Planning for retirement involves selecting the right investment options, and the Roth IRA is a favorite for many. This article breaks down the advantages and disadvantages of Roth IRAs to help you decide if it’s the right fit for your retirement savings plan.

Key Takeaways

- Tax-Free Growth and Withdrawals: Your investments grow tax-free, and you won’t pay taxes when you withdraw in retirement.

- Diversify Your Savings: Adding a Roth IRA to your portfolio can balance different types of retirement accounts.

- Flexible Withdrawals: You can access your contributions anytime without penalties.

- Contribution Limits & Income Restrictions: There are caps on how much you can contribute and income eligibility rules to consider.

Advantages of a Roth IRA

- Tax-Free Growth and Withdrawals

One of the standout benefits of a Roth IRA is that your investments grow without being taxed. Unlike traditional IRAs, you won’t owe taxes on the earnings and gains inside your Roth IRA. When you retire, your withdrawals are also tax-free, which can significantly increase your savings over time. - Tax-Free Inheritance

Roth IRAs are excellent for leaving a legacy. Your beneficiaries won’t have to pay income tax on the money they inherit, making it a valuable estate planning tool. - No Required Minimum Distributions (RMDs)

With a Roth IRA, you’re not forced to take out a minimum amount each year when you reach a certain age. This means you can let your money continue to grow tax-free as long as you want. - Flexible Access to Contributions

You can withdraw your contributions (not the earnings) at any time without taxes or penalties. While it’s best to leave the money invested for your retirement, this feature provides a safety net in case of emergencies. - Tax Diversification in Retirement

Having a Roth IRA alongside other retirement accounts like traditional IRAs or 401(k)s gives you more options when you retire. You can choose which accounts to withdraw from based on your tax situation, potentially lowering your overall tax bill.

Roth IRA Growth Potential Over Time

Note: Roth IRA contributions are made with after-tax dollars, but all growth and qualified withdrawals are tax-free. Calculations assume monthly compounding.

Contribution Settings

Return & Inflation Settings

Withdrawal Settings

Final Balances

| Nominal Balance: | $0 |

|---|---|

| Inflation-Adjusted: | $0 |

| Potential Range: | $0 – $0 |

Withdrawal Strategy

| Start Year: | – |

|---|---|

| Method: | – |

| Amount: | – |

Note: These projections are estimates and actual results may vary significantly.

Disadvantages of a Roth IRA

- Paying Taxes Upfront

Contributions to a Roth IRA are made with after-tax dollars, meaning you don’t get a tax break now. This can reduce your current take-home pay, which might be a downside if you’re looking to lower your current tax bill. - Income Limits

Roth IRAs have income limits based on your Modified Adjusted Gross Income (MAGI) and filing status. If you earn too much, you might not be eligible to contribute directly. For 2024:- Single Filers: Full contributions if MAGI is below $146,000; phased out up to $161,000.Married Filing Jointly: Full contributions if MAGI is below $230,000; phased out up to $240,000.

Check the IRS website for the latest income thresholds.

- Contribution Limits

There are yearly limits to how much you can contribute to a Roth IRA. For 2024, the maximum is $7,000 if you’re under 50 and $8,000 if you’re 50 or older. These limits might not be enough if you’re aiming to save a large amount for retirement. - Account Setup Responsibility

Unlike employer-sponsored plans like 401(k)s, you need to open and manage your Roth IRA yourself. This includes choosing your investments and keeping track of your account, which can be a bit overwhelming without guidance. - Five-Year Rule

To take out earnings tax-free, your Roth IRA must be open for at least five years. This rule applies separately to each conversion, so timing is important if you’re moving funds into a Roth IRA.

Roth IRA vs. Traditional IRA

Choosing between a Roth IRA and a Traditional IRA depends on your financial situation and retirement goals. Here are the key differences:

- Tax Treatment: Traditional IRA contributions might be tax-deductible now, but you’ll pay taxes when you withdraw in retirement. Roth IRA contributions aren’t tax-deductible, but withdrawals are tax-free.

- Required Minimum Distributions (RMDs): Traditional IRAs require you to start taking distributions at a certain age, while Roth IRAs do not.

- Income Limits: Traditional IRAs don’t have income limits for contributions, but Roth IRAs do.

- Best For: If you expect to be in a higher tax bracket in retirement, a Roth IRA could be beneficial. If you think your tax rate will be lower in retirement, a Traditional IRA might be better.

Roth IRA vs Traditional IRA: Key Features

Tax-free withdrawals

Taxed withdrawals

$8,000 (≥50)

$8,000 (≥50)

Earnings with rules

(with exceptions)

Roth IRA vs. 401(k)

Both Roth IRAs and 401(k)s are popular retirement savings options, but they have some differences:

- Accessibility: Anyone with earned income can open a Roth IRA, whereas a 401(k) is offered through your employer.

- Contribution Limits: 401(k)s generally allow higher annual contributions compared to Roth IRAs. For 2024, you can contribute up to $22,500 to a 401(k), or $30,000 if you’re 50 or older.

- Investment Choices: Roth IRAs typically offer a wider range of investment options, while 401(k)s are limited to the choices provided by your employer.

Roth IRA vs 401(k): Feature Comparison

$8,000 (≥50)

$30,000 (≥50)

no employer needed

tax-free growth

taxed withdrawals

Roth IRA Investment Options

Roth IRAs give you the flexibility to invest in various assets, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The best investments for your Roth IRA depend on your risk tolerance and retirement goals. It's a good idea to consult with a financial advisor to choose investments that align with your plans.

Frequently Asked Questions (FAQ)

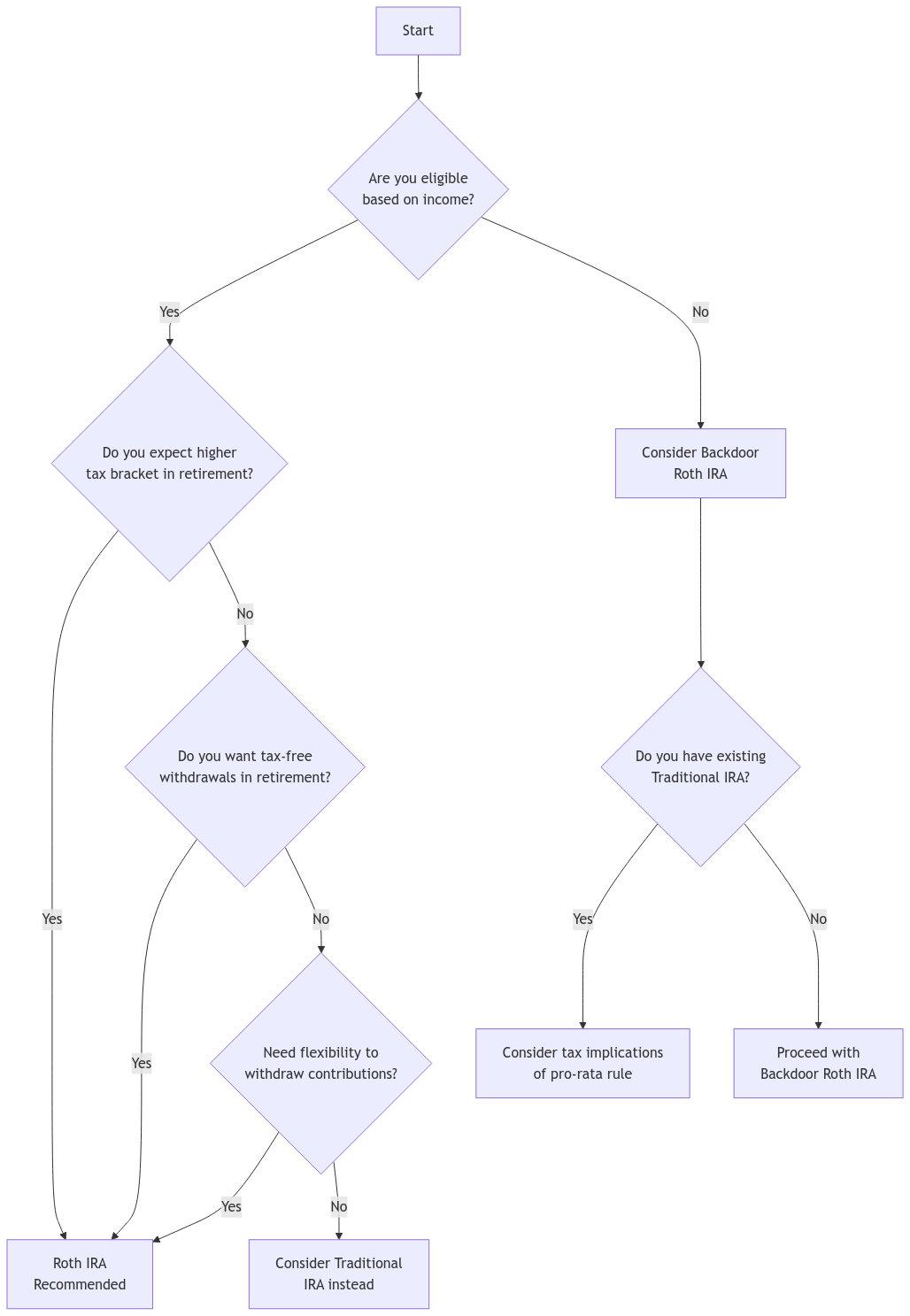

What is a Backdoor Roth IRA?

A Backdoor Roth IRA is a way for high earners to contribute to a Roth IRA indirectly. It involves making a non-deductible contribution to a Traditional IRA and then converting it to a Roth IRA, bypassing income limits.

Should I Maximize My Roth IRA Contributions?

If you can afford it, maxing out your Roth IRA contributions allows you to take full advantage of tax-free growth and withdrawals, enhancing your retirement savings.

Can I Roll Over or Convert Assets to a Roth IRA?

Yes, you can transfer funds from other retirement accounts like a Traditional IRA or 401(k) into a Roth IRA. Keep in mind that you’ll need to pay taxes on the amount you convert, which can be significant depending on your tax bracket.

What is the Saver's Credit?

The Saver's Credit is a tax credit for people who contribute to a Roth or Traditional IRA. If your income is below a certain level, you can claim a credit of 10%, 20%, or 50% of your contribution, up to $2,000 ($4,000 if married filing jointly).

Are There Any Upcoming Changes to Roth IRAs?

Yes, the SECURE 2.0 Act introduced some changes:

- 2024: The $1,000 catch-up contribution limit for those aged 50 and over will adjust for inflation.

- 2025: A new catch-up contribution limit for ages 60 through 63 will be set at 150% of the regular catch-up amount.

- 2026: If your income exceeds $145,000, catch-up contributions must be made to a Roth basis.

Conclusion

Understanding the benefits and drawbacks of a Roth IRA is essential for effective retirement planning. While the tax-free growth and withdrawals are appealing, consider factors like paying taxes upfront and income eligibility limits. Speaking with a financial advisor can provide personalized advice to ensure a Roth IRA aligns with your retirement goals.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change frequently and vary by location. XOA TAX does not offer legal advice and is not responsible for updating this information. For personalized advice, consult a professional advisor or refer to IRS Circular 230.