Finding investors for your small business can be a challenging yet rewarding endeavor. Securing the right funding is crucial for growth and sustainability, but knowing where and how to find these investors is essential. This comprehensive guide will walk you through effective strategies to help you secure the necessary funding for your business.

Strategic Partnerships: How Investors Can Assist Small Businesses

An investor’s value extends far beyond the capital they provide. Collaborating with experienced investors can offer your business strategic insights, mentorship, and access to valuable networks.

Knowledge and Expertise

Investors with industry experience can guide you through complex challenges and help you avoid common pitfalls. Their expertise can accelerate your learning curve, allowing you to focus on scaling your business effectively.

Networking Opportunities

Investors often have extensive networks that can open doors to potential partnerships, clients, and other key stakeholders. Leveraging these connections can significantly enhance your business growth prospects.

Strategic Guidance

Seasoned investors can provide strategic advice, helping you refine your business model, optimize operations, and identify new growth opportunities. Their input can be invaluable in navigating the competitive business landscape.

Where to Find Investors for Your Small Business

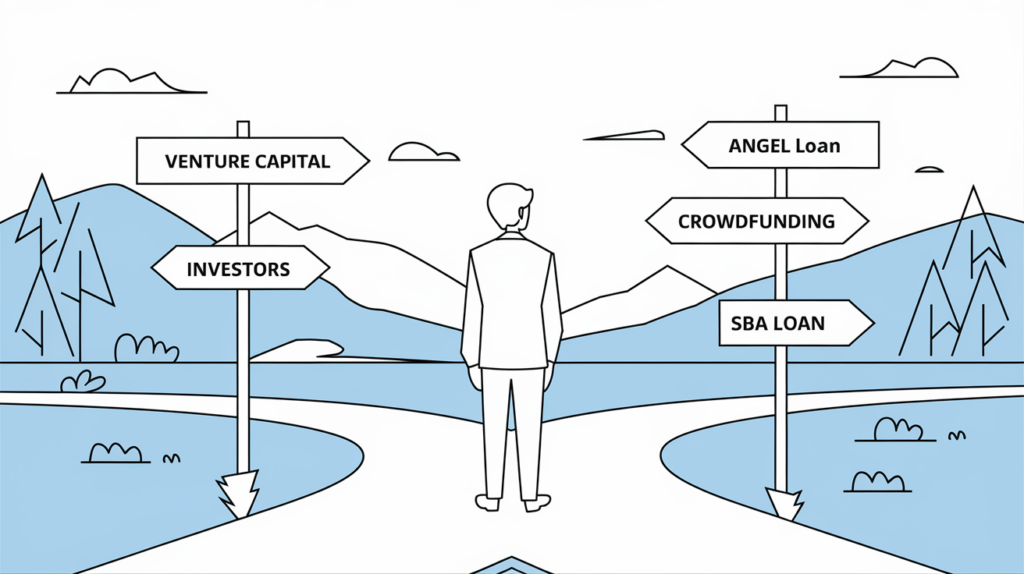

Funding for your business can come from various sources. Here are some effective strategies to help you locate and secure investors:

1. Start With Your Family and Friends

Your personal network can be a great starting point. Friends and family members who believe in your vision may be willing to invest in your business. However, it’s essential to formalize these agreements to prevent misunderstandings.

2. Request an Introduction from Your Contacts

If your immediate network isn’t able to invest, consider reaching out to their connections. A warm introduction from a mutual acquaintance can significantly increase your chances of securing an investment compared to cold outreach methods.

3. Contact Schools and Other Companies in Your Industry

Engaging with educational institutions and industry-specific companies can lead to valuable investor connections. Professors and department heads may know investors interested in your sector.

4. Try Crowdfunding Platforms

Crowdfunding platforms allow you to raise funds from a large number of people, each contributing a small amount. This method not only helps in securing capital but also validates your business idea through public support.

Reward-Based Platforms

Contributors receive rewards in exchange for their investments. Examples include Kickstarter and Indiegogo.

Donation-Based Platforms

Donations are made without expecting a return. Platforms like GoFundMe exemplify this model.

Peer-to-Peer Lending

These platforms connect borrowers directly with individual lenders. Examples include Lending Club and Prosper.

Equity-Based Platforms

Investors receive equity in your company in exchange for their investment. OurCrowd is a prominent example.

5. Be Strategic When Networking

Identify where your potential investors spend their time and join those organizations. Networking strategically can lead to meaningful connections and investment opportunities.

6. Apply for a Small Business Administration Loan

The SBA offers loan programs with favorable terms for small businesses. Utilize their lender match tool to find approved lenders who can provide the necessary capital.

Should You Get Investors for Your Business?

Deciding whether to take on investors depends on your business goals and needs. Here are some considerations to help you make an informed decision:

Pros of Getting Investors

- Access to significant capital for growth and expansion.

- Expertise and mentorship from experienced investors.

- Networking opportunities through the investor’s connections.

Cons of Getting Investors

- Potential loss of control over business decisions.

- Obligation to share profits with investors.

- Possible conflicts of interest between your vision and the investor’s expectations.

Making the Decision

Evaluate your business’s financial needs, growth potential, and how much control you’re willing to relinquish. Aligning with the right investor can propel your business forward, while the wrong partnership may hinder your progress.

Key Takeaways

- Finding and persuading the right investors is crucial for business growth.

- Funding can be sourced through crowdfunding, personal networks, venture capital, and angel investors.

- Different funding methods come with varying financial obligations like dividends, loan repayments, or equity sharing.

- A solid pitch, comprehensive business plan, clear financial statements, and proof of concept are essential to attract investors.

Frequently Asked Questions

1. What factors should be considered when selecting an investor?

Key Factors to Consider When Selecting an Investor:

- Track Record and Reputation: Investigate the investor’s past investments and their success rate.

- Industry Experience: Ensure the investor has experience in your industry to provide relevant guidance.

- Level of Involvement: Determine how actively the investor wants to participate in your business operations.

- Strategic Alignment: Align the investor’s goals with your business objectives.

- Additional Value Beyond Capital: Consider the investor’s network and expertise.

- Long-Term Relationship Potential: Ensure vision compatibility and cultural fit to foster a harmonious partnership.

By carefully evaluating these factors, you can select an investor who not only provides financial support but also contributes to your business’s long-term success.

2. How can entrepreneurs demonstrate their business idea effectively to investors?

How Entrepreneurs Can Effectively Demonstrate Their Business Idea to Investors:

- Show Proof of Concept: Develop a prototype or detailed models to demonstrate the viability of your idea.

- Improve Your Pitch: Refine your value proposition and receive feedback to enhance your presentation.

- Secure Initial Investment: Seek smaller funding from personal networks to cover initial R&D expenses.

These steps help in showcasing a well-developed and convincingly demonstrated idea, increasing the likelihood of securing investor commitment.

3. How can one find angel investors?

How to Find Angel Investors for Your Startup:

- Networking Events and Conferences: Attend industry-specific events to meet potential investors.

- Online Platforms: Utilize networks like AngelList or Gust to connect with angel investors.

- Angel Groups and Associations: Join organizations that list angel investors by region.

- Pitch Competitions: Participate in competitions to showcase your idea to angel investors.

- Social Media Channels: Leverage platforms like LinkedIn to reach out to potential investors.

- Recommendations and Referrals: Use your existing network to get introductions to angel investors.

These strategies will increase your chances of finding an angel investor who can provide both capital and mentorship for your startup.

4. What is the process for asking an investor for money?

How to Ask an Investor for Money:

- Develop a Compelling Business Plan: Outline your business model, target market, competitive analysis, and vision.

- Organize Financial Documentation: Prepare financial statements like cash flows, income statements, and balance sheets.

- Present Your Concept Clearly: Use prototypes, demos, or case studies to showcase your business idea.

- Highlight Market Need and Growth Potential: Use data and case studies to demonstrate demand and growth opportunities.

- Build Trust and Show Integrity: Be transparent about risks and your strategies to overcome them.

Tips for a Successful Pitch:

- Prepare for Questions: Anticipate investor inquiries and have well-thought-out answers ready.

- Practice Your Pitch: Rehearse your presentation to deliver it confidently.

- Seek Feedback: Present your pitch to mentors or colleagues to refine your approach.

Approaching investors with a well-prepared strategy enhances your chances of securing the necessary funding.

5. How should entrepreneurs be clear about what they are asking from investors?

How Entrepreneurs Should Clarify Their Requests from Investors:

- Identify the Role: Determine if you’re seeking stakeholders, co-founders, or advisors.

- Decide on Involvement Level: Clarify whether you want the investor to be hands-on or hands-off.

- Clarify Your Needs and Expectations: Define if you need mentorship, networking, or just financial input.

- Communicate Effectively: Clearly articulate your needs to prevent misunderstandings and ensure alignment with the investor’s vision.

Being transparent and specific about your requirements helps in forming a productive and aligned partnership with investors.

6. How can events like investor summits and pitch competitions aid in finding investors?

How Can Events Like Investor Summits and Pitch Competitions Aid in Finding Investors?

- Personal Interaction: Face-to-face meetings help build trust and rapport with potential investors.

- Tailored Pitches: Presenting at events allows you to refine your pitch based on immediate feedback.

- Interactive Feedback: Engage in dialogues to address investor concerns and improve your pitch on the spot.

- Networking Opportunities: Informal conversations during events can lead to unexpected investment opportunities.

- Reading Non-Verbal Cues: Gauge investor interest through body language and facial expressions.

Attending these events with thorough preparation can significantly boost your chances of finding the right investors for your business.

7. Who are angel investors and what role do they play in funding a business?

Understanding Angel Investors: Champions of Startup Growth

Angel investors are affluent individuals who provide financial backing to startups in exchange for equity ownership or convertible debt. They often invest during the early stages of a business, offering not just capital but also valuable mentorship and industry connections.

Role in Business Funding:

- Early-Stage Investment: Provide the essential capital needed for product development, marketing, and scaling operations.

- Limited Equity Sharing: Offer substantial investments without diluting equity among a large group of investors.

- Experience and Guidance: Bring industry knowledge and strategic guidance to help navigate business challenges.

Angel investors play a crucial role in the success of startups by not only funding but also actively contributing to their growth and development.

8. How much money should entrepreneurs ask for from investors?

How Much Money Should Entrepreneurs Ask for from Investors?

Determining the right amount to ask for is pivotal. A common approach is to align your request with a percentage of your company’s valuation. Typically, entrepreneurs aim to secure an investment that corresponds with the equity they’re willing to offer.

Considerations for Adjusting Your Ask:

- Business Needs: Assess your specific financial requirements and how the investment will fuel growth.

- Company Stage: Early-stage startups may require more substantial funds relative to their valuation.

- Investor Expectations: Align your request with what potential investors are willing to consider.

Flexible Funding Strategies: Be open to negotiating the investment amount and equity stake based on unique business circumstances and growth potential.

Clear communication and understanding of your company’s value are essential in determining an optimal investment request.

9. Why is having a business plan important when seeking investment?

The Importance of a Business Plan in Attracting Investment

A well-structured business plan is crucial when seeking investment as it demonstrates credibility and potential to investors.

Building Trust with Investors: A comprehensive business plan signals thorough planning and commitment, instilling confidence in investors.

Key Components of a Solid Plan:

- Business Model: Clearly outline how your business operates and generates revenue.

- Leadership Structure: Detail the roles of business owners and their qualifications.

- Financial Projections: Present realistic financial forecasts to showcase potential returns.

Formatting your business plan into a pitch deck can make it more accessible and engaging for potential investors.

10. What does it mean to be investor-ready?

What It Means to Be Investor-Ready

Being investor-ready means positioning your business to attract and secure potential investors by presenting a compelling and trustworthy investment opportunity.

Key Aspects of Being Investor-Ready:

- Comprehensive Business Plan: A detailed plan that outlines your vision, strategy, and financial goals.

- Validated Concept: Demonstrate the viability of your idea through prototypes or detailed models.

- Optimized Financial Health: Maintain organized and transparent financial records.

- Clear Investment Objectives: Define what you seek from investors, whether it’s capital, mentorship, or networking opportunities.

- Preparedness to Decline: Be ready to walk away from offers that don’t align with your long-term goals.

Achieving investor readiness involves demonstrating a solid foundation for your business and being strategically prepared to engage with potential investors.

11. Do angel investors require repayment in the traditional sense?

Angel investors do not require repayment in the traditional sense, as their investment is not structured as a loan. Instead, they receive an ownership stake in your company, meaning their returns come from the company’s profits, typically in the form of dividends. Essentially, they are betting on the success of your business, aiming for financial rewards tied to its growth and profitability.

12. When might it be necessary to decline an investor’s offer?

When to Say ‘No’ to an Investor’s Offer

While securing investment is exciting, it’s essential to recognize situations where declining an offer is in your best interest:

- Misaligned Goals: If the investor’s vision doesn’t align with your company’s mission.

- Unfavorable Terms and Conditions: High interest rates or restrictive covenants that could hinder growth.

- Pressure Tactics: Investors who push you to make quick decisions may not have your best interests at heart.

- Reputation and Values: Investors with a poor reputation or conflicting values can damage your brand.

- Future Control and Influence: Excessive demand for control over business decisions.

It’s better to decline an unsuitable offer now than face long-term consequences from a mismatched partnership.

13. What preparation is necessary before attending investor-related events?

How to Prepare for Investor-Related Events

- Polish Your Pitch: Develop a clear, engaging, and concise pitch that highlights your value proposition, data-driven insights, and compelling story.

- Practice Makes Perfect: Rehearse your pitch multiple times and simulate investor questioning to build confidence.

- Research Attendees: Identify key investors attending the event and tailor your approach to align with their interests.

- Prepare for Networking: Have conversation starters and an elevator pitch ready to engage potential investors.

- Master Nonverbal Communication: Maintain eye contact, offer firm handshakes, and use open body language to convey confidence.

- Gather Necessary Materials: Bring business cards, presentation slides, and financial documents to share with interested investors.

- Dress to Impress: Present yourself professionally to set the right tone for investor interactions.

Thorough preparation ensures you make a lasting impression and maximize your chances of securing investment opportunities.

14. What are some challenges associated with securing funds from private investors?

Challenges of Securing Funds from Private Investors

While private investors can provide substantial funding, there are several challenges to consider:

- Finding the Right Investor: It can be time-consuming to identify investors who align with your business niche.

- Loss of Control: Private investors often seek influence over business decisions, which can limit your autonomy.

- Emotional Strain: Mixing personal relationships with business investments can lead to conflicts and strain.

- Expectations and Misunderstandings: Without clear agreements, there may be mismatched expectations regarding returns and roles.

Mitigating these challenges involves thorough vetting of investors, clear contractual agreements, and maintaining professionalism in all interactions.

15. What is the significance of venture capital firms in the growth of a business?

Understanding the Role of Venture Capital Firms in Business Growth

Venture capital (VC) firms are pivotal in accelerating business growth, especially for companies with high potential. Here’s how they contribute:

- Fueling Growth with Strategic Investment: Provide essential capital for product development, marketing, and scaling operations.

- Exchange of Equity for Expertise: Offer strategic guidance and industry connections alongside financial investment.

- Timing and Readiness for Expansion: Target businesses ready for rapid growth and capable of achieving significant milestones.

- Economic Influence and Opportunities: Despite market volatility, substantial unspent venture capital (‘dry powder’) remains available for promising businesses.

- Deferred Goals and Potential Misalignment: Aligning VC goals with your business vision is crucial to ensure a harmonious partnership.

Venture capital firms can transform businesses by providing not just funds but also strategic partnerships that drive growth and innovation.

16. Why is financial management crucial when presenting to investors?

Why is Financial Management Crucial When Presenting to Investors?

Proper financial management is the backbone of any successful business presentation, especially when seeking investment. Investors view financial health as a key indicator of potential growth and profitability.

- Transparency and Trust: Clear and organized financial records establish trust and demonstrate transparency.

- Data-Driven Decisions: Financial statements like profit and loss statements, balance sheets, and cash flow reports provide critical insights into your business.

- Risk Assessment: Well-structured financial management highlights potential risks and allows you to present mitigation strategies effectively.

- Growth Potential: Demonstrating a steady cash flow and optimized operating costs signals to investors that your business is poised for growth.

- Competitive Edge: Startups with well-managed finances often stand out against competitors.

By showcasing disciplined financial management, you capture the interest of potential investors and lay a solid foundation for long-term business success.

17. What resources and support can business incubators offer?

What Resources and Support Can Business Incubators Offer?

Business incubators are designed to nurture startups by providing a wealth of resources and support, enhancing their chances of success:

- Workspace and Equipment: Access to essential office space and equipment without high initial costs.

- Comprehensive Training: Tailored training programs covering marketing, finance, and management.

- Guidance and Mentorship: Access to seasoned advisors and mentors offering invaluable insights.

- Administrative Support: Assistance with compliance and regulatory requirements.

- Investment Connections: Introductions to potential investors and venture capitalists.

By reducing startup and operational costs significantly, business incubators improve a startup’s chances of success in the competitive business landscape.

18. How do business incubators support startups?

How Do Business Incubators Support Startups?

Business incubators provide a comprehensive support system tailored to new and promising enterprises:

- Comprehensive Resources: Access to office space and necessary equipment.

- Access to Expertise: Network of advisors and mentors offering strategic guidance.

- Training and Development: Targeted programs to enhance business skills.

- Administrative Support: Assistance with compliance and regulatory tasks.

- Networking Opportunities: Facilitated introductions to potential investors and collaborators.

These multifaceted supports can significantly reduce initial setup and operational expenses, boosting the likelihood of early-stage success.

19. What is venture capital and how does it function in business funding?

Understanding Venture Capital and Its Role in Business Funding

Venture capital (VC) represents a specialized form of financing provided by venture capital firms. These firms gather funds from a collective of investors known as limited partners. This pooled wealth is strategically invested in businesses that exhibit significant growth potential over a brief period.

- Equity Exchange: Investors receive ownership shares, implying a stake in the company’s success.

- Growth Focus: Primarily interested in businesses poised for rapid expansion, seeking returns within a few years.

- Strategic Input: Venture capitalists contribute not just financially but also offer valuable insights and guidance.

Venture capital firms play a pivotal role in transforming the landscape of business growth, providing not just financial backing but also strategic partnerships that drive innovation and market expansion.

20. What are the potential risks of mixing personal relationships with business investments?

Potential Risks of Mixing Personal Relationships with Business Investments

Tapping into friends and family for business investments can be easier than traditional methods, but it comes with significant risks:

- Emotional Strain: Business setbacks can spill over into personal relationships, causing strain or conflicts.

- Influence and Authority: Friends or family who invest may seek a say in business decisions, leading to disagreements.

- Expectations and Misunderstandings: Without clear agreements, there may be mismatched expectations regarding returns and roles.

- Financial Strain on Relationships: If the business struggles, it can create financial pressure on both sides.

- Professionalism Challenges: Maintaining professionalism can be difficult when mixing personal ties with business matters.

Mitigating these risks involves treating the investment professionally, making clear agreements, and maintaining transparency to preserve both business integrity and personal relationships.

21. What are the typical costs associated with finding investors?

Typical Costs Associated with Finding Investors

While finding investors can be strategic and cost-effective, there are some expenses to consider:

- Event Fees: Registration fees for industry events, pitch competitions, and conferences.

- Proof of Concept: Costs related to developing prototypes or detailed models to demonstrate your business idea.

- Operational Costs: Maintaining business operations during the investment-seeking phase without immediate profits.

It’s crucial to budget carefully and avoid overspending personal funds. The goal is to attract investors through strategic financial planning and a clear demonstration of potential ROI.

anywhere

anywhere  anytime

anytime