Imagine this: you’ve invested in a rental property to generate some extra income and build long-term wealth. But instead of profits, you’re facing losses in the early years. The good news is, the tax code allows you to deduct these passive losses (PALs) against other income – but there’s a catch. There’s an income threshold that hasn’t been adjusted for inflation in decades, potentially limiting your ability to claim this deduction. Let’s break down this outdated rule and explore some strategies to help you navigate it.

Key Takeaways

- The $150,000 income threshold for deducting passive real estate losses has not been adjusted for inflation since 1986.

- This static threshold, found in Internal Revenue Code Section 469, can prevent many taxpayers from taking full advantage of the passive loss deduction.

- There are strategies available to help you manage this limitation, such as qualifying as a real estate professional or actively participating in rental activities.

- Consulting a tax professional is crucial to optimize your tax strategy when dealing with passive activity losses.

Understanding Passive Activity Losses (PALs)

First things first, what exactly are passive activity losses (PALs)? The IRS defines passive activities as trade or business activities in which you don’t materially participate. Think rental real estate, limited partnerships, or businesses where you’re not actively involved in day-to-day operations.

Now, if your rental property or other passive activity generates a loss, you can generally use that loss to offset income from other passive activities. But what about offsetting your regular income, like your salary? That’s where the $150,000 income limit comes in.

The $150,000 Question: Why is This Threshold a Problem?

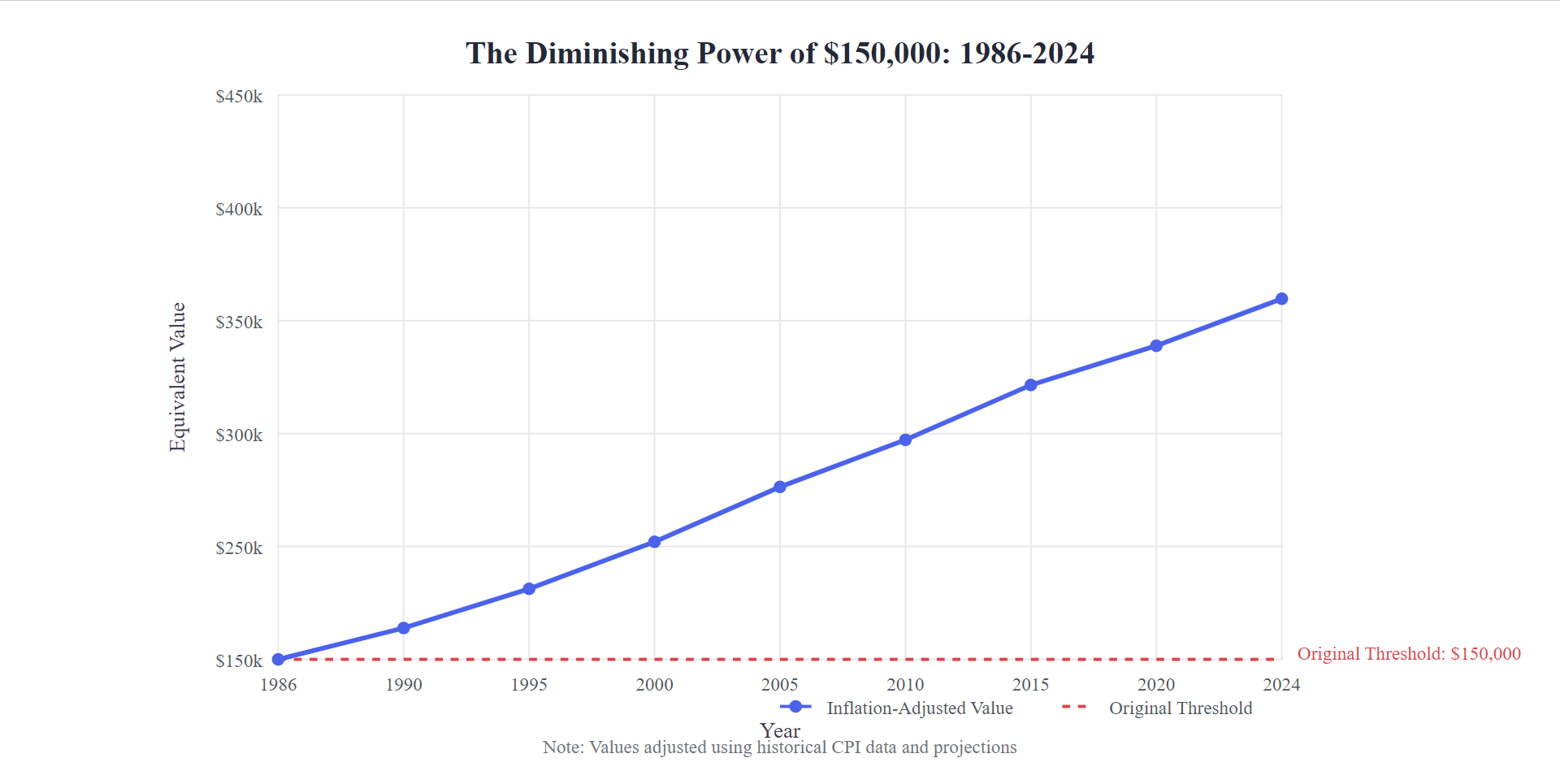

The $150,000 threshold for deducting passive losses was established by the Tax Reform Act of 1986. The problem? It hasn’t been adjusted for inflation since then! In 1986, $150,000 was a significant income. Today, with inflation, that’s closer to $400,000. This means that many taxpayers who wouldn’t have been affected in 1986 are now exceeding the limit and losing out on valuable deductions.

This graph illustrates how inflation has significantly diminished the real value of the $150,000 passive activity loss threshold since its introduction in 1986. While the threshold remains fixed at $150,000 (shown by the red dashed line), its equivalent purchasing power has increased to approximately $421,000 in 2024 (blue line). This means that today's threshold effectively impacts many more taxpayers than originally intended in 1986, as the unchanged limit has lost nearly two-thirds of its real value over the past 38 years. Data adjusted using Consumer Price Index (CPI) historical data and projections.Strategies for Managing Passive Activity Loss Limitations

1. Becoming a Real Estate Professional

If you spend a significant amount of time in real estate activities, you might qualify as a real estate professional in the eyes of the IRS. This designation allows you to deduct rental real estate losses against your other income without being subject to the passive activity loss rules.

To qualify, you generally need to meet these requirements:

- More than half of your personal services during the year are performed in real estate businesses.

- You perform more than 750 hours of services in real estate businesses during the year.

It’s important to maintain detailed records of your time spent on real estate activities, as the IRS may require you to substantiate this claim during an audit. A detailed hourly log, categorized by activity and property, can be invaluable in this situation.

2. Active Participation in Rental Activities

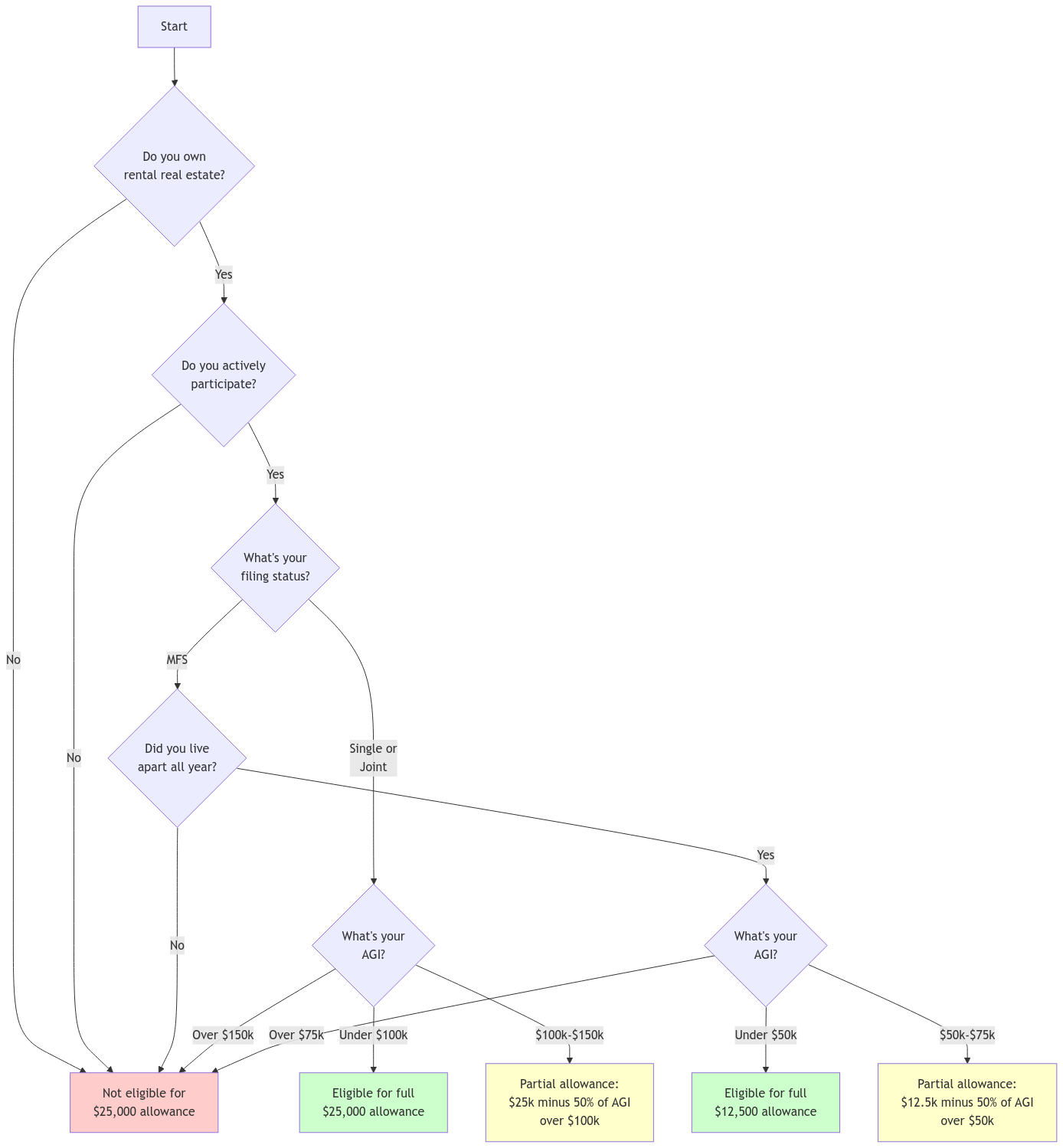

Even if you don’t meet the real estate professional criteria, you can still benefit from a partial deduction if you actively participate in your rental activity. Active participation involves making management decisions, such as approving tenants, setting rental terms, and authorizing repairs.

If you qualify, you can deduct up to $25,000 in passive losses against your other income. However, this is subject to a phase-out between $100,000 and $150,000 of adjusted gross income (AGI). For every dollar your AGI exceeds $100,000, the $25,000 allowance is reduced by 50 cents. This means the deduction is completely phased out at $150,000 AGI.

Important Note: Married individuals filing separately and who lived apart at all times during the year have a special limitation. Their phase-out begins at $50,000 and ends at $75,000.

3. Strategic Tax Planning

Sometimes, careful planning can help you stay below the income threshold or maximize your deductions. This could involve strategies like:

- Deferring income: If you’re close to the threshold, consider deferring some income to the next tax year. This could involve strategies like delaying the receipt of bonuses or capital gains.

- Accelerating deductions: You might be able to accelerate certain deductions into the current year to reduce your adjusted gross income. This could include prepaying property taxes or making charitable contributions.

4. Grouping Elections

The IRS allows taxpayers to group multiple activities together and treat them as a single activity for purposes of the passive activity loss rules. This can be beneficial if you have some profitable rental properties and some that are generating losses. By grouping them together, you can potentially offset the losses against the profits and avoid the limitations. This strategy requires careful consideration and is subject to specific rules outlined in Regulation 1.469-4.

FAQ Section

Q: How do I know if I materially participate in an activity?

A: The IRS has specific rules for determining material participation. Generally, you need to be significantly involved in the activity’s operations on a regular, continuous, and substantial basis. The IRS outlines seven tests to determine material participation, and you only need to meet one to qualify. These tests include:

- Participation for 500 hours or more during the year.

- Your participation constitutes substantially all of the participation in such activity by all individuals, including non-owners.

- You participate for more than 100 hours during the year, and you participate at least as much as any other individual (including non-owners).

- The activity is a “significant participation activity” (meaning you participate for more than 100 hours), and your aggregate participation in all significant participation activities during the year exceeds 500 hours.

- You materially participated in the activity for any five taxable years (whether or not consecutive) during the ten taxable years that immediately precede the taxable year.

- The activity is a personal service activity, and you materially participated in the activity for any three taxable years (whether or not consecutive) preceding the taxable year.

- Based on all the facts and circumstances, you participate in the activity on a regular, continuous, and substantial basis during such year.

Q: Can I carry forward unused passive losses?

A: Yes, you can generally carry forward any passive losses that you can’t deduct in the current year. These losses can be used to offset passive income in future years or deducted in full when you sell the passive activity.

Q: Does the $150,000 threshold apply to all types of passive income?

A: The $150,000 threshold specifically applies to the phase-out of the $25,000 special allowance for rental real estate activities with active participation. The basic passive activity loss rules, including the complete disallowance of passive loss deductions above $150,000 of AGI, apply to all passive activities.

Important Considerations

State Tax Implications: While this post focuses on federal tax rules, it’s important to note that states may have their own rules regarding passive activity losses. For example, some states may have lower income thresholds or different requirements for material participation.

Recordkeeping: Maintaining thorough and accurate records is crucial when claiming passive activity loss deductions. This includes records of your time spent on real estate activities, rental income and expenses, and any other relevant documentation. Contemporaneous records, meaning those created at the time the activity occurs, are generally given more weight by the IRS. Examples include:

Maintaining a detailed logbook: Use a logbook or spreadsheet to track your hours spent on each real estate activity

- Keeping a calendar of events: Mark important dates and deadlines on a calendar, including meetings, property showings, and maintenance appointments.

- Saving receipts and invoices: Keep all receipts and invoices related to your rental properties, including those for repairs, supplies, and property management fees.

- Documenting communications: Maintain records of emails, letters, and phone calls related to your rental activities.

Self-Rental and Related Party Transactions: Be aware that special rules apply to self-rental situations (where you rent property to yourself or your business) and transactions with related parties. These transactions may be subject to stricter scrutiny by the IRS.

Don’t Forget These Factors

Net Investment Income Tax (NIIT): Passive activity income, including rental income, can be subject to the 3.8% Net Investment Income Tax if your modified adjusted gross income exceeds certain thresholds.

At-Risk Rules: The at-risk rules limit the amount of loss you can deduct to the amount you have at risk in the activity. This means you can generally only deduct losses up to the amount you’ve invested in the activity, plus any recourse debt you’re personally liable for.

Cost Segregation Studies: A cost segregation study can help you accelerate depreciation deductions on your rental property by identifying and classifying building components with shorter depreciation lives. This can help increase your current year deductions and potentially reduce your taxable income.

Regular Taxpayers vs. Real Estate Professionals: Rental Activity Tax Treatment

| Aspect | Regular Taxpayer | Real Estate Professional |

|---|---|---|

| Loss Deduction Limit | Up to $25,000 maximum (subject to phase-out) | Unlimited (no dollar limit) |

| Income Limitations |

– Phase-out begins at $100,000 AGI – Complete phase-out at $150,000 AGI | No income limitations |

| Offset Against Other Income | Limited – only through special allowance | Can offset against all types of income |

| Hour Requirements | Only needs to meet “active participation” (no specific hour requirement) |

– 750+ hours in real estate activities – More than 50% of all personal services |

| Documentation Needed | Basic records of management decisions | Detailed, contemporaneous logs of all hours and activities |

| Net Investment Income Tax | Rental income generally subject to NIIT | May avoid NIIT if qualifying as real business |

| Grouping Activities | Limited grouping options | Can group real estate activities together |

| At-Risk Limitations | Still applies | Still applies |

| Carry Forward Rules | Losses above limits carry forward | Generally no carry forward needed (immediate deduction) |

| Multiple Properties | Each property subject to same limitations | Can aggregate properties to meet hour requirements |

Connecting with XOA TAX

Navigating the complexities of passive activity loss rules can be challenging. At XOA TAX, our experienced CPAs can help you understand these rules, assess your eligibility for deductions, and develop a tax strategy tailored to your unique situation. We can also help you explore other tax planning opportunities to optimize your overall tax liability.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime