As a small business owner, you’re juggling multiple roles, and managing your finances effectively is crucial. One key aspect of this is deciding how to pay yourself. Should you take an owner’s draw or pay yourself a salary? This in-depth guide will explore the differences, benefits, and tax implications of each method, helping you make an informed decision for the 2024 tax year.

Key Takeaways

- Salary vs. Draw: A salary is a regular, fixed payment like any other employee, while a draw is taking funds directly from your business profits as needed.

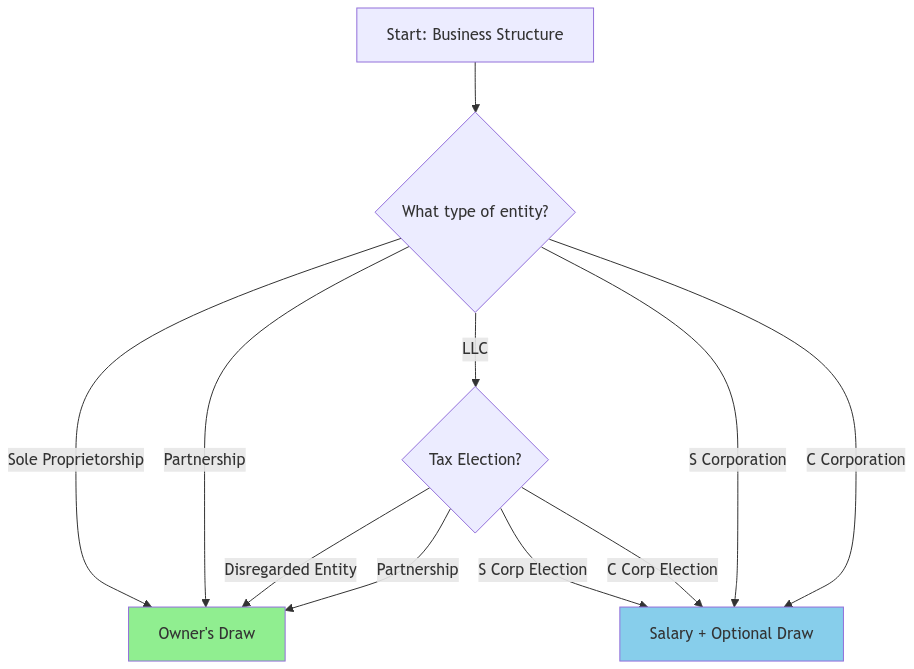

- Business Structure Matters: The best way to pay yourself depends heavily on how your business is legally structured (sole proprietorship, partnership, LLC, S Corp, etc.).

- Pros and Cons: Both methods have advantages and disadvantages, with different tax implications.

- Record Keeping is Key: No matter which method you choose, thorough record keeping is essential for tax purposes and financial health.

- “Reasonable Compensation” Can Be Tricky: The IRS has rules for “reasonable compensation” for S Corp owners, and navigating these can be subjective.

- XOA TAX Can Help: Our expert CPAs can provide personalized guidance to help you make informed decisions about your compensation and tax planning.

Owner’s Draw vs. Salary: Understanding the Basics

Before we delve into the details, let’s clarify the fundamental difference between these two methods:

Understanding Owner’s Draw

Think of an owner’s draw as taking money out of your business when needed. This method offers flexibility, allowing you to adjust the amount and frequency based on your business’s financial performance. Need extra cash to cover a personal expense? If your business is doing well, you can take a larger draw. However, it’s important to remember that draws directly reduce your business equity and aren’t subject to payroll taxes at the time of withdrawal. This means you’ll need to plan ahead for your tax liability at the end of the year.

Understanding Salary

With the salary method, you become an employee of your own company. You receive a fixed amount at regular intervals, just like your team members. This offers predictability and stability for personal budgeting. Salaries are subject to payroll taxes (Social Security and Medicare), which are automatically withheld from each paycheck. This can simplify tax calculations throughout the year.

Pros and Cons: A Quick Comparison

| Feature | Owner’s Draw | Salary |

|---|---|---|

| Flexibility | High; adjust as needed based on business performance | Low; fixed payments |

| Taxes | Not withheld from draws; paid at tax time | Withheld from each paycheck |

| Predictability | Can be unpredictable; depends on business profits | Predictable income; aids in budgeting |

| Equity | Reduces business equity | Does not directly reduce equity |

| Compliance | Less complex | Requires compliance with employment laws and regulations |

Which Payment Method is Right for You?

The optimal choice depends on several factors, including your business structure, personal financial needs, and risk tolerance. Here’s a general guideline:

| Business Entity | Recommended Payment Method |

|---|---|

| Sole Proprietorship | Draw Method |

| Partnership | Draw Method |

| LLC | Varies based on your tax election. Consult a tax professional for personalized advice. |

| S Corp | Salary Method (must pay yourself a “reasonable salary”) |

| C Corp | Salary Method |

For S Corporations: Paying yourself a reasonable salary is an IRS requirement. This ensures you’re not taking excessive draws to avoid paying payroll taxes.

How to Pay Yourself: A Step-by-Step Guide

- Determine Your Method: Based on your business structure and individual needs, choose the salary or draw method.

- Set a Reasonable Salary (if applicable): Research industry standards and ensure your salary aligns with your role and responsibilities.

- Schedule Payments: Establish a regular pay schedule for salary or determine the frequency of your draws.

- Record Everything: Maintain accurate records of all payments in your accounting system.

- Handle Taxes: Withhold taxes for salary payments and set aside funds for income and self-employment taxes if taking draws.

Tax and Compliance Considerations

Sole Proprietors and Partnerships

- Profits are considered personal income, regardless of draw amounts.

- You’ll be responsible for self-employment taxes (Social Security and Medicare) on your net profit, currently at a rate of 15.3% (12.4% for Social Security on the first $160,200 of net earnings and 2.9% for Medicare).

- Legitimate business expenses can be deducted to reduce taxable income.

LLCs

- Taxation depends on how the LLC is structured (disregarded entity, partnership, or corporation).

- Single-member LLCs are taxed similarly to sole proprietorships.

- LLCs taxed as partnerships follow partnership tax rules.

- LLCs taxed as corporations allow for salary payments and follow corporate tax regulations.

S Corporations

- Must pay a “reasonable compensation” as a salary.

- This prevents owners from minimizing their salary to reduce payroll taxes.

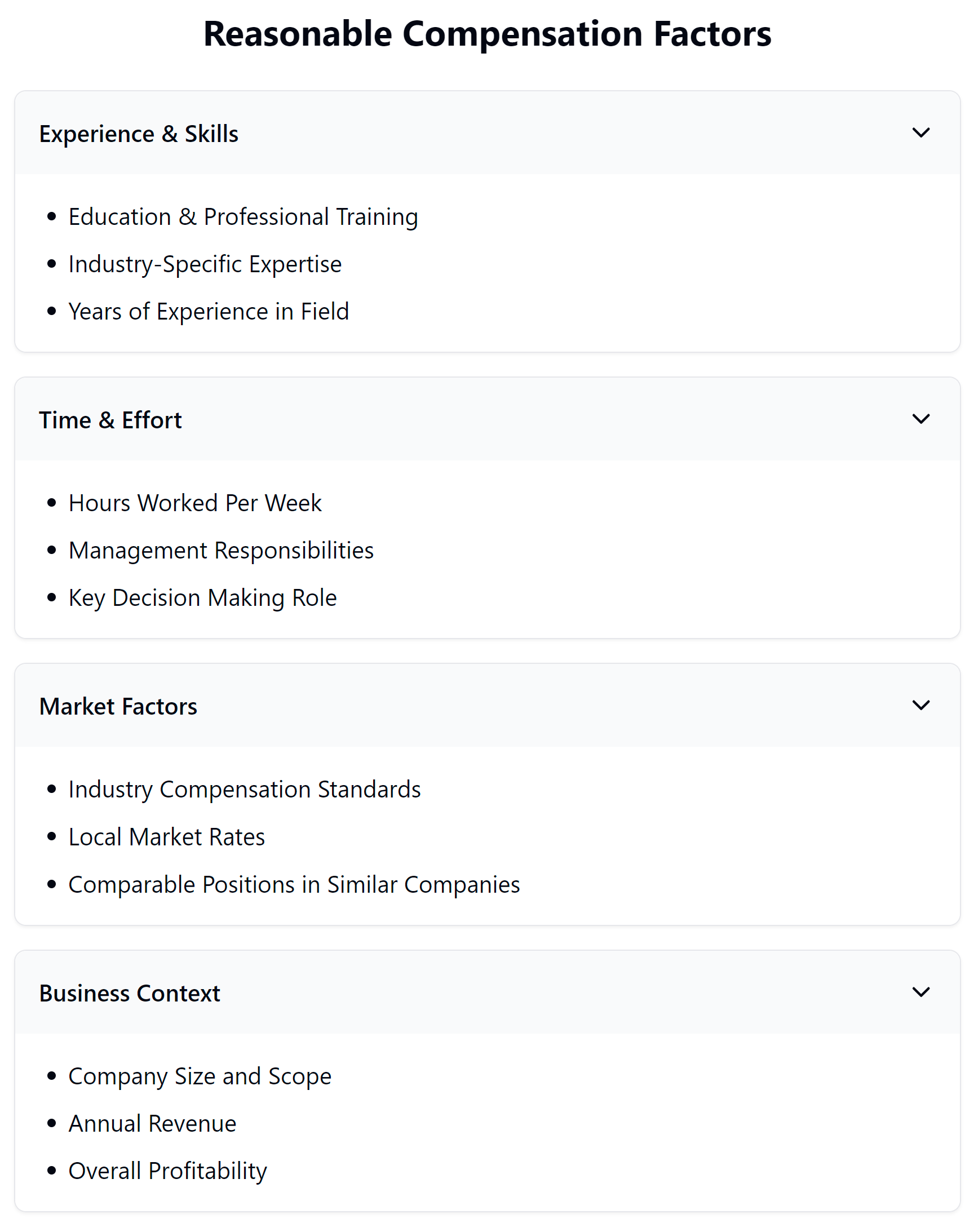

- Determining reasonable compensation can be subjective, requiring careful research and documentation. The IRS outlines factors to consider in publications like Revenue Ruling 74-44, which include training and experience, duties and responsibilities, time and effort devoted to the business, and comparable salaries for similar positions.

C Corporations

- Follow similar rules to S Corporations regarding reasonable compensation.

- May face double taxation on profits (at the corporate level and again on dividends paid to shareholders).

Reasonable Compensation: Navigating the IRS Guidelines

The IRS requires S Corp owners to pay themselves a “reasonable compensation” that reflects the market value of their work, preventing artificially low salaries to minimize taxes. While the IRS doesn’t provide a specific formula, factors considered include:

- The owner’s experience and qualifications

- The time and effort devoted to the business

- The nature and scope of the work performed

- Industry standards and comparable salaries (refer to resources like the Bureau of Labor Statistics or industry-specific salary surveys)

Challenges and Considerations

Determining reasonable compensation can be complex. There’s no one-size-fits-all formula. It’s crucial to document your decision-making process and consider seeking professional advice to ensure compliance.

Estimated Taxes: Planning Ahead

Whether you choose a salary or draw, it’s important to understand your estimated tax obligations. If you expect to owe $1,000 or more in taxes when you file, you may need to make estimated tax payments throughout the year to avoid penalties. This applies to both federal and state taxes.

State-Specific Considerations

Keep in mind that state tax laws can significantly impact your payroll tax obligations and how you pay yourself. Some states have different self-employment tax rates or require additional withholdings. Be sure to research your specific state’s regulations or consult with a tax professional for guidance.

Need Help? XOA TAX is Here for You

Choosing the right payment method and navigating the complexities of tax compliance can be challenging. At XOA TAX, our experienced CPAs can provide personalized guidance tailored to your unique situation. We can help you:

- Determine the best payment method for your business structure

- Calculate a reasonable salary for S Corp owners

- Develop a tax planning strategy to minimize your liability

- Ensure accurate record-keeping and compliance with IRS regulations

Connect with us today to schedule a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime