Real estate remains a powerful investment strategy, offering the potential for appreciation, rental income, and significant tax advantages. These tax benefits can even reduce your overall tax burden, including taxes on your W-2 earnings. At XOA TAX, we guide clients through the complexities of real estate taxation to achieve their financial goals. Let’s explore how you can leverage real estate to your advantage in 2024.

Key Takeaways

- Rental real estate can generate passive losses that may offset other income.

- Becoming a Real Estate Professional unlocks greater tax benefits.

- Depreciation, including bonus depreciation, and deductible expenses reduce your taxable rental income.

- Short-term rentals offer unique advantages but require careful consideration.

- Strategic tax planning with a qualified professional is crucial.

- Understanding recent tax law changes is essential for maximizing benefits.

Understanding Passive Loss Limitations

The IRS generally classifies rental real estate activities as passive. This means losses from these activities can’t offset your active income, like your salary. However, there are key exceptions and strategies to understand:

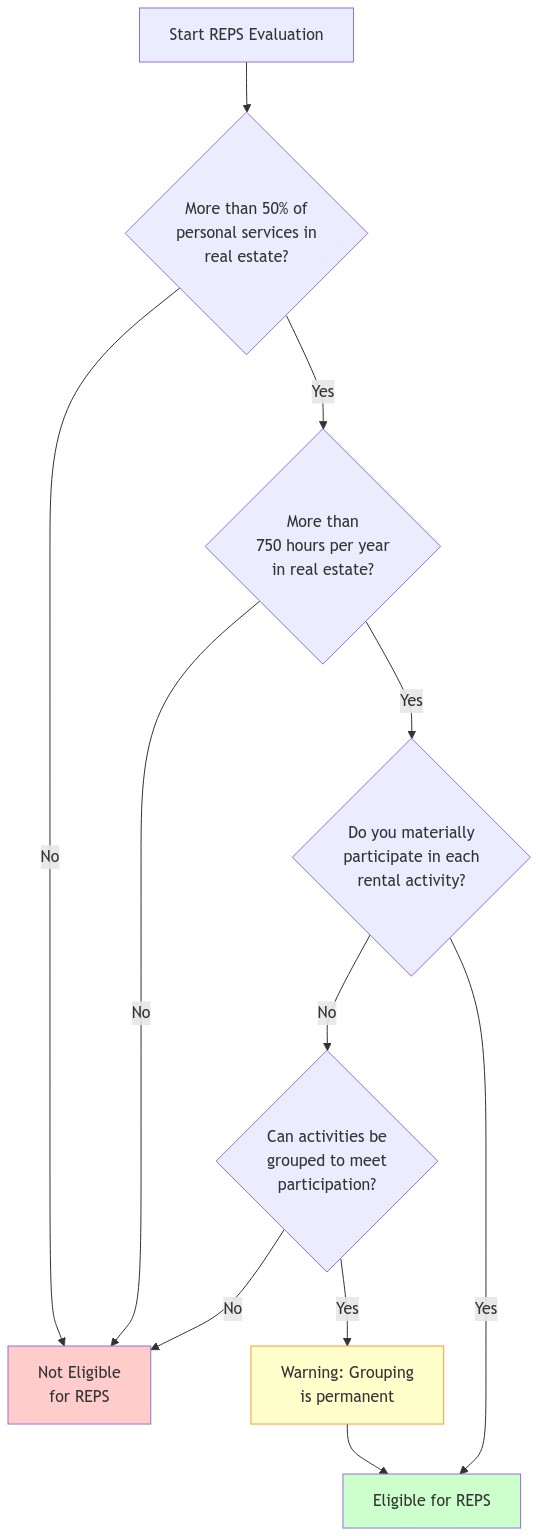

1. Real Estate Professional Status (REPS)

Qualifying as a Real Estate Professional (REP) significantly changes the tax implications of your real estate investments. The IRS will treat your rental activities as non-passive, allowing you to use losses to offset your active income, including W-2 wages.

How to Qualify as a Real Estate Professional:

- More than 50% of your personal services during the tax year must be in real property trades or businesses in which you materially participate.

- You must perform more than 750 hours of services during the tax year in these real property trades or businesses.

- You must materially participate in each rental activity.

Material Participation: This means you’re regularly, continuously, and substantially involved in the operation of the rental property, such as managing the property, finding tenants, and handling maintenance. The IRS has seven tests to determine material participation, and it’s important to understand which ones apply to your situation. In some cases, grouping elections may be available, allowing you to combine multiple activities to meet the material participation requirements. However, be cautious with grouping elections, as you cannot ungroup them without IRS consent.

Important Note: Meeting the REPS requirements can be challenging, especially if you have a full-time job outside of real estate.

2. Short-Term Rentals: A Valuable Exception

Short-term rentals, often found on platforms like Airbnb, typically have an average rental period of seven days or less. These may be treated as non-passive activities, depending on the level of services you provide to guests. If you provide significant services, like cleaning, meals, and concierge services, your short-term rental activity may be considered a business rather than a rental activity. This distinction can impact your tax liability and available deductions.

Maximizing Deductions and Depreciation

1. Depreciation: A Powerful Tool

Depreciation is a significant tax advantage for real estate investors. You can deduct a portion of the property’s cost each year over its “useful life,” which the IRS sets at 27.5 years for residential rental properties. This depreciation expense reduces your taxable income, even though it’s a non-cash expense.

Bonus Depreciation: For qualified improvement property placed in service during 2024, you can take advantage of bonus depreciation, which allows you to deduct 60% of the property’s cost upfront. This can significantly increase your deductions and reduce your tax liability in the early years of ownership.

Example: Let’s say you make $50,000 in qualified improvements to your rental property in 2024. With bonus depreciation, you can deduct $30,000 (60% of $50,000) upfront. You can then depreciate the remaining $20,000 over the applicable recovery period.

2. Section 179 Expensing

Section 179 allows you to deduct the full cost of certain qualifying property, up to a limit, in the year it’s placed in service. For 2024, the Section 179 deduction limit is $1,220,000, with a phase-out beginning at $3,050,000. This can be a valuable tool for real estate investors, especially those purchasing equipment or making improvements to their properties. However, it’s important to note that Section 179 cannot be used for residential rental buildings themselves, only for qualifying improvements and equipment.

3. Deductible Expenses

A wide range of expenses associated with your rental property are deductible, including:

- Mortgage interest

- Property taxes

- Insurance premiums

- Maintenance and repairs

- Property management fees

- Advertising costs

- Travel expenses to and from your rental property (using the standard mileage rate of 65.5 cents per mile for 2024)

Diligently tracking and deducting these expenses can further reduce your taxable rental income.

Limitations and Considerations

While real estate investing offers significant tax benefits, it’s important to be aware of the limitations:

- Passive Loss Limitations: If you’re not a Real Estate Professional, your ability to offset passive losses against non-passive income is limited. The amount of passive loss you can deduct is phased out as your Modified Adjusted Gross Income (MAGI) increases. For 2024, the phase-out begins at $110,000 and ends at $160,000. However, you may qualify for a special allowance of up to $25,000 to offset non-passive income with passive losses from rental real estate, even if you don’t meet the REPS requirements. This allowance is also subject to income limitations and phase-outs.

- At-Risk Rules: Your ability to deduct losses from rental real estate is limited to the amount you have “at risk” in the activity. This generally includes your cash investment and any recourse debt you’ve taken on. Non-recourse financing, where you’re not personally liable for the debt, can limit your deductible losses.

Strategic Planning for Tax Optimization

To maximize the tax benefits of real estate investing, consider these strategies:

- Cost Segregation Studies: These studies, conducted by qualified professionals, can help you identify building components that can be depreciated more quickly, potentially increasing your deductions in the early years of ownership. This is particularly helpful with the Tangible Property Regulations and de minimis safe harbor amounts. You can also explore partial asset disposition elections to optimize depreciation deductions when selling or replacing parts of your property. However, be aware of potential recapture issues if you sell the property.

- Entity Structuring: Holding your real estate within an LLC or other entity can offer liability protection and potential tax advantages. It’s essential to consider the implications of the qualified business income deduction (Section 199A), which allows for a deduction of up to 20% of qualified business income from a pass-through entity. State tax laws regarding LLCs can vary significantly, so consult with a tax professional to determine the best structure for your situation.

- Like-Kind Exchanges (Section 1031): If you’re looking to defer capital gains taxes when selling a rental property, consider a Section 1031 exchange. This allows you to exchange your property for another “like-kind” property and defer paying taxes on the gain. It’s important to follow specific IRS rules and timelines to qualify for this deferral.

FAQ Section

Q: Can I use rental losses to offset my stock market gains?

A: Generally no, unless you qualify as a Real Estate Professional. Stock market gains are considered capital gains, which are a different category of income than rental income.

Q: What records do I need to keep for my rental property?

A: Maintaining detailed records of all income and expenses related to your rental property is crucial. This includes lease agreements, mortgage statements, insurance policies, repair receipts, and property tax bills. You should also keep thorough documentation to support your claim of material participation, such as logs of your time spent on rental activities and details of your involvement in management decisions. The IRS accepts electronic records, so utilize digital tools and software to efficiently organize and store your documents.

Q: How can I learn more about material participation?

A: The IRS provides detailed guidance on material participation in Publication 925, Passive Activity and At-Risk Rules. You can find this publication on the IRS website (www.irs.gov). Or you can read more from our blog here.

Q: Can I take a home office deduction for managing my rental property?

A: Potentially, yes. If you use a dedicated space in your home exclusively and regularly for managing your rental property, you may be eligible to claim a home office deduction. This deduction can help you offset expenses like mortgage interest, utilities, and depreciation allocated to that portion of your home. However, specific requirements must be met, so it’s crucial to consult with a tax professional to determine your eligibility.

**Q: Do state taxes affect my real estate investment strategy?

A: Absolutely. State tax laws can significantly impact your real estate investment returns. States have different rules regarding property taxes, income taxes on rental income, and even how they treat LLCs. It’s essential to research the specific tax laws in your state or consult with a tax professional to understand the implications for your investment strategy. For example, some states have different depreciation rules or offer specific tax credits for real estate investments.

Q: How do the 2024 tax law changes impact real estate investors?

A: Several tax law changes in 2024 can affect real estate investors. For example, the standard mileage rate for business use of your vehicle is 65.5 cents per mile. The income tax brackets have also been adjusted for inflation, which could impact your overall tax liability. It’s crucial to stay informed about these updates and consult with a tax professional to assess their impact on your specific situation.

Additional Considerations for Real Estate Investors

Beyond the core concepts discussed above, it’s important to be aware of these additional factors:

- Vacation Home Rules: If you rent out your vacation home for part of the year, special rules apply regarding deductions and rental income. The tax treatment depends on the number of days the property is rented versus personal use.

- Mixed-Use Property: If your property has both residential and commercial use, you’ll need to allocate expenses and income accordingly. Proper allocation is essential for accurate tax reporting.

- Opportunity Zones: Investing in designated Opportunity Zones can offer significant tax benefits, including deferral and potential elimination of capital gains taxes. These incentives are designed to encourage investment in economically distressed areas.

- Net Investment Income Tax: If your income exceeds certain thresholds, you may be subject to a 3.8% Net Investment Income Tax on your rental income. This tax applies to individuals with modified adjusted gross income over $200,000 ($250,000 for married filing jointly).

- Self-Rental Rules: If you rent property to your own business, special rules apply regarding deductions and rental income. It’s essential to understand these rules to ensure proper tax treatment.

Important Reminders

- Passive Activity Grouping Elections: While grouping activities can be beneficial for material participation, it’s crucial to understand the potential drawbacks. Once you group activities, you can’t ungroup them without IRS consent.

- Contemporaneous Recordkeeping: Maintain detailed records of all your real estate activities as they occur. This will be essential for supporting your deductions and avoiding issues during an audit.

- Potential Audit Triggers: Certain actions, such as claiming large losses or aggressive deductions, can increase your chances of an IRS audit. Consult with a tax professional to ensure your tax strategy is sound and compliant.

Connecting with XOA TAX

Navigating the complexities of real estate taxation, especially with the 2024 updates, can be challenging. At XOA TAX, our experienced CPAs can help you develop a personalized tax strategy to maximize the benefits of your real estate investments. Whether you’re a seasoned investor or just starting out, we can provide guidance on everything from passive activity loss rules to depreciation strategies and cost segregation studies.

Contact us today for a consultation:

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime