Receiving money from abroad can be exciting, but it’s essential to understand the tax implications. Whether it’s a gift from a loved one, income from a foreign employer, or a reimbursement for expenses, the IRS has rules you need to know. This guide will help you navigate these rules and ensure you’re tax compliant.

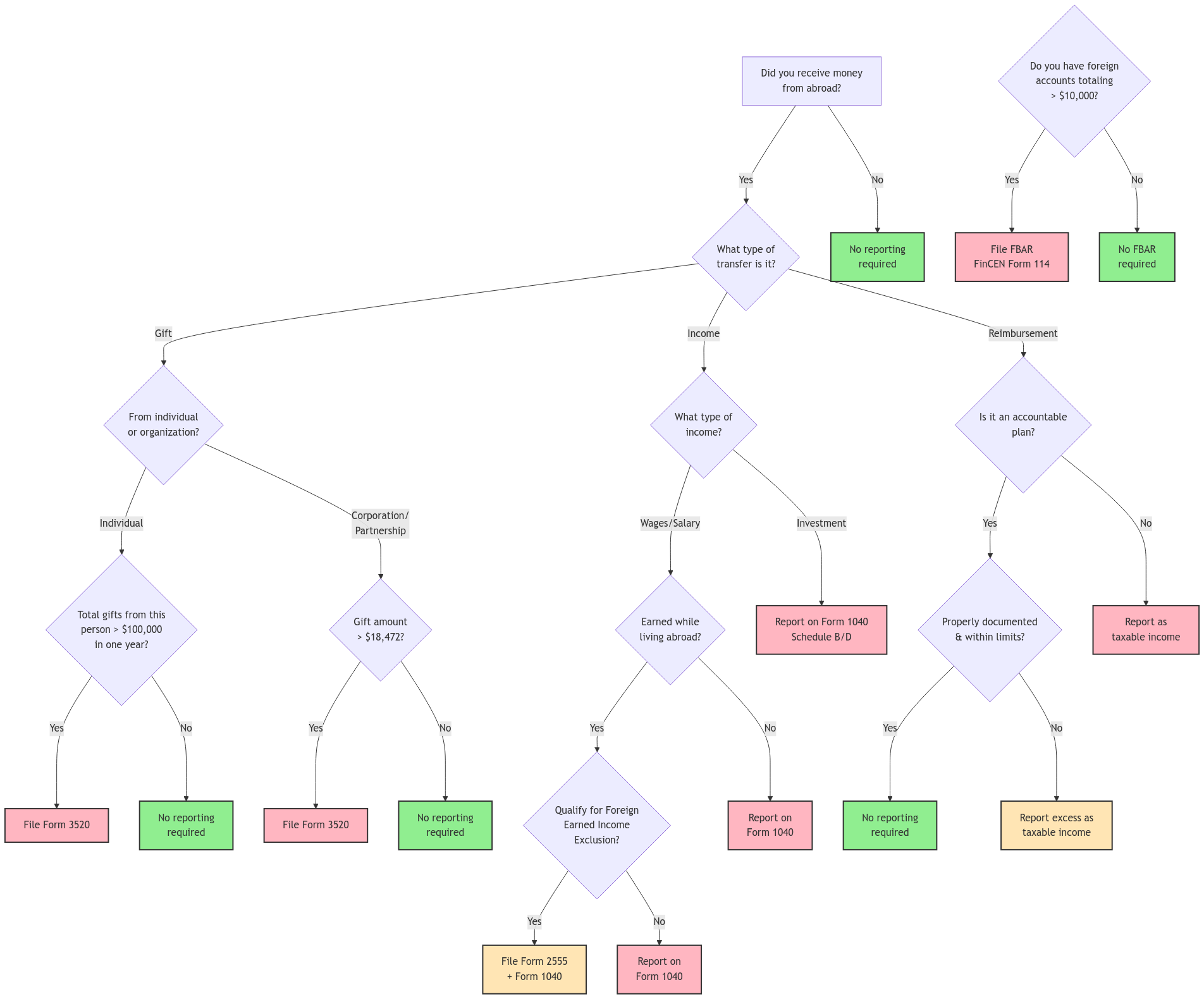

Use this decision tree to quickly determine your reporting obligations for money received from abroad. Follow the paths based on your situation, and refer to the detailed sections below for more information about each requirement.

Note: Open image in a new tab for a full view. Green boxes indicate no reporting required, yellow boxes indicate possible reporting or exemptions available, and red boxes indicate mandatory reporting requirements. This is a simplified guide – please refer to the detailed sections below for complete information.

Gifts

A gift is something you receive without any expectation of something in return. Think of it like a birthday present from a loved one overseas. Generally, you don’t have to pay taxes on gifts you receive from abroad. However, there are some reporting rules you should be aware of.

Reporting Gifts from Abroad

Even though you might not owe taxes on the gift itself, you might need to let the IRS know about it. This is done by filing Form 3520, “Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.”

When do you need to file Form 3520?

- Gifts from individuals: If the total amount of gifts you receive from a single foreign person (like a friend or relative) is more than $100,000 in a year, you’ll need to file this form.

- Gifts from corporations or partnerships: If a foreign corporation or partnership gives you a gift worth more than $18,472 (for 2024), you’ll also need to file.

Why is reporting important?

It’s crucial to file Form 3520 correctly and on time. If you don’t, you could face some hefty penalties – up to 25% of the gift amount!

What about taxes for the giver?

While you, as the recipient, generally don’t pay taxes on gifts, the person giving the gift might have to pay gift tax if the amount is above a certain limit. But that’s their responsibility, not yours.

Special Considerations for Gifts from Non-U.S. Parents

When non-U.S. parents give gifts to their U.S. resident children, the good news is that the child generally doesn’t have to pay any taxes on the gift. The U.S. has a gift tax, but it’s usually the giver who is responsible for paying it, not the recipient.

However, there are a couple of things to keep in mind:

- Reporting Requirements: Even though you might not owe taxes on the gift, you might still need to report it to the IRS if the amount is significant. This is done by filing Form 3520, “Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.” For 2024, you need to file this form if the total gifts you receive from your parents (or any other foreign individual) exceed $100,000.

- Gift Tax for the Parents: Your non-U.S. parents might have to pay U.S. gift tax if the amount they give you exceeds the annual gift tax exclusion. For 2024, that exclusion is $18,000 per recipient. However, there’s also a lifetime gift tax exemption, which is quite substantial ($13.61 million for 2024), so most parents won’t end up owing any gift tax.

Here’s an example: Let’s say your parents, who live outside the U.S., give you $50,000 in 2024. You wouldn’t owe any taxes on this gift. However, since the amount exceeds $18,000, your parents might have to file a gift tax return. They would likely use some of their lifetime gift tax exemption to cover the gift, so they probably wouldn’t owe any tax.

Given these substantial exemption amounts, most individuals, including parents making gifts to their children, will not owe federal gift tax. However, it’s advisable to keep detailed records of all gifts and consult with a tax professional to ensure compliance with IRS regulations and to understand how these gifts may impact your overall estate planning strategy.

Income

When it comes to taxes, Uncle Sam has a long reach. Even if you’re earning money from a company overseas, you still need to report it to the IRS. This includes salaries, wages, commissions, and any income from a business or investments you have abroad.

Reporting Foreign Income

As a U.S. citizen or resident alien, you’re taxed on your worldwide income. This means that any money you earn from a foreign source needs to be declared on your U.S. tax return.

Form 2555 and the Foreign Earned Income Exclusion

Now, here’s some good news. You might be able to lower your U.S. tax bill on that foreign income. You can use Form 2555, “Foreign Earned Income,” to claim either the Foreign Earned Income Exclusion or the Foreign Housing Exclusion. For 2024, the Foreign Earned Income Exclusion lets you exclude up to $126,500 of your foreign earnings from U.S. taxes.

Foreign Tax Credit

Another way to potentially reduce your U.S. tax liability is by claiming the Foreign Tax Credit. This allows you to offset the U.S. taxes you owe on your foreign income with the taxes you’ve already paid to the foreign country. You’ll need to file Form 1116, “Foreign Tax Credit,” to claim this credit.

FBAR: Reporting Foreign Bank Accounts

If you have a foreign bank account or financial account, you might also need to file a report called the FBAR (FinCEN Form 114). This is a separate filing from your tax return and is used to report your foreign financial accounts if the total balance of all your foreign accounts exceeds $10,000 at any point during the year.

Reimbursements

Sometimes, you might get money from abroad to cover expenses you’ve had while working for a foreign company or with a business partner overseas. These payments are called reimbursements.

Are Reimbursements Taxable?

The good news is that reimbursements are usually not considered taxable income, as long as they don’t exceed the actual expenses you incurred. Think of it like getting your money back for something you already paid for.

Accountable vs. Non-Accountable Plans

- Accountable Plans: These plans have specific rules about how expenses are tracked and reported. You’ll generally need to provide documentation for your expenses and return any excess reimbursements within a specific timeframe. The good news is that reimbursements from an accountable plan are typically not taxed.

- Non-Accountable Plans: These plans are less strict, but any reimbursements you receive are considered taxable income.

Timing and Documentation

To keep things clear for tax purposes, it’s important to submit expense reports promptly and keep detailed records of all your expenses and reimbursements. This includes receipts, invoices, and any other documentation that supports your claims. If the IRS ever comes knocking, you’ll be prepared!

Key Considerations

- Tax Treaties: The U.S. has special agreements with many countries called tax treaties. These treaties help prevent you from being taxed twice on the same income. It’s worth checking if the country you’re receiving funds from has a tax treaty with the U.S., as it could significantly impact your tax liability.

- Currency Exchange Rates: Since we’re talking about international funds, you’ll need to convert any foreign currency into U.S. dollars when you’re reporting it on your tax return. Make sure you use the correct exchange rate for the date of the transaction.

- Record Keeping: This is super important! Keep detailed records of all your international money transfers. This includes the source of the funds, the date, the amount, and the reason for the transfer. Good record-keeping will make your life much easier come tax time.

- FATCA: FATCA stands for the Foreign Account Tax Compliance Act. It’s a set of rules aimed at preventing U.S. taxpayers from hiding money in foreign accounts. If you have certain foreign financial assets, you might need to report them to the IRS using Form 8938, “Statement of Specified Foreign Financial Assets.”

- State Tax Implications: Don’t forget about state taxes! Even if you meet the requirements for the Foreign Earned Income Exclusion, you might still owe taxes to your home state. Each state has its own rules, so it’s important to check the specific requirements for your state.

- Timelines: Make sure you’re aware of the deadlines for reporting foreign income and filing any related forms. These deadlines can vary depending on the type of income and the forms required.

Recent Changes in International Tax Laws

- Increased Foreign Earned Income Exclusion: The Foreign Earned Income Exclusion amount for 2024 has increased to $126,500, up from $120,000 in 2023. This means you can exclude even more of your foreign earnings from U.S. taxation!

- Inflation Adjustments: Many tax thresholds and deductions are adjusted annually for inflation. Be sure to check the latest IRS guidelines for the current year’s figures.

- Tax Treaty Updates: The U.S. regularly updates its tax treaties with other countries. It’s a good idea to check for any recent changes to the treaty with the country you’re receiving funds from, as this could affect your tax liability.

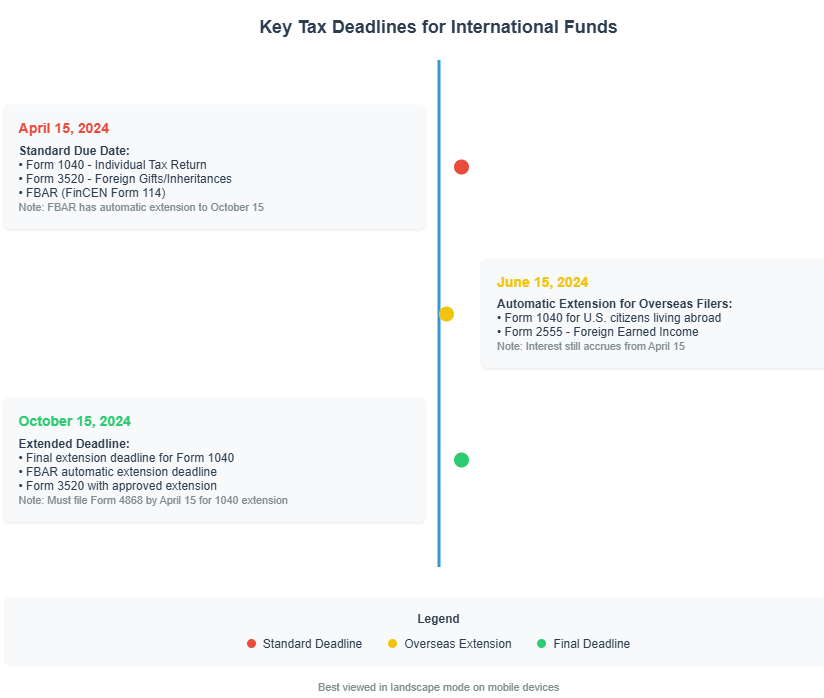

Tax Deadlines Timeline

Understanding tax deadlines for international funds can be challenging, especially with different forms and filing requirements. Below is a comprehensive timeline of key dates for 2024 that you need to know. Pay special attention to automatic extensions for overseas filers and remember that even if you qualify for an extension, any taxes owed are still due by April 15 to avoid interest charges. This timeline serves as a quick reference guide – mark these dates in your calendar to ensure timely compliance with all reporting requirements.

FAQs

Do I need to report a small gift from a friend abroad?

Generally, small gifts don’t need to be reported. However, if the total amount of gifts you receive from a single foreign person exceeds $100,000 in a year, the giver may need to file a gift tax return, and you may need to report the gift on Form 3520.

What if I’m a U.S. citizen living abroad?

Even if you live abroad, you’re still generally required to file a U.S. tax return and report your worldwide income. However, you may qualify for the Foreign Earned Income Exclusion, which allows you to exclude up to $126,500 of your foreign earnings from U.S. taxes in 2024. You can claim this exclusion by filing Form 2555.

Where can I find more information about tax treaties?

The IRS website has a section dedicated to tax treaties where you can find detailed information about specific treaties. You can access it here: [insert link to IRS tax treaties page].

What are the penalties for not reporting foreign income or filing required forms like Form 3520 or FBAR?

The penalties vary depending on the specific form and the reason for non-compliance. They can range from a percentage of the unreported amount to significant fines. For example, failure to file Form 3520 can result in penalties of up to 25% of the gift value.

When are these forms due?

Most tax forms, including those related to foreign income, are generally due on April 15th each year. However, if you’re living abroad, you may qualify for an automatic extension to June 15th. Be sure to check the specific instructions for each form to confirm the deadline.

What is the FBAR filing deadline?

The FBAR (FinCEN Form 114) is due on April 15th, but you automatically get an extension to October 15th each year.

Do I need to report my foreign income if I already paid taxes on it to the foreign country?

Yes, you still need to report your foreign income on your U.S. tax return. However, you may be able to claim the Foreign Tax Credit to offset the U.S. taxes you owe with the taxes you already paid to the foreign country.

Still Have Questions? Contact XOA TAX

We understand that international tax matters can be confusing. If you have any further questions or need assistance with your specific situation, please don’t hesitate to contact XOA TAX. Our team of experienced CPAs can provide personalized guidance and support to ensure you’re meeting all your tax obligations.

Why Choose XOA TAX?

- International Tax Expertise: We have extensive experience in helping individuals and businesses navigate the complexities of international taxation.

- Personalized Service: We take the time to understand your unique situation and provide tailored solutions to meet your needs.

- Up-to-Date Knowledge: We stay current with the latest tax laws and regulations to ensure you receive the most accurate and effective advice.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime