Navigating the world of tax forms can be tricky, but reporting your investment income doesn’t have to be a headache. This guide will walk you through completing Schedule B for tax year 2024, making the process as smooth as possible.

What is Schedule B?

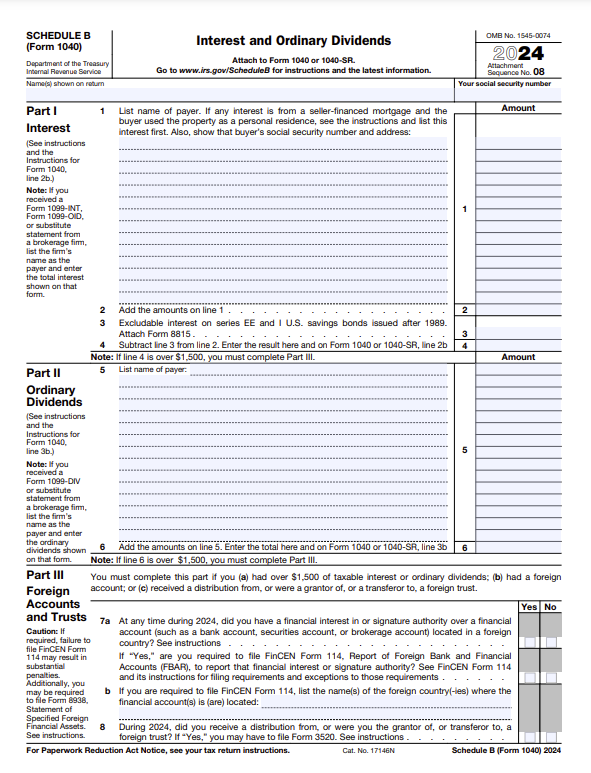

Schedule B is a form used to report income earned from interest and ordinary dividends. If your combined interest and dividend income tops $1,500 for the year, you’ll need to include this form with your Form 1040. This includes income from:

- Savings accounts

- Bonds

- Stocks

- Mutual funds

Who Needs to File Schedule B?

You’ll likely need to file Schedule B if you answer “yes” to any of the following:

- Did your total taxable interest and ordinary dividends exceed $1,500?

- Did you receive interest from a seller-financed mortgage where the buyer used the property as their personal residence?

- Did you earn interest from a bond?

- Do you need to report an original issue discount (OID) that’s less than the amount shown on Form 1099-OID?

- Is your reported interest income less than the amount on Form 1099-INT due to an amortizable bond premium?

- Are you claiming the exclusion of interest from Series EE or I U.S. savings bonds issued after 1989?

- Did you receive interest or ordinary dividends as a nominee (on behalf of someone else)?

- Do you have a financial interest in a foreign account, or were you a grantor or transferor to a foreign trust?

Pro Tips for Completing Schedule B

1. Gather Your Documents:

Having all your paperwork in order before you start will save you time and frustration. Here’s what you’ll need:

- Form 1099-INT: This reports interest income from banks, financial institutions, and other payers.

- Form 1099-DIV: This reports dividends, specifying whether they are qualified or nonqualified, which impacts how they’re taxed.

- Form 1099-OID: This reports original issue discount, which is the interest you earn over the life of a bond.

- Foreign account information: If you have any foreign accounts, gather details like account numbers and the highest balance in each account during the year. You might also need to file FinCEN Form 114 (Report of Foreign Bank and Financial Accounts), also known as FBAR, if the total value of your foreign accounts exceeds $10,000 at any point during the year.

2. Stay Organized:

Keeping your financial records organized throughout the year is key to a smooth tax filing process. Make sure you have:

- Bank statements

- Brokerage statements

- Any other documents related to your interest and dividend income

Consider using digital tools like cloud storage or scanning apps to keep your records safe, accessible, and organized.

3. Understand Qualified vs. Nonqualified Dividends:

- Qualified dividends are taxed at lower rates, similar to long-term capital gains.

- Nonqualified dividends are taxed as ordinary income.

Your Form 1099-DIV will indicate which type of dividends you received.

4. Don’t Forget Foreign Accounts:

- If you have a financial interest in any foreign accounts, you’ll need to report them on Schedule B.

- Be aware of reporting thresholds and requirements, which can be found on the IRS website.

- You might also need to file FinCEN Form 114 (FBAR) if the aggregate value of your foreign accounts exceeds $10,000 at any time during the year. Depending on your circumstances, you may also need to file Form 8938 (Statement of Specified Foreign Financial Assets).

5. Double-Check Your Work:

- Review your entries carefully before submitting.

- Make sure the information on Schedule B matches the information on your other tax forms.

- Keep a copy of Schedule B for your records.

Important Notes and Deadlines

- Tax Law Changes: Tax laws can change, so always check the IRS website for the latest updates.

- Filing Deadlines: Schedule B is filed with your Form 1040, typically due on April 15th. FinCEN Form 114 (FBAR) generally has the same due date, but it may have a different filing deadline or extension depending on your situation. Check the IRS instructions for the most current information.

- Electronic Filing: You can file Schedule B electronically when you e-file your tax return.

- State Taxes: Some states also have their own requirements for reporting interest and dividend income. Check with your state’s tax agency for details.

- Record Retention: Keep your tax records for at least 3 years, but consider keeping them for 7 years, as this is the general statute of limitations for the IRS to audit your return.

- Amended Returns: If you discover an error after filing, you can file an amended return using Form 1040-X.

Frequently Asked Questions (FAQ)

1. What if I don’t report all of my interest and dividend income?

Failing to report all your income can lead to penalties and interest. The IRS receives copies of your 1099 forms, so it’s important to accurately report all income received.

2. Can I file Schedule B electronically?

Yes, you can file Schedule B electronically when you e-file your tax return.

3. Where can I get help if I have questions about Schedule B?

The IRS website (IRS.gov) is a great resource for information and instructions. You can also consult a qualified tax professional for personalized assistance.

4. What are the penalties for filing Schedule B late?

The penalty for filing late is typically a percentage of the unpaid taxes, and interest can also accrue on the unpaid amount.

5. Can I amend my tax return if I make a mistake on Schedule B?

Yes, you can file an amended return using Form 1040-X to correct any errors.

Need More Help?

The IRS website (IRS.gov) is your best resource for accurate and up-to-date information. You can also consult a qualified tax professional like XOA TAX if you have complex tax situations or need personalized advice.

Contact us today for a free consultation:

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime