Tax season. Those two words can strike fear into the hearts of many. But what if you knew that sometimes, even if you’re not required to file a tax return, doing so could actually be in your best interest?

That’s right! While the idea of voluntarily tackling taxes might seem puzzling, there are some compelling reasons why you might want to consider it. Let’s dive into what you need to know for the 2024 tax year.

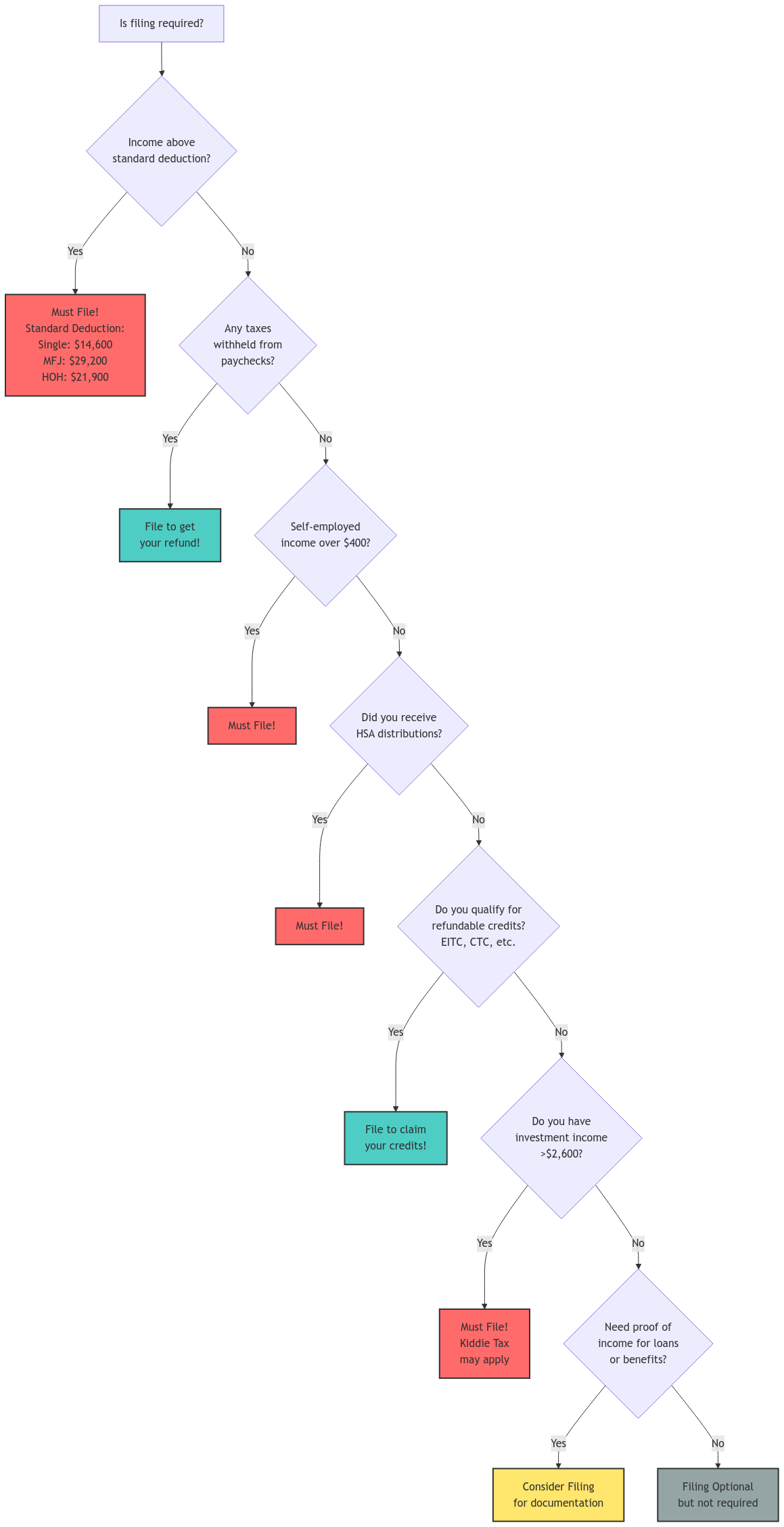

Should You File? Quick Decision Guide

Before we dive into the details, use this simple flowchart to determine if you should file a 2024 tax return:

Pro Tip: Even if your path leads to “Filing Optional,” keep reading to discover potential benefits of filing you might not have considered!

Understanding the 2024 Tax Brackets

Before we explore whether you should file, let’s look at where your income might fall. For 2024 (filing in 2025), the tax brackets are:

Single Filers

- 10%: $0 to $11,600

- 12%: $11,601 to $47,150

- 22%: $47,151 to $100,525

- 24%: $100,526 to $191,950

- 32%: $191,951 to $243,725

- 35%: $243,726 to $609,350

- 37%: $609,351 or more

Married Filing Jointly

- 10%: $0 to $23,200

- 12%: $23,201 to $94,300

- 22%: $94,301 to $201,050

- 24%: $201,051 to $383,900

- 32%: $383,901 to $487,450

- 35%: $487,451 to $731,200

- 37%: $731,201 or more

Who Must File a Tax Return?

For 2024, you generally must file if your gross income exceeds the standard deduction for your filing status:

- Single: $14,600

- Married Filing Jointly: $29,200

- Head of Household: $21,900

- Married Filing Separately: $14,600

Pro Tip: If you’re 65 or older, you may be eligible for a higher standard deduction!

Special Filing Requirements

Even if your income falls below these thresholds, you must file if:

- You’re self-employed with net earnings of $400 or more

- You received distributions from a Health Savings Account (HSA)

- You claimed the advanced clean vehicle credit at a dealership

- You have special tax situations (like foreign income or Section 965 tax liability)

Why File When You’re Not Required To?

Here’s where it gets interesting! Even if you’re not legally required to file, here are compelling reasons why you might want to:

1. Get Money Back in Your Pocket

Tax Refund Opportunities

- Withheld Taxes: If your employer withheld any income tax, filing is the only way to get that money back

- Estimated Tax Payments: Claim refunds for any overpayments you made

- Excess Social Security: If you had multiple employers, you might have overpaid Social Security tax

Refundable Tax Credits

Even with no tax liability, these credits could mean cash in your pocket:

- Earned Income Tax Credit: Up to $7,830 for qualifying families

- Child Tax Credit: Up to $2,000 per qualifying child

- American Opportunity Credit: Up to $1,000 refundable for education expenses

- Premium Tax Credit: Help with health insurance marketplace premiums

2. Smart Financial Planning

- Build Your Credit History: Tax returns can support loan applications

- Document Income: Useful for rental applications or financial aid

- Protect Future Benefits: Some tax benefits carry forward to future years

- Social Security Benefits: Documented income history can affect future benefits

Understanding the Kiddie Tax: What Parents Need to Know for 2024

The Kiddie Tax isn’t just about preventing tax avoidance – it’s designed to ensure children with significant investment income pay their fair share while protecting legitimate family financial planning.

How the Kiddie Tax Works

For 2024, unearned income (interest, dividends, capital gains) is taxed in tiers:

- First $1,300: Tax-free (matches dependent standard deduction)

- Next $1,300: Taxed at child’s rate (usually lower)

- Above $2,600: Taxed at parent’s marginal rate

Impact on Family Financial Planning

College Savings and 529 Plans

Good news! The Kiddie Tax typically doesn’t affect 529 plans:

- Qualified distributions remain tax-free

- Growth within the plan isn’t subject to annual taxation

- Withdrawals for eligible education expenses avoid Kiddie Tax implications

Smart Investment Strategies for Children

- Focus on tax-advantaged investments

- Consider timing of investment income

- Look into municipal bonds for tax-free income

- Explore custodial IRAs for earned income

Real-World Kiddie Tax Example

Imagine your teenager has:

- $2,000 in stock dividends

- $1,000 in savings account interest

- Total unearned income: $3,000

Here’s the tax breakdown:

- First $1,300: No tax

- Next $1,300: Child’s tax rate (typically 10%)

- Final $400: Parent’s tax rate (could be 22-37%)

Form Requirements

- Form 8615: Required if unearned income exceeds $2,600

- Form 8814: Optional parent election to report child’s income on their return

Special Considerations for 2024

Record Keeping Tips

- Keep all W-2s and 1099s

- Track charitable donations

- Document business expenses

- Save receipts for education expenses

Important Deadlines

- Regular filing deadline: April 15, 2025

- Extended filing deadline: October 15, 2025

- Quarterly estimated taxes:

- Q1: April 15, 2024

- Q2: June 15, 2024

- Q3: September 15, 2024

- Q4: January 15, 2025

Making the Decision to File

Consider filing if you:

- Had any tax withholding

- Made estimated tax payments

- Qualify for refundable credits

- Need proof of income

- Want to maintain good tax records

Need Expert Help with Your 2024 Taxes?

Don’t navigate tax decisions alone. The XOA TAX team is here to help you make the best choice for your situation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Disclaimer: This post provides general information only and not legal, tax, or financial advice. Tax laws and regulations vary by jurisdiction and change frequently. Consult a qualified professional for advice specific to your situation. XOA TAX does not provide legal advice or assume responsibility for updating this information.

anywhere

anywhere  anytime

anytime