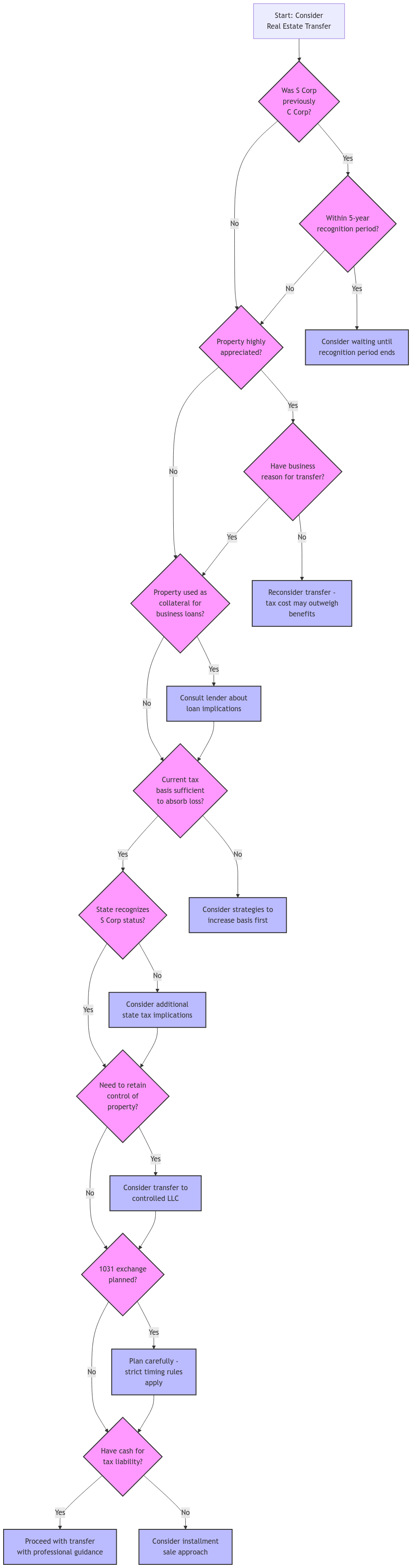

At XOA TAX, we often guide business owners through the complexities of transferring real estate out of their S corporations. This is a multifaceted area with potentially significant tax implications. Before making any decisions, it’s vital to understand the rules and potential pitfalls. Let’s break down some of the key considerations.

Key Takeaways

- Transferring appreciated real estate out of an S corporation is a taxable event.

- The corporation recognizes gain on the difference between the property’s fair market value and its adjusted basis.

- This gain is passed through to the shareholders and reported on their individual tax returns.

- Built-in gains may apply if the S corporation was previously a C corporation.

- The shareholder’s basis in their S corporation stock is affected by the transfer.

- Recapture of depreciation may be required.

- Consulting with a tax professional is crucial to minimize tax liabilities and ensure compliance.

Understanding the Tax Implications

When an S corporation distributes real estate to its shareholders, the IRS treats it as if the corporation sold the property at fair market value. This can result in a significant tax liability, especially if the property has appreciated in value since the corporation acquired it.

Example: Let’s say your S corporation purchased a rental property for $200,000, and it’s now worth $500,000. If you transfer this property to your LLC, the corporation would recognize a $300,000 gain. This gain would then be passed through to you and the other shareholders, and you would be responsible for paying taxes on it at your individual income tax rates.

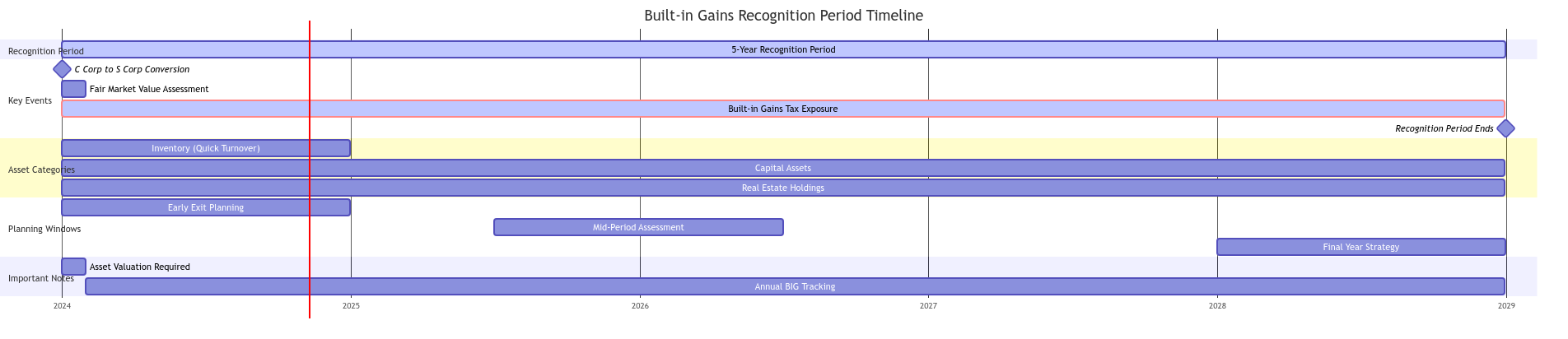

Built-in Gains Tax

If your S corporation was previously a C corporation, you might encounter another tax implication: the built-in gains tax. This tax applies to appreciated assets held by the corporation during its time as a C corporation. If these assets are sold or distributed within a specific recognition period (typically five years) after the conversion to an S corporation, the corporation will owe tax on the built-in gain.

Example: Let’s imagine your company was a C corporation that held a property with a $100,000 built-in gain when it converted to an S corporation. If you distribute this property within the recognition period, your corporation could face a built-in gains tax on that $100,000.

Impact on Shareholder Basis

Transferring real estate out of an S corporation also affects the shareholder’s basis in their S corporation stock. The shareholder’s basis is reduced by the fair market value of the distributed property. This can have significant implications for future transactions, such as selling the stock or deducting losses from the S corporation.

Example: If your basis in your S corporation stock is $250,000, and you receive a property distribution with a fair market value of $100,000, your stock basis would be reduced to $150,000.

Section 1239: Ordinary Income Reclassification

It’s crucial to be aware of Section 1239 of the Internal Revenue Code. This section can recharacterize gain as ordinary income when depreciable property is sold between related parties, such as an S corporation and its shareholders. This can further increase your tax liability.

Depreciation Recapture

When depreciable real estate is transferred, you might also encounter depreciation recapture rules. This means that some of the depreciation deductions you’ve taken on the property over the years may need to be recaptured as income, potentially increasing your tax liability.

Planning for a Tax-Efficient Transfer

While transferring real estate out of an S corporation can be a tax trigger, there are strategies to help mitigate the impact.

| Strategy | Description | Pros | Cons | Key Considerations | Best For |

|---|---|---|---|---|---|

| Outright Distribution | Direct transfer of property from S corp to shareholders | – Immediate completion of transfer – Simplest approach – Clean break from corporate ownership | – Immediate recognition of full gain – Large upfront tax liability – Potential cash flow issues – Immediate basis reduction | – Fair market value determination crucial – Section 1239 ordinary income recharacterization – Impact on stock basis – State tax implications | – Entities with sufficient cash for tax liability – Situations requiring quick transfer – When property has minimal appreciation |

| Installment Sale | Property sold to shareholders/LLC with payments spread over time | – Spreads tax liability over multiple years – Better cash flow management – Can help fund purchase through property income | – Complex documentation required – Interest charges on installments – Risk of future tax rate changes – Ongoing administrative burden | – Interest rate requirements – Payment term structuring – Security arrangements – Related party rules | – Cash flow-conscious transfers – High-value properties – When buyer needs financing – Long-term planning scenarios |

| 1031 Exchange | Exchange property for like-kind replacement property | – Defers recognition of gain – Preserves investment in real estate – Potential for property upgrade | – Very strict timing requirements – Complex rules must be followed – Limited property selection – Requires qualified intermediary | – 45-day identification period – 180-day exchange period – Like-kind requirements – Boot recognition rules | – Continuing real estate investors – Properties with large appreciation – When reinvestment is desired – Strategic portfolio changes |

| Contribution to Partnership | Transfer to new or existing partnership | – Potential for tax-free contribution – Flexible ownership arrangements – Maintained interest in property | – Complex partnership rules – Potential disguised sale issues – Seven-year mixing bowl rules – Loss of direct control | – Partnership agreement terms – Holding period requirements – Built-in gain rules – Control retention needs | – Multi-party arrangements – Joint venture situations – When flexibility needed – Strategic partnerships |

| Stock Redemption | Corporation redeems stock in exchange for property | – Can achieve complete exit for some shareholders – Selective transfer possible – Potential capital gain treatment | – Complex redemption rules – Risk of dividend treatment – Impact on remaining shareholders – Corporate basis issues | – Section 302 requirements – Relative ownership changes – Valuation requirements – Impact on operations | – Shareholder exits – Family transitions – Corporate restructuring – Ownership consolidation |

| Liquidation | Complete liquidation of S corporation | – Clean break from corporate form – Single tax event – Fresh start possible | – Immediate recognition of all gain – Loss of corporate entity – Complex unwinding required – All assets affected | – Timing of liquidation – Impact on other assets – Employee/contract implications – State law requirements | – Business cessation – Complete restructuring – Entity simplification – Fresh start situations |

Here are a few options to discuss with your tax advisor:

- Installment Sale: Instead of an outright distribution, consider selling the property to the LLC on an installment basis. This can spread the gain recognition over several years, potentially reducing your tax burden in the short term.

- Like-Kind Exchange (Section 1031): A 1031 exchange allows you to defer the gain by exchanging the property for a similar one. However, the rules for 1031 exchanges are strict, and coordinating this with an S corporation exit can be complex, so careful planning is essential. You can learn more about 1031 exchanges in this XOA TAX blog post: [insert link to relevant blog post].

- Reassessing the S Corporation Structure: If you frequently deal with real estate transactions, it might be worth evaluating if an S corporation is the most suitable structure for your business. Perhaps holding the real estate in a separate LLC from the start would be more advantageous.

Should You Transfer Your Real Estate?

Timing Your Transfer

Timing is crucial when transferring real estate from an S corporation. Consider factors like:

- Remaining Recognition Period for Built-in Gains: If your S corporation was previously a C corporation, be mindful of the built-in gains recognition period.

- Quick Reference: The typical recognition period is 5 years.

- Coordination with a 1031 Exchange: If you’re planning a 1031 exchange, ensure you meet the strict deadlines for identifying and acquiring replacement property.

- Quick Reference: You have 45 days to identify potential replacement properties and 180 days to complete the exchange.

- State Tax Laws: Understand your state’s tax laws and how they might affect the timing of your transfer.

Avoid These Pitfalls

Overlooking Built-in Gains: Failing to consider the built-in gains tax can lead to unexpected tax liabilities.

Ignoring Basis Adjustments: Not accounting for basis adjustments can create complications for future transactions and deductions.

Disregarding State Tax Implications: State tax laws can significantly impact the overall tax consequences of the transfer.

Inaccurate Valuations: Ensure you obtain a qualified appraisal to determine the fair market value of the property.

Neglecting Debt Considerations: If the property has a mortgage or other debt, address the potential tax implications of debt relief.

Pre-Transfer Checklist

Determine the Fair Market Value: Obtain a professional appraisal.

Calculate Your Adjusted Basis: Gather the necessary records to determine your basis in the property.

Analyze Potential Gains and Recapture: Estimate the potential tax liability from the transfer.

Explore Tax Mitigation Strategies: Discuss options like installment sales or 1031 exchanges with your tax advisor.

Review Your State Tax Laws: Understand the specific rules in your state.

Required Documentation

Deed: The original deed showing the S corporation’s ownership of the property.

Property Tax Records: Recent property tax assessments and payment records.

Loan Documents: If applicable, any mortgage or loan agreements related to the property.

Transfer Agreement: A legal agreement outlining the terms of the transfer between the S corporation and the recipient (e.g., LLC).

FAQs about Transferring Real Estate from an S Corporation

Q: Can I gift the property to my LLC to avoid taxes?

A: Unfortunately, no. Gifting the property would still trigger a taxable event for the S corporation. The IRS will recognize the gain based on the fair market value of the property.

Q: What are the tax rates on the gain from the transfer?

A: The tax rates will depend on your individual income tax bracket and whether the gain is considered capital gain or ordinary income under Section 1239.

Q: Are there any state tax implications to consider?

A: Yes, in addition to federal taxes, you’ll also need to consider state tax laws, which can vary significantly. Some states don’t recognize S corporations, which can add another layer of complexity.

Need Help? Connect with XOA TAX

Transferring real estate out of an S corporation is a complex process with significant tax implications. It’s crucial to have a knowledgeable tax advisor on your side to help you navigate the rules, minimize your tax liability, and make informed decisions.

The experienced CPAs at XOA TAX can provide personalized guidance and support. Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime