Planning for retirement is a marathon, not a sprint. But sometimes, life throws unexpected hurdles your way, and you might need access to your retirement funds before age 59 ½. While dipping into your 401(k) early can seem like a solution, it’s crucial to understand the potential consequences. Let’s break down the rules, penalties, and exceptions surrounding early 401(k) withdrawals.

Key Takeaways

- Early 401(k) withdrawals typically incur a 10% penalty: in addition to your regular income tax rate.

- The IRS offers several exceptions to the penalty: including medical hardship, disability, and certain qualifying life events.

- Strategic planning and exploring alternatives: can help you avoid early withdrawal penalties and keep your retirement goals on track.

Understanding the Penalty

In most cases, withdrawing money from your 401(k) before age 59 ½ results in a 10% early withdrawal penalty on top of your usual individual income tax rate.

Example: If you withdraw $10,000 early, you could owe $1,000 in penalties (10% of $10,000) plus income tax on the entire $10,000, based on your tax bracket. For the 2024 tax year, the tax brackets range from 10% to 37%. You can find the latest tax rates and brackets on the IRS website.

Exceptions to the Rule

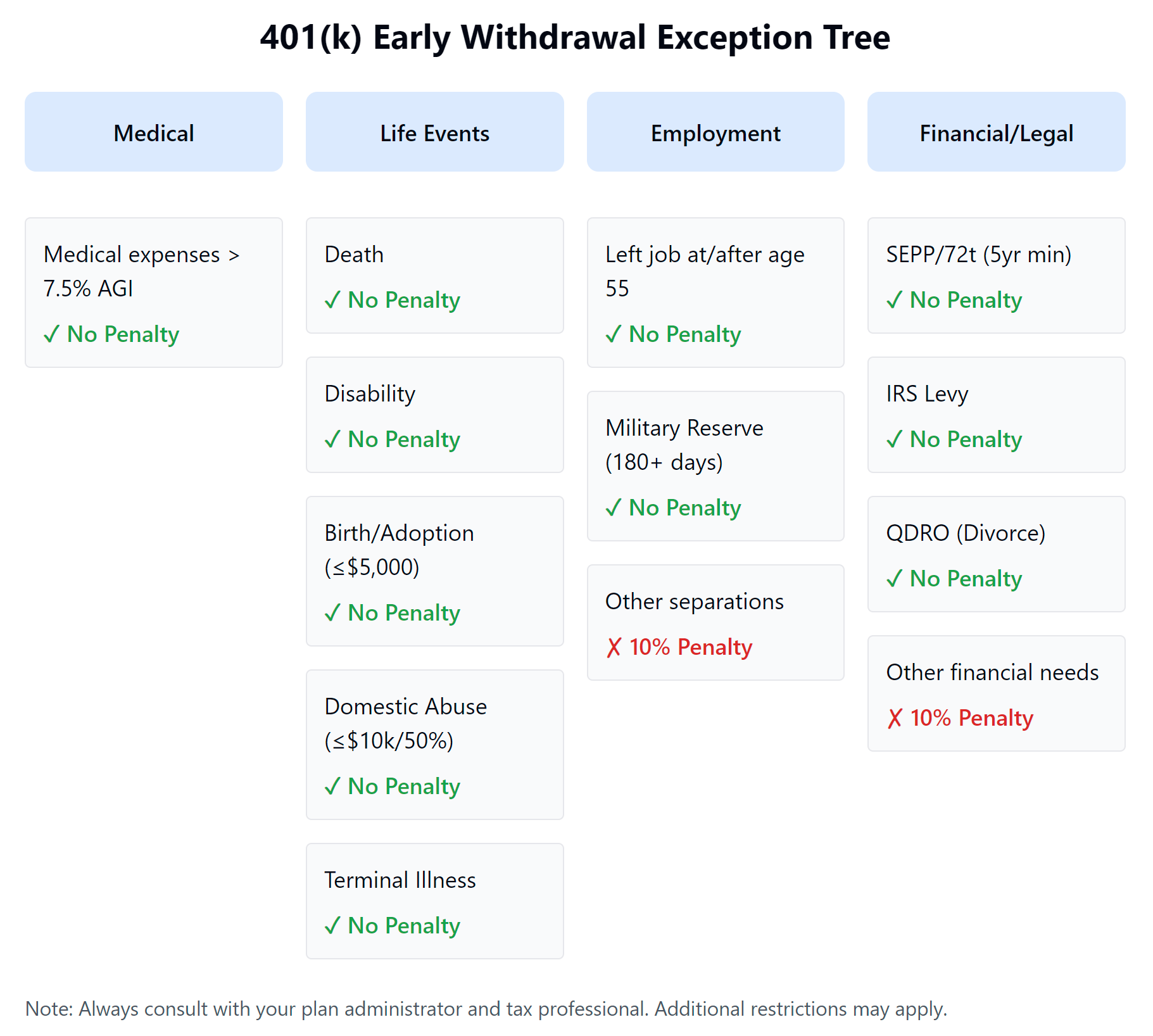

The IRS does provide some exceptions where you might be able to avoid the 10% early withdrawal penalty. You might qualify if you meet the specific requirements for any of the following:

- Unreimbursed Medical Expenses: If your unreimbursed medical expenses exceed 7.5% of your adjusted gross income (AGI), you can withdraw funds to cover the excess amount without penalty. (See IRS Publication 502 for more details.) The 7.5% AGI threshold is subject to annual adjustments for inflation.

- Total and Permanent Disability: If you become totally and permanently disabled, you can withdraw from your 401(k) penalty-free. (See IRS Publication 524 for more details.)

- Death: Beneficiaries of a deceased account holder can withdraw funds without penalty.

- IRS Levy: Withdrawals made to satisfy an IRS levy are exempt from the penalty.

- Substantially Equal Periodic Payments (SEPP): This option, under Section 72(t) of the tax code, allows you to take a series of substantially equal periodic payments calculated based on your life expectancy, avoiding the penalty. Important: Once you start SEPP payments, you must continue them for at least 5 years or until you reach age 59 ½, whichever comes later. This is a complex strategy with strict rules, so it’s essential to consult with a qualified tax professional before opting for SEPP.

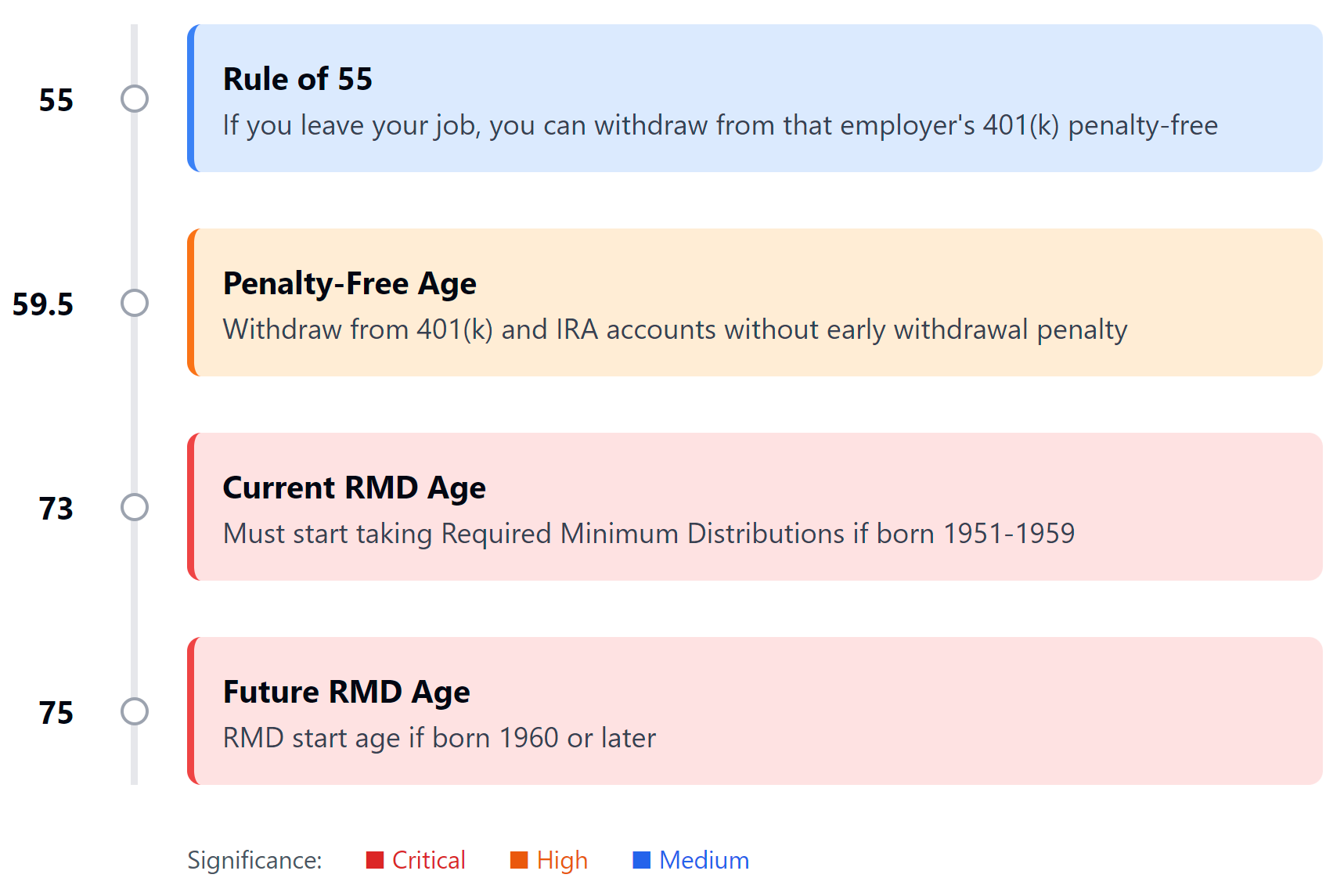

- Separation from Service at Age 55 or Older: If you leave your job in the year you turn 55 or later, you can withdraw from your 401(k) without penalty. This is often referred to as the “Rule of 55.” Important: This exception applies only to 401(k)s, not IRAs.

- Birth or Adoption: You can withdraw up to $5,000 penalty-free for qualified expenses related to the birth or adoption of a child within one year of the event. (See IRS Section 72(t)(2)(B) for more details.)

- Qualified Domestic Relations Order (QDRO): If a QDRO is issued as part of a divorce decree, withdrawals made according to the order are penalty-free.

- Disaster Relief: The IRS may offer penalty relief for withdrawals made due to a federally declared disaster. Specific rules and qualifications apply. Check the IRS website for the latest guidance on disaster relief, including any special provisions related to the COVID-19 pandemic.

- Terminal Illness: If you’ve been diagnosed with a terminal illness, you may qualify for penalty-free withdrawals. The definition of “terminal illness” and the requirements for this exception can vary. (See IRS Publication 524 for more details.)

- Military Reservists Called to Active Duty: Reservists called to active duty for 180 days or more may be eligible for penalty-free withdrawals.

- Victims of Domestic Abuse: (Effective for distributions after December 31, 2023) Under certain circumstances, victims of domestic abuse may qualify for penalty-free withdrawals from their retirement accounts, up to a limit of $10,000 or 50% of the account balance, whichever is less. (See IRS Section 72(t)(2)(F) for more details.)

Know Your Plan’s Rules

While the IRS provides these exceptions, it’s crucial to remember that your 401(k) plan provider may have its own specific rules and restrictions. Always check your plan documents or consult with your plan administrator before making any withdrawals.

State Tax Alert: State tax rules regarding early 401(k) withdrawals may differ from federal rules. It’s essential to consult with a qualified tax professional or your state’s tax agency for guidance specific to your state of residence.

401(k) Loan vs. Hardship Withdrawal Comparison

401(k) Loan

✓ Advantages

- • No taxes or penalties if repaid on time

- • Interest paid goes back to your account

- • No impact on credit score

- • Can borrow up to 50% or $50,000

✗ Disadvantages

- • Must be repaid within 5 years

- • Missed growth on borrowed amount

- • Full balance due if you leave job

Hardship Withdrawal

✓ Advantages

- • No repayment required

- • Immediate access to funds

- • May qualify for penalty exception

✗ Disadvantages

- • 10% early withdrawal penalty

- • Immediate income tax due

- • Permanently reduces balance

- • Must prove immediate need

- • Cannot repay/restore funds

Strategies to Avoid Penalties

Ideally, your 401(k) should be left untouched to grow and compound until retirement. Here are some strategies to help you avoid the need for early withdrawals:

- Build an Emergency Fund: Having 3-6 months of living expenses in an easily accessible account can help you weather unexpected financial storms without touching your retirement savings.

- Use Credit Cards Wisely: While a 0% introductory APR credit card can be helpful for short-term needs, make sure you can pay off the balance before the promotional period ends to avoid high interest charges.

- Consider Alternatives: Explore options like borrowing from friends or family (with a formal agreement in place), taking out a personal loan, or using a home equity line of credit. If you have a taxable investment account, a portfolio line of credit could provide access to cash without selling your investments.

- Reduce Expenses: Take a close look at your budget and identify areas where you can cut back on spending to free up more cash flow.

- Increase Income: Consider taking on a side gig or part-time job to boost your income and build your savings.

FAQs about Early 401(k) Withdrawals

What’s the difference between a 401(k) loan and a hardship withdrawal?

A 401(k) loan allows you to borrow from your own account and repay it with interest, usually within five years. While you won’t face taxes or penalties if you repay the loan on time and according to the terms, failure to do so can result in taxes and penalties on the outstanding balance, as it will be treated as a distribution. Hardship withdrawals, on the other hand, are generally subject to taxes and the 10% penalty, and the withdrawn amount can’t be repaid.

How do early withdrawals impact my retirement savings?

Early withdrawals can significantly impact your long-term financial security. Not only do you lose the potential for tax-deferred growth on the withdrawn amount, but you also miss out on years of compounding returns. This can make it harder to reach your retirement goals and may require you to save more aggressively later on.

Where can I find more information about the exceptions to the early withdrawal penalty?

The IRS website (IRS.gov) is a great resource for detailed information on 401(k) rules and exceptions. You can also find helpful information on our XOA TAX website.

Are there any options for first-time homebuyers to withdraw from retirement accounts without penalty?

Yes, first-time homebuyers can potentially withdraw up to $10,000 from their traditional or Roth IRA—not from their 401(k)—without penalty for a down payment on a first home. There are specific conditions and rules, so it’s important to consult with a qualified tax professional to see if this applies to your situation and to understand the potential long-term impact on your retirement savings.

What are Required Minimum Distributions (RMDs)?

RMDs are mandatory withdrawals from tax-deferred retirement accounts that begin at a certain age (currently 73, but changing to 75 for individuals who turn 72 after December 31, 2022). These withdrawals are taxable and need to be factored into your retirement income planning. It’s important to understand the RMD rules for your specific type of retirement account and to plan for the tax implications.

Connecting with XOA TAX

Navigating the complexities of 401(k) withdrawals can be challenging. For personalized guidance and support, consider consulting with a qualified tax professional. XOA TAX has experienced CPAs who can help you understand the rules, explore your options, and make informed decisions about your retirement savings.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For the latest guidance, refer to the IRS website (IRS.gov) and relevant IRS publications. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime