So, you’re ready to take the plunge and incorporate your business? Congratulations! That’s a big step. You’ve got the structure figured out, the paperwork’s in order…but hold on a sec! Have you thought about what happens to your business debt when you incorporate?

This is where things can get a little tricky. Transferring assets to your new corporation might seem straightforward, but there’s a section in the tax code – Section 357, and specifically, Section 357(b) – that can throw a wrench in your plans if you’re not careful.

Key Takeaways

- Transfer business assets tax-free: Section 357 generally allows you to move assets into your corporation without immediate tax consequences, even if those assets come with debt.

- Beware of tax avoidance red flags: Section 357(b) is designed to prevent folks from using debt transfers to dodge taxes.

- Understand “bona fide business purpose”: The IRS wants to see that assuming debt makes sense for your business, not just your tax return.

- Keep good records: Solid documentation is your best friend when dealing with Section 357(b).

What is Section 357?

Imagine you’re moving your business from a sole proprietorship into a shiny new corporation. You’ve got equipment, inventory, maybe even a building – all with loans or mortgages attached. Section 357 of the Internal Revenue Code basically says, “Hey, you can usually transfer those assets and their associated liabilities into your corporation without getting hit with a big tax bill right now.”

Think of it like moving your stuff from one truck to another. The stuff (your assets) and the boxes they’re in (the liabilities) go together. This is generally a tax-free exchange, meaning you won’t owe taxes on the value of those assets just because they’ve changed trucks.

Important Note: While we’re using the “moving truck” analogy to keep things simple, there are some specific rules you need to follow for this exchange to be truly tax-free. We’ll dive into those a bit later.

To be extra precise, Treasury Regulation §1.357-1(c) defines a liability as “a right to receive money or money’s worth that would be includible in gross income if it were received by the taxpayer.” So, it’s not just any old debt; it has to be something that would create income if you received it directly.

But keep in mind that there are other sections of the tax code, like Section 358 and Section 362, that will come into play to determine your basis in the stock you receive and the corporation’s basis in the assets.

The Tax Avoidance Catch: §357(b)

But here’s where things get interesting. The IRS is pretty smart, and they know people might try to get creative with debt to avoid paying taxes. That’s where Section 357(b) comes in. It’s like a special IRS agent who’s always on the lookout for suspicious activity!

Example:

Let’s say, just before incorporating, you take out a big personal loan for $50,000 and attach it to a piece of business equipment worth $30,000. Then, you transfer that equipment and the loan to your corporation. See what happened there? You essentially pulled $20,000 of cash out of your business without paying taxes on it.

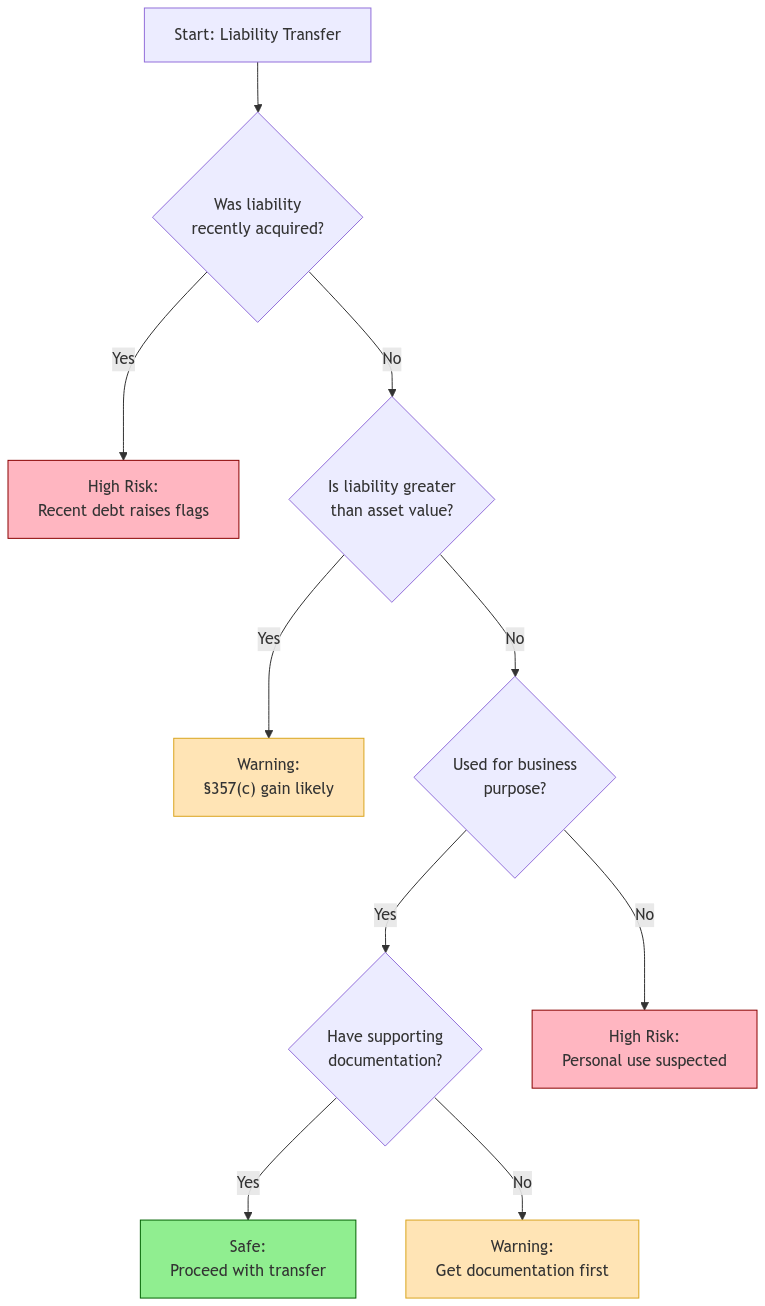

Section 357(b) is designed to catch those kinds of maneuvers. If the IRS thinks your main reason for transferring a liability is to avoid taxes, they can treat that liability as if it were cash – and bam – you’ve got a tax bill. Treasury Regulation §1.357-2 gives us some clues about what the IRS looks for when deciding if there’s a tax avoidance motive. They’ll consider things like:

- The nature of the liability: Is it a legitimate business debt, or is it something more personal?

- When the liability was incurred: Did you take on the debt right before the transfer, which might be suspicious?

- Your overall financial situation: Does the transfer make sense from a business perspective, or does it seem like you’re just trying to get cash out tax-free?

Determining a “Bona Fide Business Purpose”

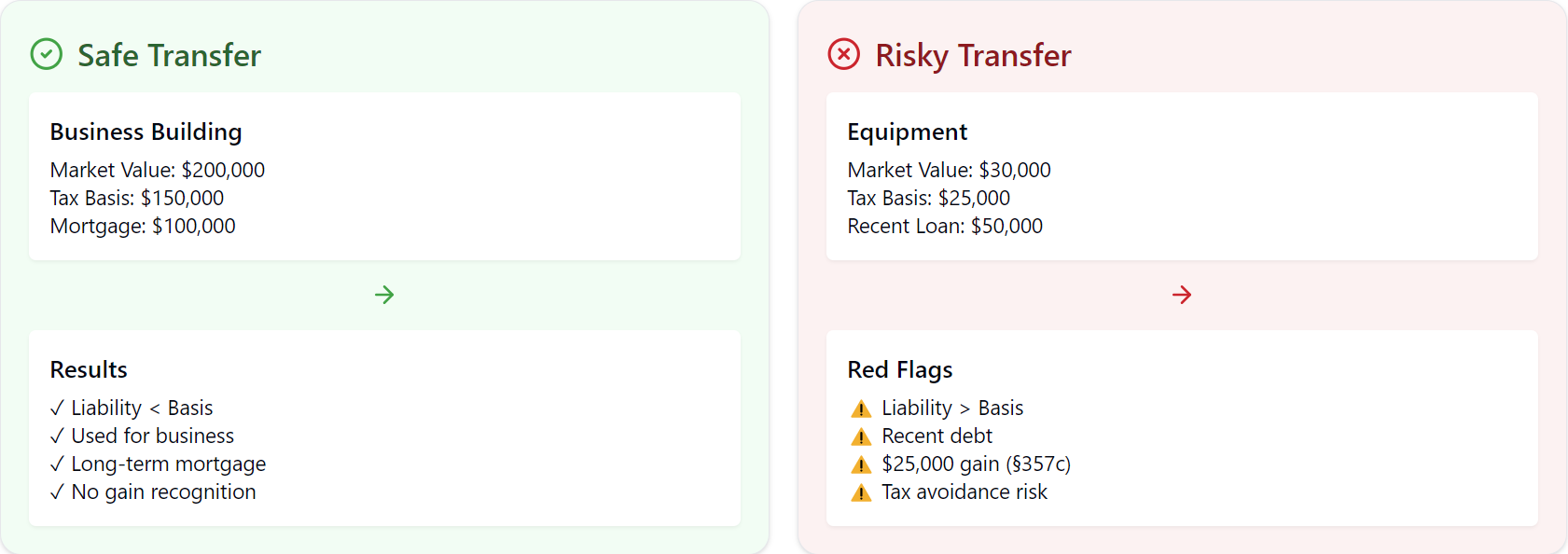

The key to staying on the right side of Section 357(b) is showing that assuming the liability serves a real business need. This is what the IRS calls a “bona fide business purpose.”

Think of it this way:

- Good: You transfer a building with a $100,000 mortgage to your corporation. The mortgage was used to buy the building five years ago, and your business operates from that building. This is a clear business purpose.

- Not-so-good: You transfer a piece of equipment worth $10,000 with a $15,000 loan that’s mostly for personal expenses. This raises red flags because it doesn’t seem to have much to do with running your business.

The IRS will look at a bunch of factors to figure out if you have a “bona fide business purpose,” including:

- Why did you take on the liability in the first place? Was it to acquire a business asset, or was it for something unrelated to your business?

- How does the liability relate to your business operations? Is the liability attached to an asset that’s essential to your business?

- What’s the overall financial picture of your business? Does taking on this liability make sense financially for your company?

- Did you keep good records showing the business reasons for the transfer? Do you have documents like loan agreements, board meeting minutes, or financial projections that support your case?

Uh Oh! Liabilities Exceed Your Basis? Section 357(c)

There’s another important piece to this puzzle: Section 357(c). This section says that if the liabilities you transfer to your corporation are greater than your tax basis in the assets, you’ll have to recognize a gain.

Let’s break that down. Your “tax basis” is basically what you paid for an asset, minus any depreciation. So, if you transfer a building with a basis of $50,000 but it has a $70,000 mortgage, you’ll have to recognize a $20,000 gain.

Example:

You transfer the following to your new corporation:

- Asset: Equipment

- Your Basis: $10,000 (what you paid for it, minus depreciation)

- Liability: $15,000 loan

Because the liability ($15,000) exceeds your basis ($10,000) by $5,000, you’ll have to recognize a $5,000 gain. This means you’ll owe taxes on that $5,000 now, even if you have a bona fide business purpose for transferring the liability.

Watch Out for the Step Transaction Doctrine!

Here’s another thing to keep in mind: the “step transaction doctrine.” It sounds complicated, but it’s a pretty simple idea. Basically, the IRS can look at a series of separate transactions as one big transaction if they think you’re trying to get a tax advantage by breaking things up into smaller steps.

Example:

Let’s say you want to transfer some assets to your corporation, but you know the liabilities are greater than your basis. To avoid recognizing a gain under Section 357(c), you first borrow some money against the assets and then transfer the assets and the increased liability to the corporation. The IRS might see right through this and treat the whole thing as one transaction, meaning you’ll still have to recognize the gain.

Recourse vs. Non-Recourse: What’s the Difference?

When it comes to liabilities, there are two main types: recourse and non-recourse.

- Recourse liability: This means you’re personally on the hook for the debt. If your business can’t pay, the lender can come after your personal assets.

- Non-recourse liability: With this type of debt, the lender can only go after the specific asset that secures the loan. They can’t touch your other stuff.

Why does this matter for Section 357? Well, the IRS tends to scrutinize recourse liabilities more closely. They might be more likely to see a recourse liability as a way to pull cash out of your business, especially if it’s a large liability compared to the value of the asset.

Don’t Forget About Basis!

Your Basis in the Stock (Section 358)

Section 358 tells us how to figure out your basis in the stock you get from the corporation. Generally, your basis will be the same as your basis in the assets you transferred, minus any liabilities the corporation takes on, plus any gain you recognize on the exchange.

The Corporation’s Basis in the Assets (Section 362)

Section 362 determines the corporation’s basis in the assets it receives. Usually, the corporation’s basis is the same as your basis. But, if any of the liabilities are treated as boot under Section 357(b) or (c), the corporation’s basis will be reduced. This is important because the corporation’s basis will affect things like depreciation deductions and how much gain or loss it recognizes when it sells the assets later on. There’s also Section 362(d) which can further limit the corporation’s basis in certain situations, so it’s important to understand how these rules interact.

Navigating §357(b): Practical Considerations

Dealing with Section 357(b)? Here’s how to stay out of trouble:

- Document everything! Keep detailed records that show exactly why you’re assuming each liability. Think contracts, appraisals, meeting minutes – anything that supports your business case.

- Know the red flags: Liabilities that are way bigger than the value of the assets they’re attached to? Personal loans disguised as business debts? Those are the kinds of things that make the IRS raise an eyebrow.

- Get expert help: XOA TAX can help you analyze your situation, make sure you’re following the rules, and avoid any unexpected tax surprises.

Section 357(b) Documentation Checklist

Critical Documents (Keep Both Digital & Physical)

-

🔴 Loan Agreements

Original loan documents showing terms, dates, and purposes -

🔴 Asset Documentation

Purchase records, appraisals, and depreciation schedules

Important Supporting Documents (Digital Storage Recommended)

-

🟡 Board Meeting Minutes

Records showing business purpose discussions -

🟡 Financial Projections

Business plans and cash flow analyses

Supplementary Records (Digital Only)

-

🟢 Email Communications

Related business correspondence -

🟢 Market Research

Industry data supporting business decisions

Storage Tips: Keep critical documents in both physical and digital formats. Use cloud storage with encryption for digital copies. Maintain physical copies in a fireproof safe.

FAQs

What kinds of liabilities usually trigger Section 357(b) scrutiny?

Liabilities that seem out of proportion to the assets involved, those taken on right before incorporating, or those that don’t seem to have a clear business purpose are often red flags.

How can I prove I have a “bona fide business purpose”?

Detailed documentation is key! This might include business plans, loan agreements, financial projections, and anything that shows the economic benefit to your business.

What happens if I don’t follow Section 357(b)?

The IRS might treat the assumed liability as cash, meaning you could owe taxes on it right away. Ouch!

Do state taxes matter when it comes to Section 357(b)?

Absolutely! While Section 357(b) is a federal rule, states often have their own quirks. Some states, like California, generally follow the federal rules. But others, like Pennsylvania, have their own unique provisions. It’s crucial to check the specific rules in your state.

What are some common mistakes people make with Section 357(b)?

Not keeping good records, forgetting about state taxes, and not understanding how Section 357(b) works with other parts of the tax code are some common pitfalls. For example, you also need to meet the requirements of Section 351 for the transfer of property to a corporation to be tax-free. It’s best to talk to a tax professional to make sure you’ve got all your bases covered.

What if I transfer property with a built-in loss to my corporation?

Even if you have a loss on the property (meaning your basis is higher than the fair market value), Section 357(c) can still apply. If the liabilities exceed your basis, you’ll have to recognize a gain.

Can I avoid Section 357(b) by contributing cash to the corporation along with the liabilities?

This might help, but it’s not a guaranteed solution. The IRS will still look at all the facts and circumstances to determine if you have a bona fide business purpose for assuming the liabilities. Contributing cash might show that you’re not just trying to pull money out of the business tax-free, but it’s not the only factor they’ll consider.

Feeling overwhelmed by Section 357(b)?

Don’t worry, you don’t have to navigate this alone! At XOA TAX, our team of experienced CPAs has helped many businesses successfully incorporate and restructure while steering clear of tax trouble. We can help you:

- Analyze your specific situation: We’ll take a close look at your assets, liabilities, and business goals to identify any potential issues.

- Develop a tax-smart strategy: We’ll help you structure your incorporation or restructuring to minimize your tax liability.

- Ensure you have the right documentation: We’ll guide you through the paperwork and make sure you have everything you need to show the IRS you’re playing by the rules.

Ready to get started? Contact XOA TAX today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime