Selling online presents fantastic opportunities, but navigating the tax landscape can be challenging. Whether you’re a seasoned e-commerce pro or just starting a print-on-demand side hustle, understanding your tax obligations is essential for success. At XOA TAX, we empower online business owners like you to approach tax season with confidence.

Key Takeaways

- All income generated from online sales is taxable, regardless of the amount.

- Sales tax and nexus are critical concepts for online sellers to master.

- Numerous expenses are deductible for e-commerce and print-on-demand businesses.

- Accurate record-keeping is vital for tax compliance.

- Professional guidance can save you time and money.

Understanding Your Tax Obligations

The IRS considers all income from online sales taxable, regardless of whether you’re selling digital downloads on Etsy, handcrafted goods on Shopify, or t-shirts through Amazon Merch on Demand. This includes hobby income, which many new online sellers may mistakenly believe is non-taxable. Failing to report online sales can lead to penalties and back taxes.

For a detailed explanation of business income and reporting requirements, refer to the IRS Publication 334, Tax Guide for Small Business.

Active vs. Self-Employment Income in the Print-on-Demand World

Print-on-demand (POD) businesses can generate both active and self-employment income, each with different tax implications:

- Active Income: If you actively manage your own website, marketing, and customer service, your POD business operates similarly to a traditional e-commerce store. You’re responsible for collecting and remitting sales tax, and your profits are considered active business income.

- Self-Employment Income: If you sell through platforms like Amazon Merch on Demand, Redbubble, or TeePublic, these platforms often handle sales tax and customer service. However, your share of the profits is still considered taxable income, typically categorized as self-employment income, subject to self-employment tax.

Understanding this distinction is vital for accurate tax reporting. While platforms like those mentioned above may simplify certain aspects, it’s essential to consult a tax professional to ensure you meet all your obligations.

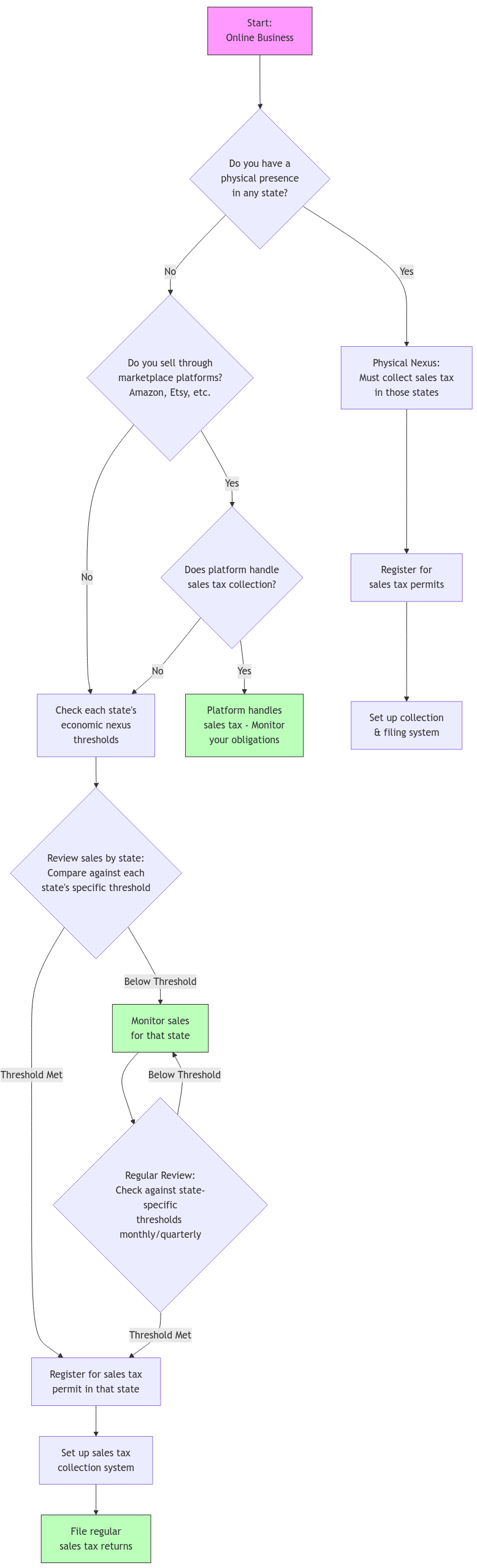

Mastering Sales Tax and Nexus for Online Sellers

Sales tax can be a significant challenge for online businesses. The concept of nexus plays a crucial role. Nexus is the connection your business has with a state that triggers the requirement to collect and remit sales tax in that state.

Traditionally, nexus was established through a physical presence (e.g., a store, warehouse, or office). However, the Supreme Court decision in South Dakota v. Wayfair, Inc. significantly changed the landscape. This ruling enabled states to require businesses with no physical presence to collect sales tax based on economic activity within the state (economic nexus).

Determining Nexus

Many states have adopted economic nexus laws, typically based on exceeding a certain threshold of sales or number of transactions within the state. These thresholds vary significantly by state. Common thresholds are $100,000 in sales or 200 transactions, but it’s crucial to understand the specific laws in each state where you make sales.

Resources

- State Tax Agencies: Each state has its own tax agency with information on sales tax registration, rates, and filing requirements. [Link to a directory of state tax agencies needed here]

- Sales Tax Calculators: Tools are available online to help calculate sales tax for different locations.

Marketplace Facilitator Laws

Many states have implemented marketplace facilitator laws, which shift the responsibility of collecting and remitting sales tax from individual sellers to the marketplace platform itself (e.g., Amazon, Etsy). If you sell through a marketplace facilitator, you generally don’t need to collect sales tax yourself, but you should confirm this with the platform and your tax advisor.

Automated Sales Tax Solutions

Consider using automated sales tax solutions like TaxJar or Avalara. These tools can help you track your sales, determine where you have nexus, and automate the process of collecting and filing sales tax returns.

Claiming Deductible Expenses for Your Online Business

As an online business owner, you can deduct a variety of expenses to reduce your taxable income. Accurate record-keeping is crucial to maximize these deductions.

Common Deductible Expenses

- Home Office: If you have a dedicated space in your home used exclusively for your business, you may be able to deduct a portion of your rent or mortgage interest, utilities, and other home-related expenses. You can calculate this deduction using the simplified method ($5 per square foot up to 300 square feet) or the regular method, which requires more detailed calculations.

- Marketing and Advertising: This includes costs for online advertising, social media promotion, email marketing, and website maintenance.

- Software and Subscriptions: Expenses for design software, e-commerce platforms, accounting software, and other essential tools are often deductible.

- Inventory: If you sell physical products, the cost of goods sold (COGS) is deductible.

- Professional Services: Fees for legal, accounting, or other professional services related to your business can be deductible.

Record-Keeping Best Practices for Online Businesses

Maintaining organized financial records is essential for tax purposes and overall business management.

- Cloud-Based Accounting Software: Invest in reputable accounting software like QuickBooks Online or Xero to streamline your bookkeeping and financial reporting.

- Separate Bank Accounts: Open a dedicated business bank account to keep your personal and business finances separate.

- Track All Expenses: Use a business credit card and track every expense, no matter how small. Consider using expense tracking apps or software.

- Maintain Detailed Sales Records: Keep detailed reports of all sales from each platform you use.

Understanding Self-Employment Tax

If you’re self-employed, you’ll generally need to pay self-employment tax, which covers Social Security and Medicare taxes. The self-employment tax rate for 2024 is 15.3% (12.4% for Social Security and 2.9% for Medicare). You can calculate your self-employment tax using Schedule SE (Form 1040), Self-Employment Tax.

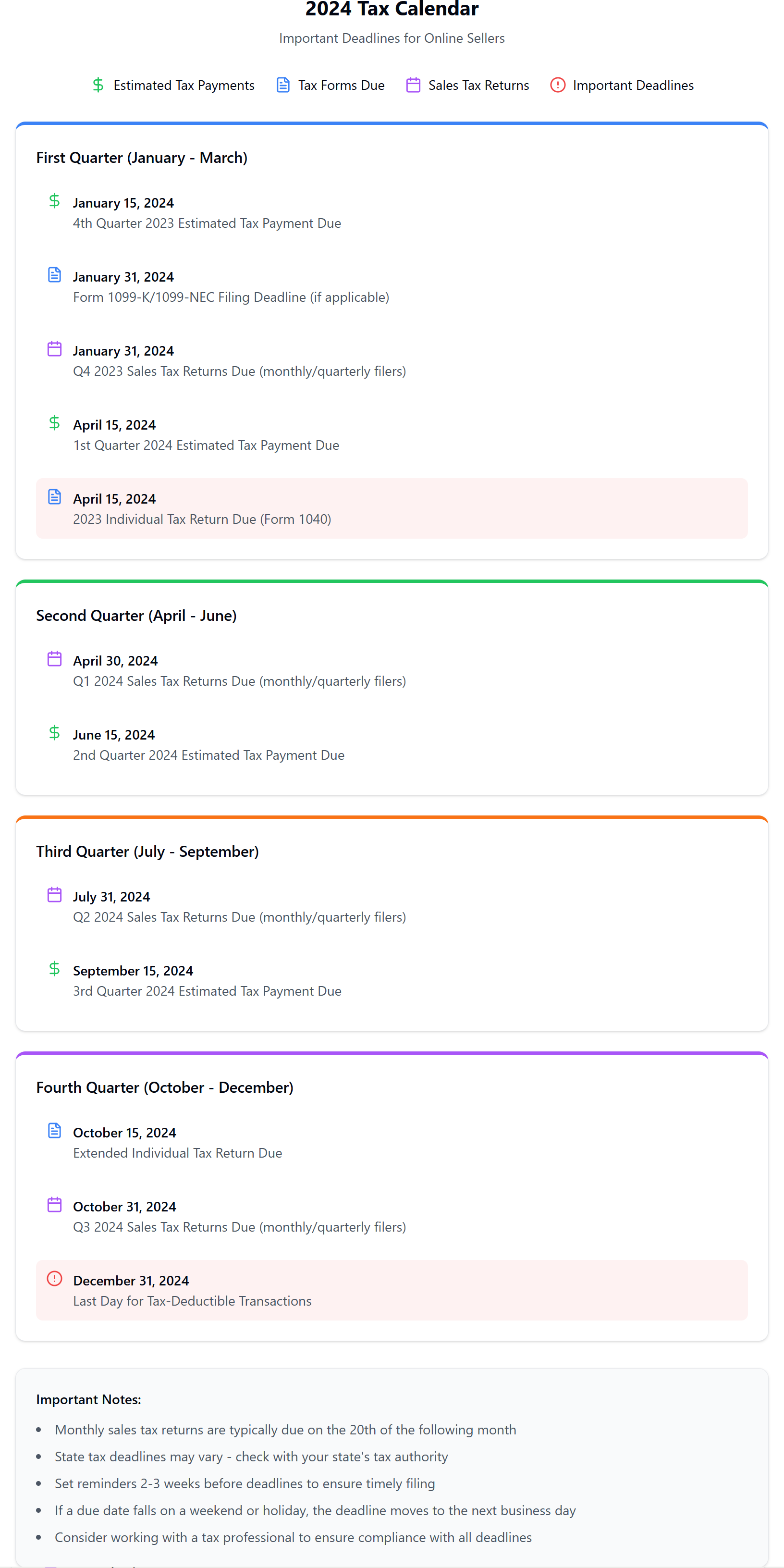

Estimated Taxes: Paying as You Go

If you expect to owe $1,000 or more in taxes when you file your return, you’ll likely need to make estimated tax payments throughout the year. These payments help you avoid penalties for underpayment of taxes. You can calculate and pay estimated taxes using IRS Form 1040-ES, Estimated Tax for Individuals.

Don’t Forget State Income Taxes

In addition to federal income tax, you may also owe state income tax, depending on your state of residence and the states where you conduct business. Be sure to check your state’s tax laws and filing requirements.

Form 1099-K Reporting

For the 2024 tax year (filed in 2025), if you receive payments through third-party payment networks such as PayPal or Venmo, and your gross payments exceed $5,000 during the year, you’ll receive Form 1099-K. This form reports your payment transactions to the IRS. The IRS has announced plans to phase in the $600 reporting threshold, with a $5,000 threshold set for 2024 to facilitate a smoother transition.

Maximizing Opportunities and Diversifying Income Streams

Expanding your online business with digital products, online courses, or membership programs can diversify your income and potentially open up new tax planning strategies. However, each new income stream comes with its own set of tax implications. Consult with a tax professional at XOA TAX to explore how diversification can affect your tax situation.

Checklist for New Online Sellers

- Obtain an EIN: If you’re operating as a sole proprietorship, you may not need an EIN, but it can be helpful for opening business bank accounts and establishing business credit.

- Choose a Business Structure: Decide on the best business structure for your needs (sole proprietorship, LLC, partnership, etc.).

- Understand Sales Tax: Research your state’s sales tax laws and register for a sales tax permit if necessary.

- Track Your Income and Expenses: Set up a system for tracking all income and expenses related to your business. [Link to a sample expense tracking spreadsheet needed here]

- Consider Estimated Taxes: Determine if you need to make estimated tax payments throughout the year.

- Consult with a Tax Professional: Seek guidance from a qualified tax professional to ensure you’re meeting all your tax obligations.

Important Tax Dates for Online Sellers

Staying organized and meeting deadlines is crucial for tax compliance. Here’s a summary of key tax dates to keep in mind:

- Federal Estimated Taxes:

- April 15th, 2024

- June 15th, 2024

- September 15th, 2024

- January 15th, 2025

- Federal Tax Return:

- April 15th, 2025 (for the 2024 tax year)

- State Taxes: State tax deadlines vary. Check your state’s tax agency website for specific due dates.

- Sales Tax: Sales tax filing frequencies and deadlines vary by state.

International Tax Considerations for Online Sellers

If you sell to customers outside the United States, you may have international tax obligations. Here are some key points to consider:

- VAT (Value-Added Tax): If you sell to customers in the European Union, you may need to register for VAT and collect it on your sales. VAT rates and regulations vary by country. [Link to a resource on VAT for online sellers needed here]

- GST (Goods and Services Tax): If you sell to customers in Canada, you may need to register for GST/HST and collect it on your sales.

- International Payment Processing: Be aware of potential tax implications related to international payment processing and currency conversions. Consult with a tax professional for guidance.

Digital Products and Taxes

The taxation of digital products can be complex and varies by location. Here are some key considerations:

- State-Specific Taxation: Different states have different rules for taxing digital goods. Some states may impose sales tax, while others may not. [Link to resources on state taxation of digital products needed here]

- International Digital Product Tax: Many countries have implemented or are considering digital service taxes or other consumption taxes on digital products sold to their residents.

- Record-Keeping: Maintain detailed records of your digital product sales, including customer information and sales dates.

The Value of Professional Guidance

Navigating the complexities of online business taxes can be challenging. At XOA TAX, we provide personalized guidance tailored to your specific needs. We can help you:

- Minimize your tax liability: We identify all applicable deductions and credits to ensure you’re paying only what you owe.

- Stay compliant with tax laws: We keep abreast of the latest regulations to ensure your business remains in good standing.

- Focus on Growing Your Business: By handling your tax planning and preparation, we free up your time and energy to focus on what you do best.

FAQs

Do I need to pay taxes if I only sell a few items online?

Yes, all income is taxable, even if it’s from occasional online sales. It’s important to report all income to the IRS to avoid penalties.

How do I know if I have nexus in a state?

Nexus is generally triggered by having a physical presence or exceeding a certain threshold of sales within a state. Each state has its own specific rules. You can find more information on state tax agency websites or consult with a tax professional.

What records do I need to keep for my online business?

Essential records include income and expense reports, sales records, invoices, bank statements, and any documentation related to deductions. [Link to a sample expense tracking spreadsheet needed here]

Can I deduct my home internet expenses?

If you have a dedicated home office space, you may be able to deduct a portion of your internet expenses. The IRS provides specific guidelines for the home office deduction.

What are some common audit triggers for online businesses?

Some common audit triggers include large home office deductions, excessive business expenses, and inconsistencies between reported income and bank deposits. It’s crucial to maintain accurate records and categorize expenses correctly.

Connecting with XOA TAX

We understand the unique challenges faced by online entrepreneurs. Our team at XOA TAX can help you navigate sales tax, nexus, deductions, and all other aspects of tax planning and compliance. Contact us today to schedule a consultation and gain peace of mind knowing your taxes are handled correctly.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime