The Residential Clean Energy Credit, established by the Inflation Reduction Act (IRA) of 2022, has been a game-changer for homeowners seeking to invest in clean energy solutions. This valuable credit offers a 30% tax break for those who install qualified systems, such as solar panels, between 2022 and 2032. However, recent discussions around potential legislative changes, including the possible repeal of the IRA, have raised questions and concerns about the future of this credit.

At XOA TAX, we understand that navigating these uncertainties can be confusing. That’s why we’re here to break down the current status of the credit, the potential impact of legislative changes, and what homeowners can do to stay ahead of the curve.

Key Takeaways

- The Residential Clean Energy Credit currently offers a 30% tax credit for qualified clean energy systems.

- Potential legislative changes to the IRA could impact the availability and terms of the credit.

- Homeowners should stay informed, consult with a tax professional, and consider the timing of installations.

Current Status of the Residential Clean Energy Credit

As of right now, the Residential Clean Energy Credit remains in effect. This means that if you’re considering making energy-efficient upgrades to your home, you can still take advantage of this substantial incentive. The credit is designed to encourage homeowners to adopt renewable energy solutions, contributing to a greener future.

Potential Impact of Legislative Changes

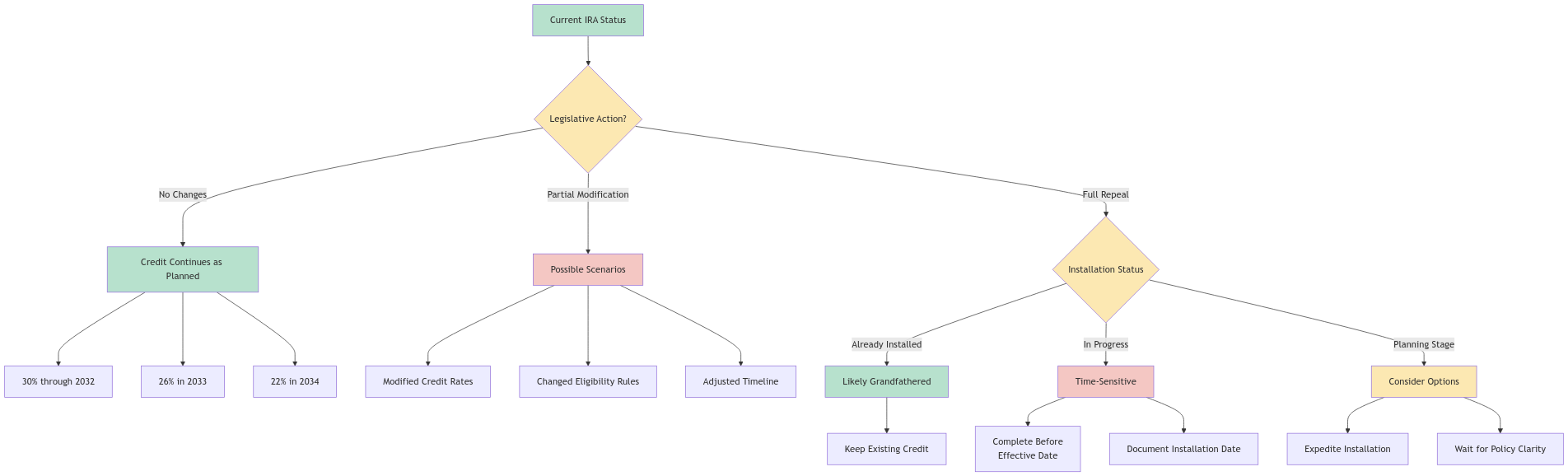

The political landscape can be unpredictable, and the possibility of the IRA being repealed or modified does exist. If this were to happen, the Residential Clean Energy Credit could be affected. The specific changes would depend on the new legislation, and it’s difficult to predict the exact outcome.

Historically, tax credits have been adjusted by lawmakers, and these changes can be applied retroactively or prospectively. This means that new rules could potentially affect installations that have already been completed or those planned for the future.

Considerations for Homeowners with Pending Installations

If you’re in the process of installing a solar system or other qualifying clean energy improvements, it’s important to be aware of the potential implications of legislative changes. Here are a few things to keep in mind:

- Installation Completion Date: The tax credit applies to systems that are “placed in service” during the tax year. This means the installation must be complete, and the system ready for use, within the tax year you want to claim the credit. So, if your installation is finished in 2024, you would claim the credit on your 2024 tax return.

- Legislative Timing: If changes to the law occur after your system is installed and in use, your installation might be protected under the previous rules. This is often referred to as being “grandfathered” in. However, this isn’t a guarantee, and it would depend on the specific wording of any new legislation. It’s important to note that, historically, energy tax credits have rarely been modified retroactively to a taxpayer’s detriment.

What Can Homeowners Do?

Stay Informed: Keep up-to-date on any legislative developments that could affect the Residential Clean Energy Credit. The IRS website (IRS.gov) and reliable news sources are good places to find current information.

Consult a Tax Professional: Tax laws can be complex, and a qualified tax professional can offer personalized guidance based on your individual circumstances. They can help you understand the potential impact of any changes and make informed decisions.

Consider Timing: If you’re thinking about installing a clean energy system, completing it sooner rather than later could help ensure you qualify for the credit under the current rules. However, this should be weighed against practical considerations and the advice of a tax professional. Don’t rush into a decision that isn’t right for you.

Frequently Asked Questions (FAQ)

What types of clean energy systems qualify for the Residential Clean Energy Credit?

The credit applies to a range of systems, including:

- Solar panels

- Wind turbines

- Geothermal heat pumps

- Biomass fuel systems

- Solar water heaters

- Fuel cells (with a limitation of $500 per 0.5 kW of capacity)

- Battery storage technology (added starting in 2023)

You can find a detailed list of eligible systems on the IRS website.

Can I claim the credit if I install a used clean energy system?

No, the credit is only available for new systems.

Is there a limit on the amount of credit I can claim?

For most technologies, the credit is worth 30% of the cost of your qualified expenses, with no upper limit. However, fuel cells have a limit of $500 per 0.5 kW of capacity.

Understanding the Requirements

To claim the Residential Clean Energy Credit, you’ll need to meet certain requirements and keep thorough records. Here’s a breakdown of the key things to know:

Manufacturer Certification

Ensure that the equipment you install meets the necessary certification standards. For many systems, this includes meeting Energy Star requirements. Always check with the manufacturer to confirm that their products are eligible for the tax credit.

Documentation

Keep detailed records of all expenses related to your clean energy system installation. This includes:

- Purchase invoices for equipment and materials

- Installation contracts and labor costs

- Permits and inspection fees

You’ll need this documentation to accurately calculate your credit and support your claim if needed.

IRS Form 5695

To claim the Residential Clean Energy Credit, you’ll need to file IRS Form 5695, Residential Energy Credits, along with your tax return. This form guides you through the calculation of the credit and helps you determine the amount you can claim. You can find this form and related instructions on the IRS website.

Credit Carryforward

If your tax liability is less than the amount of the credit you’re eligible for, you can carry forward the unused portion to future years. This allows you to maximize the benefit of the credit even if you can’t use it all in the current year.

State-Level Incentives

In addition to the federal Residential Clean Energy Credit, many states offer their own incentives for homeowners who install renewable energy systems. These incentives can include tax credits, rebates, and other financial assistance programs. Check with your state’s energy office or tax agency to learn about available programs in your area.

Connecting with XOA TAX

We understand that making financial decisions related to tax credits and renewable energy can be challenging. If you have questions or need assistance navigating these complex issues, the experienced team at XOA TAX is here to help.

We can provide personalized guidance, ensuring you make the most of available tax benefits while planning for a sustainable future.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime