Think you’ve missed the boat on depreciation deductions? Think again! Many property owners are unaware that they can still benefit from potential tax savings through a retroactive cost segregation study. Even if you’ve owned a property for years, this strategy can unlock hidden deductions and potentially lead to substantial tax refunds. At XOA TAX, we help clients navigate the complexities of cost segregation to maximize their returns.

Key Takeaways:

- Potential to Recapture Missed Depreciation: Claim deductions you may have been entitled to but didn’t take in previous years.

- Possible Reduction of Taxable Income: Apply these deductions to potentially lower your current tax liability and possibly generate a refund.

- Maximize Benefits (where applicable): Take advantage of potentially higher bonus depreciation percentages from prior years.

- Expert Guidance is Key: A qualified cost segregation professional can ensure accurate analysis and implementation.

What is a Retroactive Cost Segregation Study?

A cost segregation study is a strategic tax planning tool that analyzes the various components of your commercial property and reclassifies them into shorter depreciation lifespans. This allows you to accelerate depreciation deductions, thereby potentially reducing your tax burden. A retroactive, or look-back, study applies this principle to properties you’ve owned for years, identifying missed depreciation opportunities.

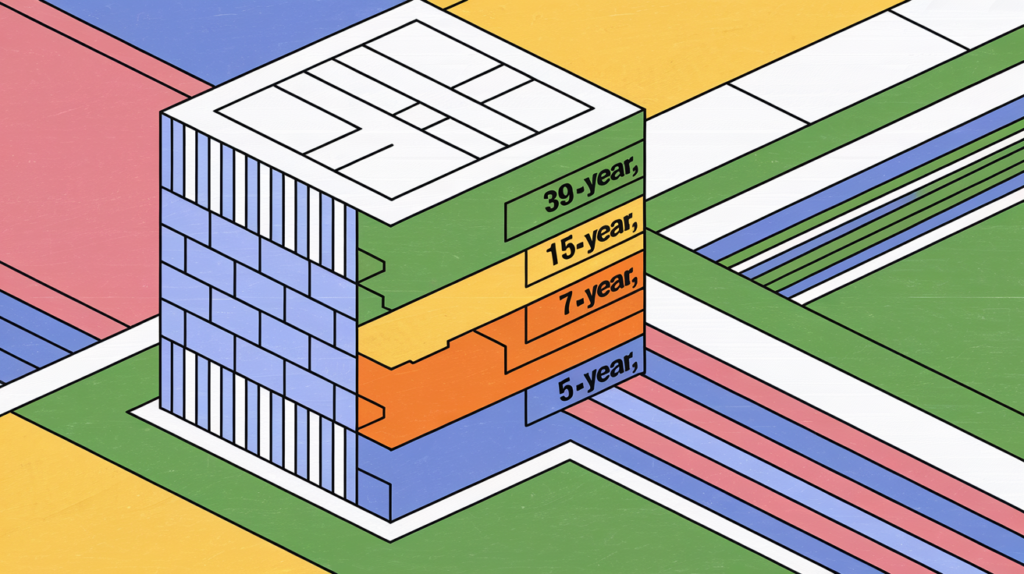

Imagine you own an office building. While the building itself might have a 39-year depreciation life, components like carpeting, light fixtures, and certain interior finishes qualify for shorter depreciation periods (5, 7, or 15 years). A cost segregation study identifies these shorter-life assets, allowing you to deduct their cost more quickly.

Why Consider a Retroactive Study?

There are several compelling reasons to explore a retroactive cost segregation study:

- Higher Income Years: If you’re currently in a high tax bracket, a retroactive study could provide tax savings by offsetting current income with past deductions.

- Missed Opportunities: Perhaps you weren’t aware of cost segregation or didn’t qualify for certain deductions in the past (e.g., due to real estate professional status).

- Maximize Depreciation (when possible): Retroactive studies allow you to potentially utilize higher bonus depreciation percentages that were available in previous years. For example, if you placed your property in service in 2019, you could potentially claim 100% bonus depreciation on qualified assets, even if you didn’t claim it initially.

How Does it Work?

There are two primary ways to apply a retroactive cost segregation study:

1. Amending Past Tax Returns:

This approach involves filing amended tax returns (Form 1040-X) for the specific years where you want to claim the missed depreciation. This is generally suitable if you have a specific prior year with significantly higher income or unique tax situations.

2. Form 3115 and Section 481(a) Adjustment:

This method allows you to “catch up” on missed depreciation on your current tax return. It involves filing Form 3115 (Application for Change in Accounting Method) and utilizing an IRC Section 481(a) adjustment to correct your depreciation. This adjustment spreads the catch-up depreciation over a period of years, minimizing the impact on any single year’s tax liability.

Bonus Depreciation Considerations:

- Varying Percentages: Bonus depreciation percentages have changed over the years. A retroactive study can help you potentially take advantage of higher percentages from previous years.

- Opting Out: If you previously opted out of bonus depreciation, you might be able to revoke that election by amending your return or filing Form 3115, depending on the circumstances.

Choosing the Right Approach

Choosing between amending past returns or using Form 3115 with a Section 481(a) adjustment depends on your specific situation. Factors to consider include:

- Complexity: Amending multiple returns can be more complex and time-consuming.

- State Tax Implications: Different states have different rules regarding amended returns and cost segregation.

- Professional Fees: Amending returns might involve higher fees due to the increased complexity.

Real-World Examples

Scenario 1: Significant Benefit

Let’s say you purchased a warehouse in 2020 and weren’t aware of cost segregation. In 2024, you’re now in a higher tax bracket and looking for ways to reduce your tax liability. A retroactive cost segregation study could identify $200,000 in assets that could have been depreciated over 5 years instead of 39 years. By amending your 2020, 2021, and 2022 tax returns or filing Form 3115, you can claim the missed depreciation, potentially generating a significant tax refund and reducing your current tax bill.

Scenario 2: Limited Benefit

You own a small retail store that you purchased in 2018. The majority of the building’s value is in the structure itself, with relatively few short-life assets. In this case, the potential benefits of a cost segregation study, especially a retroactive one, might be limited.

Factors Affecting the Look-Back Period

While the IRS allows for retroactive cost segregation back to the original placed-in-service date of your property, there are practical considerations:

- Records Availability: Obtaining accurate records for very old properties can be challenging.

- Cost/Benefit Ratio: The cost of the study may outweigh the potential benefits for extremely old look-backs, especially if depreciation has already been significantly claimed.

- State Statute of Limitations: State laws may limit how far back you can amend returns or claim adjustments for state tax purposes.

Potential Risks and Considerations

- IRS Scrutiny: Inaccurate or improperly documented cost segregation studies can attract IRS scrutiny. It’s crucial to work with a qualified professional.

- Impact on Future Property Sales: Reclassifying assets can impact the calculation of depreciation recapture and capital gains when you eventually sell the property.

- Not All Properties Benefit Equally: The potential benefits of cost segregation depend on the type of property, its age, and the proportion of short-life assets.

FAQ Section

Q: What types of properties qualify for cost segregation?

A: Cost segregation studies are generally applicable to commercial properties, including office buildings, retail spaces, warehouses, apartment complexes, hotels, and manufacturing facilities.

Q: How far back can I go with a retroactive cost segregation study?

A: While technically you can go back to the original placed-in-service date, practical limitations like records availability, cost/benefit analysis, and state statutes of limitations should be considered.

Q: How much does a cost segregation study cost?

A: The cost varies depending on the size and complexity of your property and the scope of the study. It’s important to weigh the potential tax benefits against the cost of the study.

Q: What are the risks associated with cost segregation?

A: While cost segregation is a legitimate tax strategy, it’s important to ensure the study is conducted by a qualified professional. An inaccurate study could lead to IRS scrutiny. Additionally, cost segregation can impact the calculation of depreciation recapture upon the sale of the property.

Connecting with XOA TAX

Navigating the intricacies of retroactive cost segregation requires expertise and attention to detail. At XOA TAX, our experienced CPAs can help you determine if a cost segregation study is right for you and guide you through the entire process. We’ll analyze your property, identify potential deductions, and ensure accurate implementation to help you achieve potential tax savings.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

We’re here to help you explore the full potential of depreciation deductions and boost your bottom line.

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime