Imagine this: you’ve just launched your dream Shopify store, the orders are rolling in, and you’re finally seeing your hard work pay off. But amidst the excitement, there’s a nagging question in the back of your mind: “Am I really on top of my finances?”

That’s where Shopify accounting comes in. It’s the backbone of your e-commerce business, giving you the insights you need to make smart decisions and achieve your goals. At XOA TAX, we understand that navigating the world of online sales, payment gateways, and ever-changing tax laws can be tricky. That’s why we’re here to break it all down for you.

In this guide, we’ll explore the ins and outs of Shopify accounting, from understanding your cash flow to mastering sales tax and staying ahead of the curve with modern e-commerce trends.

Key Takeaways

- Shopify accounting involves unique challenges like managing multiple sales channels and payment processors.

- Accurate inventory valuation and sales tax compliance are crucial for profitability.

- Staying on top of chargebacks, fraud prevention, and modern e-commerce trends is essential for long-term success.

- XOA TAX can provide expert guidance and support to navigate the complexities of Shopify accounting.

Why Shopify Accounting Matters

Think of your Shopify store as a ship sailing the sometimes turbulent seas of e-commerce. Shopify accounting is your compass and map, guiding you towards profitability and growth. It’s not just about crunching numbers; it’s about understanding your financial performance, spotting potential problems early on, and making informed decisions that drive your business forward.

Understanding Shopify’s Native Accounting Features

Before we dive deeper, let’s take a look at what Shopify offers right out of the box. While not a full-fledged accounting system, Shopify provides some handy tools to get you started:

Features of Shopify’s Native Accounting

- Reports: Shopify offers a variety of built-in reports that provide insights into your sales, finances, and customer behavior. Key reports include the Sales Summary Report, Finance Summary Report, and Customer Reports. These reports can be customized by date range and other criteria, allowing you to analyze your data and identify trends.

- Dashboard: Your Shopify dashboard provides a quick overview of your store’s performance, including key metrics like total sales, conversion rates, and average order value.

- Analytics: Shopify’s analytics tools provide deeper insights into your store’s data, helping you understand customer behavior, track marketing campaigns, and identify areas for improvement.

While these features are helpful for basic tracking, you’ll likely need to integrate with a dedicated accounting software for more robust financial management.

Setting Up Your Shopify Accounting System

Chart of Accounts

A well-structured chart of accounts is essential for organizing your financial data. For Shopify businesses, this typically includes accounts for:

- Assets: Cash, accounts receivable, inventory

- Liabilities: Accounts payable, sales tax payable

- Equity: Owner’s equity, retained earnings

- Revenue: Sales revenue, shipping revenue

- Expenses: Cost of goods sold, advertising expenses, shipping expenses

Choosing the Right Accounting Software

Selecting the right accounting software is crucial for managing your Shopify finances. Popular options include Xero (compatible with Starter, Standard, and Premium plans) and QuickBooks Online (compatible with Simple Start, Essentials, and Plus plans). Consider factors like your budget, business size, and desired features when making your choice.

Integrating with Inventory Management Systems

If you’re managing a large inventory, integrating your accounting software with an inventory management system can streamline your operations and improve accuracy.

Unique Aspects of Shopify Accounting

While Shopify offers fantastic features and integrations to streamline your business, it also presents some unique accounting considerations:

Sales Channels and Payment Processors

Unlike traditional brick-and-mortar stores, your Shopify business might be juggling sales from various online channels like your website, Facebook Shop, or even Instagram. Each channel often comes with its own payment gateway, adding complexity to your transaction tracking.

Example: Let’s say you sell handmade jewelry. A customer buys a necklace through your Facebook Shop, while another purchases earrings directly from your website. Each sale will have a different payment flow, requiring careful tracking and reconciliation in your accounting system.

Pitfall: Failing to categorize sales by channel can lead to inaccurate sales data and make it difficult to analyze which channels are most profitable.

Solution: Take advantage of Shopify’s reporting features to filter sales by channel. Ensure your accounting software accurately reflects these different channels. Also, be mindful of the different fees and processing times associated with each payment gateway.

Shopify Payments vs. Third-Party Processors

Shopify offers its own payment gateway, Shopify Payments, which can simplify transaction processing and reduce fees. However, you might choose to use a third-party processor like Stripe or PayPal. Each option has its pros and cons, so it’s important to choose the one that best fits your business needs.

Inventory Valuation

Knowing the true value of your inventory is essential for determining your Cost of Goods Sold (COGS) and, ultimately, your profitability.

Example: Imagine you sell custom-designed phone cases. Each color and design variation needs to be tracked as a separate SKU (Stock Keeping Unit) to ensure accurate inventory costing.

Pitfall: Using a simple average cost method for products with significant cost variations can distort your COGS and give you a misleading picture of your profits.

Solution: Explore inventory tracking methods like specific identification or FIFO/LIFO (First-In, First-Out or Last-In, First-Out). At XOA TAX, we can help you determine the best method for your specific products and accounting preferences.

Cost Accounting Methods

Different business models may require different cost accounting methods. For example, if you’re manufacturing your own products, you’ll need to track direct materials, direct labor, and manufacturing overhead. If you’re dropshipping, your COGS will primarily consist of the cost of goods from your supplier plus any shipping or handling fees.

Third-Party App Integrations

Apps like A2X (for automated e-commerce accounting) or Link My Books (for seamless Shopify integration) can automate the import of your Shopify sales data into your accounting software. But setting them up correctly and mapping accounts accurately is crucial.

Pitfall: Incorrectly configured app integrations can lead to data discrepancies and accounting errors that can be a real headache down the line. Also, be aware of API limitations that might restrict the amount of data that can be transferred.

Solution: Follow app setup instructions carefully, map accounts accurately, and regularly review data synchronization to ensure everything is running smoothly. If you’re feeling overwhelmed, our team at XOA TAX can provide expert guidance and support.

Mastering Shopify Accounting Challenges

Now, let’s dive into some common challenges Shopify businesses face and how to overcome them:

Sales Tax Compliance

Ah, sales tax! It can be a real minefield for online sellers, with different rates and rules across various states and jurisdictions.

Pitfall: Taking a “one-size-fits-all” approach to sales tax can lead to overcharging or undercharging customers, resulting in penalties or lost revenue. Ouch!

Solution: Shopify’s automated tax calculations are a great starting point. However, for complete peace of mind, consider consulting with a tax professional or using specialized sales tax software. We can connect you with the right resources to ensure you’re compliant in all the regions where you sell.

Economic Nexus and Marketplace Facilitator Laws

Understanding economic nexus is crucial for online sellers. Many states have economic nexus laws that require businesses to collect sales tax if they exceed a certain threshold of sales or transactions within that state.

Additionally, be aware of Marketplace Facilitator laws, where platforms like Amazon or Etsy collect and remit sales tax on your behalf in certain states.

International VAT Obligations

If you’re selling internationally, you’ll need to navigate Value-Added Tax (VAT) regulations. These vary by country, so it’s important to research the specific requirements for each region you sell to.

Chargebacks and Disputes

In the world of e-commerce, chargebacks and payment disputes are an unfortunate reality.

Pitfall: Not having a clear process for managing disputes can lead to lost revenue and damage your hard-earned reputation.

Solution: Implement a robust system for tracking and responding to chargebacks. This includes documenting evidence, communicating effectively with customers, and working with payment processors.

Fraud Prevention

Online stores are vulnerable to fraudulent transactions and cyberattacks.

Pitfall: Insufficient security measures can expose your business to financial loss and data breaches.

Solution: Protect your business with strong fraud prevention measures. This includes address verification, AVS (Address Verification System) and CVV (Card Verification Value) checks, and two-factor authentication for payment gateways.

Best Practices for Shopify Accounting

Here are some essential practices to keep your Shopify accounting accurate and efficient:

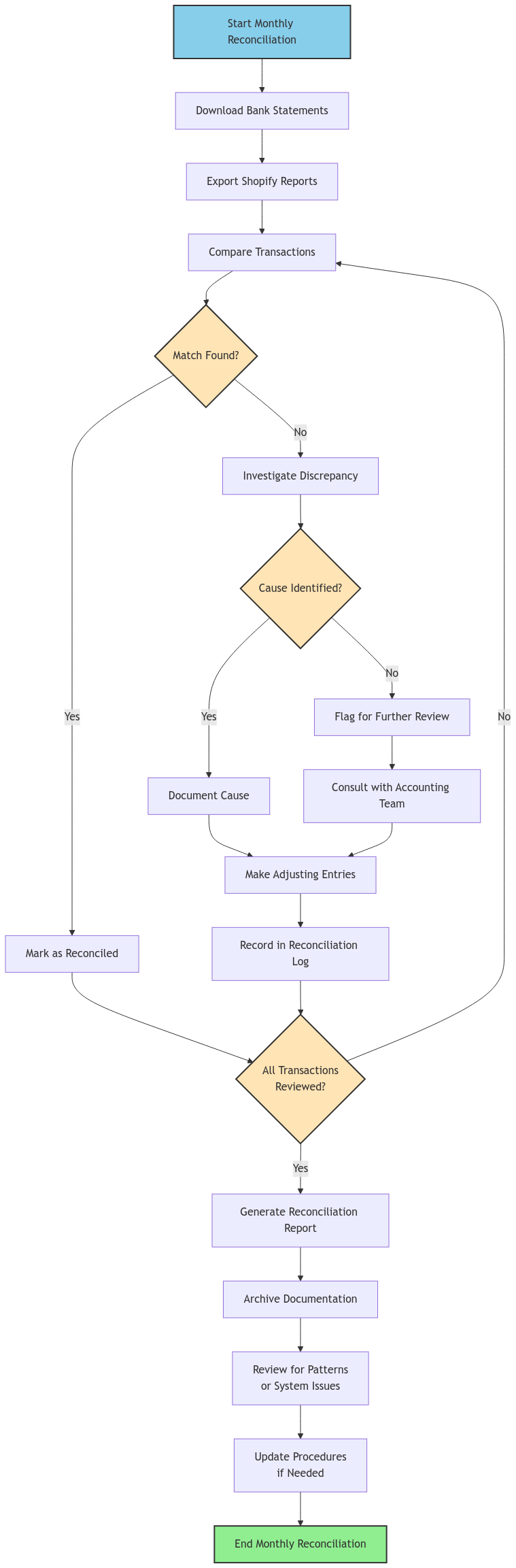

Reconciliation Workflow

Think of reconciliation as a regular check-up for your finances. Here’s a simple workflow:

- Download Bank Statements: Obtain your business bank statements for the period you want to reconcile.

- Export Shopify Reports: Export relevant Shopify financial reports, such as sales summaries and payment gateway payouts.

- Compare and Match: Compare transactions in your bank statements with those in your Shopify reports.

- Identify and Investigate Discrepancies: If you find any differences, investigate the cause. This could be due to timing differences, refunds, chargebacks, or errors.

- Record Adjustments: Make necessary adjustments in your accounting software to reconcile any discrepancies.

- Document the Reconciliation: Keep a record of the process, including any adjustments made and explanations for discrepancies.

Business Insurance

Protecting your online business with the right insurance coverage is crucial. Consider these options:

- General Liability Insurance: Covers common business risks like customer injuries and property damage.

- Product Liability Insurance: Protects you against claims arising from product defects.

- Cyber Liability Insurance: Helps mitigate financial losses from cyberattacks and data breaches.

Modern E-commerce Considerations

As e-commerce evolves, so does the accounting landscape. Here are some key trends to keep in mind:

Cryptocurrency Payments

Accepting cryptocurrencies like Bitcoin can open your business to a wider audience. But it also brings accounting complexities.

Challenge: Cryptocurrency values can fluctuate significantly, impacting revenue recognition and accounting for gains or losses.

Solution: Specialized accounting software or guidance from a CPA experienced in cryptocurrency transactions can ensure accurate record-keeping and tax compliance. At XOA TAX, we’re up-to-date on the latest regulations surrounding cryptocurrency and can help you navigate this evolving area.

Stablecoins and Payment Processor Compatibility

It’s important to distinguish between different types of cryptocurrencies. Stablecoins, which are pegged to a stable asset like the US dollar, may have different accounting implications than volatile cryptocurrencies like Bitcoin. Also, ensure your chosen payment processor supports the specific cryptocurrencies you want to accept.

Dropshipping Accounting

Dropshipping can simplify order fulfillment, but it presents unique accounting challenges.

Challenge: Tracking inventory costs and profit margins can be tricky when you don’t physically handle the products.

Solution: Maintain detailed records of supplier costs, shipping fees, and your own pricing to accurately calculate COGS and profit margins.

Multi-Channel Selling

Selling on multiple platforms like Amazon, Etsy, and your own Shopify store can be a fantastic way to reach more customers. But it can also complicate your accounting.

Challenge: Consolidating sales data and reconciling transactions across different platforms can be time-consuming.

Solution: Consider using multi-channel accounting software or integrating your various platforms with your primary accounting system. This streamlines data aggregation and reporting, giving you a clear overview of your business performance.

Multi-Currency Management

If you’re selling internationally, you’ll likely need to deal with multiple currencies. This can add complexity to your accounting, especially when it comes to reconciling transactions and reporting financial data.

Solution: Shopify Markets can simplify multi-currency management by allowing you to set different prices and currencies for different regions. However, you’ll still need to ensure your accounting system can handle multiple currencies and accurately track exchange rate fluctuations.

Data Privacy and Compliance

In today’s digital age, protecting customer data is paramount. Here are some key considerations for Shopify businesses:

- GDPR (General Data Protection Regulation): If you’re selling to customers in the European Economic Area (EEA), you need to comply with GDPR, which sets strict rules for collecting, storing, and processing personal data.

- CCPA (California Consumer Privacy Act): Similar to GDPR, CCPA applies to businesses that collect personal information from California residents.

- Data Retention: Establish clear data retention policies to ensure you’re only keeping customer data for as long as necessary.

FAQs

What are the most common mistakes Shopify businesses make with their accounting?

Many businesses struggle with accurate inventory valuation, sales tax compliance, and reconciling transactions from multiple sales channels. It’s also common to overlook the importance of robust fraud prevention measures and proper insurance coverage.

How often should I reconcile my Shopify accounts?

We recommend reconciling your accounts monthly. This helps you identify and address discrepancies promptly, ensuring accurate financial reporting.

Do I need a separate bank account for my Shopify business?

Yes, it’s highly advisable to have a separate bank account for your business. This makes it much easier to track income and expenses, and it’s essential for maintaining clean financial records.

Can XOA TAX help me set up my Shopify accounting system?

Absolutely! Our team can help you choose the right accounting software, configure app integrations, and establish a robust accounting system tailored to your Shopify business.

What are some resources for staying up-to-date on Shopify accounting and tax regulations?

The Shopify blog and help center are great resources for staying informed about platform updates and best practices. You can also find valuable information on the IRS website and state tax agency websites. And of course, our blog is regularly updated with the latest tax tips and e-commerce insights.

Partner with XOA Tax for Expert Support

We understand that navigating the complexities of Shopify accounting can feel overwhelming. That’s why we encourage you to reach out to XOA TAX. Our team of experienced CPAs specializes in e-commerce accounting and can provide tailored solutions to help you succeed.

Whether you need help with sales tax compliance, inventory valuation, setting up efficient accounting systems, or staying compliant with the latest regulations, we’re here to guide you every step of the way.

Ready to take your Shopify business to the next level? Contact us today for a free consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime