Withholding allowances and thresholds can also vary.

State Tax Examples

For example, in California, where XOA TAX is located, you’ll need to submit a Form DE 4 to each employer to adjust your withholding for state income tax. States like Texas and Florida have no state income tax, while New York has multiple tax brackets and requires separate state withholding calculations.

Strategies for Tax Optimization

- Accurate W-4 Completion: Carefully complete Form W-4 for each employer, taking into account your total income from all sources. You may need to adjust your withholding by claiming fewer allowances or requesting an additional amount to be withheld from each paycheck.

- Estimated Tax Payments: If you anticipate owing a significant amount of taxes, consider making estimated tax payments throughout the year to avoid penalties. You can find more information about estimated taxes on the IRS website https://www.irs.gov/payments/direct-pay.

- Professional Guidance: Consult with a qualified tax professional, like those at XOA TAX, to discuss your specific situation and develop a tax planning strategy.

Self-Employment and Multiple Jobs

Understanding Self-Employment Tax

If one of your income sources involves self-employment, you’ll need to consider additional tax obligations. Self-employment tax covers Social Security and Medicare taxes and is calculated on your net profit. You’ll also need to make estimated tax payments quarterly.

Record-Keeping for Multiple Jobs

Essential Records to Keep

Maintaining organized records is crucial when you have multiple jobs. Keep track of all your pay stubs, W-2 forms, and any expense receipts related to your employment. This will make tax preparation much easier and help ensure accuracy.

Potential Impact on Benefits

Benefit Eligibility Considerations

Having multiple jobs can sometimes affect your eligibility for certain benefits, such as health insurance and retirement plans. It’s essential to check with each employer to understand any potential implications.

Example of Benefit Impact

For example, if you work more than 30 hours per week at one job, you might qualify for their health insurance, but working multiple part-time jobs totaling 30+ hours might not qualify you for benefits at either employer.

Digital Tools for Managing Multiple Incomes

Helpful Tools for Managing Income

Several apps and online tools can help you manage your income and expenses from multiple jobs. These can be helpful for tracking your earnings, budgeting, and even estimating your tax liability.

Specific Tool Examples

- The IRS Tax Withholding Estimator

- Mobile apps for expense tracking (e.g., Mint, Personal Capital)

- Spreadsheet templates for income tracking

- Digital receipt management systems (e.g., Expensify, Shoeboxed)

FAQs

How do I know if I’m having enough taxes withheld from my multiple jobs?

Review your paystubs and compare the withholding amounts to your projected total income and tax liability. You can also use the IRS Withholding Estimator tool or consult with a tax professional.

Can I claim the same deductions and credits on my tax return if I have multiple jobs?

Yes, you can still claim the deductions and credits you’re eligible for, even with multiple jobs. Your total income from all sources will determine your eligibility for certain deductions and credits.

What happens if I overpay Social Security tax?

You can claim a credit for any excess Social Security tax withheld on your tax return. This will reduce your overall tax liability.

Connecting with XOA TAX

Navigating the tax implications of multiple jobs can be complex. At XOA TAX, our experienced CPAs can provide personalized guidance and support to ensure you meet your tax obligations and optimize your financial situation. We have extensive experience helping clients with multiple income sources, and we’re dedicated to developing tailored strategies that maximize your tax benefits. Contact us today for a consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime