Hi there! It’s your friends at XOA TAX, here to help you navigate the sometimes confusing world of tax forms. Today, we’re taking a deep dive into Schedule 2 of Form 1040. This form is used to report certain taxes that aren’t calculated directly on your main Form 1040. Let’s break it down and make sure you’re ready for the 2024 tax season.

Key Takeaways

- Schedule 2 covers Alternative Minimum Tax (AMT), self-employment tax, and other specific tax situations.

- You’ll need to attach Schedule 2 to your Form 1040 if you owe any of the taxes listed on it.

- Staying informed about recent updates to tax laws is crucial for accurate tax reporting.

Understanding Schedule 2

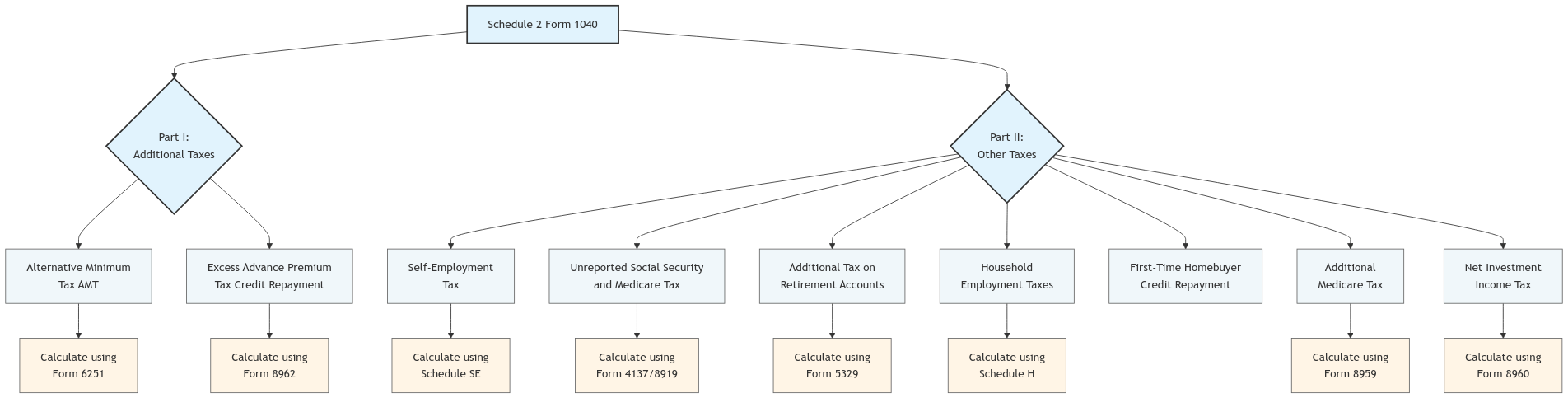

Schedule 2 might seem a bit daunting at first, but it’s really just a way to organize specific tax calculations that don’t fit on your main Form 1040.

Part I – Tax

This section is primarily for the Alternative Minimum Tax (AMT). The AMT is a separate tax calculation designed to ensure that higher-income taxpayers pay their fair share, even if they have many deductions or credits. For 2024, the AMT exemption amount is $85,700 for single filers and $133,300 for married couples filing jointly. If your income exceeds these thresholds, you may need to calculate the AMT using Form 6251 and report the amount on Schedule 2.

Part I also includes any repayment of excess Advance Premium Tax Credit. This credit helps individuals afford health insurance purchased through the Marketplace. If your household income for 2024 is above 400% of the Federal Poverty Level, you may need to repay some or all of the Advance Premium Tax Credit. This calculation is done on Form 8962.

Part II – Other Taxes

This section covers a variety of other taxes, including:

- Self-Employment Tax: If you’re self-employed or an independent contractor, you’ll generally need to pay self-employment tax, which covers Social Security and Medicare taxes. The self-employment tax rate for 2024 is 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare. You’ll calculate this on Schedule SE.

- Unreported Social Security and Medicare Tax: If you had any income where Social Security and Medicare taxes weren’t withheld correctly, you’ll report and pay those taxes here.

- Additional Taxes on IRAs and Other Tax-Favored Accounts: This includes taxes on early withdrawals from retirement accounts or excess contributions.

- Household Employment Taxes: If you paid wages to a household employee like a nanny or caregiver, you may need to pay employment taxes.

- Repayment of First-Time Homebuyer Credit: If you claimed this credit in the past and certain conditions are met, you might have to repay a portion of it.

- Additional Medicare Tax and Net Investment Income Tax: These taxes apply to higher-income earners.

Who Needs to File Schedule 2?

If you owe any of the taxes listed on Schedule 2, you’ll need to file it with your Form 1040. Even if only one item applies to you, it’s still necessary to complete and attach the schedule.

Do You Need to File Schedule 2? A Checklist

To determine whether you need to file Schedule 2 (Form 1040) for the 2024 tax year, consider the following questions:

- Alternative Minimum Tax (AMT):

- Did you calculate an AMT liability using Form 6251?

- Is your income above the AMT exemption thresholds for 2024?

- Excess Advance Premium Tax Credit Repayment:

- Did you receive advance payments of the Premium Tax Credit for health insurance purchased through the Marketplace?

- Is your household income for 2024 above 400% of the Federal Poverty Level, necessitating repayment of some or all of the credit?

- Self-Employment Tax:

- Were you self-employed or an independent contractor during 2024?

- Do you owe self-employment tax, covering Social Security and Medicare contributions?

- Unreported Social Security and Medicare Tax:

- Did you have income, such as tips or wages, where Social Security and Medicare taxes were not withheld correctly?

- Additional Taxes on IRAs and Other Tax-Favored Accounts:

- Did you make early withdrawals from retirement accounts without qualifying exceptions?

- Did you contribute more than the allowable limits to IRAs or other tax-favored accounts?

- Household Employment Taxes:

- Did you pay wages to a household employee, such as a nanny or caregiver, that require employment tax payments?

- Repayment of First-Time Homebuyer Credit:

- Did you claim the First-Time Homebuyer Credit in a previous year and sell the home or cease using it as your main residence within the required period?

- Additional Medicare Tax and Net Investment Income Tax:

- Is your income above the thresholds that subject you to the Additional Medicare Tax?

- Do you have significant investment income that may be subject to the Net Investment Income Tax?

If you answered “yes” to any of these questions, you may need to file Schedule 2 with your Form 1040 for the 2024 tax year. Consulting with a tax professional or referring to the IRS instructions for Schedule 2 can provide further guidance specific to your situation.

2024 Tax Law Updates

Tax laws are always evolving, and it’s essential to stay updated. For the 2024 tax year, the IRS has made adjustments for inflation, which can affect various tax provisions. For example, the standard deduction amounts have increased. Here are the 2024 standard deduction amounts:

- Single filers: $14,600

- Married filing jointly: $29,200

- Head of household: $21,900

The income thresholds for certain tax brackets have also been adjusted. You can find the 2024 tax brackets and rates in the table below:

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $16,550 |

| 12% | $11,600 to $47,150 | $23,200 to $94,300 | $16,550 to $63,100 |

| 22% | $47,150 to $100,525 | $94,300 to $201,050 | $63,100 to $100,500 |

| 24% | $100,525 to $191,950 | $201,050 to $383,900 | $100,500 to $191,950 |

| 32% | $191,950 to $243,725 | $383,900 to $487,450 | $191,950 to $243,700 |

| 35% | $243,725 to $609,350 | $487,450 to $731,200 | $243,700 to $609,350 |

| 37% | Over $609,350 | Over $731,200 | Over $609,350 |

These changes can impact your overall tax liability and whether or not you need to file Schedule 2. You can find details about these changes on the IRS website (irs.gov).

Electronic Filing Requirements

The IRS encourages taxpayers to file electronically whenever possible. If your adjusted gross income is above a certain threshold, you may be required to file electronically. You can e-file through tax preparation software or a tax professional.

Avoid These Common Mistakes

- Incorrectly calculating AMT: Make sure you use the correct form (Form 6251) and follow the instructions carefully.

- Forgetting to repay excess Premium Tax Credit: If you received more credit than you were eligible for, it’s crucial to report and repay the excess amount.

- Miscalculating self-employment tax: Ensure you’re using the correct rate and including all relevant income.

- Overlooking state tax implications: Remember that state tax laws may differ from federal laws.

FAQs

What if I’m not sure whether I need to file Schedule 2?

If you’re unsure whether any of the taxes on Schedule 2 apply to you, it’s always a good idea to consult with a tax professional. They can help you determine your specific filing requirements and ensure you’re meeting all your tax obligations.

Can I use tax software to help me complete Schedule 2?

Yes, most tax software programs will guide you through the process of completing Schedule 2, including any necessary calculations. However, it’s still important to understand the types of taxes covered on the form and whether they apply to your situation.

What happens if I don’t file Schedule 2 when I’m required to?

Failing to file Schedule 2 when you owe any of the listed taxes can result in penalties and interest. It’s crucial to file accurately and on time to avoid any issues with the IRS.

Need Help? Connect with XOA TAX

We understand that navigating the complexities of tax forms can be challenging. If you have any questions about Schedule 2 or any other tax-related matters, the team at XOA TAX is here to help. We can provide personalized guidance and support to ensure you meet all your tax obligations and achieve your financial goals. Feel free to reach out to us through our website, give us a call, or send us an email.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime