Running a nonprofit is no easy feat. You’re juggling fundraising, managing programs, and ensuring your organization makes a real difference in the community. But amidst the whirlwind of responsibilities, it’s crucial not to overlook one critical area: taxes.

At XOA TAX, we’ve witnessed firsthand how tax complexities can trip up even the most dedicated nonprofits. That’s why we’re here to demystify the process and provide expert guidance so you can focus on what truly matters: your mission.

In this comprehensive guide, we’ll equip you with ten essential strategies to navigate the nonprofit tax landscape, maintain compliance, and safeguard your precious resources.

Key Takeaways

- Understanding your tax-exempt status is paramount.

- Mastering Form 990 is key to transparency and compliance.

- Balancing expenses wisely demonstrates financial responsibility.

- A solid budget is your roadmap to financial health.

- Unrelated Business Income Tax (UBIT) can be a hidden pitfall.

- Sound accounting practices build trust and ensure accountability.

- State and local taxes add another layer of complexity.

- Properly handling donations fosters donor confidence.

- Financial ratios provide valuable insights into your organization’s performance.

- Preparing for audits safeguards your assets and reputation.

Decoding Your Tax-Exempt Status

At XOA TAX, we always begin by helping our nonprofit clients understand their tax-exempt status. It’s not as straightforward as it might seem! The Internal Revenue Code (IRC) outlines various classifications, each with its own set of rules, requirements, and benefits.

Here’s what you need to know:

- Identify your IRC section: Are you a 501(c)(3) public charity, a 501(c)(4) social welfare organization, or perhaps a 501(c)(6) business league? Knowing your specific classification is crucial.

- Understand the implications: Your tax-exempt status impacts your eligibility for grants, exemption from federal income tax, and potential state-level benefits.

- Maintain compliance: Familiarize yourself with the obligations associated with your status. This might include restrictions on political campaign activity, lobbying limitations, and public disclosure requirements.

Action Steps:

- Explore IRS Publication 557 (link to IRS Publication 557) for a detailed overview of tax-exempt status and related regulations.

- Consider seeking guidance from a tax professional specializing in nonprofit law to ensure you’re meeting all the necessary requirements.

Conquering Form 990: Your Nonprofit’s Public Face

Think of IRS Form 990 as your nonprofit’s annual report to the world. It’s an information return for the IRS, but it’s also a public document that provides transparency into your organization’s activities. Donors, grantmakers, and watchdog organizations often review Form 990, so accuracy and completeness are vital.

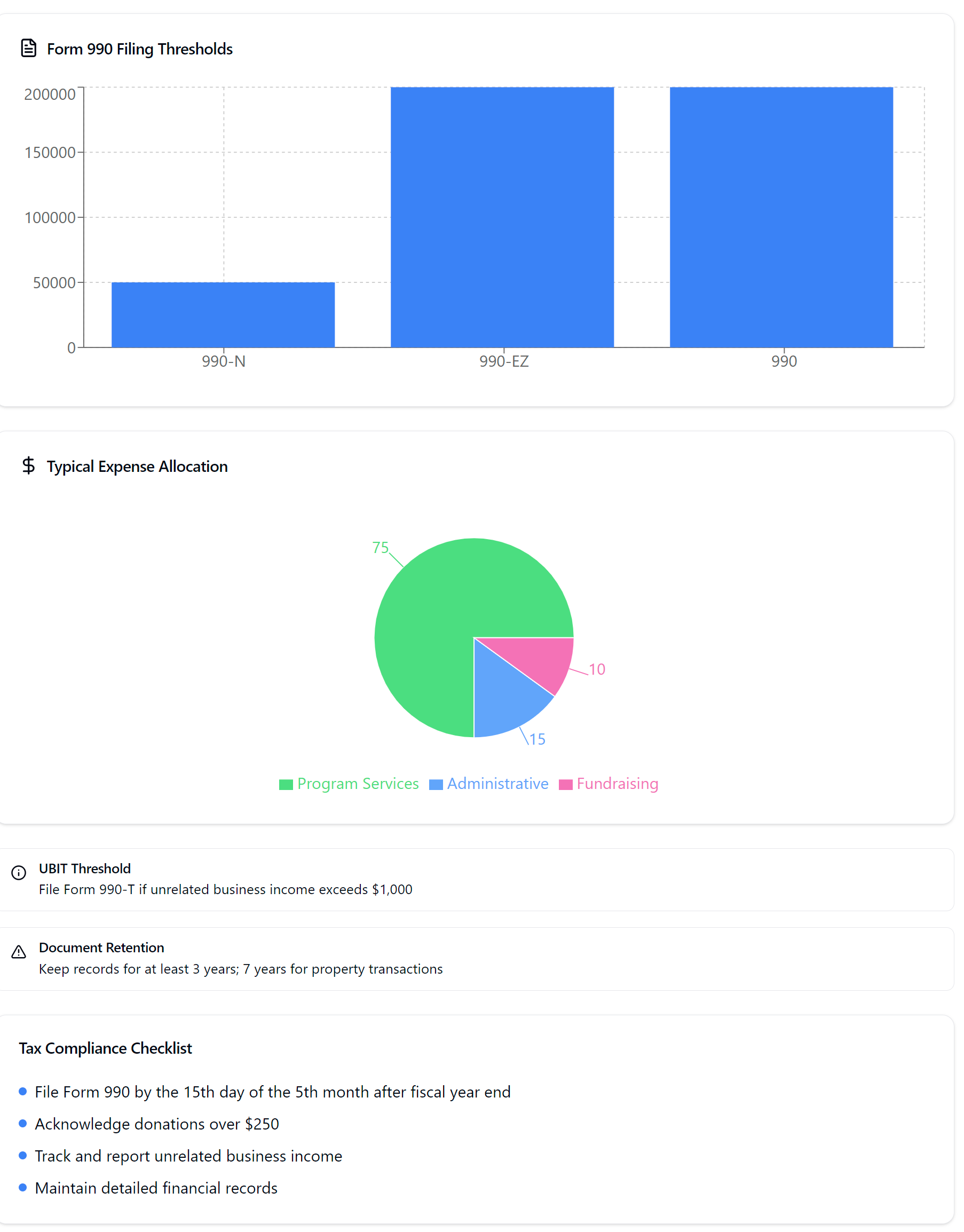

Here’s the thing: There isn’t just one Form 990! The version you file depends on your organization’s size and financial activity.

- Form 990-N (e-Postcard): For smaller organizations with gross receipts typically less than $50,000.

- Form 990-EZ: For those with gross receipts less than $200,000 and total assets less than $500,000.

- Form 990: For larger organizations with gross receipts of $200,000 or more, or total assets of $500,000 or more.

Regardless of which form you file, be prepared to provide detailed information about your mission, programs, governance, and finances.

Action Steps:

- File accurately and on time! The deadline is the 15th day of the fifth month after your fiscal year ends.

- Gather all essential financial records, board meeting minutes, and program documentation well in advance of the filing deadline.

- Use Form 990 to showcase your organization’s transparency and accomplishments to stakeholders.

The Balancing Act: Managing Your Expenses

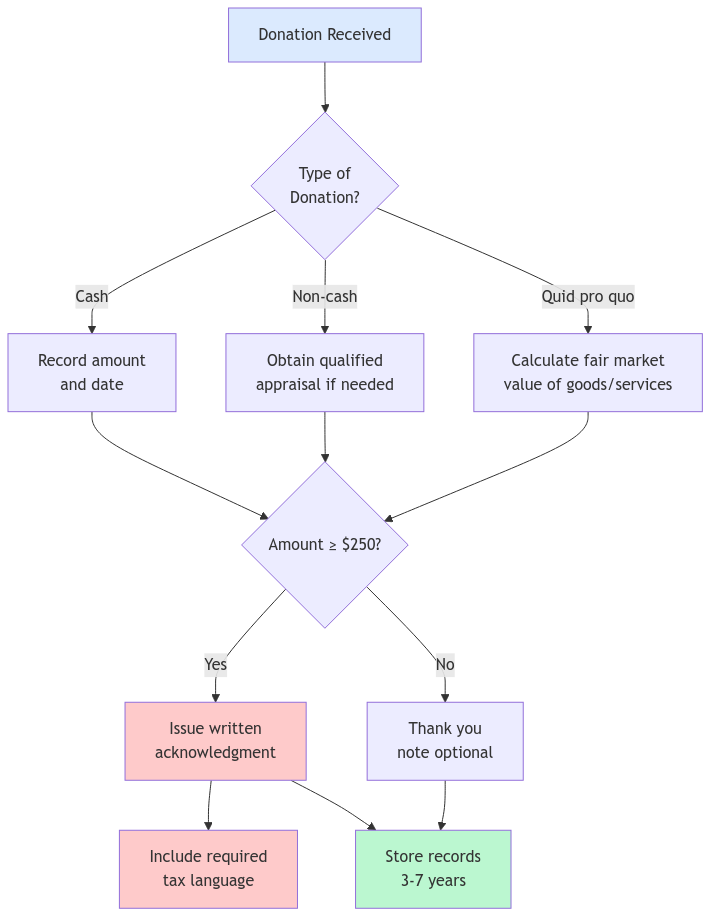

At XOA TAX, we advise our nonprofit clients to prioritize responsible stewardship of their resources. This means striking the right balance between program services, administrative costs, and fundraising expenses.

Why is this so crucial?

- Program expense ratio: This key metric reveals how much of your spending directly supports your mission. While the ideal ratio varies, a higher program expense ratio generally fosters trust with donors.

- Donor expectations: Donors want to know that their contributions are primarily funding your programs, not excessive overhead.

- IRS scrutiny: The IRS examines expense allocations to ensure nonprofits are using funds in alignment with their tax-exempt purposes.

Action Steps:

- Strive for a program expense ratio that aligns with industry standards and the nature of your organization.

- Regularly review your expense allocations to identify areas for improvement and increased efficiency.

- Be transparent about your expenses in your financial statements and Form 990.

Budgeting: Your Financial Compass

A well-crafted budget is like a compass guiding your nonprofit’s financial journey. It helps you anticipate income and expenses, allocate resources effectively, and plan for the future.

Here’s how a strong budget can benefit your organization:

- Financial forecasting: Projecting your income and expenses allows you to make informed decisions and avoid financial surprises.

- Resource allocation: Ensure your funds are strategically directed towards your programs, operations, and growth initiatives.

- Tax planning: A budget can help you identify potential tax liabilities, such as UBIT, and plan accordingly.

Action Steps:

- Involve key staff and board members in the budgeting process to gain diverse perspectives and foster buy-in.

- Regularly monitor your actual financial performance against your budget and adjust as needed.

- Consider using budgeting software specifically designed for nonprofits to streamline the process.

Unrelated Business Income Tax (UBIT): Don’t Get Caught Off Guard

UBIT often catches nonprofits off guard. It applies to income generated from activities that are unrelated to your organization’s tax-exempt purpose.

Let’s break it down:

- What is UBI? It’s income from a trade or business that you regularly carry on, and it’s not substantially related to your mission.

- Common sources of UBI: This can include advertising revenue, rental income from debt-financed property, and certain types of merchandise sales.

- Tax obligations: If your UBI exceeds $1,000, you’ll need to file Form 990-T and may owe taxes.

Action Steps:

- Carefully evaluate all your revenue streams to identify potential UBI.

- Maintain separate accounting for unrelated business activities to simplify reporting.

- Consult with a tax professional experienced in UBIT to navigate complex situations.

FAQs about UBIT

We’re a nonprofit animal shelter. We sell t-shirts with our logo at fundraising events. Is this considered UBI?

Possibly. The IRS will consider factors such as how regularly you sell merchandise, whether the sales are related to your exempt purpose (e.g., promoting your mission), and whether you’re competing with for-profit businesses. It’s best to consult with a tax professional to assess your specific situation.

We just realized that we generated some UBI last year. What should we do?

First, accurately calculate the amount of UBI. If it exceeds $1,000, you’ll need to file Form 990-T. At XOA TAX, we can guide you through this process and ensure you meet all the IRS requirements. Contact Us

Solid Accounting: The Cornerstone of Nonprofit Financial Health

Accurate and transparent accounting isn’t just a compliance requirement; it’s the cornerstone of building trust and demonstrating responsible stewardship to your donors and stakeholders. At XOA TAX, we guide our nonprofit clients to establish robust accounting practices that foster confidence and ensure long-term sustainability.

Here’s why it matters:

- Meticulous record-keeping: Maintaining detailed records not only supports your tax filings but also provides valuable data for informed decision-making. Think of it as creating a clear financial history for your organization.

- GAAP Compliance: While not always legally required, adhering to Generally Accepted Accounting Principles (GAAP) enhances the consistency and reliability of your financial reporting. This is particularly important for larger nonprofits, those receiving government grants, or those seeking to enhance transparency.

- Financial accountability: Transparent accounting builds trust with donors, grantmakers, and regulatory bodies. It demonstrates that you’re managing funds responsibly and ethically.

Action Steps:

- Implement accounting software designed specifically for nonprofits. This can streamline fund accounting, generate reports, and track restricted donations with ease.

- Conduct regular internal audits, and consider periodic external audits to ensure accountability and identify areas for improvement.

- Invest in training for your staff involved in financial management. Make sure they’re well-versed in nonprofit accounting standards and best practices.

Navigating the State and Local Tax Maze

While federal taxes often take center stage, don’t overlook the potential complexities of state and local taxes. These can vary significantly from state to state, and what applies in one location might not apply in another.

Why is this important? Many states have specific requirements for nonprofits, even those with federal tax-exempt status. Failing to comply with state and local regulations could lead to penalties, fines, or even jeopardize your organization’s ability to operate.

Here are some common state-level requirements to be aware of:

- State income tax: While many states exempt nonprofits from income tax, some may require filing an informational return or impose taxes on certain types of income.

- Sales tax: Nonprofits might be exempt from sales tax on purchases used for their charitable purposes, but this often requires obtaining an exemption certificate or following specific procedures.

- Property tax: Some states offer property tax exemptions for nonprofits, but eligibility criteria and application processes can vary.

- Charitable solicitation registration: Many states require nonprofits to register before soliciting donations from their residents. This typically involves providing information about your organization’s mission, finances, and governance.

- Employment taxes: Nonprofits are generally subject to state unemployment taxes and may need to withhold state income tax from employee wages.

Action Steps:

- Start with your Secretary of State: The website for your state’s Secretary of State is often a good starting point for finding information on nonprofit regulations and registration requirements.

- Check your state’s Department of Revenue: This department typically handles state tax matters and can provide guidance on sales tax exemptions, income tax obligations, and other relevant issues.

- Consult with a tax professional: If you’re operating in multiple states or dealing with complex tax situations, it’s wise to seek guidance from a qualified tax professional who understands the nuances of nonprofit taxation in your specific locations.

Handling Donations with Care: Building Trust and Ensuring Compliance

Donations are the lifeblood of many nonprofits. Managing them effectively is crucial not only for compliance but also for maintaining donor trust and encouraging continued support.

Key considerations:

- Acknowledgment requirements: The IRS requires nonprofits to provide written acknowledgments for donations above certain thresholds (currently $250). These acknowledgments must include specific information, such as the donation amount and a statement that no goods or services were provided in exchange for the contribution, if that’s the case.

- Quid pro quo contributions: If a donor receives goods or services in exchange for a donation (think of a charity gala with a ticket price), there are specific disclosure requirements.

- Non-cash donations: Receiving donations of property, stock, or other non-cash items triggers specific rules for valuation and acknowledgment.

Action Steps:

- Issue acknowledgment letters promptly, ensuring they include all the required information.

- Accurately value non-cash donations. If someone donates a valuable piece of art, for instance, you’ll need to obtain a qualified appraisal.

- Keep detailed records of all donations for at least three years, as required by the IRS. For certain documents, such as those related to property transactions, a longer retention period of seven years may apply.

Financial Ratios: A Checkup for Your Nonprofit’s Financial Health

Think of financial ratios as a regular health checkup for your nonprofit. Analyzing key ratios provides valuable insights into your organization’s financial performance, stability, and efficiency.

Some key ratios to track:

- Program efficiency ratio: This measures the percentage of your expenses dedicated to program services. A higher ratio generally indicates greater efficiency in fulfilling your mission.

- Operating reliance ratio: This shows the extent to which your organization relies on unrestricted funds to cover expenses. A high ratio might indicate vulnerability to fluctuations in funding.

- Liquidity ratios: These assess your organization’s ability to meet short-term obligations. They provide a snapshot of your financial health and stability.

Action Steps:

- Make ratio analysis a regular part of your financial reviews.

- Compare your ratios against industry benchmarks or similar organizations to see how you measure up.

- Use the insights gained from ratio analysis to inform your budgeting, fundraising, and program development strategies.

Audit Preparedness: Ensuring Transparency and Accountability

While no one relishes the thought of an audit, being prepared is essential for safeguarding your nonprofit’s assets, ensuring compliance, and maintaining your reputation.

Key aspects of audit preparedness:

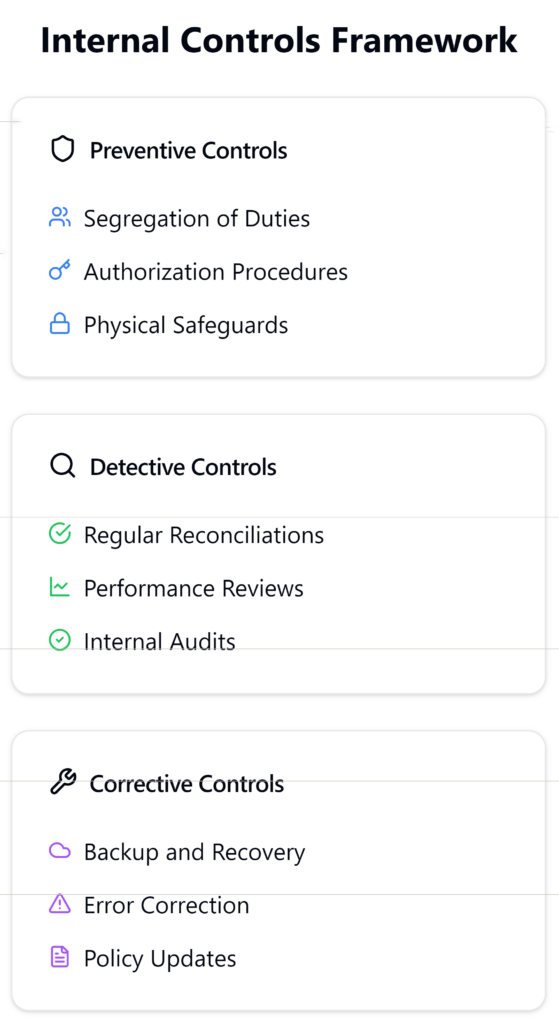

- Strong internal controls: These are the policies and procedures you put in place to prevent errors, deter fraud, and ensure accurate financial reporting. This might include things like segregation of duties, authorization procedures, and regular reconciliations.

- Audit readiness: Maintaining organized records, documenting your processes, and understanding your tax obligations will make the audit process smoother and less stressful.

- Regulatory compliance: Nonprofits are subject to certain provisions of the Sarbanes-Oxley Act, such as whistleblower protections and document retention policies.

Action Steps:

- Develop and regularly update your financial policies and procedures.

- Implement segregation of duties. This means separating financial responsibilities among different staff members to create checks and balances.

- Conduct periodic internal audits or “mock audits” to identify and address potential issues before an external auditor comes knocking.

Need Help Navigating the Nonprofit Tax Maze?

We understand that managing your nonprofit’s finances can be overwhelming. That’s where XOA TAX comes in. Our team of experienced CPAs specializes in nonprofit tax management. We can provide expert guidance, answer your questions, and help you stay compliant with all the ever-changing regulations.

Contact us today for a free consultation!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime